Actuarial Report (15th) on the Public Service Death Benefit Account as at 31 March 2023

Accessibility statement

The Web Content Accessibility Guidelines (WCAG) defines requirements for designers and developers to improve accessibility for people with disabilities. It defines three levels of conformance: Level A, Level AA, and Level AAA. This report is partially conformant with WCAG 2.0 level AA. If you require a compliant version, please contact webmaster@osfi-bsif.gc.ca.

ISSN: 2369-4998

The Honourable Anita Anand, P.C., M.P.

President of the Treasury Board

Ottawa, Canada

K1A 0R5

Dear Minister:

Pursuant to Section 59 of the Public Service Superannuation Act, I am pleased to submit the report on the actuarial review as at 31 March 2023 of the Public Service Death Benefit Account established under Part II of this Act.

Yours sincerely,

Assia Billig, FCIA, FSA, PhD

Chief Actuary

Office of the Chief Actuary

Table of contents

List of Tables

- Table 1 Ultimate best-estimate economic assumptions

- Table 2 Demographic assumptions

- Table 3 State of the account

- Table 4 Actuarial excess over estimated benefits ratio

- Table 5 Monthly cost and contributions per $1,000 of coverage for plan year 2024 (cents)

- Table 6 Projected monthly cost

- Table 7 Paid-up insurance per $10,000 of coverage for plan year 2024

- Table 8 Previous valuation results for plan year 2021 and 2024

- Table 9 Reconciliation of results for plan year 2024

- Table 10 Sensitivity of valuation results to variations in key assumptions

- Table 11 Contribution per $2,000 of death benefit (cents)

- Table 12 Legislated single premium per $10,000 of basic benefit ($)

- Table 13 Public Service Death Benefit Account

- Table 14 Rates of interest

- Table 15 Reconciliation of non-elective participants

- Table 16 Reconciliation of elective participants

- Table 17 Non-elective participants

- Table 18 Non-elective participants - Summary

- Table 19 Elective participants in receipt of a disability pension

- Table 20 Elective participants in receipt of a disability pension - Summary

- Table 21 Elective retired participants

- Table 22 Elective retired participants - Summary

- Table 23 Summary of economic assumptions

- Table 24 Sample of assumed seniority and promotional salary increases

- Table 25 Assumed annual increases in number of contributors

- Table 26 Sample of assumed rates of retirement – Main group 1 – Male

- Table 27 Sample of assumed rates of retirement – Main group 1 – Female

- Table 28 Sample of assumed rates of retirement – Main group 2 – Male

- Table 29 Sample of assumed rates of retirement – Main group 2 – Female

- Table 30 Sample of assumed rates of retirement – Operational service

- Table 31 Sample of assumed rates of pensionable disability

- Table 32 Sample of assumed rates of withdrawal – Main group – Male

- Table 33 Sample of assumed rates of withdrawal – Main group – Female

- Table 34 Sample of assumed rates of withdrawal – Operational group

- Table 35 Sample of assumed rates of mortality

- Table 36 Sample of assumed mortality improvement rates

List of Charts

1. Highlights of the report

| Public Service Death Benefit Account | |

|---|---|

| Financial position | As at 31 March 2023, the Account balance is $4,131 million, the actuarial liability is $1,203 million, resulting in an actuarial excess of $2,928 million. |

| Ratio of actuarial excess to annual benefit payments | The actuarial excess totalling $2,928 million is 13.2 times the total amount of death benefits projected for plan yearTable Main findings Footnote a 2024. |

| Term insurance monthly cost and contribution per $1000 of coverage for plan year 2024 |

The monthly cost rate projected for plan year 2024 is 17.2 cents per month per $1,000 of term insurance. Participants contributions are 15 cents per $1,000 of term insurance. Government contributions are equal to one-twelfth of the total amount of term insurance proceeds payable during the year. It is estimated to be 1.6 cents per $1,000 of term insurance for plan year 2024. |

| Paid-up death benefit |

The legislated contribution rates per $10,000 of paid-up death benefit for age 65 are $310 for males and $291 for females. The estimated single premiums per $10,000 of paid-up death benefit for age 65 in plan year 2024, are $5,344 for males and $5,086 for females. |

|

Table Main findings Footnotes

|

|

2. Introduction

This actuarial report on the Public Service Death Benefit Account was made pursuant to Section 59 of the Public Service Superannuation Act (PSSA).

This actuarial valuation is as at 31 March 2023 and is in respect of death benefits and contributions defined by Part II of the PSSA.

In this report, paid-up insurance refers to the $10,000 portion of the benefit for which monthly contributions are no longer required from either the participant or the government. The contribution for the paid-up benefit is generally made at age 65.

In this report, term insurance refers to the basic coverage (two times salary) less 10% reduction per year from age 66 and less $10,000 paid-up insurance.

The previous actuarial report was prepared as at 31 March 2020. The date of the next periodic review is scheduled to occur no later than 31 March 2026.

2.1 Purpose of this actuarial report

The purpose of this actuarial valuation is to determine the state of the Account as well as to assist the President of the Treasury Board in making informed decisions regarding the financing of the government's death benefit obligation. This report may not be suitable for another purpose.

2.2 Structure of the report

Section 3 presents a general overview of the valuation basis used in preparing this actuarial report and section 4 presents the financial position of the plan, the cost of the term and paid-up insurance, a reconciliation of the main results as well as a sensitivity analysis of those results to variations in key assumptions.

Finally, section 5 provides the actuarial opinion for the current valuation.

The various appendices provide a summary of the plan provisions, a description of data, methodology and assumptions employed.

Numbers shown in the tables throughout this report may not add up due to rounding.

3. Valuation basis

3.1 Valuation inputs

This valuation report is based on the supplementary death benefits (SDB) plan provisions enacted by the Legislation, summarized in Appendix A.

No amendments were made to the PSSA since the previous valuation. Minor amendments were applied to the Public Service Superannuation Regulations since the previous valuation. Those amendments did not have any impact on the actuarial valuation of the SDB.

The financial data on which this valuation is based relate to the Account established to track contributions and benefits under the SDB plan provisions. The Account data is summarized in Appendix B.

The membership data is summarized in Appendix C.

The valuation was prepared using accepted actuarial practice in Canada, methods and assumptions which are summarized in Appendices D to F.

All actuarial assumptions used in this report are best-estimate assumptions. They are independently reasonable and appropriate in aggregate for the purposes of the valuation at the date of this report. The actuarial assumptions used in the previous report were revised based on economic trends and demographic experience. A complete description of the assumptions is shown in Appendices E and F.

The following tables present summaries of the ultimate economic and of the demographic assumptions used in this report and a comparison with those used in the previous report.

| 31 March 2023 | 31 March 2020 | |

|---|---|---|

| Increase in average earnings | 2.5% | 2.7% |

| Projected yield on the Public Service Death Benefit Account | 4.0% | 4.1% |

| 31 March 2023 | 31 March 2020 | |

|---|---|---|

| Promotional and seniority rate of increase | ||

| Male | 0.6 - 6.1% | 0.6 - 5.9% |

| Female | 0.7 - 6.3% | 0.7 - 6.1% |

| Cohort life expectancy at age 65Table 2 Footnote a | ||

| Male | 22.5 years | 22.4 years |

| Female | 24.1 years | 24.1 years |

| Average retirement age | ||

| Group 1 | 60.3 years | 60.1 years |

| Group 2 | 62.2 years | 62.1 years |

|

Table 2 Footnotes

|

||

3.2 Subsequent events

The Pay Equity Act, which came into force on 31 August 2021, applies to all federally regulated employers with 10 employees or more. On 19 August 2024, the Pay Equity Commissioner has granted Treasury Board Secretariat the requested extension of 3 years to post a final pay equity plan for employees of Core Public Administrations by 31 August 2027. Since federal employers are at various steps of the pay equity process, the details of the expected changes to compensation are not known, and the impact of the implementation of the Pay Equity Act has not been considered in this report.

As of the date of the signing of this report, we were not aware of any other subsequent events that may have a material impact on the results of this valuation.

4. Valuation results

4.1 State of the account

The state of the account as at 31 March 2023 was prepared using the Account balance described in Appendix B, the data described in Appendix C, the methodology described in Appendix D, and the assumptions described in Appendices E and F.

The following table presents the state of the Account as at 31 March 2023. The results of the previous valuation are also shown for comparison purposes.

| 31 March 2023 | 31 March 2020 | |

|---|---|---|

| Account balance | 4,131 | 3,880 |

| Liabilities | ||

| Paid-up death benefit | 1,099 | 965 |

| IBNR and outstanding paymentsTable 3 Footnote a | 104 | 31 |

| Total liabilities | 1,203 | 996 |

| Actuarial excess | 2,928 | 2,884 |

|

Table 3 Footnotes

|

||

4.2 Actuarial excess over estimated benefits

The estimated benefits consist of death benefit payments from term and paid-up insurance.

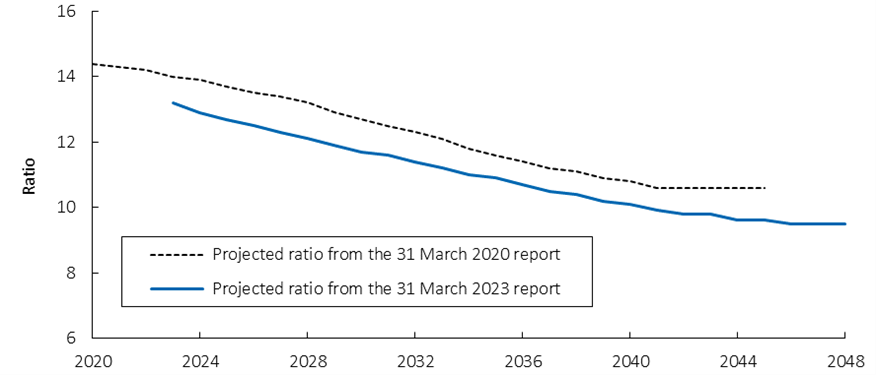

At 31 March 2023, the ratio of actuarial excess over estimated benefits is 13.2. By comparison, this ratio was 14.4 under the previous report. Both ratios are presented in the following table.

| 31 March 2023 | 31 March 2020 | |

|---|---|---|

| Actuarial excess (A) | 2,928 | 2,884 |

| Estimated benefits for next plan year | ||

| Term Insurance | 175 | 156 |

| Paid-up death benefit | 47 | 44 |

| Total estimated benefits for next plan year (B) | 222 | 200 |

| Ratio of the actuarial excess over estimated benefits for next plan year (A/B) | 13.2 | 14.4 |

The actuarial excess is projected to reach $5,070 million at the end of plan year 2048 mainly due to the growth in the interest credits made.

Chart 1 shows the ratio of projected actuarial excess at the end of the plan year to annual benefit payments projected for the following plan year. This ratio is expected to decrease from the current level of 13.2 to 9.5 by the end of plan year 2048 as the cost continues to exceed the contributions throughout the period. This ratio is expected to be 12.5 by the end of plan year 2026.

Chart 1 Projected ratio of actuarial excess to annual benefit payments

(Actuarial excess is measured at the end of plan year and annual payments are those of the following plan year)

Chart 1 - Text version

Line graphs comparing the projected ratio of actuarial excess to annual benefit payments from previous and current report. The vertical axis represents the ratio of actuarial excess to annual benefit payments. The horizontal axis represents the plan year, starting in plan year 2020 and ending in 2048.

The projected ratio of actuarial excess to annual benefit payments for plan year 2023 is 13.2 compared to 14.0 in the previous report. This projected ratio decreases over time. As a result, by plan year 2045 the projected ratio is 9.6, a decrease of 1.0 from the projected ratio of 10.6 in the previous report.

| Plan year | Projected ratio from the 31 March 2020 report | Projected ratio from the 31 March 2023 report |

|---|---|---|

| 2020 | 14.4 | no data |

| 2021 | 14.3 | no data |

| 2022 | 14.2 | no data |

| 2023 | 14.0 | 13.2 |

| 2024 | 13.9 | 12.9 |

| 2025 | 13.7 | 12.7 |

| 2026 | 13.5 | 12.5 |

| 2027 | 13.4 | 12.3 |

| 2028 | 13.2 | 12.1 |

| 2029 | 12.9 | 11.9 |

| 2030 | 12.7 | 11.7 |

| 2031 | 12.5 | 11.6 |

| 2032 | 12.3 | 11.4 |

| 2033 | 12.1 | 11.2 |

| 2034 | 11.8 | 11.0 |

| 2035 | 11.6 | 10.9 |

| 2036 | 11.4 | 10.7 |

| 2037 | 11.2 | 10.5 |

| 2038 | 11.1 | 10.4 |

| 2039 | 10.9 | 10.2 |

| 2040 | 10.8 | 10.1 |

| 2041 | 10.6 | 9.9 |

| 2042 | 10.6 | 9.8 |

| 2043 | 10.6 | 9.8 |

| 2044 | 10.6 | 9.6 |

| 2045 | 10.6 | 9.6 |

| 2046 | no data | 9.5 |

| 2047 | no data | 9.5 |

| 2048 | no data | 9.5 |

4.3 Term insurance

The monthly cost is defined as the ratio of the expected monthly term benefit payments over the amount of expected monthly term insurance benefit coverage, where coverage is expressed per thousand dollars.

The projected monthly cost for plan year 2024 is 17.2 cents per $1000 of term insurance. The amounts of insurance coverage and benefits payable for plan year 2024 are projected to be $84,683 million and $175 million, respectively.

Non‑elective participants and elective participants in receipt of an immediate annuity or an annual allowance are required to contribute 15 cents per $1,000 of term insurance monthly. As a minimum, the government contribution credited monthly to the Account is equal to one‑twelfth of the total amount of term insurance proceeds payable during the month.

The following table presents the monthly contribution and the cost rates for plan year 2024. It shows that contributions are 0.6 cents less than the monthly cost.

| Contribution | Total Cost | ||

|---|---|---|---|

| Participant | Government | Total | |

| 15 | 1.6 | 16.6 | 17.2 |

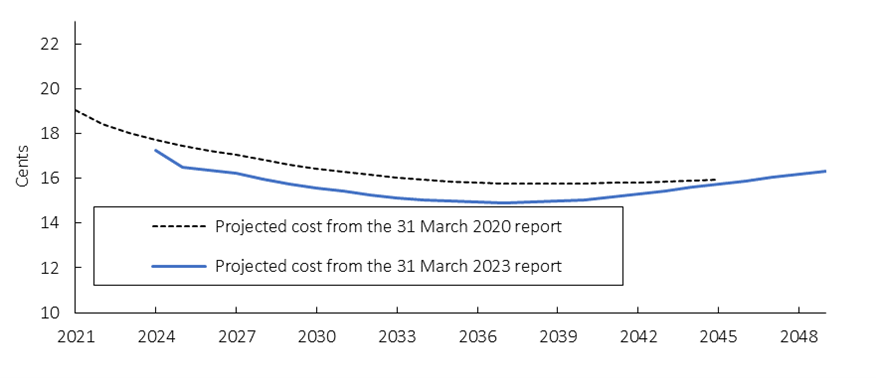

As shown in Chart 2, the projected monthly cost in the 31 March 2023 report is generally lower than in the previous valuation. This is mainly due to:

- a change in the mortality improvement rates,

- changes in demography, for example, the number of non-elective participants increased by about 68,000 participants.

Chart 2 Projected monthly cost

(cents per $1,000 of term insurance)

Chart 2 - Text version

Line graphs comparing the projected monthly costs over time between the current and previous valuation report. The vertical axis represents the monthly cost in cents per thousand dollar of term insurance. The horizontal axis represents the plan year, starting in plan year 2021 and ending in 2048.

The projected monthly cost for plan year 2024 is 17.2 cents per thousand dollar of term insurance compared to 17.7 cents in the previous report. By plan year 2045 the projected monthly cost is 15.7 cents per thousand dollars of term insurance representing an decrease of 0.2 cents from the projected 15.9 cents in the previous report.

| Plan Year | Projected cost from the 31 March 2020 report | Projected cost from the 31 March 2023 report |

|---|---|---|

| 2021 | 19.0 | no data |

| 2022 | 18.4 | no data |

| 2023 | 18.0 | no data |

| 2024 | 17.7 | 17.2 |

| 2025 | 17.5 | 16.5 |

| 2026 | 17.2 | 16.3 |

| 2027 | 17.0 | 16.2 |

| 2028 | 16.8 | 16.0 |

| 2029 | 16.6 | 15.8 |

| 2030 | 16.4 | 15.6 |

| 2031 | 16.3 | 15.4 |

| 2032 | 16.1 | 15.3 |

| 2033 | 16.0 | 15.1 |

| 2034 | 15.9 | 15.0 |

| 2035 | 15.9 | 15.0 |

| 2036 | 15.8 | 14.9 |

| 2037 | 15.8 | 14.9 |

| 2038 | 15.8 | 14.9 |

| 2039 | 15.8 | 15.0 |

| 2040 | 15.8 | 15.1 |

| 2041 | 15.8 | 15.2 |

| 2042 | 15.8 | 15.3 |

| 2043 | 15.9 | 15.4 |

| 2044 | 15.9 | 15.6 |

| 2045 | 15.9 | 15.7 |

| 2046 | no data | 15.9 |

| 2047 | no data | 16.0 |

| 2048 | no data | 16.2 |

The following table shows the projected monthly costs per $1,000 of term insurance by participant type for selected plan years.

| Participants | 2024 | 2028 | 2033 | 2038 | 2043 | 2048 |

|---|---|---|---|---|---|---|

| Non-elective | 9.2 | 8.6 | 8.3 | 8.1 | 8.5 | 8.8 |

| Elective | 56.4 | 53.8 | 50.5 | 47.3 | 46.4 | 48.3 |

| All | 17.2 | 16.0 | 15.1 | 14.9 | 15.4 | 16.2 |

The monthly cost per $1,000 of term insurance is projected to gradually decrease to 14.9 cents in 2038 and then to increase to 16.2 cents by plan year 2048. In plan year 2048, the total contribution rate is projected to be 16.5 cents (15 cents from the participants and 1.5 cents from the government). The decrease in the monthly cost is mainly due to lower mortality rates in accordance with the mortality improvement rates shown in Table 36 applied to the current mortality rates shown in Table 35. The increase in the cost is due to changes of demographic assumptions other than mortality. For example, the average age of the non-elective participants increases.

4.4 Paid‑up insurance

The estimated single premiumsFootnote 1 and the legislated contribution ratesFootnote 2 at age 65 for each $10,000 of paid-up insured benefit are shown in the table below.

| Single premiums at age 65 ($) | Legislated contribution ($) | |

|---|---|---|

| Male | 5,344 | 310 |

| Female | 5,086 | 291 |

The assumed mortality improvements and the projected increase in yield from 3.1% in plan year 2024 to 4.0% ultimately are expected to cause the projected single premium for the paid‑up death benefit to decrease over time. The projected single premium for male and female in plan year 2048 are $4,244 and $4,012, respectively.

4.5 Reconciliation as at 31 March 2023

The following table illustrates the impact of the updated assumptions, intervaluation economic and demographic assumptions changes since the last valuation report as at 31 March 2020.

In the intervaluation period, the non-elective population grew significantly more than expected. The higher proportion of non-elective members compared to the elective group resulted in a lower monthly cost than anticipated. The monthly cost is expected to lower over time because of the mortality improvement factors.

The main revision to economic assumptions is the change of interest rates. The main revision to the demographic assumption is a change to IBNR and outstanding payments' assumption.

| Monthy cost by $1,000 of term insurance | Actuarial excess (beginning of plan year) to benefit payments ratio | |

|---|---|---|

| Previous valuation as at 31 March 2020 for plan year 2021 | 19.0 | 14.4 |

| Previous valuation as at 31 March 2020 for plan year 2024 | 17.7 | 14.0 |

| Monthy cost by $1,000 of term insurance | Actuarial excess (beginning of plan year) to benefit payments ratio | |

|---|---|---|

| Previous valuation as at 31 March 2020 | 17.7 | 14.0 |

| Demographic changes | (0.8) | (0.2) |

| Changes in assumptions | ||

| Revision of economic assumptions | 0.1 | 0.0 |

| Revision of demographic assumptions | 0.2 | (0.6) |

| Valuation as at 31 March 2023 | 17.2 | 13.2 |

4.6 Sensitivity of valuation results

The following supplementary estimates indicate the degree to which the valuation results depend on some of the key assumptions. The table below presents the effects on valuation results when key assumptions are varied.

| Assumption(s) varied | Actuarial liability | Effect | Actuarial excess to benefit payments ratio | Effect |

|---|---|---|---|---|

| 1,203 | no data | 13.18 | no data | |

| Projected interest yields | ||||

| +1% | 1,074 | (129) | 13.76 | 0.58 |

| -1% | 1,360 | 157 | 12.48 | (0.70) |

| Mortality improvement | ||||

| No mortality improvement | 1,225 | 22 | 13.08 | (0.10) |

| Constant at plan year 2024 | 1,194 | (9) | 13.22 | 0.04 |

Differences between these results and those shown in the valuation can also serve as a basis for approximating the effect of other numerical variations in a key assumption to the extent that such effects are indeed linear.

4.7 Sensitivity of projected monthly cost

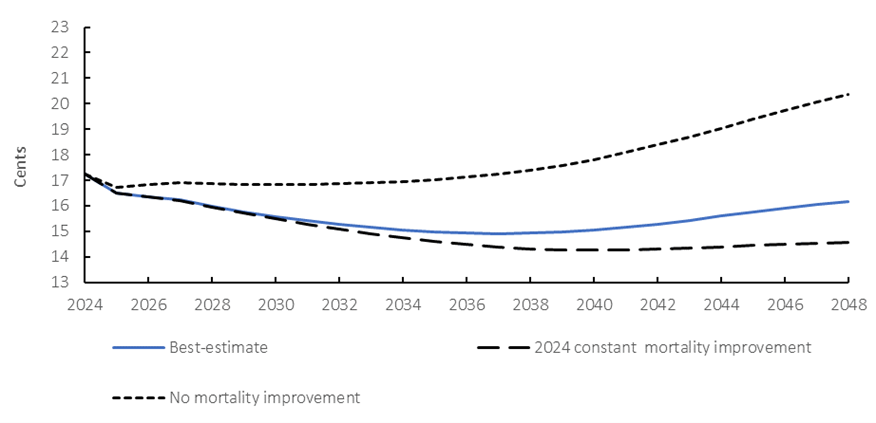

Chart 3 below shows that lower (no mortality improvement – top dotted line) or higher (2024 constant mortality improvement – bottom dotted line) mortality improvement factors would have a significant impact on the monthly cost per $1,000 of term insurance.

Chart 3 Sensitivity of projected monthly cost to different mortality improvement assumptions

Chart 3 - Text version

Line graphs comparing three curves of monthly cost over time. The difference in the curves show the impact of disregarding mortality improvement and applying constant mortality improvement at 2024 level on the monthly cost. The vertical axis represents the monthly cost in cents per thousand dollars of term insurance. The horizontal axis represents the plan year, starting in 2024 and ending in 2048.

If mortality improvement is disregarded, the projected monthly cost in plan year 2024 would be 20.4 cents per thousand dollars of term insurance compared to 16.2 in the current valuation.

If mortality improvements are kept at their level for plan year 2024 level, the projected monthly cost in plan year 2048 would be 14.6 cents per thousand dollars of term insurance compared to 16.2 in the current valuation.

| Plan Year | Best-estimate | No mortality improvement | 2024 constant mortality improvement |

|---|---|---|---|

| 2024 | 17.2 | 17.2 | 17.2 |

| 2025 | 16.5 | 16.7 | 16.5 |

| 2026 | 16.3 | 16.8 | 16.3 |

| 2027 | 16.2 | 16.9 | 16.2 |

| 2028 | 16.0 | 16.9 | 15.9 |

| 2029 | 15.8 | 16.8 | 15.7 |

| 2030 | 15.6 | 16.8 | 15.5 |

| 2031 | 15.4 | 16.8 | 15.3 |

| 2032 | 15.3 | 16.9 | 15.1 |

| 2033 | 15.1 | 16.9 | 14.9 |

| 2034 | 15.0 | 16.9 | 14.7 |

| 2035 | 15.0 | 17.0 | 14.6 |

| 2036 | 14.9 | 17.1 | 14.5 |

| 2037 | 14.9 | 17.2 | 14.4 |

| 2038 | 14.9 | 17.4 | 14.3 |

| 2039 | 15.0 | 17.6 | 14.3 |

| 2040 | 15.1 | 17.8 | 14.2 |

| 2041 | 15.2 | 18.1 | 14.3 |

| 2042 | 15.3 | 18.4 | 14.3 |

| 2043 | 15.4 | 18.7 | 14.3 |

| 2044 | 15.6 | 19.0 | 14.4 |

| 2045 | 15.7 | 19.4 | 14.4 |

| 2046 | 15.9 | 19.7 | 14.5 |

| 2047 | 16.0 | 20.0 | 14.5 |

| 2048 | 16.2 | 20.4 | 14.6 |

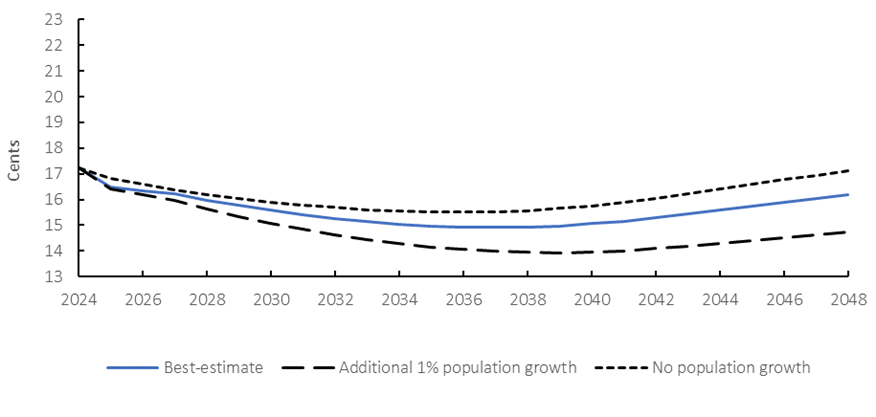

Chart 4 below shows that lower (no population growth – top dotted line) or higher (additional 1% population growth – bottom dotted line) population growth assumptions would also have an impact on the monthly cost per $1,000 of term insurance.

Chart 4 Sensitivity of projected monthly cost to different population growth assumptions

Chart 4 - Text version

Line graphs comparing three curves of monthly cost over time. The difference in the curves show the impact of having no population growth and having additional one percent population growth than best-estimate's on the monthly cost. The vertical axis represents the monthly cost in cents per thousand dollars of term insurance. The horizontal axis represents the plan year, starting in 2024 and ending in 2048.

If there is no population growth, the projected monthly cost in plan year 2048 would be 17.1 cents per thousand dollars of term insurance compared to 16.2 in the current valuation.

If the population growth is one percent higher than best-estimate assumptions, the projected monthly cost in plan year 2048 would be 14.7 cents per thousand dollars of term insurance compared to 16.2 in the current valuation.

| Plan Year | Best-estimate | No population growth | Additional 1% population growth |

|---|---|---|---|

| 2024 | 17.2 | 17.2 | 17.2 |

| 2025 | 16.5 | 16.8 | 16.4 |

| 2026 | 16.3 | 16.6 | 16.2 |

| 2027 | 16.2 | 16.4 | 16.0 |

| 2028 | 16.0 | 16.2 | 15.6 |

| 2029 | 15.8 | 16.0 | 15.3 |

| 2030 | 15.6 | 15.9 | 15.1 |

| 2031 | 15.4 | 15.8 | 14.9 |

| 2032 | 15.3 | 15.7 | 14.6 |

| 2033 | 15.1 | 15.6 | 14.4 |

| 2034 | 15.0 | 15.5 | 14.3 |

| 2035 | 15.0 | 15.5 | 14.2 |

| 2036 | 14.9 | 15.5 | 14.0 |

| 2037 | 14.9 | 15.5 | 14.0 |

| 2038 | 14.9 | 15.6 | 13.9 |

| 2039 | 15.0 | 15.7 | 13.9 |

| 2040 | 15.1 | 15.8 | 14.0 |

| 2041 | 15.2 | 15.9 | 14.0 |

| 2042 | 15.3 | 16.1 | 14.1 |

| 2043 | 15.4 | 16.2 | 14.2 |

| 2044 | 15.6 | 16.4 | 14.3 |

| 2045 | 15.7 | 16.6 | 14.4 |

| 2046 | 15.9 | 16.8 | 14.5 |

| 2047 | 16.0 | 16.9 | 14.6 |

| 2048 | 16.2 | 17.1 | 14.7 |

5. Actuarial opinion

In our opinion, considering that this report was prepared pursuant to the Public Pensions Reporting Act,

- the valuation input data on which the valuation is based are sufficient and reliable for the purposes of the valuation;

- the assumptions used are individually reasonable and appropriate in aggregate for the purposes of the valuation; and

- the methods employed are appropriate for the purposes of the valuation.

This report has been prepared, and our opinions given, in accordance with accepted actuarial practice in Canada. In particular, this report was prepared in accordance with the Standards of Practice (General Standards) published by the Canadian Institute of Actuaries.

The subsequent event described in section 3.2 was not considered in this valuation since the details were not available at the time the report was prepared. To the best of our knowledge, after discussion with Public Services and Procurement Canada and the Treasury Board of Canada Secretariat, there were no other subsequent events between the valuation date and the date of this report that would have a material impact on the results of this valuation.

Assia Billig, FCIA, FSA

Chief Actuary

Alexandre Larose, FCIA, FSA

Annie St-Jacques, FCIA, FSA

Ottawa, Canada

27 September 2024

Appendix A – Summary of plan provisions

The following is a summary description of the main provisions of the SDB plan established for public servants under Part II of the PSSA. This plan supplements benefits payable under the pension plan for the Public Service of Canada (PSPP) by providing a lump sum benefit upon the death of a plan participant.

A.1 Plan participants

A.1.1 Non-elective participants

The term non-elective participant means all contributors to the PSPP who are employed in the Public Service except employees of Crown corporations covered under other group life insurance plans.

A.1.2 Elective participants

The term elective participant means all participants who have ceased to be employed in the Public Service following disability or retirement and have opted to continue their coverage under the SDB plan. Such right is limited to participants who, at the time they cease to be employed in the Public Service, have completed at least two years of continuous service in the Public Service or two years of participation in the SDB plan.

A non-elective participant who ceases employment and becomes entitled to an immediate annuity or an annual allowance in the PSPP automatically becomes an elective participant. During the first 30 days as an elective participant, an individual has the right to opt out of the plan, effective on the 31st day.

A.2 Contributions

A.2.1 Non-elective participants and elective participants in receipt of an immediate annuity or an annual allowance

For non-elective participants as well as elective participants in receipt of an immediate annuity (disability or retirement) or an annual allowance under the PSPP, the rate of contribution is 15 cents per month for each $1,000 of death benefit. When these participants attain age 65 (or complete two years of service, if later), their contribution is reduced by $1.5 per month in recognition of the fact that $10,000 of basic benefit becomes paid-up (by the government) for the remaining lifetime of the participant.

A.2.2 Elective participants entitled to a deferred annuity

For elective participants entitled to a deferred annuity under the PSPP, the contribution rate set in the legislationFootnote 3 varies in accordance with the attained age of the participant, and the corresponding contributions become chargeable on the 30th day immediately following cessation of employment.

The contribution rates for selected ages are shown in the following table:

| Age | AnnuallyTable 11 Footnote a | MonthlyTable 11 Footnote b |

|---|---|---|

| 25 | 9.70 | 0.82 |

| 30 | 11.42 | 0.97 |

| 35 | 13.58 | 1.15 |

| 40 | 16.29 | 1.39 |

| 45 | 19.72 | 1.67 |

| 50 | 24.11 | 2.05 |

| 55 | 29.80 | 2.53 |

| 60 | 37.65 | 3.20 |

|

Table 11 Footnotes

|

||

A.2.3 Government

The government credits monthly to the Account an amount equal to one‑twelfth of the total amount of death benefits paid in the month.

Crown corporations and public boards whose employees are participants in the plan contribute at the rate of four cents per month for each $1,000 of death benefit.

When a participant, other than one entitled to a deferred annuity, reaches age 65 (or completes two years of service, if later), the government credits to the Account a single premium for the individual $10,000 paid‑up portion of basic benefit in respect of which contributions are no longer required from the participant.

The legislated amount of single premiumFootnote 4 for each such $10,000 paid‑up portion of basic benefit is shown in the following table and corresponds to one-twentieth of the single premium rate for $10,000 dollars of death benefit, computed on the basis of the Life Tables, Canada, 1950-1952 and interest at 4% per annum.

| Age | Male | Female |

|---|---|---|

| 65 | 310 | 291 |

| 66 | 316 | 298 |

| 67 | 323 | 306 |

| 68 | 329 | 313 |

| 69 | 336 | 320 |

| 70 | 343 | 328 |

| 71 | 349 | 335 |

| 72 | 356 | 342 |

| 73 | 362 | 349 |

| 74 | 369 | 356 |

| 75 | 375 | 363 |

Under the statutes, if for whatever reason the Account were to become exhausted, the government would then credit special contributions to the Account in an amount at least equal to the basic benefits then due but not paid by reason of such cash shortfall.

A.3 Amount of basic benefit

Subject to the applicable reductions described below, the lump sum benefit payable upon the death of a participant is equal to twice the participant's current salary, the result being rounded to the next higher multiple of $1,000 if not already equal to such a multiple. For this purpose, the current salary of an elective participant is defined as the annual rate of pay at the time of cessation of employment in the Public Service.

The amount of basic benefit described above is reduced by 10% per year starting at age 66 until it would normally vanish at age 75. However, the amount of basic benefit cannot at any time be reduced below a basic floor value of $10,000 subject to the following exceptions:

- For those elective participants who had, upon cessation of employment prior to 5 October 1992, made an election to reduce their basic benefit to $500 and further had made a second election, within one year thereafter, to keep their basic benefit at $500, the floor value is $500 instead of $10,000. Such election is irrevocable.

- For non-elective participants, the amount of basic benefit cannot be reduced below the multiple of $1,000 equal to or next above one-third of the participant's annual salary, even if the resulting amount is higher than $10,000.

- For elective participants entitled to a deferred annuity, there is no coverage past age 75.

Upon ceasing to be employed in the Public Service, elective participants in receipt of an immediate annuity or in receipt of an annual allowance under the PSPP may opt to reduce their amount of basic benefit to $10,000.

Appendix B – Account balance

B.1 Reconciliation of the Public Service Death Benefit Account

The Account, which forms part of the Public Accounts of Canada, records the transactions for the plan. No formal debt instrument has been issued to the Account by the government in recognition of the amounts therein. The Account is:

- credited with all contributions made by participants, Crown corporations and the government;

- credited with interest earnings every three months on the basis of the actual average yield for the same period on the combined Superannuation Accounts of the Public Service, Canadian Forces and Royal Canadian Mounted Police pension plans. These accounts generate interest earnings as though net cash flows were invested quarterly in 20‑year Government of Canada bonds issued at prescribed interest rates and held to maturity; and

- debited with basic benefit payments when they become due.

Table 13 shows the reconciliation of the balance of the Account from the last valuation date to the current valuation date. Since the last valuation, the Account balance has grown by $251 million (a 6% increase) to $4,131 million as at 31 March 2023. The net growth in the Account balance is to a large extent the result of interest credits made.

| Plan year | 2021 | 2022 | 2023 | 2021-2023 |

|---|---|---|---|---|

| Opening balance as at 1 April of the previous year | 3,880.2 | 3,976.9 | 4,063.5 | 3,880.2 |

| Income | ||||

| Employee contributions | ||||

| Active members | ||||

| Public Service employees | 88.6 | 97.3 | 104.2 | 290.1 |

| Public Service corporations | 6.5 | 6.8 | 6.7 | 20.0 |

| Retired employees | 27.6 | 28.0 | 28.7 | 84.3 |

| Total employee contributions | 122.7 | 132.1 | 139.6 | 394.4 |

| Employer contributions | ||||

| Public Service corporations | 1.7 | 1.8 | 1.8 | 5.3 |

| Death benefit - general | 11.5 | 12.8 | 13.8 | 38.1 |

| Death benefit - single premium $10,000 | 3.2 | 3.3 | 3.4 | 9.8 |

| Interest | 133.5 | 131.9 | 128.1 | 393.5 |

| Total income | 272.6 | 281.9 | 286.7 | 841.1 |

| Expenditures - Benefits payments | ||||

| General | 138.2 | 153.6 | 165.5 | 457.3 |

| Life coverage for $10,000 | 37.7 | 41.7 | 53.4 | 132.8 |

| Other death benefit payments | 0.0 | 0.0 | 0.1 | 0.1 |

| Total expenditures | 175.9 | 195.3 | 219.0 | 590.2 |

| Closing balance as at 31 March of the plan year | 3,976.9 | 4,063.5 | 4,131.1 | 4,131.1 |

B.2 Rates of interest

The following rates of interest on the Account by plan year were calculated using the foregoing entries.

| Plan year | Interest |

|---|---|

| 2021 | 3.5% |

| 2022 | 3.3% |

| 2023 | 3.2% |

B.3 Sources of the financial data

The Account entries shown previously were taken from the Public Accounts of Canada.

Appendix C – Participant data

C.1 Source of participant data

The valuation input data required in respect of contributors (both active and non-active) and pensioners are extracted from master computer files maintained by the Department of Public Services and Procurement Canada (PSPC).

The main valuation data file supplied by PSPC contained the historical status information on all participants up to 31 March 2023.

C.2 Validation of participant data

The participant data were validated with respect to the Actuarial Report on the Pension Plan for the Public Service of Canada as at 31 March 2023. Details of the data validation can be found in Appendix D of that report.

C.3 Participant data summary

Tables 15 to 21 on the following pages show the detailed participant data upon which this valuation is based.

| Male | Female | Total | |

|---|---|---|---|

| As at 31 March 2020 | 143,955 | 185,593 | 329,548 |

| Data corrections | 1,159 | 1,651 | 2,810 |

| Eligibility change | 40 | 35 | 75 |

| New non-elective from | |||

| New participants | 47,242 | 68,828 | 116,070 |

| Rehired from cash-outs | 1,472 | 2,240 | 3,712 |

| Rehired from pensioners | 862 | 1,395 | 2,257 |

| Subtotal | 49,576 | 72,463 | 122,039 |

| Non-elective terminations | |||

| Disabled pensioners | (601) | (1,245) | (1,846) |

| Deferred retired pensioners | (3,666) | (4,444) | (8,110) |

| Retired pensioners in pay | (11,781) | (13,911) | (25,692) |

| Death (no survivors) | (247) | (257) | (504) |

| Death (with survivors) | (428) | (311) | (739) |

| ROC or TVTable 15 Footnote a | (8,909) | (11,059) | (19,968) |

| Subtotal | (25,632) | (31,227) | (56,859) |

| As at 31 March 2023 | 169,098 | 228,515 | 397,613 |

|

Table 15 Footnotes

|

|||

| Male | Female | Total | |

|---|---|---|---|

| As at 31 March 2020 | 98,714 | 93,842 | 192,556 |

| Data corrections | 150 | 208 | 358 |

| New from non-elective | 12,239 | 14,968 | 27,207 |

| Elective terminations | |||

| Non-elective | (30) | (52) | (82) |

| Death | (9,827) | (5,488) | (15,315) |

| Subtotal | (9,857) | (5,540) | (15,397) |

| As at 31 March 2023 | 101,246 | 103,478 | 204,724 |

| Age | NumberTable 17 Footnote a | Basic benefits ($ thousands) | ||||

|---|---|---|---|---|---|---|

| Male | Female | Total | Male | Female | Total | |

| 15-19 | 100 | 96 | 196 | 10,214 | 9,597 | 19,811 |

| 20-24 | 4,757 | 6,649 | 11,406 | 571,773 | 778,653 | 1,350,426 |

| 25-29 | 16,049 | 24,079 | 40,128 | 2,365,717 | 3,486,657 | 5,852,374 |

| 30-34 | 19,945 | 29,309 | 49,254 | 3,275,184 | 4,633,315 | 7,908,498 |

| 35-39 | 21,846 | 31,162 | 53,008 | 3,922,276 | 5,311,739 | 9,234,015 |

| 40-44 | 24,188 | 34,877 | 59,065 | 4,644,204 | 6,281,697 | 10,925,901 |

| 45-49 | 23,801 | 33,474 | 57,275 | 4,788,788 | 6,305,947 | 11,094,735 |

| 50-54 | 22,247 | 29,020 | 51,267 | 4,577,128 | 5,523,368 | 10,100,496 |

| 55-59 | 18,781 | 22,591 | 41,372 | 3,841,368 | 4,149,213 | 7,990,581 |

| 60-64 | 11,818 | 12,369 | 24,187 | 2,342,088 | 2,127,542 | 4,469,630 |

| 65-69 | 4,221 | 3,830 | 8,051 | 702,572 | 553,218 | 1,255,790 |

| Above 69 | 1,345 | 1,059 | 2,404 | 77,073 | 53,891 | 130,964 |

| Total | 169,098 | 228,515 | 397,613 | 31,118,384 | 39,214,836 | 70,333,221 |

|

Table 17 Footnotes

|

||||||

| Average | Male | Female | Total | |

|---|---|---|---|---|

| As at 31 March 2020 | AgeTable 18 Footnote a | 46.5 | 44.8 | 45.6 |

| ServiceTable 18 Footnote a | 14.0 | 12.9 | 13.4 | |

| Basic benefit ($) | 173,733 | 160,719 | 166,386 | |

| As at 31 March 2023 | AgeTable 18 Footnote a | 45.0 | 43.7 | 44.3 |

| ServiceTable 18 Footnote a | 12.7 | 11.7 | 12.1 | |

| Basic benefit ($) | 184,026 | 171,607 | 176,889 | |

|

Table 18 Footnotes

|

||||

| Age | Number | Basic benefits ($ thousands) | ||||

|---|---|---|---|---|---|---|

| Male | Female | Total | Male | Female | Total | |

| To 34 | 8 | 10 | 18 | 1,150 | 1,298 | 2,448 |

| 35-39 | 35 | 87 | 122 | 4,705 | 12,016 | 16,721 |

| 40-44 | 79 | 286 | 365 | 11,270 | 38,833 | 50,103 |

| 45-49 | 193 | 607 | 800 | 28,906 | 83,445 | 112,351 |

| 50-54 | 372 | 929 | 1,301 | 56,156 | 127,698 | 183,854 |

| 55-59 | 691 | 1,513 | 2,204 | 101,185 | 202,727 | 303,912 |

| 60-64 | 905 | 2,149 | 3,054 | 121,197 | 263,912 | 385,109 |

| 65-69 | 844 | 1,797 | 2,641 | 78,287 | 152,547 | 230,833 |

| 70-74 | 791 | 1,199 | 1,990 | 23,994 | 34,305 | 58,298 |

| 75-79 | 567 | 709 | 1,276 | 5,670 | 7,090 | 12,760 |

| 80-84 | 375 | 441 | 816 | 3,750 | 4,410 | 8,160 |

| 85-89 | 240 | 268 | 508 | 2,400 | 2,680 | 5,080 |

| 90-94 | 81 | 89 | 170 | 810 | 890 | 1,700 |

| 95-99 | 16 | 15 | 31 | 160 | 150 | 310 |

| Above 99 | 4 | 8 | 12 | 40 | 80 | 120 |

| Total | 5,201 | 10,107 | 15,308 | 439,680 | 932,080 | 1,371,760 |

| Average | Male | Female | Total | |

|---|---|---|---|---|

| As at 31 March 2020 | AgeTable 20 Footnote a | 59.9 | 58.1 | 58.7 |

| Basic benefit ($) | 80,020 | 91,711 | 87,539 | |

| As at 31 March 2023 | AgeTable 20 Footnote a | 59.7 | 58.5 | 58.9 |

| Basic benefit ($) | 84,538 | 92,221 | 89,611 | |

|

Table 20 Footnotes

|

||||

| Age | NumberTable 21 Footnote a | Basic benefits ($ thousands) | ||||

|---|---|---|---|---|---|---|

| Male | Female | Total | Male | Female | Total | |

| To 49 | 5 | 7 | 12 | 992 | 1,327 | 2,319 |

| 50-54 | 162 | 208 | 370 | 34,966 | 37,881 | 72,847 |

| 55-59 | 3,635 | 5,442 | 9,077 | 756,297 | 999,933 | 1,756,230 |

| 60-64 | 12,438 | 17,542 | 29,980 | 2,353,799 | 2,830,699 | 5,184,498 |

| 65-69 | 19,338 | 24,041 | 43,379 | 2,678,423 | 2,832,580 | 5,511,003 |

| 70-74 | 21,428 | 20,986 | 42,414 | 1,067,978 | 893,212 | 1,961,190 |

| 75-79 | 18,355 | 13,176 | 31,531 | 183,550 | 131,760 | 315,310 |

| 80-84 | 10,985 | 6,520 | 17,505 | 109,850 | 65,200 | 175,050 |

| 85-89 | 5,759 | 3,119 | 8,878 | 57,590 | 31,190 | 88,780 |

| 90-94 | 2,975 | 1,564 | 4,539 | 29,750 | 15,640 | 45,390 |

| 95-99 | 840 | 632 | 1,472 | 8,400 | 6,320 | 14,720 |

| Above 99 | 125 | 134 | 259 | 1,250 | 1,340 | 2,590 |

| Total | 96,045 | 93,371 | 189,416 | 7,282,846 | 7,847,082 | 15,129,927 |

|

Table 21 Footnotes

|

||||||

| Average | Male | Female | Total | |

|---|---|---|---|---|

| As at 31 March 2020 | AgeTable 22 Footnote a | 65.5 | 64.2 | 64.9 |

| Basic benefit ($) | 79,471 | 89,973 | 84,453 | |

| As at 31 March 2023 | AgeTable 22 Footnote a | 65.8 | 64.8 | 65.3 |

| Basic benefit ($) | 75,827 | 84,042 | 79,877 | |

|

Table 22 Footnotes

|

||||

Appendix D – Methodology

D.1 Account balance

The balance of the Account forms part of the Public Accounts of Canada. The Account records the transactions for the plan, meaning that no debt instrument has been issued to the Account by the government in recognition of the amounts therein. The recorded balance is shown at the book value of the underlying notional bond portfolio described in Appendix B.

The Account balance corresponds to the cumulative historical excess of contributions and interest credits over basic benefit payments. The Account balance is accordingly projected to the end of a given plan year by adding to the Account at the beginning of that plan year the net income (i.e. the excess of contributions and interest credits over benefits) projected as described below for that plan year.

In the projection of the Account, no assumption was made regarding the expenses incurred for the administration of the plan. These expenses, which are not debited to the Account, are commingled with all other government charges.

D.2 Contributions

D.2.1 Participants

Participants' annual contributions are projected for a given plan year by multiplying:

-

the legislated annual contribution rate of $1.8 per $1,000 of coverage (equivalent to the monthly rate of 15 cents per $1,000 of coverage),

by

-

the aggregate of two times the salaries of participants projected for that plan year on an open-group basis,

less

- 10% per year reduction from age 65, and

- 10,000 paid-up coverage after age 65.

Non-elective participants' salaries are projected for a given plan year using the assumed rates of increase described in Appendix E and the assumed seniority and promotional salary increases described in Table 24. Elective participants' salaries are frozen at the time of retirement or disability and are not subject to further increases.

D.2.2 Government

The government's annual contribution is projected for a given plan year as the sum of:

-

one-twelfth of the amount of term insurance death benefits projected to be paid during that plan year,

and

- the legislated single premiums in respect of relevant participants 65 years of age (or participants completing two years of service, if older).

D.2.3 Crown corporations and public boards

Crown corporations' and public boards' annual contributions are projected for a given plan year by multiplying:

-

the legislated annual contribution rate of $0.48 per $1,000 of coverage (equivalent to the monthly rate of 4 cents per $1,000 of coverage),

by

-

the aggregate of two times the salaries of each participant who is employed by the Crown corporation or public board projected for that plan year on an open-group basis,

less

- 10% per year reduction from age 65, and

- 10,000 paid-up coverage after age 65.

D.2.4 Interest credits

Annual interest credits are projected for a given plan year as the product of the yield projected for that plan year (shown in Appendix E) and the projected average Account balance in that plan year.

D.2.5 Basic benefit payments

The total amount of basic benefits (term and paid-up insurance) for a given plan year is projected as the total amount of insurance in force during that plan year multiplied by the mortality rates assumed to apply during that plan year. The amount of basic benefit in force depends on the salary projected to time of death. Salaries are projected for this purpose using the assumed rates of increase in salaries and the number of participants is projected on an open-group basis as described in Appendix F.

D.3 Liabilities

D.3.1 Paid-up reserve

At the end of a given plan year, the liabilities associated with the individual $10,000 paid-up death benefit in force correspond to the amount which, together with interest at the projected yields, is sufficient to pay for each individual $10,000 paid-up death benefit projected payable on the basis of the assumed mortality rates.

D.3.2 IBNR and outstanding payments

On the basis of the plan's experience, at the end of a given plan year, the liabilities for deaths incurred but not reported (IBNR) are set equal to 1% of the expected payments of the plan year. The IBNR deaths are assumed to be reported the following plan year.

Outstanding payments are liabilities related to deaths reported, but still unpaid at the end of a given plan year. They are determined by taking the difference between 97% of the expected payments and the payments already disbursed for the deaths that have already occurred. The 97% assumption was developed based on the actual percentage of payments made from prior years according to the data provided.

In the previous valuation, the reserve at the end of a given plan year for claims incurred but not reported (IBNR) and for pending claims was set equal to one-sixth of the projected annual death benefits paid on average during the six previous plan year.

Appendix E – Economic Assumptions

The following economic assumptions are required for valuation purposes:

E.1 Employment earnings increases

Average earnings increases are exclusive of seniority and promotional increases, which are considered under a separate demographic assumption. Except for the first two years which reflect the current collective agreements, the annual increase in pensionable earnings is assumed to be 0.5% higher than the corresponding increase in CPI. This corresponds to an increase in average pensionable earnings of 2.6 % for plan year 2026 and 2027, and 2.5% for plan year 2028 and thereafter (2.7% in the previous valuation for plan year 2029 and thereafter).

E.2 Projected yields on SDB Account

These yields are required for the long-term projection of the SDB Account balance, liabilities, and excess. The methodology used to determine the projected yields on the Superannuation Account is described in Appendix F of the Report on the Pension Plan for the Public Service of Canada as at 31 March 2023 prepared by Office of the Chief Actuary. The projected yield on the Account is 3.1% in plan year 2024. It is projected to reach a low of 2.6% in 2036 and to reach its ultimate value of 4.0% in 2050.

E.3 Summary of economic assumptions

The economic assumptions used in this report are summarized in the following table.

| Plan year | Average earnings increase of non-elective participants | Projected yield on Account |

|---|---|---|

| 2024 | 3.5 | 3.1 |

| 2025 | 2.3 | 3.0 |

| 2026 | 2.6 | 2.9 |

| 2027 | 2.6 | 2.9 |

| 2028 | 2.5 | 2.8 |

| 2029 | 2.5 | 2.7 |

| 2030 | 2.5 | 2.7 |

| 2031 | 2.5 | 2.6 |

| 2032 | 2.5 | 2.6 |

| 2033 | 2.5 | 2.6 |

| 2035 | 2.5 | 2.6 |

| 2040 | 2.5 | 3.1 |

| 2045 | 2.5 | 3.8 |

| 2050+ | 2.5 | 4.0 |

Appendix F – Demographic and other assumptions

All contributors to the pension plan for the Public Service of Canada are covered by a supplementary death benefit as defined under Part II of the PSSA. Hence, given the size of the population subject to the PSSA, except where otherwise noted, the demographic assumptions are the same as those used in the Actuarial Report on the Pension Plan for the Public Service of Canada as at 31 March 2023.

Details on these assumptions can be found in Appendix G of that report.

F.1 Demographic assumptions

F.1.1 Seniority and promotional salary increases

Seniority means length of service within a classification and promotion means moving to a higher paid classification.

The following table shows a sample of the assumed seniority and promotional salary increases.

| Years of pensionable service | Male | Female |

|---|---|---|

| 0 | 6.1 | 6.3 |

| 1 | 5.6 | 5.8 |

| 2 | 5.0 | 5.3 |

| 3 | 4.4 | 4.7 |

| 4 | 3.8 | 4.1 |

| 5 | 3.4 | 3.6 |

| 6 | 3.0 | 3.3 |

| 7 | 2.8 | 3.0 |

| 8 | 2.5 | 2.8 |

| 9 | 2.4 | 2.7 |

| 10 | 2.2 | 2.5 |

| 15 | 1.6 | 1.9 |

| 20 | 1.2 | 1.5 |

| 25 | 1.0 | 1.2 |

| 30 | 0.8 | 1.1 |

F.1.2 New participants

As the active population of the plan is expected to grow, new participants are projected to replace members that cease to be active as well as increase the number of participants over time.

The assumed percentage increases in the number of participants for each plan year are shown in the following table:

| Plan Year | Percentage |

|---|---|

| 2024 | 3.8 |

| 2025 to 2026 | -1.0 |

| 2027 to 2031 | 0.7 |

| 2032 and after | 0.6 |

It is assumed that the distribution of new members by age, gender, service, and salary level (which is adjusted by the economic increases) will be on average the same as those of members with less than one year of service at each of the three years preceding the valuation date.

F.1.3 Pensionable retirement

The following tables show a sample of the assumed rates of pensionable retirement.

| Age | Years of pensionable service | ||||||

|---|---|---|---|---|---|---|---|

| 2 | 5 | 10 | 20 | 29 | 30 | 35 | |

| 50 | 55 | 35 | 25 | 15 | 20 | 20 | 0 |

| 55 | 50 | 45 | 30 | 20 | 130 | 280 | 275 |

| 60 | 90 | 75 | 100 | 165 | 275 | 320 | 335 |

| 65 | 160 | 135 | 245 | 250 | 235 | 325 | 335 |

| 70 | 220 | 310 | 250 | 325 | 315 | 330 | 530 |

| Age | Years of pensionable service | ||||||

|---|---|---|---|---|---|---|---|

| 2 | 5 | 10 | 20 | 29 | 30 | 35 | |

| 50 | 90 | 45 | 15 | 10 | 15 | 15 | 0 |

| 55 | 65 | 45 | 30 | 30 | 200 | 325 | 550 |

| 60 | 115 | 70 | 130 | 200 | 360 | 375 | 400 |

| 65 | 205 | 230 | 240 | 290 | 240 | 300 | 395 |

| 70 | 300 | 415 | 270 | 275 | 300 | 280 | 495 |

| Age | Years of pensionable service | ||||||

|---|---|---|---|---|---|---|---|

| 2 | 5 | 10 | 20 | 29 | 30 | 35 | |

| 55 | 40 | 40 | 30 | 19 | 25 | 28 | 0 |

| 60 | 85 | 65 | 75 | 57 | 162 | 301 | 332 |

| 65 | 160 | 135 | 245 | 250 | 235 | 325 | 335 |

| 70 | 220 | 310 | 250 | 325 | 315 | 330 | 530 |

| Age | Years of pensionable service | ||||||

|---|---|---|---|---|---|---|---|

| 2 | 5 | 10 | 20 | 29 | 30 | 35 | |

| 55 | 55 | 35 | 25 | 16 | 21 | 23 | 0 |

| 60 | 95 | 70 | 95 | 76 | 233 | 355 | 585 |

| 65 | 205 | 230 | 240 | 290 | 240 | 300 | 395 |

| 70 | 300 | 415 | 270 | 275 | 300 | 280 | 495 |

| Age | Years of pensionable service | ||||||

|---|---|---|---|---|---|---|---|

| 2 | 5 | 10 | 20 | 25 | 30 | 35 | |

| 40 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 45 | 0 | 0 | 0 | 5 | 20 | 0 | 0 |

| 50 | 15 | 15 | 15 | 10 | 125 | 100 | 0 |

| 55 | 20 | 20 | 20 | 15 | 100 | 225 | 350 |

| 60 | 100 | 100 | 100 | 125 | 250 | 250 | 500 |

| 65 | 300 | 300 | 300 | 300 | 450 | 300 | 500 |

F.1.4 Disability retirement

The following table shows a sample of the assumed rates of disability retirement.

| Age | Male | Female |

|---|---|---|

| 25 | 0.00 | 0.00 |

| 30 | 0.15 | 0.10 |

| 35 | 0.40 | 0.85 |

| 40 | 0.70 | 1.65 |

| 45 | 1.40 | 2.65 |

| 50 | 2.45 | 4.45 |

| 55 | 4.00 | 6.25 |

| 59 | 4.50 | 6.55 |

| 60 to 64Table 31 Footnote a | 2.00 | 6.00 |

| 65 and above | 0.00 | 0.00 |

|

Table 31 Footnotes

|

||

F.1.5 Withdrawal

Withdrawal with less than two years of service includes termination of employment for any reason. Withdrawal with two or more years of service means termination of employment for reasons other than death, disability or retirement with an immediate annuity or an annual allowance. Tables 32 to 34 provide samples of the assumed rates of withdrawal.

| Age | Years of pensionable service | ||||||

|---|---|---|---|---|---|---|---|

| 0 | 1 | 2 | 5 | 10 | 15 | 21 and after+ | |

| 20 | 420 | 250 | 80 | 0 | 0 | 0 | 0 |

| 25 | 150 | 120 | 70 | 40 | 0 | 0 | 0 |

| 30 | 99 | 85 | 50 | 28 | 14 | 0 | 0 |

| 35 | 88 | 75 | 50 | 28 | 14 | 10 | 0 |

| 40 | 90 | 76 | 50 | 28 | 14 | 10 | 0 |

| 45 | 96 | 78 | 50 | 28 | 14 | 10 | 0 |

| 50 | 115 | 91 | 50 | 28 | 14 | 10 | 0 |

| 54 | 133 | 105 | 50 | 28 | 14 | 10 | 0 |

| 60 | 190 | 158 | 0 | 0 | 0 | 0 | 0 |

| 65 | 259 | 196 | 0 | 0 | 0 | 0 | 0 |

| Age | Years of pensionable service | ||||||

|---|---|---|---|---|---|---|---|

| 0 | 1 | 2 | 5 | 10 | 15 | 21 and after+ | |

| 20 | 350 | 200 | 100 | 0 | 0 | 0 | 0 |

| 25 | 130 | 110 | 60 | 23 | 0 | 0 | 0 |

| 30 | 94 | 82 | 50 | 23 | 13 | 0 | 0 |

| 35 | 88 | 71 | 50 | 23 | 13 | 10 | 0 |

| 40 | 92 | 72 | 50 | 23 | 13 | 10 | 0 |

| 45 | 102 | 77 | 50 | 23 | 13 | 10 | 0 |

| 50 | 129 | 97 | 50 | 28 | 15 | 10 | 0 |

| 54 | 156 | 112 | 50 | 30 | 20 | 15 | 0 |

| 60 | 223 | 164 | 0 | 0 | 0 | 0 | 0 |

| 65 | 312 | 220 | 0 | 0 | 0 | 0 | 0 |

The assumed rates of withdrawal are the same for actual operational contributors as well as for deemed operational contributors.

| Years of pensionable service | Unisex |

|---|---|

| 0 | 50 |

| 1 | 40 |

| 2 | 30 |

| 3 | 22 |

| 4 | 17 |

| 5 | 14 |

| 10 | 9 |

| 15 | 9 |

| 19 | 7 |

| 20 and after+ | 0 |

F.1.6 Elective participants entitled to a deferred annuity

Due to their negligible impact on costs and liabilities, actual and future deferred annuitants are not taken into consideration for the purpose of this valuation.

F.1.7 Mortality

The following table provides samples of the assumed mortality rates.

| Age | Non-elective participants and elective retired participants | Elective disabled participants | ||

|---|---|---|---|---|

| Male | Female | Male | Female | |

| 30 | 0.3 | 0.2 | 5.5 | 3.2 |

| 40 | 0.5 | 0.3 | 8.6 | 4.9 |

| 50 | 1.2 | 1.0 | 10.7 | 7.6 |

| 60 | 3.6 | 2.6 | 19.5 | 11.7 |

| 70 | 11.2 | 9.3 | 34.6 | 23.4 |

| 80 | 37.7 | 27.9 | 77.3 | 54.8 |

| 90 | 139.9 | 112.6 | 186.4 | 154.7 |

| 100 | 360.0 | 330.0 | 421.0 | 435.1 |

| 110 | 500.0 | 500.0 | 500.0 | 500.0 |

Mortality rates are expected to reduce over time. A sample of assumed mortality improvement rates is shown in the following table.

| Age | Initial and ultimate plan year mortality improvement rates (%) | |||

|---|---|---|---|---|

| Male at plan year 2025 | Male at plan year 2040 and after+ | Female at plan year 2025 | Female at plan year 2040 and after+ | |

| 40 | 0.60 | 0.80 | 0.79 | 0.80 |

| 50 | 1.34 | 0.80 | 1.27 | 0.80 |

| 60 | 1.73 | 0.80 | 1.53 | 0.80 |

| 70 | 1.65 | 0.80 | 1.27 | 0.80 |

| 80 | 1.54 | 0.80 | 1.04 | 0.80 |

| 90 | 1.48 | 0.62 | 1.34 | 0.62 |

| 100 | 0.67 | 0.28 | 0.75 | 0.28 |

| 110 and above | 0.00 | 0.00 | 0.00 | 0.00 |

F.2 Election proportions

A rate of 100% is assumed for the non-elective participants who opt to continue their coverage under the SDB plan at retirement. This is derived from the plan's own recent experience.

A non-elective participant who becomes disabled is also assumed to always opt to continue the coverage.

F.3 Other assumptions

F.3.1 Option to reduce coverage to $10,000

The valuation data indicates that the proportion of elective participants opting to reduce their basic benefit to $10,000 is negligible. Accordingly, no elective participants were assumed to make such an option.

F.3.2 Option to reduce 10% coverage annually from age 61

Bill C-78 introduced this option to participants effective 1 October 1999. Election of this option by participants would have a positive effect on the plan's actuarial excess. The valuation data indicates that participants that have opted for this option have already passed age 75. Accordingly, no non-elective participants were assumed to make such an election anymore in the future.

Appendix G – Acknowledgements

The Superannuation Directorate of Public Services and Procurement Canada provided the data on plan participants.

The following individuals assisted in the preparation of this report:

Linda Benjauthrit, ACIA, ASA

Simon Brien, ACIA, ASA

Julie Fortier

Shufen Lee, ACIA, ASA

Kelly Moore