Pension Plan for Federally Appointed Judges as at 31 March 2022 – Highlights

Report type

Federally Appointed Judges

As at date

Message from the Chief Actuary

We have prepared the report on the actuarial valuation as at 31 March 2022 to determine the government's projected cost for future Plan years. This cost corresponds to the difference between the Plan benefits and the judges' contributions in accordance with the pay-as-you-go financing arrangement in effect.

The previous statutory actuarial report was prepared as at 31 March 2019 and the next periodic review is scheduled for no later than 31 March 2025.

Main findings

Main findings - Text description

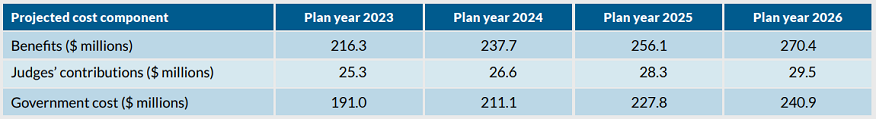

| Projected cost component | Plan year 2023 | Plan year 2024 | Plan year 2025 | Plan year 2026 |

|---|---|---|---|---|

| Benefits ($ millions) | 216.3 | 237.7 | 256.1 | 270.4 |

| Judges' contributions ($ millions) | 25.3 | 26.6 | 28.3 | 29.5 |

| Government cost ($ millions) | 191.0 | 211.1 | 227.8 | 240.9 |

Key assumptions

Key assumptions - Text description

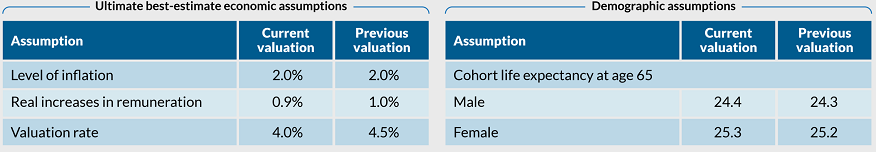

| Assumption | Current valuation | Previous valuation |

|---|---|---|

| Level of inflation | 2.0% | 2.0% |

| Real increases in remuneration | 0.9% | 1.0% |

| Valuation rate | 4.0% | 4.5% |

| Assumption | Current valuation | Previous valuation |

|---|---|---|

| Cohort life expectancy at age 65 | ||

| Male | 24.4 | 24.3 |

| Female | 25.3 | 25.2 |

Summary of membership data

Summary of membership data - Text description

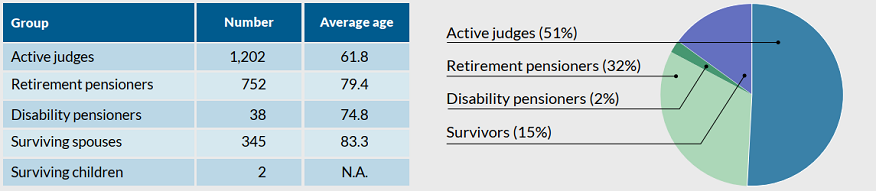

| Group | Number | Average age |

|---|---|---|

| Active judges | 1,202 | 61.8 |

| Retirement pensioners | 752 | 79.4 |

| Disability pensioners | 38 | 74.8 |

| Surviving spouses | 345 | 83.3 |

| Surviving children | 2 | N.A. |

| Group | Percentage |

|---|---|

| Active judges | 51% |

| Retirement pensioners | 32% |

| Disability pensioners | 2% |

| Survivors | 15% |