Actuarial Report (20th) on the Pension Plan for the Public Service of Canada as at 31 March 2023

Accessibility statement

The Web Content Accessibility Guidelines (WCAG) defines requirements for designers and developers to improve accessibility for people with disabilities. It defines three levels of conformance: Level A, Level AA, and Level AAA. This report is partially conformant with WCAG 2.0 level AA. If you require a compliant version, please contact webmaster@osfi-bsif.gc.ca.

ISSN: 1701-8269

27 September 2024

The Honourable Anita Anand, P.C., MP.

President of Treasury Board

Ottawa, Canada

K1A 0R5

Dear Minister:

Pursuant to Section 6 of the Public Pensions Reporting Act, I am pleased to submit the report on the actuarial review as at 31 March 2023 of the pension plan for the Public Service of Canada. This actuarial review is in respect of pension benefits and contributions which are defined by Parts I, III and IV of the Public Service Superannuation Act, the Special Retirement Arrangements Act and the Pension Benefits Division Act.

Yours sincerely,

Assia Billig, FCIA, FSA

Chief Actuary

Table of contents

List of tables

- Table 1 Ultimate best-estimate economic assumptions

- Table 2 Demographic assumptions

- Table 3 State of the Superannuation Account

- Table 4 Financial position of the Pension Fund (Service Since 1 April 2000)

- Table 5 Reconciliation of financial position from plan year 2020 to 2023 by financing arrangement

- Table 6 Experience gains and losses from 31 March 2020 to 31 March 2023 by financial arrangement

- Table 7 Impact of the revision of actuarial assumptions on the financial position

- Table 8 Current service cost for plan year 2025

- Table 9 Reconciliation current service cost (as a percentage of pensionable payroll)

- Table 10 Member contribution rates

- Table 11 Projection of the current service cost on a plan year basis

- Table 12 Projection of the current service cost on a calendar year basis

- Table 13 Projection of the current service cost on a calendar year basis – Group 1

- Table 14 Projection of the current service cost on a calendar year basis – Group 2

- Table 15 Pension fund administrative expenses

- Table 16 Estimated contributions for prior service buyback

- Table 17 Sensitivity of valuation results to variations in key economic assumptions

- Table 18 State of the RCA No. 1 Account

- Table 19 State of the RCA No. 2 Account

- Table 20 RCA No. 1 – Projection of the current service cost on a plan year basis

- Table 21 RCA No. 1 – Projection of the current service cost on a calendar year basis

- Table 22 Estimated government credits

- Table 23 Estimated government cost - Pension Fund

- Table 24 Member contribution rates

- Table 25 Contributor benefits

- Table 26 Pensioner benefits

- Table 27 RCA – Summary of Plan provisions

- Table 28 Reconciliation of balances in Superannuation Account

- Table 29 Reconciliation of balances in Pension Fund

- Table 30 Reconciliation of balances in RCA No. 1 Account

- Table 31 Reconciliation of balances in RCA No. 2 Account

- Table 32 Rates of interest (return)

- Table 33 Summary of membership data

- Table 34 Reconciliation of Group 1 contributors

- Table 35 Reconciliation of Group 2 contributors

- Table 36 Reconciliation of pensioners

- Table 37 Reconciliation of surviving spouses

- Table 38 Reconciliation of children survivors

- Table 39 Reconciliation of pensioners with RCA No. 2 benefits (ERI)

- Table 40 Actuarial value of Pension Fund assets

- Table 41 Asset mix

- Table 42 Real rate of return by asset class

- Table 43 Overall rate of return on assets of the Pension Fund

- Table 44 Rates of return on assets in respect of the Pension Fund

- Table 45 Transfer value real interest rates

- Table 46 Economic assumptions

- Table 47 Sample of assumed seniority and promotional salary increases

- Table 48 Assumed annual increases in number of contributors

- Table 49 Sample of assumed rates of retirement – Main group 1 – Male

- Table 50 Sample of assumed rates of retirement – Main group 2 – Male

- Table 51 Sample of assumed rates of retirement – Main group 1 – Female

- Table 52 Sample of assumed rates of retirement – Main group 2 – Female

- Table 53 Sample of assumed rates of retirement – Operational group

- Table 54 Sample of assumed rates of pensionable disability

- Table 55 Sample of assumed rates of withdrawal – Main group – Male

- Table 56 Sample of assumed rates of withdrawal - Main group - Female

- Table 57 Sample of assumed rates of withdrawal – Operational group

- Table 58 Sample of assumed rates of mortality – For Plan year 2024

- Table 59 Sample of assumed mortality improvement rates

- Table 60 Cohort life expectancy of contributors and non-disabled pensioners

- Table 61 Probability of an eligible spouse at death of member

- Table 62 Spouse age difference with the member at death of member

- Table 63 Assumed rates of children ceasing to be eligible for a survivor allowance

- Table 64 Sample of assumed proportion eligible spouse at termination of employment

- Table 65 Sample of assumed divorce rates

- Table 66 Sensitivity to interest rate risk

- Table 67 Sensitivity of cohort life expectancy to variations in mortality improvement rates

- Table 68 Sensitivity of financial results to variations to the ultimate mortality improvement rates

- Table 69 Climate change scenario – Average nominal annual rate of return on assets in respect of the pension fund (%)

- Table 70 Climate change scenario – Pension fund status as at 31 March 2023

- Table 71 Financial positions at tail-events of best-estimate portfolio as at 31 March 2026

- Table 72 Male contributors (Group 1 - Main group)

- Table 73 Male contributors (Group 1 - Main group) - Summary

- Table 74 Female contributors (Group 1 - Main group)

- Table 75 Female contributors (Group 1 - Main group) - Summary

- Table 76 Male contributors (Group 1 - Operational group)

- Table 77 Male contributors (Group 1 - Operational group) - Summary

- Table 78 Female contributors (Group 1 - Operational group)

- Table 79 Female contributors (Group 1 - Operational group) - Summary

- Table 80 Male and female contributors (Group 1 - Leave without pay and non-active contributors)

- Table 81 Male and female contributors (Group 1 - Leave without pay and non-active contributors) - Summary

- Table 82 Male contributors (Group 2 - Main group)

- Table 83 Male contributors (Group 2 - Main group) - Summary

- Table 84 Female contributors (Group 2 - Main group)

- Table 85 Female contributors (Group 2 - Main group) - Summary

- Table 86 Male contributors (Group 2 - Operational group)

- Table 87 Male contributors (Group 2 - Operational group) - Summary

- Table 88 Female contributors (Group 2 - Operational group)

- Table 89 Female contributors (Group 2 - Operational group) - Summary

- Table 90 Male and female contributors (Group 2 - Leave without pay and non-active contributors)

- Table 91 Male and female contributors (Group 2 - Leave without pay and non-active contributors) - Summary

- Table 92 Male retired pensioners Number of retired pensioners and average annual pension in pay as at 31 March 2023

- Table 93 Male retired pensioners - Summary

- Table 94 Female retired pensioners Number of retired pensioners and average annual pension in pay as at 31 March 2023

- Table 95 Female retired pensioners - Summary

- Table 96 Male disabled pensioners Number of disabled pensioners and average annual pension in pay as at 31 March 2023

- Table 97 Male disabled pensioners - Summary

- Table 98 Female disabled pensioners Number of disabled pensioners and average annual pension in pay as at 31 March 2023

- Table 99 Female disabled pensioners - Summary

- Table 100 Male deferred pensioners Number of deferred pensioners and average annual deferred pension as at 31 March 2023

- Table 101 Male deferred pensioners - Summary

- Table 102 Female deferred pensioners Number of deferred pensioners and average annual deferred pension as at 31 March 2023

- Table 103 Female deferred pensioners - Summary

- Table 104 Surviving spouses Number of surviving spouses and average annual allowance as at 31 March 2023

- Table 105 Surviving spouses - Summary

List of charts

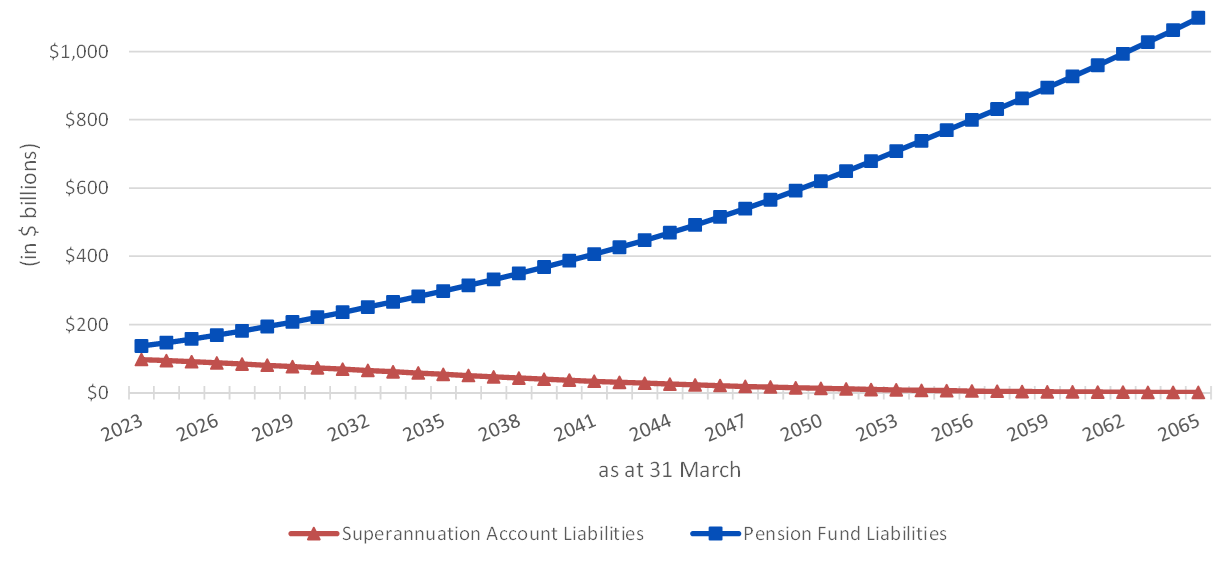

- Chart 1 Pension Fund and Superannuation Account Evolution of liabilities from plan year 2023 to plan year 2065 in $ billions

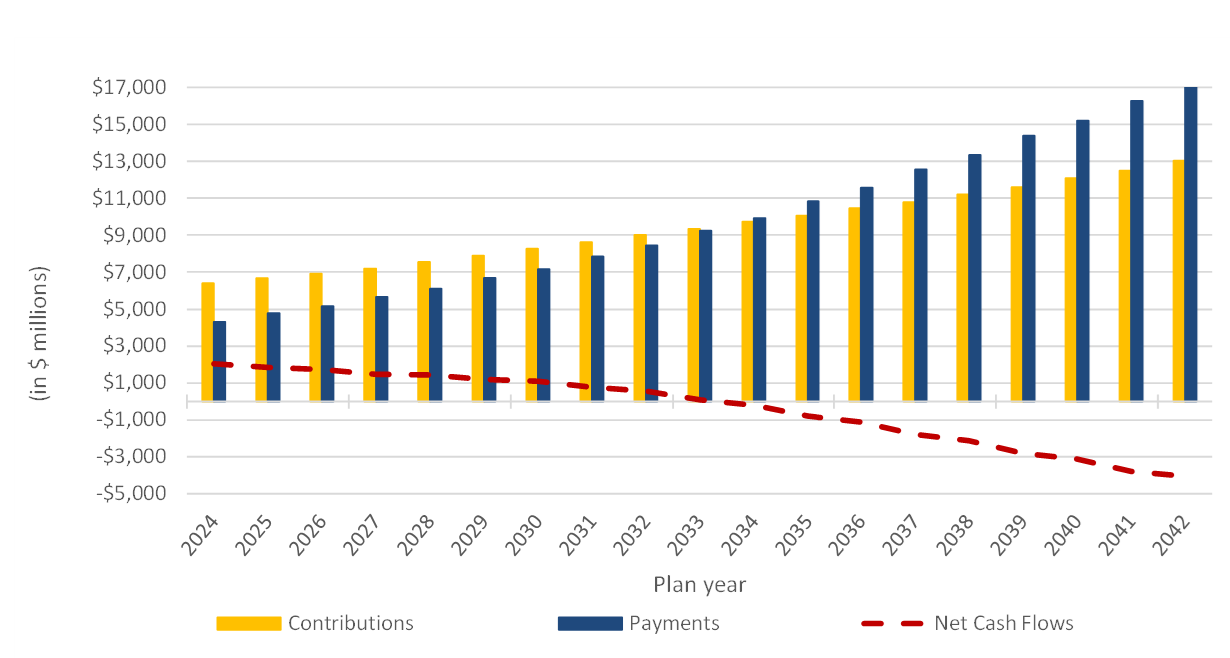

- Chart 2 Pension Fund – Evolution of cash flows from plan year 2024 to plan year 2042 in $ millions

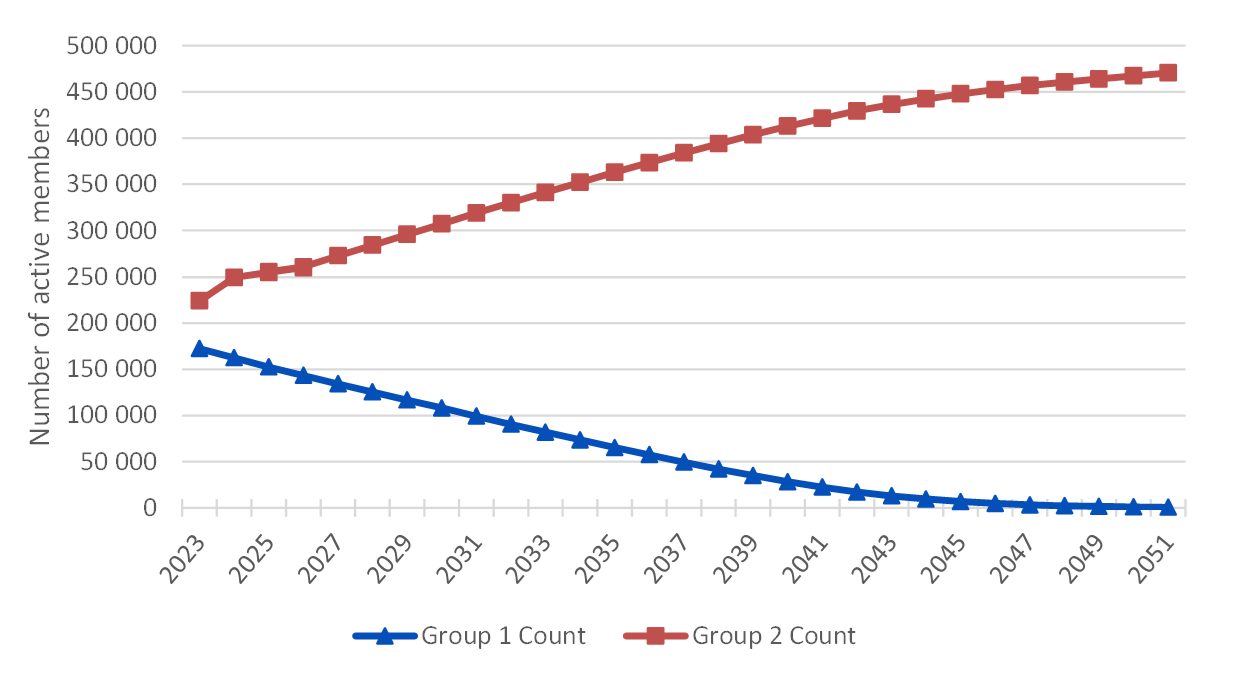

- Chart 3 Pension Fund – Evolution of Group 1 and Group 2 active membership from plan year 2023 to plan year 2051

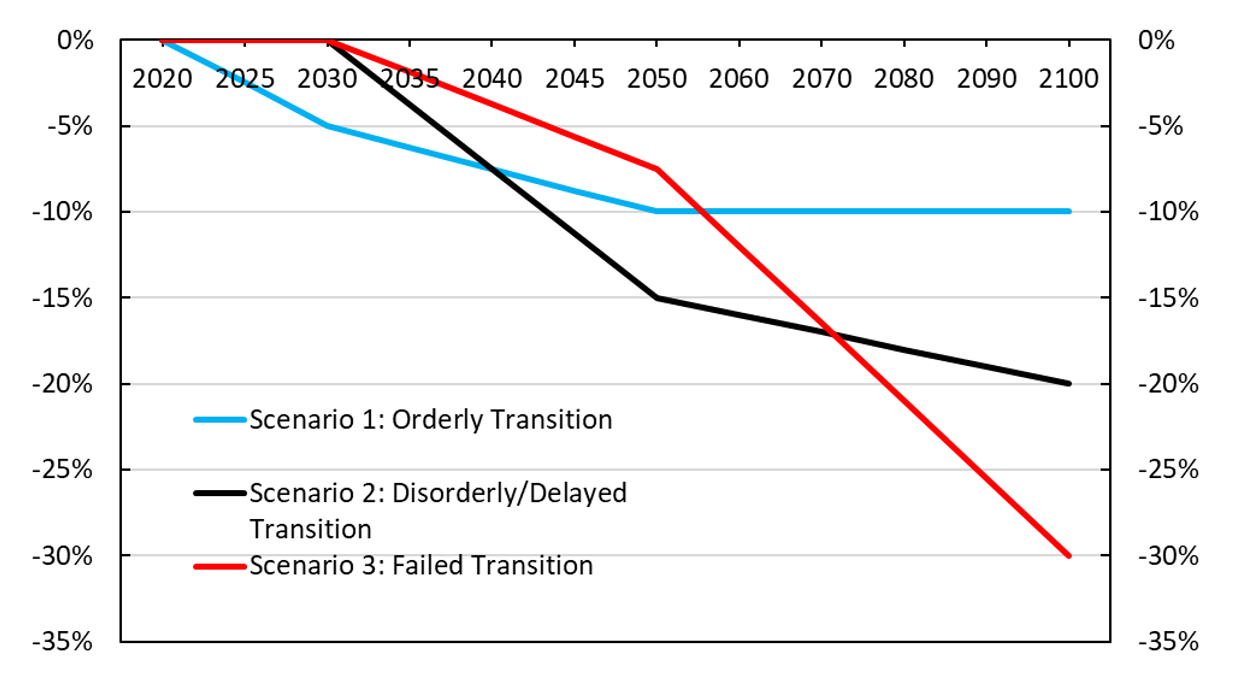

- Chart 4 Climate scenarios – Cumulative Canadian GDP impact relative to baseline scenario from 2020 to 2100

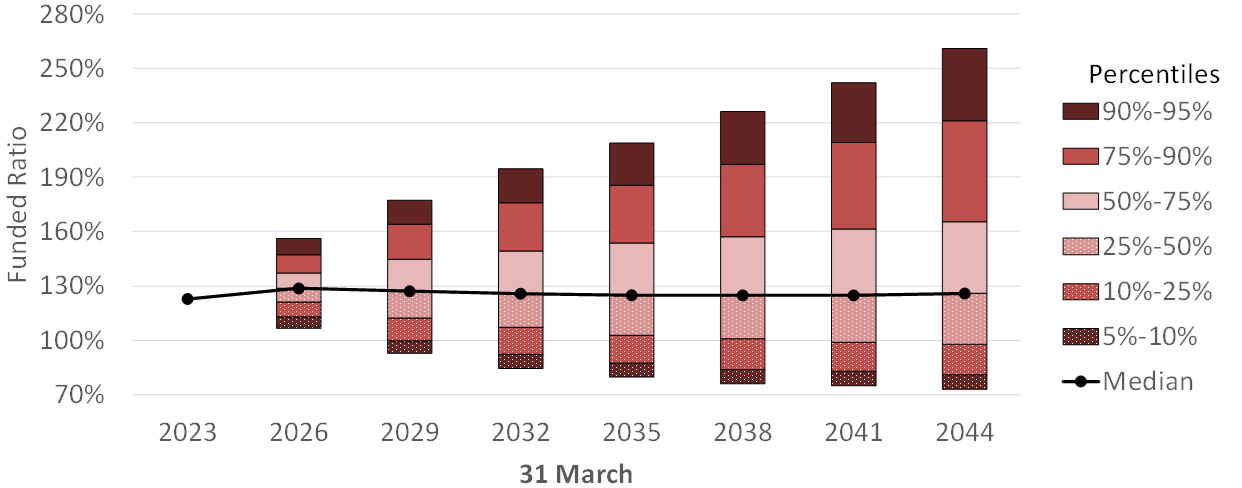

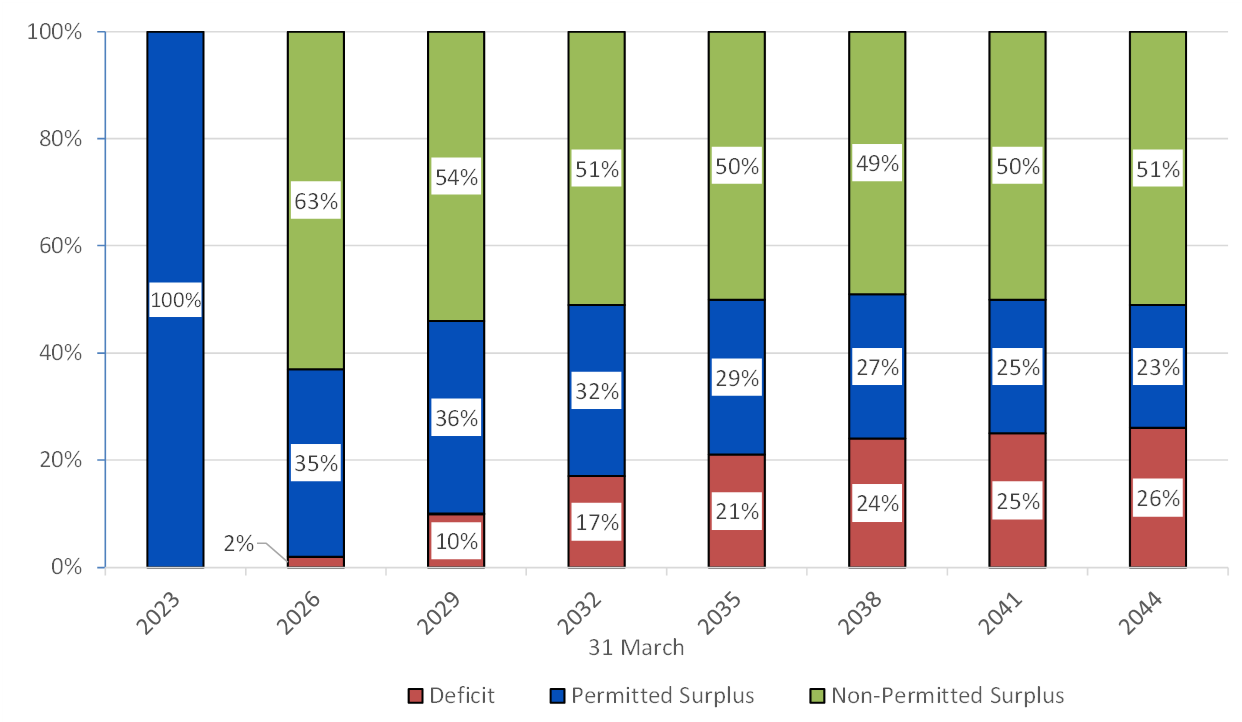

- Chart 5 Pension Fund – Range of potential funded ratio for the best-estimate portfolio from plan year 2023 to plan year 2044

- Chart 6 Pension Fund – Likelihood of deficit, permitted and non-permitted surplus due to investment volatility and inflation modelling from plan year 2023 to plan year 2044

1 Highlights of the report

| Superannuation Account (Service prior to 1 April 2000) |

Pension Fund (Service since 1 April 2000) |

|

|---|---|---|

| Financial position | The balance of the Superannuation Account is $91,353 million. | The actuarial value of the assets in respect of the Pension Fund is $169,178 million. |

| The actuarial liability for service prior to 1 April 2000Main findings - Table footnote a is $97,403 million. | The actuarial liability for service since 1 April 2000 is $137,172 million. | |

| The resulting actuarial shortfall is $6,050 million. | The resulting actuarial surplus is $32,006 million. | |

| Funded ratio/Special credits or payments |

|

The funded ratio is 123.3%. |

| Member contribution rates | No contribution is made to the Superannuation Account. |

For calendar year 2025, the contribution rates are assumed to be:

|

| Projected current service cost (Calendar year 2025) |

No current service cost for the Superannuation Account. |

|

|

Main findings - Table footnotes

|

||

2 Introduction

This actuarial report on the pension plan for the Public Service of Canada (PSPP) was made pursuant to the Public Pensions Reporting Act (PPRA).

This actuarial valuation is as at 31 March 2023 and is in respect of pension benefits and contributions defined by Parts I, III and IV of the Public Service Superannuation Act (PSSA), the Special Retirement Arrangements Act (SRAA), which covers the Retirement Compensation Arrangements Regulations No. 1 and No. 2 (RCA), and the Pension Benefits Division Act (PBDA).

The previous actuarial report was prepared as at 31 March 2020. The next periodic review is scheduled to occur no later than 31 March 2026.

2.1 Purpose of actuarial report

The purposes of this actuarial valuation are to:

- determine the state of the Public Service Superannuation Account (Superannuation Account), the Public Service Pension Fund (Pension Fund) and the RCA Accounts;

- determine the projected current service costs for the Pension Fund and the RCA Accounts; and

- assist the President of the Treasury Board in making informed decisions regarding the financing of the government’s pension benefit obligation.

This report may not be suitable for another purpose.

2.2 Structure of the report

Section 3 presents a general overview of the valuation basis used in preparing this actuarial report and section 4 presents the financial position of the plan as well as the reconciliation of the changes in financial position and the cost certificate.

Finally, section 5 provides the actuarial opinion for the current valuation.

The various appendices provide a summary of the plan provisions, a description of data, methodologies and assumptions employed. The appendices also provide pension plan projections, scenarios illustrating downside risks and the uncertainty of results resulting from future investment returns.

Numbers shown in the tables throughout this report may not add up due to rounding.

3 Valuation basis

3.1 Valuation inputs

This report is based on pension benefit provisions enacted by the legislation, summarized in Appendices A and B.

No amendments were made to the PSSA since the previous valuation. Minor amendments were applied to the Public Service Superannuation Regulations since the previous valuation. Those amendments did not have any impact on the actuarial valuation of the plan.

The Funding Policy for the Public Sector Pension Plans (Funding Policy) was approved by the Treasury Board in 2018. The policy provides guidance and rules to support prudent governance of the plansFootnote 1 and ensures that sufficient assets are accumulated to meet the cost of the accrued pension benefits. The methods, assumptions and results of this actuarial valuation are consistent with the provisions of the Funding Policy.

The financial data on which this valuation is based on are composed of:

- the Pension Fund invested assets that the government has earmarked for the payment of benefits for service since 1 April 2000;

- the Superannuation Account established to track the government’s pension benefit obligations for service prior to 1 April 2000.

- the RCA Accounts established to track the pension benefit obligations in excess of those that can be provided under the Income Tax Act limits for registered pension plans.

These pension assets and account balances are summarized in Appendix C.

The membership data are provided by the Department of Public Services and Procurement Canada (PSPC). Membership data and tests performed on them are summarized in Appendix D.

The valuation was prepared using accepted actuarial practices, methods and assumptions, which are summarized in Appendices E to I.

All actuarial assumptions used in this report are best-estimate assumptions and do not include any margin for adverse deviations. They are independently reasonable and appropriate in aggregate for the purposes of the valuation at the date of this report.

Actuarial assumptions used in the previous report were revised based on economic trends and demographic experience. A complete description of the assumptions is detailed in Appendices F to I.

A summary of the ultimate economic assumptions used in this report and those used in the previous report is shown in the following table.

| 31 March 2023 | 31 March 2020 | |

|---|---|---|

| Assumed level of inflation | 2.0% | 2.0% |

| Real increase in average pensionable earnings | 0.5% | 0.7% |

| Real increase in YMPE and MPETable 1 Footnote a | 0.9% | 1.0% |

| Real rate of return on the Pension Fund | 4.0% | 3.9% |

| Real projected yield on the Superannuation Account and RCA accounts | 2.0% | 2.1% |

|

Table 1 Footnotes

|

||

The following table presents a summary of the demographic assumptions used in this report and those used in the previous report.

| 31 March 2023 | 31 March 2020 | |

|---|---|---|

| Promotional and seniority rate of increase for males | 0.6% to 6.1% | 0.6% to 5.9% |

| Promotional and seniority rate of increase for females | 0.7% to 6.3% | 0.7% to 6.1% |

| Male cohort life expectancy at age 65Table 2 Footnote a | 22.5 years | 22.4 years |

| Female cohort life expectancy at age 65Table 2 Footnote a | 24.1 years | 24.1 years |

| Group 1 expected average retirement age | 60.3 years | 60.1 years |

| Group 2 expected average retirement age | 62.2 years | 62.1 years |

|

Table 2 Footnotes

|

||

3.2 Subsequent events

Certain occupational groups who promote the safety and security of Canadians are eligible to early retirement: retirement after 25 years of service without a pension reduction. The government has announced on 13 June 2024 its intent to expand this early pension eligibility for frontline and security workers under the PS pension plan. Since the details are not yet available and legislative changes have not been introduced yet, we have not reflected any of these potential changes in this report. Pursuant to section 4 of the PPRA, a report on an actuarial review of the PS pension plan could be required when the legislative changes are introduced.

The Pay Equity Act, which came into force on 31 August 2021, applies to all federally regulated employers with 10 employees or more. On 19 August 2024, the Pay Equity Commissioner has granted Treasury Board Secretariat the requested extension of 3 years to post a final pay equity plan for employees of Core Public Administrations by 31 August 2027. Since federal employers are at various steps of the pay equity process, the details of the expected changes to compensation are not known, and the impact of the implementation of the Pay Equity Act has not been considered in this report.

As of the date of the signing of this report, we were not aware of any other subsequent events that may have a material impact on the results of this valuation.

4 Valuation results

This report is based on the pension benefit provisions enacted by the legislation, summarized in Appendices A and B, and the financial and membership data, summarized in Appendices C and D, respectively. The valuation was prepared using accepted actuarial practices, methods and assumptions summarized in Appendices E to I. Emerging experience that differs from the corresponding assumptions will result in gains or losses to be revealed in subsequent reports.

4.1 PSSA – Financial position

The Superannuation Account is credited with all PSSA member contributions and government costs prior to 1 April 2000, as well as with prior service contributions and costs for elections made prior to 1 April 2000. Beginning on 1 April 2000, member and government contributions are no longer credited to the Superannuation Account. Rather, they are credited to the Pension Fund, and the total amount of contributions net of benefits and administrative expenses paid is transferred to the Public Sector Pension Investment Board (PSP Investments) and invested in the financial markets.

This section presents the financial positions for both PSSA financing arrangements as at 31 March 2023. The results of the previous valuation are also shown for comparison.

| Components of financial position | 31 March 2023 | 31 March 2020 |

|---|---|---|

| Assets | ||

| Recorded Account balance | 91,343 | 91,516 |

| Present value of prior service contributions | 10 | 21 |

| Total assets | 91,353 | 91,537 |

| Actuarial liability | ||

| Active contributors | 7,368 | 12,422 |

| Non-active contributors | 140 | 111 |

| Retirement pensioners | 78,689 | 75,391 |

| Deferred pensioners | 626 | 875 |

| Disability pensioners | 2,431 | 2,523 |

| Surviving dependents | 7,567 | 6,985 |

| Outstanding payments | 0 | 7 |

| Administrative expenses | 582 | 523 |

| Total actuarial liability | 97,403 | 98,837 |

| Actuarial excess or (shortfall) | (6,050) | (7,300) |

In accordance with the PSSA, the actuarial shortfall of $6,050 million could be amortized over a maximum period of 15 years beginning on 31 March 2025. If the shortfall is amortized over the maximum period, 15 equal annual credits of $514 million could be made to the Superannuation Account. The time, manner and amount of such credits are to be determined by the President of the Treasury Board.

It is expected that the government will eliminate the actuarial shortfall of the Superannuation Account by making a one-time credit of $6,425 million as at 31 March 2025 to take into account the interest on the shortfall accumulated from 31 March 2023 to 31 March 2025.

| Components of financial position | 31 March 2023 | 31 March 2020 |

|---|---|---|

| Actuarial value of assets | ||

| Market value of assets | 177,974 | 123,433 |

| Actuarial smoothing adjustmentTable 4 Footnote a | (9,281) | 1,248 |

| Present value of prior service contributions | 485 | 728 |

| Total actuarial value of assets | 169,178 | 125,409 |

| Actuarial liability | ||

| Active contributors | 79,966 | 68,398 |

| Non-active contributors | 310 | 210 |

| Retirement pensioners | 49,377 | 36,330 |

| Deferred pensioners | 3,403 | 2,907 |

| Disability pensioners | 2,582 | 1,929 |

| Surviving dependents | 1,437 | 963 |

| Outstanding payments | 97 | 172 |

| Total actuarial liability | 137,172 | 110,909 |

| Actuarial surplus/(deficit) | 32,006 | 14,500 |

|

Table 4 Footnotes

|

||

As at 31 March 2023, the Pension Fund has a surplus of $32,006 million and the funded ratio is 123.3%. As such, no special payments are required and there is no non-permitted surplusFootnote 2.

4.2 PSSA – Reconciliation of the changes in financial position

Table 5 shows the reconciliation of the changes in the financial positions of the Superannuation Account and the Pension Fund. Explanations of the items largely responsible for the changes follow the table.

| Components of reconciliation of the financial position | Superannuation Account actuarial excess/(shortfall) | Pension Fund actuarial surplus/(deficit) |

|---|---|---|

| Financial position as at 31 March 2020 | (7,300) | 14,500 |

| Recognized investment gains or (losses) as at 31 March 2020 | n/a not applicable | (1,248) |

| Change in methodology | (184) | (823) |

| Revised financial position as at 31 March 2020 | (7,484) | 12,429 |

| Expected interest on revised financial position | (766) | 1,959 |

| Special credits or payments with interest | 8,047 | n/a not applicable |

| Net experience gains and (losses) | (4,330) | 21,219 |

| Revision of actuarial assumptions | (1,358) | 5,961 |

| Change in the present value of prior service contributions | (12) | (281) |

| Change in the present value of administrative expenses | (147) | n/a not applicable |

| Unrecognized investment gains or (losses) as at 31 March 2023 | n/a not applicable | (9,281) |

| Financial position as at 31 March 2023 | (6,050) | 32,006 |

4.2.1 Recognized investment gains or losses as at 31 March 2020

An actuarial asset valuation method that minimizes the impact of short-term fluctuations on the market value of assets was used in the previous valuation report, causing the actuarial value of the Pension Fund assets to be $1,248 million more than its market value.

4.2.2 Change in methodology

Improvements to the actuarial valuation software were made. The impacts of these improvements increased the Superannuation Account liability as at 31 March 2020 by $184 million and the Pension Fund liability as at the same date by $823 million.

4.2.3 Expected interest on revised initial financial position

The amount of interest expected to accrue during the intervaluation period increased the shortfall by $766 million for the Superannuation Account and increased the surplus by $1,959 million for the Pension Fund.

These amounts of interest were based on the Superannuation Account yields and the Pension Fund returns projected in the previous report for the three-year intervaluation period.

4.2.4 Special credits and payments made in the intervaluation period

The government made a one-time special credit as at 31 March 2022 to eliminate the $7,300 million shortfall reported in the Superannuation Account as at 31 March 2020. After factoring the expected interest, this credit resulted in an increase of $8,047 million in the recorded balance of the Superannuation Account as at 31 March 2023.

No deficit was reported in the Pension Fund as at 31 March 2020. Thus, no special payments were made during the intervaluation period.

4.2.5 Experience gains and (losses)

Since the previous valuation, experience gains and losses increased the Superannuation Account shortfall by $4,330 million and increased the Pension Fund surplus by $21,219 million. The main experience gain and loss items are shown in the following table followed by explanatory notes (i) through (iii). Gains are represented by positive numbers and losses are represented by negative numbers.

| Components of experience gains and (losses) | Superannuation Account | Pension Fund |

|---|---|---|

| Terminations | 44 | (50) |

| Retirements | (160) | (159) |

| Disabilities with an annuity | (2) | (123) |

| Active deaths | 52 | 41 |

| Retired pensioner mortality | (192) | (394) |

| Disabled pensioner mortality | 81 | 15 |

| Widow(er) mortality | 52 | 7 |

| Investment earnings Table 6 Footnote i | 114 | 26,730 |

| Service/contributions difference | (4) | (343) |

| Expected/actual disbursements | (114) | (307) |

| Corrections to the population data | 75 | (211) |

| Pension indexation Table 6 Footnote ii | (4,064) | (2,489) |

| Promotional and seniority increases | 35 | 91 |

| Economic salary increases Table 6 Footnote iii | (127) | (1,602) |

| YMPE and MPE increases | 3 | 48 |

| Pension benefit division | (6) | (52) |

| Administrative expenses | (23) | (22) |

| Miscellaneous | (95) | 38 |

| Total experience gains and (losses) | (4,330) | 21,219 |

|

Table 6 Footnotes

|

||

4.2.6 Revision of actuarial assumptions

Actuarial assumptions were revised based on economic trends and demographic experience as described in Appendices F to I. These revisions have increased the Superannuation Account shortfall by $1,358 million and increased the Pension Fund surplus by $5,961 million. The impact of these revisions is shown in Table 7 with the most significant items discussed thereafter.

| Actuarial assumptions | Superannuation Account | Pension Fund |

|---|---|---|

| Economic assumptions | ||

| Yields and rates of return | 1,270 | 8,078 |

| Increases in YMPE/MPE | 11 | 245 |

| Increases in pensionable earnings | (71) | (841) |

| Pension indexation | (2,994) | (2,080) |

| Transfer value rates | 0 | 184 |

| Demographic assumptions | ||

| Disabled pensioner mortality rates | 28 | 26 |

| Spouse mortality rates | 329 | 138 |

| Healthy contributor mortality rates | 0 | 8 |

| Healthy pensioner mortality rates | 571 | 406 |

| Mortality improvement factors | (196) | (139) |

| Withdrawal rates | 0 | (48) |

| Retirement rates | 51 | 431 |

| Disability rates | (6) | 17 |

| Seniority and promotional salary increases | (2) | (544) |

| Proportion opting for a deferred annuity | 0 | 200 |

| Family composition | (349) | (120) |

| Net impact of revision | (1,358) | 5,961 |

The net impact of the revision of the assumptions is largely attributable to the changes in economic assumptions.

The following revisions were made to the economic assumptions used in the previous report:

- ultimate real rate of return on the Pension Fund was increased from 3.9% to 4.0%;

- real rates of return on the Fund during plan years 2024 to 2034 were increased on average from 3.6% to 3.9%;

- ultimate real projected yield on the Superannuation Account was decreased from 2.1% to 2.0%;

- real projected yields on the Superannuation Account during plan years 2024 to 2043 were increased on average from 1.7% to 1.9%;

- real increases in pensionable earnings during plan years 2024 to 2027 were increased on average from 2.2% to 2.8%;

- ultimate real increase in pensionable earnings was decreased from 0.7% to 0.5%.

Details of the changes in economic assumptions are described in Appendix F.

Details of the changes in demographic assumptions are described in Appendix G.

4.2.7 Change in the present value of prior service contributions

New members’ prior service election paid through instalments since the last report and changes to payment schedules for some members resulted in a change in the present value of prior service contributions. This change increased the Account shortfall by $12 million and decreased the Pension Fund surplus by $281 million.

4.2.8 Change in the present value of administrative expenses

The administrative expense assumption was increased by 0.05% and corresponds to 0.45% of total pensionable payroll.

For plan year 2024, 37% of total administrative expenses are being charged to the Superannuation Account; it is assumed that the proportion charged to the Superannuation Account will reduce at the rate of 2% per year as in the previous report. An increase in the expected present value of administrative expenses charged to the Superannuation Account due to demographic changes and the increase of the administrative expense assumption resulted in an increase of the Superannuation Account shortfall as at 31 March 2023 of $147 million.

4.2.9 Unrecognized investment gains

An actuarial asset valuation method that minimizes the impact of short-term fluctuations in the market value of assets was also used for this valuation. This method, which is described in Appendix E.1, resulted in an actuarial value of assets that is $9,281 million less than the market value of the Pension Fund assets as at 31 March 2023.

4.3 PSSA – Cost certificate

4.3.1 Current service cost

The details of the current service cost for plan yearFootnote 3 2025 and reconciliation with the 2022 current service cost are shown below.

| Member required contributions | 3,274 |

|---|---|

| Government current service cost | 3,295 |

| Total current service cost | 6,569 |

| Expected pensionable payroll (in $ millions) | 35,839 |

| Total current service cost as % of expected pensionable payroll | 18.33 |

| Component of reconciliation of current service cost | |

|---|---|

| Current service cost for plan year 2022 | 19.67 |

| Expected current service cost change between plan years 2022 and 2025 | (0.30) |

| Change in methodology | 0.22 |

| Intervaluation experience | (0.08) |

| Changes in administration expenses assumption | 0.03 |

| Changes in demographic assumptions | 0.15 |

| Changes in economic assumptions | (1.36) |

| Current service cost for plan year 2025 | 18.33 |

4.3.2 Projection of current service cost

The current service cost is borne jointly by the plan members and the government. Group 1 and Group 2 (as defined in Note A.4.1) member contribution rates are determined such that the government share of the current service cost contribution is 50%. They are determined on a calendar year basis and are shown in the following table.

| Calendar year | Group 1 | Group 2 | ||

|---|---|---|---|---|

| Below YMPE | Above YMPE | Below YMPE | Above YMPE | |

| 2025 | 9.06% | 11.64% | 7.95% | 10.53% |

| 2026 | 9.10% | 11.69% | 8.00% | 10.58% |

| 2027 | 9.15% | 11.75% | 8.04% | 10.63% |

The projection of the current service costs on a plan year basis, expressed in dollar amount as well as in percentage of the projected pensionable payroll (as defined in Note A.4.2) are shown in the following table.

| Plan yearTable 11 Footnote a | in $ millions | as a percentage of pensionable payroll | Portion borne by the governmentTable 11 Footnote b | ||||

|---|---|---|---|---|---|---|---|

| Contributors | Government | Total | Contributors | Government | Total | ||

| 2025 | 3,274 | 3,295 | 6,569 | 9.14% | 9.19% | 18.33% | 50.14% |

| 2026 | 3,414 | 3,435 | 6,849 | 9.19% | 9.25% | 18.44% | 50.16% |

| 2027 | 3,534 | 3,555 | 7,089 | 9.23% | 9.28% | 18.51% | 50.14% |

| 2028 | 3,722 | 3,744 | 7,466 | 9.26% | 9.31% | 18.57% | 50.13% |

|

Table 11 Footnotes

|

|||||||

The following tables show projections of current service cost expressed in millions of dollars and as a percentage of the expected pensionable payroll for the three calendar years following the expected tabling of this report. The ratio of government current service cost to contributor current service cost is also shown. Table 13 and Table 14 show the same results for Group 1 and Group 2, respectively.

The projections of current service cost shown in these tables are based on the memberFootnote 4 contribution rates presented in Table 10 and government contribution rates required to fund the current service cost. The PSSA allows the President of the Treasury Board to reduce contributions in certain situations.

| Calendar year | in $ millions | as a percentage of pensionable payroll | Ratio of government to contributor current service cost | ||||

|---|---|---|---|---|---|---|---|

| Contributors | Government | Total | Contributors | Government | Total | ||

| 2025 | 3,373 | 3,395 | 6,768 | 9.17% | 9.22% | 18.39% | 1.01 |

| 2026 | 3,499 | 3,520 | 7,019 | 9.21% | 9.26% | 18.47% | 1.01 |

| 2027 | 3,670 | 3,692 | 7,362 | 9.24% | 9.29% | 18.53% | 1.01 |

| Calendar year | in $ millions | as a percentage of pensionable payroll | Ratio of government to contributor current service cost | ||||

|---|---|---|---|---|---|---|---|

| Contributors | Government | Total | Contributors | Government | Total | ||

| 2025 | 1,681 | 1,703 | 3,384 | 10.00% | 10.12% | 20.12% | 1.01 |

| 2026 | 1,656 | 1,677 | 3,333 | 10.06% | 10.19% | 20.25% | 1.01 |

| 2027 | 1,641 | 1,662 | 3,303 | 10.13% | 10.26% | 20.39% | 1.01 |

| Calendar year | in $ millions | as a percentage of pensionable payroll | Ratio of government to contributor current service cost | ||||

|---|---|---|---|---|---|---|---|

| Contributors | Government | Total | Contributors | Government | Total | ||

| 2025 | 1,692 | 1,692 | 3,384 | 8.47% | 8.47% | 16.94% | 1.00 |

| 2026 | 1,843 | 1,843 | 3,686 | 8.56% | 8.56% | 17.12% | 1.00 |

| 2027 | 2,030 | 2,030 | 4,060 | 8.63% | 8.63% | 17.26% | 1.00 |

4.3.3 Administrative expenses

Based upon the assumptions described in Appendix F.3.5, the Pension Fund administrative expenses are included in the total current service costs and are estimated to be as follows.

| Plan Year | ($ millions) |

|---|---|

| 2025 | 104 |

| 2026 | 111 |

| 2027 | 119 |

| 2028 | 129 |

The Superannuation Account administrative expenses have been capitalized and are shown as a liability in the balance sheet.

4.3.4 Contributions for prior service elections

Member and government contributions for prior service elections were estimated as follows:

| Plan Year | Superannuation Account | Pension Fund | ||

|---|---|---|---|---|

| Contributors | Government | Contributors | Government | |

| 2025 | 1 | 1 | 47 | 38 |

| 2026 | 1 | 1 | 41 | 33 |

| 2027 | 1 | 1 | 36 | 28 |

| 2028 | 1 | 1 | 31 | 24 |

4.4 PSSA – Sensitivity of valuation results to economic assumptions

The information required by statute, which is presented in the main report, has been derived using best‑estimate assumptions regarding future demographic and economic trends. The key best‑estimate assumptions, i.e. those for which changes within a reasonable range have the most significant impact on the long-term financial results, are described in Appendices F and G.

Given the length of the projection period and the number of assumptions required, it is unlikely that the actual experience will develop precisely in accordance with the best‑estimate assumptions. Individual sensitivity tests have been performed, projecting the pension plan’s financial status using alternative assumptions.

Table 17 shows the effect on the plan year 2025 current service cost as well as the effect on the liabilities at the valuation date for the Superannuation Account and the Pension Fund when key economic assumptions are varied by one percentage point per annum.

| Assumption(s) varied | Current service cost as a percentage of pensionable payroll | Actuarial liability ($ millions) | ||||

|---|---|---|---|---|---|---|

| Pension Fund | Superannuation Account | Pension Fund | ||||

| Plan year 2025 | Effect | As at 31 March 2023 | Effect | As at 31 March 2023 | Effect | |

| None (i.e. current basis) | 18.33 | None | 97,403 | None | 137,172 | None |

| Account yield/Fund rate of return 1% higherTable 17 Footnote a | 14.39 | (3.94) | 87,643 | (9,760) | 116,740 | (20,432) |

| Account yield/Fund rate of return 1% lowerTable 17 Footnote a | 23.80 | 5.47 | 109,122 | 11,719 | 163,672 | 26,500 |

| Pension indexation 1% higher | 20.70 | 2.37 | 108,514 | 11,111 | 154,102 | 16,930 |

| Pension indexation 1% lower | 16.38 | (1.95) | 87,938 | (9,465) | 123,038 | (14,134) |

| Salary, YMPE, and MPE 1% higher | 20.55 | 2.22 | 97,454 | 51 | 143,273 | 6,101 |

| Salary, YMPE, and MPE 1% lower | 16.48 | (1.85) | 97,361 | (42) | 131,865 | (5,307) |

| Inflation 1% higher Table 17 Footnote b | 18.01 | (0.32) | 97,030 | (373) | 135,376 | (1,796) |

| Inflation 1% lower Table 17 Footnote b | 18.66 | 0.33 | 97,795 | 392 | 139,040 | 1,868 |

|

Table 17 Footnotes

|

||||||

The differences between the results above and those shown in the valuation can also serve as a basis for approximating the effect of other numerical variations in one of a key assumption to the extent that such effects are assumed to be linear.

4.5 RCA – Financial position

This section shows the financial position of the RCA accounts as at 31 March 2023. The results of the previous valuation are also shown for comparison.

| 31 March 2023 | 31 March 2020 | |

|---|---|---|

| RCA No. 1 recorded account balance | 1,404 | 1,315 |

| Refundable tax | 1,391 | 1,297 |

| Present value of prior service contributions | 4 | 3 |

| Total assets | 2,799 | 2,615 |

| Actuarial liability | ||

| Pensionable excess earnings from contributors | 769 | 689 |

| Pensionable excess earnings from pensioners | 1,355 | 1,003 |

| Survivor allowance from contributors | 168 | 99 |

| Survivor allowance from pensioners | 401 | 363 |

| Former deputy heads | 38 | 38 |

| Total actuarial liability | 2,731 | 2,192 |

| Actuarial excess or (shortfall) | 68 | 423 |

The sum of the recorded balance of the RCA No. 1 Account, the refundable tax and the present value of prior service cost contributions as at 31 March 2023 is $2,799 million, which exceeds the actuarial liability of $2,731 million by $68 million.

| 31 March 2023 | 31 March 2020 | |

|---|---|---|

| RCA No. 2 recorded account balance | 528 | 628 |

| Refundable tax | 546 | 644 |

| Total assets | 1,074 | 1,272 |

| Actuarial liability | 1,048 | 1,142 |

| Actuarial excess or (shortfall) | 26 | 130 |

Since the previous valuation, the actuarial excess of the RCA No. 2 Account reduced from $130 million to $26 million.

4.6 RCA – Current service cost

4.6.1 RCA No. 1 – Current service cost

The current service cost, which is borne jointly by the members and the government, increased by 0.03% to reach 0.21% of pensionable payroll in this valuation for plan year 2025 from 0.18% of pensionable payroll calculated in the previous actuarial report.

The RCA No. 1 current service cost is estimated to be 0.21% of pensionable payroll for plan year 2025 to 2028. The following table shows the estimated RCA No. 1 current service cost in millions of dollars for the next four plan years.

| Components of the current service cost | Plan yearTable 20 Footnote b | |||

|---|---|---|---|---|

| 2025 | 2026 | 2027 | 2028 | |

| Excess pensionable earnings | 54.2 | 56.2 | 58.0 | 60.8 |

| Survivor allowance | 20.5 | 21.1 | 21.6 | 22.2 |

| Deputy head | 0.3 | 0.0 | 0.0 | 0.0 |

| Total | 75.0 | 77.3 | 79.6 | 83.0 |

| Member contributions | ||||

| Earnings above the Maximum Pensionable Earnings (MPE)Table 20 Footnote a | 12.4 | 12.8 | 13.2 | 13.9 |

| Deputy head | 0.1 | 0.0 | 0.0 | 0.0 |

| Total | 12.5 | 12.8 | 13.2 | 13.9 |

| Government current service cost | 62.5 | 64.5 | 66.4 | 69.1 |

|

Table 20 Footnotes

|

||||

The following table shows the projected current service cost in millions of dollars and as a percentage of the expected pensionable payroll for the three calendar years following the expected tabling of this report. The ratio of government current service cost to contributor current service cost is also shown.

| Calendar year | in $ millions | as a percentage of pensionable payroll | Ratio of government to contributor current service costTable 21 Footnote a | ||||

|---|---|---|---|---|---|---|---|

| Contributors | Government | Total | Contributors | Government | Total | ||

| 2025 | 12.6 | 64.1 | 76.7 | 0.03% | 0.18% | 0.21% | 5.09 |

| 2026 | 13.1 | 66.0 | 79.1 | 0.03% | 0.18% | 0.21% | 5.04 |

| 2027 | 13.7 | 68.5 | 82.2 | 0.03% | 0.18% | 0.21% | 5.00 |

|

Table 21 Footnotes

|

|||||||

4.6.2 RCA No. 2 – Current service cost

RCA No. 2 was used as an early retirement incentive (ERI) as part of a downsizing initiative by the Government. There is currently no service cost for this program.

4.7 Summary of estimated government costs

Table 22 summarizes the estimated total government credits for the RCA No. 1 and the Superannuation Account on a plan year basis. Table 23 summarizes the estimated total government costs for the Pension Fund on a plan year basis.

| Plan yearTable 22 Footnote a | RCA No. 1 | Superannuation Account | Total government credits | |

|---|---|---|---|---|

| Government current service cost | Total prior service contributions | Expected special credits | ||

| 2025 | 63 | 1 | 6,425 | 6,489 |

| 2026 | 64 | 1 | 0 | 65 |

| 2027 | 66 | 1 | 0 | 67 |

| 2028 | 69 | 1 | 0 | 70 |

|

Table 22 Footnotes

|

||||

| Plan yearTable 23 Footnote a | Government current service cost | Total prior service contributions | Total government contributions |

|---|---|---|---|

| 2025 | 3,295 | 38 | 3,333 |

| 2026 | 3,435 | 33 | 3,468 |

| 2027 | 3,555 | 28 | 3,583 |

| 2028 | 3,744 | 24 | 3,768 |

|

Table 23 Footnotes

|

|||

5 Actuarial opinion

In our opinion, considering that this report was prepared pursuant to the Public Pensions Reporting Act,

- the valuation data on which the valuation is based are sufficient and reliable for the purposes of the valuation;

- the assumptions used are individually reasonable and appropriate in aggregate for the purposes of the valuation; and

- the methods employed are appropriate for the purposes of the valuation.

This report has been prepared, and our opinion given, in accordance with accepted actuarial practice in Canada. In particular, this report was prepared in accordance with the Standards of Practice (General Standards and Practice – Practice-Specific Standards for Pension Plans) published by the Canadian Institute of Actuaries.

Subsequent events described in section 3.2 were not considered in this valuation since the details were not available at the time the report was prepared. To the best of our knowledge, after discussion with Public Services and Procurement Canada and the Treasury Board of Canada Secretariat, there were no other subsequent events between the valuation date and the date of this report that would have a material impact on the results of this valuation.

Assia Billig, FCIA, FSA

Chief Actuary

Annie St-Jacques, FCIA, FSA

François Lemire, FCIA, FSA

Alexandre Larose, FCIA, FSA

Ottawa, Canada

27 September 2024

Appendix A - Summary of pension benefit provisions

The government has been providing its employees with a pension plan since 1870. Pensions for members of the Public Service are provided primarily under the Public Service Superannuation Act (PSSA) as enacted in 1954 and modified thereafter. Benefits are also provided to public servants under the Special Retirement Arrangements Act. Benefits may be modified in accordance with the Pension Benefits Division Act if there is a breakdown of a spousal union.

Changes since the last valuation

Minor amendments were applied to the Public Service Superannuation Regulations since the previous valuation. Those amendments did not have any impact on the actuarial valuation of the plan.

Summary of pension benefit provisions

Summarized in this Appendix are the pension benefits provided under the PSSA registered provisions, which are in compliance with the Income Tax Act. The portion of the benefits in excess of the Income Tax Act limits for registered pension plans is provided under the retirement compensation arrangements described in Appendix B.

In case of any discrepancy between this summary and the legislation, the legislation shall prevail.

A.1 Membership

Subject to the exceptions mentioned in the next paragraph, membership in the plan is compulsory for all full‑time and part-time employees working 12 or more hours per week (except those who were grandfathered as at 4 July 1994) in the Public Service. This includes all positions in any department or portion of:

- the Executive Government of Canada;

- the Senate and the House of Commons;

- the Library of Parliament; and

- any board, commission or corporation listed in a Schedule to the Act, as well as those designated as contributors by the President of the Treasury Board either individually or as members of a class for persons engaged as seasonal employees and some others.

The main groups of persons employed in the Public Service to which the Act does not apply are:

- part-time employees working less than 12 hours per week;

- persons locally engaged outside Canada;

- employees of some Crown corporations, boards or commissions covered by their own pension plans; and

- seasonal employees, and some others, unless designated as contributors by the President of the Treasury Board.

Since the previous valuation, no entities have left the plan.

A.2 Contributions

A.2.1 Members

Different contribution rates apply to Group 1 and Group 2 contributors (as defined in Note A.4.1). The expected rates are consistent with the government objective of maintaining a 50:50 employer to employee current service cost sharing ratio.

During the first 35 years of pensionable service, members contribute according to the rates shown in the following table.

| Calendar year | Group 1 | Group 2 | ||

|---|---|---|---|---|

| Below YMPE | Above YMPE | Below YMPE | Above YMPE | |

| 2023Table 24 Footnote a | 9.35% | 12.37% | 7.93% | 11.72% |

| 2024Table 24 Footnote a | 9.35% | 12.25% | 7.94% | 11.54% |

| 2025 | 9.06% | 11.64% | 7.95% | 10.53% |

| 2026 | 9.10% | 11.69% | 8.00% | 10.58% |

| 2027 | 9.15% | 11.75% | 8.04% | 10.63% |

|

Table 24 Footnotes

|

||||

After 35 years of pensionable service, members contribute only 1% of pensionable earnings. The total pensionable earnings used to determine the contribution rates excludes the earnings from those members with more than 35 years of pensionable service.

Actual and deemed operational members (from Correctional Service Canada (CSC)) contribution rates are those of Group 1 members. In order to keep their rights to an early retirement benefit, deemed operational members contribute an additional 0.62% of their payroll during a calendar year to maintain their entitlement to the operational benefits.

A.2.2 Government

A.2.2.1 Current service

The government determines the normal monthly contribution as the amount which, when combined with the required contributions by members in respect of current service and expected interest earnings, is sufficient to cover the cost, as estimated by the President of the Treasury Board, of all future payable benefits that have accrued in respect of pensionable service during that month and the Pension Fund administrative expenses incurred during that month.

A.2.2.2 Elected prior service

The government matches member contributions made to the Superannuation Account for prior service elections; however, it makes no contributions if the member is paying the double rate.

Government contributions to the Pension Fund in respect of elected prior service are calculated using the same ratio of Government contributions to employee contributions as for the current service cost. For members paying the double rate, the government contributes only the excess of the ratio of Government contributions to employee contributions over 1.

A.2.2.3 Actuarial excess and surplus

The PSSA gives the government the authority to:

- debit the excess of the Superannuation Account over the actuarial liability subject to limitations, and

- deal with any actuarial surplus, subject to limitations, in the Pension Fund as they occur, either by

- reducing employer contributions or

- reducing employer and employee contributions or

- by making withdrawals.

A.2.2.4 Actuarial shortfall and deficit

In accordance with the PSSA, if either a Superannuation Account actuarial shortfall or a Pension Fund actuarial deficit is identified through a triennial statutory actuarial valuation, the actuarial shortfall/deficit can be amortized over a period of up to 15 years.

The President of the Treasury Board will determine the time, the manner and the amount of credits to be made. The shortfall/deficit must be fully paid by the end of the fifteenth fiscal year following the tabling of that report at the latest.

A.3 Summary description of benefits

The objective of the PSPP is to provide an employment earnings–related lifetime retirement pension to eligible members. Benefits to members in case of disability and to the spouse and children in case of death are also provided.

Subject to coordination with the pensions paid by the Canada Pension Plan (CPP) or the Québec Pension Plan (QPP), the initial rate of retirement pension is equal to 2% of the highest average of annual pensionable earnings over any period of five consecutive years, multiplied by the number of years of pensionable service not exceeding 35. Once in pay, the pension is indexed annually with the Consumer Price Index. Such indexation also applies to deferred pensions during the deferral period. Detailed notes on the following overview are provided in the following section.

| Contributor's type of termination | Benefit | |

|---|---|---|

| With less than two years of serviceTable 25 Footnote a | All types of termination | Return of contributions |

| With two or more years of serviceTable 25 Footnote a; and | Disability | Immediate annuity |

| Death leaving no surviving spouse or eligible children | Minimum benefit | |

| Death leaving surviving spouse and/or eligible children | Survivor allowance(s) | |

| Leaving prior to age 45, except for death or disability | Actual operational service between 20 and 25 years | Actual operational service annual allowanceTable 25 Footnote b |

| Actual operational service 25 years or more | Immediate annuity | |

| Otherwise | Deferred annuity or transfer value | |

| Leaving at ages 45 to 49, except for death or disability, and | Deemed operational service 20 years or more | Deemed operational service annual allowanceTable 25 Footnote c |

| Actual operational service between 20 and 25 years | Actual operational service annual allowanceTable 25 Footnote b | |

| Actual operational service 25 years or more | Immediate annuity | |

| Otherwise | Deferred annuity or transfer value | |

| Leaving at age 50 or over, except for death or disability, and | Deemed operational service between 20 and 25 years | Deemed operational service annual allowanceTable 25 Footnote c |

| Deemed operational service 25 years or more | Immediate annuity | |

| Actual operational service between 20 and 25 years | Actual operational service annual allowanceTable 25 Footnote b | |

| Actual operational service 25 years or more | Immediate annuity | |

| Group 1, with no or less than 20 years of operational service, and either age 60 or over, or age 55 or over and service 30 years or more | Immediate annuity | |

| Group 2, with no or less than 20 years of operational service, and either age 65 or over, or age 60 or over and service 30 years or more | Immediate annuity | |

| Group 1, between age 50 and 55; or between age 55 and 60 and service less than 30 years | Deferred annuity or annual allowance | |

| Group 2, between age 55 and 60; or between age 60 and 65 and service less than 30 years | Deferred annuity or annual allowance | |

| Otherwise | Deferred annuity | |

|

Table 25 Footnotes

|

||

| Deferred pensioner and retired pensioner's type of termination | Benefit |

|---|---|

| Group 1 disability before age 60 while entitled to a deferred annuity or an annual allowance | Immediate annuity |

| Group 2 disability before age 65 while entitled to a deferred annuity or an annual allowance | Immediate annuity |

| Death leaving no eligible survivor | Minimum benefit |

| Death leaving eligible survivor(s) | Survivor allowance(s) |

A.4 Explanatory notes

A.4.1 Member subgroups

Benefit provisions, member’s demographic assumptions (Appendix G), detailed information on membership (Appendix M), and member contribution rates differ depending on the membership date and the type of service being accrued. Before receiving an annuity, contributors and deferred pensioners are divided into the following groups:

- Group 1: Members who entered the PSPP prior to 1 January 2013.

- Group 2: Members who entered the PSPP on or after 1 January 2013.

Then, each member can accrue different types of service (see A.4.4 below):

- Operational members (from Correctional Service Canada) - correspond to members who accrue either:

- actual operational service; or

- deemed operational service.

- Main members: correspond to non-operational members.

In this report, membership data is divided into the following subgroups. The eligibility and provisions of each group are further explained in the explanatory notes below.

Contributors: Members who have yet to terminate their employment.

Deferred pensioners: Members who have terminated their employment and have opted, by choice or by default, to defer the moment where they will become retired pensioners.

Retired pensioners: Members who terminated their employment and are currently receiving an annuity.

Disabled pensioners: Members currently receiving an annuity and are disabled.

Surviving spouses: The spouse, of a deceased member, that is currently receiving an annuity.

Surviving children: The child, of a deceased member, that is currently receiving an annuity.

Pending and outstanding members: Members eligible to a either a return of contribution or a transfer value but have yet to receive it as of 31 March 2023. Pending members terminated between 31 March 2020 and 31 March 2023 while outstanding members terminated before 31 March 2020.

A.4.2 Pensionable earnings

Pensionable earnings means the annual employment earnings (excluding overtime but including pensionable allowances such as bilingual bonuses) of a contributor.

Pensionable payroll means the aggregate pensionable earnings of all contributors with less than 35 years of pensionable service. Payroll of members on leave without pay at 31 March 2023 is excluded as they are not considered participating contributors in this report.

A.4.3 Indexation

A.4.3.1 Level of indexation adjustments

All immediate and deferred annuities (pensions and allowances) are adjusted every January to the extent warranted by the increase, as at 30 September of the previous year, in the 12-month average Consumer Price Index relative to the corresponding figure one year earlier. If the indicated adjustment is negative, annuities are not decreased for that year; however, it is carried-forward and the next positive adjustment is diminished accordingly.

A.4.3.2 First indexation adjustment

Indexation adjustments accrue from the end of the month in which employment terminates. The first annual adjustment following termination of employment is prorated accordingly.

A.4.3.3 Commencement of indexation payments

The indexation portion of a retirement, disability or survivor pension normally starts being paid when the pension is put into pay. However, regarding an operational service retirement pension, indexation payments start only when the pensioner is either

- at least 55 years old, provided the sum of age and pensionable service is at least 85; or

- at least 60 years old.

A.4.4 Pensionable service, actual operational service and deemed operational service

Pensionable service of a contributor includes any period of service in the Public Service for which the contributor has been required to contribute or has elected to contribute, if eligible to do so, and such other types of service for which the contributor has elected to make the required special contributions to the Superannuation Account or the Pension Fund. Pensionable service is limited to 35 years.

Actual operational service

Refers to employees working in federal correctional facilities, parole offices and community correctional centres. More specifically, operational service is defined as service by a person employed by Correctional Service Canada (CSC) whose principal place of work is not: the national headquarters or a regional headquarters of CSC; the offices of the CSC Commissioner; or a regional CSC Staff College or any other institution that provides similar training to CSC employees.

Deemed operational service

Refers to CSC employees in operational service for one or more periods totalling at least 10 years, who then cease to be engaged in operational service but continue to be employed by CSC and elect to continue to accumulate operational service and contribute an additional 0.62% of pensionable earnings.

A.4.5 Return of contributions

Return of contributions means the payment of an amount equal to the accumulated current and prior service contributions paid or transferred by the contributor into the plan. Interest is credited quarterly on returned contributions in accordance with the investment return on the Pension Fund.

A.4.6 Annuity payments

Annuities are payable at the end of month until the month in which the pensioner dies or until the disabled pensioner recovers from disability (the last payment would then be pro-rated). Upon the death of the pensioner, either a survivor allowance (Note A.4.16) or a residual death benefit (Note A.4.17) may be payable.

A.4.7 Coordination with CPP (or QPP)

When a pensioner attains age 65 or becomes entitled to a disability pension from the CPP (or QPP), the annual pension amount is reduced by 0.625% of the indexed CPP annual pensionable earningsFootnote 5 (or, if lesser, the indexed five-year7 pensionable earnings average on which the immediate annuity is based), multiplied by the years of CPP pensionable serviceFootnote 6. This coordination does not apply to annual allowance for eligible survivors (note A.4.16).

A.4.8 Immediate annuity

Immediate annuity means an unreduced pension that becomes payable immediately upon a pensionable retirement or pensionable disability. The annual amount is equal to 2% of the highest average of annual pensionable earnings of the contributor over any period of fiveFootnote 7 consecutive years, multiplied by the number of years of pensionable service not exceeding 35. For contributors with periods of part-time pensionable service, earnings used in the five-year average are based on a full 37.5‑hour workweek, but the resulting average is multiplied by the proportion of the actual workweek over a full workweek averaged by the contributor over the entire period of pensionable service.

A.4.9 Deferred annuity

Deferred annuity means an annuity that normally becomes payable to a former Group 1 contributor who reaches age 60 or a former Group 2 contributor who reaches age 65. The annual payment is determined as for an immediate annuity (Note A.4.8) but is also adjusted to reflect the indexation (Note A.4.3) from the date of termination to the commencement of benefit payments.

The deferred annuity of a former Group 1 contributor becomes an immediate annuity during any period of disability beginning before age 60. If the disability ceases before age 60, the immediate annuity reverts to the original deferred annuity unless the pensioner elects an annual allowance (Notes A.4.11, A.4.12, and A.4.13) that is the prescribed actuarial equivalent to the deferred annuity. Similarly, the deferred annuity of a former Group 2 contributor becomes an immediate annuity during any period of disability beginning before age 65, and reverts back to the original deferred annuity if the disability ceases before age 65, unless the pensioner elects an annual allowance as described above.

A.4.10 Transfer value

A contributor who has ceased to be employed in the Public Service and has to his credit two or more years of pensionable service, is a Group 1 contributor and is under age 50, or is a Group 2 contributor and is under age 55, and is eligible for a deferred annuity may elect to transfer the commuted value of his benefit, determined in accordance with the regulations, to

- a locked-in Registered Retirement Savings Plan; or

- another pension plan registered under the Income Tax Act; or

- a financial institution for the purchase of a locked-in immediate or deferred annuity.

A.4.11 Main members - annual allowance

For a Group 1 member, annual allowance means an annuity payable immediately on retirement or upon attaining age 50, if later. The amount of the allowance is equal to the amount of the deferred annuity to which the member would otherwise be entitled, reduced by 5% for each year between 60 and the age when the allowance becomes payable. However, if the member is at least 50 years old at termination, and has at least 25 years of pensionable service , then the difference, in years, between 60 and the age when the allowance becomes payable is reduced to the greater of

- 55 minus the age when the allowance becomes payable, and

- 30 minus the number of years of pensionable serviceFootnote 8.

For a Group 2 member, the eligibility age is increased by 5 years, so that annual allowance means an annuity payable immediately on retirement or upon attaining age 55 if later. The amount of the allowance is equal to the amount of the deferred annuity to which the member would otherwise be entitled, reduced by 5% for each year between 65 and the age when the allowance becomes payable. However, if the member is at least 55 years old at termination, and has at least 25 years of pensionable service8, then the difference, in years, between 65 and the age when the allowance becomes payable is reduced to the greater of

- 60 minus the age when the allowance becomes payable, and

- 30 minus the number of years of pensionable serviceFootnote 8.

The Treasury Board can waive all or part of the reduction for Group 1 contributors who are involuntarily retired at ages 55 and over with at least 10 years of Public Service employment, or for Group 2 contributors who are involuntarily retired at ages 60 and over with at least 10 years of Public Service employment.

When a Group 1 member in receipt of an annual allowance becomes disabled before reaching age 60, or a Group 2 member in receipt of an annual allowance becomes disabled before reaching age 65, the annual allowance becomes an immediate annuity adjusted in accordance with the regulations to take into account the amount of any annual allowance received prior to becoming disabled.

A.4.12 Deemed operational service - immediate annuity and annual allowance

A deemed operational service immediate annuity differs from an immediate annuity (Note A.4.8) only in that it is available as early as age 50 with 25 years of operational service.

A deemed operational service annual allowance differs from an annual allowance (Note A.4.11) in two ways. Firstly, it is available as early as age 45 with 20 years of operational service. Secondly, the reduction factor is 5% multiplied by the greater of

- 50 minus the age, and

- 25 minus the years of operational service.

The foregoing operational service–related benefits are calculated in relation to both deemed and actual operational service only. Additional non-operational service results in the applicable non-operational benefit where any thresholds or reductions are based on total pensionable service, including operational service.

A.4.13 Actual operational service - immediate annuity and annual allowance

An actual operational service immediate annuity differs from an immediate annuity (Note A.4.8 and Note A.4.12) only in that it is available when the member has accrued 25 years of actual operational service.

An actual operational service annual allowance differs from other annual allowances (Note A.4.11 and Note A.4.12) in two ways. Firstly, it is available as soon as 20 years of actual operational service is accrued. Secondly, the reduction factor is 5% multiplied by 25 minus the years of actual operational service.

The foregoing operational service-related benefits are calculated in relation to actual operational service only. Additional non-operational service results in the applicable non-operational benefit where any thresholds or reductions are based on total pensionable service, including operational service. Also, additional deemed operational service results in the applicable deemed operational benefit where any thresholds or reductions are based on operational pensionable service.

A.4.14 Eligible surviving spouse

Eligible surviving spouse means the surviving spouse (includes a common-law or same‑sex partner recognized under the plan) of a contributor or pensioner except if:

- the contributor or pensioner died within one year of commencement of the spousal union, unless the Treasury Board is satisfied that the health of the contributor or pensioner at the time of such commencement justified an expectation of surviving for at least one year; or

- the pensioner married after ceasing to be a contributor, unless after such marriage the pensioner either:

- became a contributor again, or

- made an optional survivor benefit election within 12 months following marriage to accept a reduced pension so that the new spouse would be eligible for a survivor benefit. This reduction is reversed if and when the new spouse predeceases the pensioner or the spousal union is terminated for reason other than death.

A.4.15 Eligible surviving children

Eligible surviving children includes all children of the contributor or pensioner who are under age 18, and any child of the contributor or pensioner who is age 18 or over but under 25, in full-time attendance at a school or university, having been in such attendance substantially without interruption since he or she reached age 18 or the contributor or pensioner died, whichever occurred later.

A.4.16 Annual allowance for eligible survivor(s)

Annual allowance means, for the eligible surviving spouse and children of a contributor or pensioner, an annuity that becomes payable immediately upon the death of that individual. The amount of the allowance is determined with reference to a basic allowance that is equal to 1% of the highest average of annual pensionable earnings of the contributor over five consecutive years, multiplied by the number of years of pensionable service not exceeding 35.

The annual allowance for a spouse is equal to the basic allowance unless the spouse became eligible as a result of an optional survivor benefit election, in which case it is equal to the percentage of the basic allowance specified by the pensioner making the election.

The annual allowance for an eligible surviving child is equal to 20% of the basic allowance, subject to a reduction if there are more than four eligible surviving children in the same family. The allowance otherwise payable to an eligible surviving child is doubled if there is no eligible surviving spouse.

Survivor annual allowances are not coordinated with the CPP (or QPP) and are payable in equal monthly instalments in arrears until the end of the month in which the survivor dies or otherwise loses eligibility. If applicable, a residual benefit (Note A.4.17) is payable to the estate upon the death of the last survivor.

A.4.17 Minimum and residual death benefits

If a contributor or a pensioner dies leaving no eligible survivor, the lump sum normally paid is the excess of the greater of:

- a return of contributions; and

- five times the annual amount of the immediate annuity to which the contributor would have been entitled, or the pensioner was entitled, at the time of death,

less any pension payments already received. Indexation adjustments are excluded from these calculations.

The same formula is used to determine the residual death benefit, which is the lump sum payable upon the death of an eligible survivor but also subtracting all amounts (excluding indexation adjustments) already paid to the survivor.

A.4.18 Division of pension with former spouse

In accordance with the Pension Benefits Division Act (PBDA), upon the breakdown of a spousal union (including common-law), a lump sum can be debited by court order or by mutual consent from the accounts and/or the Pension Fund, as the case may be, to the credit of the former spouse of a contributor or pensioner. The maximum transferable amount is half the value, calculated as at the transfer date, of the retirement pension accrued by the contributor or pensioner during the period of cohabitation. If the member’s benefits are not vested, the maximum transferable amount corresponds to half the member’s contributions made during the period subject to division, accumulated with interest at the rate applicable on a refund of contributions. The accrued benefits of the contributor or pensioner are then reduced accordingly.

Appendix B - Retirement compensation arrangement benefit provisions

Retirement compensation arrangements (RCAs) are arrangements for benefits in excess of benefit limitations of registered pension plans and therefore are less tax-advantageous as the fund must transfer a 50% refundable tax to the Canada Revenue Agency (CRA) immediately. Under the PSSA RCA a debit is made from the RCA Account such that in total roughly half the recorded balance in the RCA Account is held as a tax credit (CRA refundable tax). This Appendix describes the Public Service pension benefits financed through retirement compensation arrangements (RCA No. 1 and RCA No. 2) rather than through the registered PSSA provisions that have a material impact on this valuation

Effective 15 December 1994, RCA No. 1 was established pursuant to the Special Retirement Arrangements Act (SRAA) to provide for all pension benefits in excess of those that may, in accordance with the Income Tax Act (ITA) restrictions on registered pension plans, be paid under the PSSA registered provisions.

Effective 1 April 1995, RCA No. 2 was established by the RCA regulations as an early retirement incentive program (ERI) for certain Public Service employees declared surplus before 1 April 1998 as part of the downsizing initiative. Participation was limited to individuals between ages 50 and 54 who met the conditions specified in the regulations. RCA No. 2 pays the difference between a pension unreduced for early retirement and the reduced pension payable in accordance with the PSSA. It is financed entirely by the government.

The following benefits have been provided under RCA No. 1 since 20 November 1997, unless otherwise indicated, to the extent that they are in excess of the ITA limit.

| Benefit | PSSA Registered Provisions limit |

|---|---|

|

Survivor allowance for service from 1 January 1992 onward (see Note A.4.16 of Appendix A) |

Pre‑retirement death

Post‑retirement death The amount of spouse allowance is limited in any year to a maximum of two-thirds the retirement benefit that would have been payable to the member in that year under the PSSA. |

|

Excess pensionable earnings (provided since 15 December 1994 for service since then) |

The highest average of pensionable earnings under the PSSA is limited to the MPE (see Appendix F.2.3). The Excess pensionable earnings component in this report represents the benefits payable to the member from the portion of the average of pensionable earnings in excess of the MPE. Minimum death benefit in relations to the Excess pensionable earnings is also included in this component. However, any survivor benefits in relations to the excess pensionable earnings are included in the Survivor allowance. |

|

Continued benefit accrual for former deputy heads (provided since 15 December 1994 for service since then) |

Deputy heads ceasing employment under age 60 may elect to be deemed full-time employees absent from the Public Service on leave without pay up to age 60. They contribute twice what they would contribute should they be part of Group 2, based on their total deemed salary. This entire benefit is outside the registered plan limit. It represents the PSSA accrued service, plus service accrued in this program, multiplied by the deemed salary at the time of retirement (or when opting out of the program), multiplied by 2% (or 1% for survivor), minus the benefits paid under the PSSA, the Excess pensionable earnings and the Survivor allowance. |

|

Elective service for service prior to 1 January 1990 |

The amount of lifetime retirement benefits for each such year of service is limited to two-thirds of the defined benefit limit (i.e. $3,610.00 for calendar year 2024) for the year in which the lifetime retirement benefits commence to be paid. For years subsequent to the commencement year of lifetime retirement benefits, this amount can be adjusted to reflect increases in the Consumer Price Index. |

Appendix C - Assets, accounts and rates of return

C.1 Assets and account balances

The government has a statutory obligation to fulfill the pension promise enacted by legislation to members of the Public Service. Since 1 April 2000, the government has earmarked invested assets (the Pension Fund) to meet the cost of pension benefits.

With respect to the unfunded portion of the PSPP, accounts were established to track the government’s pension benefit obligations, such as the Superannuation Account for service prior to 1 April 2000, and the RCA No. 1 and No. 2 Accounts for benefits in excess of those that can be provided under the Income Tax Act limits for registered pension plans.

C.1.1 Public Service Superannuation Account

PSSA member contributions, government costs and benefits earned up to 31 March 2000 are tracked entirely through the Public Service Superannuation Account, which forms part of the Accounts of Canada.

The Superannuation Account is credited with all PSSA member contributions and government costs prior to 1 April 2000, as well as with prior service contributions and costs for elections made prior to 1 April 2000. It is charged with both the benefit payments made in respect of service earned under the Superannuation Account and the allocated portion of the plan administrative expenses.

The Superannuation Account is credited with interest earnings as though net cash flows were invested quarterly in 20‑year Government of Canada bonds issued at prescribedFootnote 9 interest rates and held to maturity. No formal debt instrument is issued to the Superannuation Account by the government in recognition of the amounts therein. Interest is credited every three months on the basis of the average yield for the same period on the combined Superannuation Accounts of the Public Service, Canadian Forces and RCMP pension plans.

| Plan year | 2021 | 2022 | 2023 | 2021 to 2023 |

|---|---|---|---|---|

| Opening balance as at 1 April of the previous year | 91,516 | 89,011 | 94,113 | 91,516 |

| Income | ||||

| Interest earnings | 3,089 | 2,896 | 2,914 | 8,899 |

| Employer contributions | 3 | 2 | 2 | 7 |

| Member contributions | 3 | 3 | 2 | 8 |

| Transfers received | 0 | 0 | 0 | 0 |

| Actuarial adjustments | 0 | 7,805 | 0 | 7,805 |

| Income subtotal | 3,095 | 10,706 | 2,918 | 16,719 |

| Expenditures | ||||

| Annuities | 5,519 | 5,513 | 5,596 | 16,628 |

| Pension divisions | 9 | 10 | 7 | 26 |

| Return of contributions | 0 | 0 | 1 | 1 |

| Pension transfer value payments | 5 | 6 | 3 | 14 |

| Transfers to other pension plans | 2 | 2 | 1 | 5 |

| Minimum benefits | 13 | 20 | 29 | 62 |

| Administrative expenses | 52 | 53 | 51 | 156 |

| Expenditures subtotal | 5,600 | 5,604 | 5,688 | 16,892 |

| Closing balance as at 31 March of the plan year | 89,011 | 94,113 | 91,343 | 91,343 |

Since the last valuation, the Account balance has decreased by $0.2 billion (a 0.2% reduction) to reach $91.3 billion as at 31 March 2023.

C.1.2 Public Service Pension Fund

Since 1 April 2000, PSSA contributions (except for prior service elections made prior to 1 April 2000) have been credited to the Pension Fund. The Pension Fund is invested in the financial markets with a view to achieving maximum rates of return without undue risk.