Highlights of the Canada Student Financial Assistance Program Actuarial Report as at 31 July 2022

Message from the Actuary

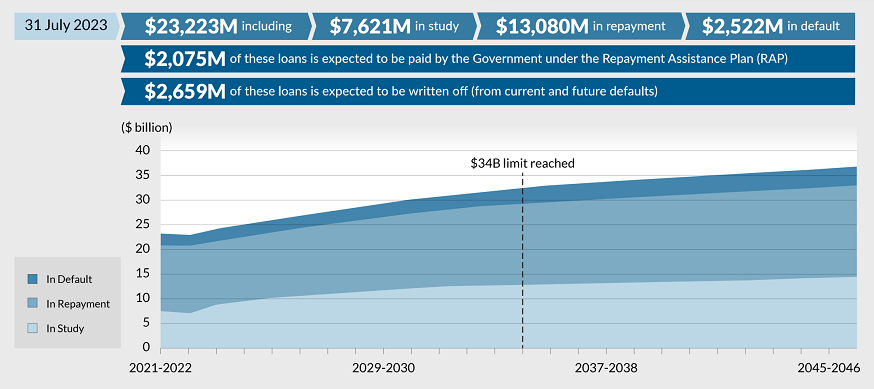

The main source of revenues of the Program has been reduced to zero with the permanent elimination of interest accrual on loans. The $34 billion limit on the loan portfolio is projected to be reached in 2034-2035, which is a year earlier than expected in the previous report.

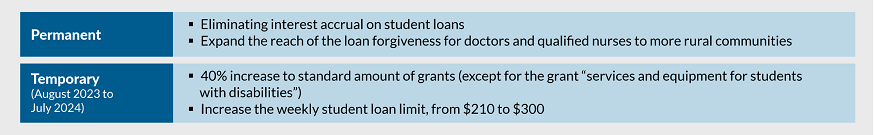

Recent changes to the program

Recent changes to the program - text description

Permanent

- Eliminating interest accrual on student loans

- Expand the reach of the loan forgiveness for doctors and qualified nurses to more rural communities

Temporary (August 2023 to July 2024)

- 40% increase to standard amount of grants (except for the grant “services and equipment for students with disabilities”)

- Increase the weekly student loan limit, from $210 to $300

Projected disbursements

Projected disbursements - text description

- From August 2022 to July 2023, it includes $3,408 million of grants and $3,015 million of loans for 670,000 students

- From August 2023 to July 2024, it includes $2,377 million of grants and $4,334 million of loans for 685,000 students

- From August 2024 to July 2025, it includes $1,758 million of grants and $4,119 million of loans for 703,000 students

- From August 2046 to July 2047, it includes $1,793 million of grants and $5,478 million of loans for 821,000 students

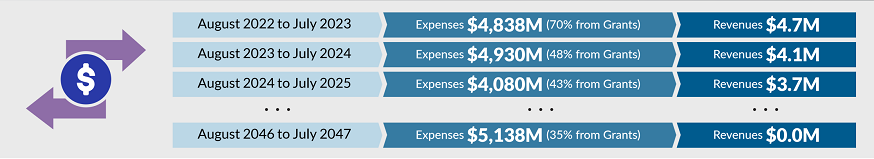

Projected expenses and revenues

Projected expenses and revenues - text description

- From August 2022 to July 2023, there are expenses of $4,838 million (70% from grants) and revenues of $4.7 million

- From August 2023 to July 2024, there are expenses of $4,930 million (48% from grants) and revenues of $4.1 million

- From August 2024 to July 2025, there are expenses of $4,080 million (43% from grants) and revenues of $3.7 million

- From August 2046 to July 2047, there are expenses of $5,138 million (35% from grants) and revenues of $0.0 million

Portfolio of outstanding loans - Principal

Portfolio of outstanding loans - Principal - text description

- As at 31 July 2023, the sum of outstanding loans (principal only) is $23,223 million and includes: $7,621 million in study, $13,080 million in repayment and $2,522 million in default.

- $2,075 million of these loans is expected to be paid by the Government under the Repayment Assistance Plan (RAP)

- $2,659 million of these loans is expected to be written off (from current and future defaults)

“Stacked Area” chart showing the projected outstanding loans (principal only) for “In Study”, “In Repayment” and “In Default” by loan years. The Y axis represents the outstanding loans (principal only) in billions of dollars. The X axis represents the loan year. The stacking order, from bottom to top, is “In Study”, “In Repayment” and “In Default”. A vertical dotted line is placed on the loan year 2034-2035, which represents the loan year where the total of the outstanding loans (principal only) first exceeds the $34 billion limit during the year (when considering the monthly peak).

Portfolio of outstanding loans - Principal As at 31 July of the loan year Outstanding loans in study (Principal only) Outstanding loans in repayment (Principal only) Outstanding loans in default (Principal only) Total outstanding loans (Principal only) 2021-2022 8.1 12.7 2.4 23.3 2022-2023 7.6 13.1 2.5 23.2 2023-2024 9.2 12.5 2.6 24.3 2024-2025 10.0 12.6 2.6 25.2 2025-2026 10.7 12.9 2.6 26.2 2026-2027 11.2 13.1 2.7 27.0 2027-2028 11.7 13.5 2.7 27.9 2028-2029 12.0 13.9 2.8 28.7 2029-2030 12.3 14.3 2.9 29.5 2030-2031 12.6 14.7 2.9 30.2 2031-2032 12.8 15.1 3.0 30.9 2032-2033 13.0 15.4 3.1 31.6 2033-2034 13.2 15.8 3.2 32.2 2034-2035 13.3 16.0 3.3 32.7 2035-2036 13.4 16.3 3.4 33.1 2036-2037 13.5 16.5 3.5 33.5 2037-2038 13.6 16.7 3.5 33.8 2038-2039 13.7 16.9 3.6 34.2 2039-2040 13.8 17.1 3.6 34.5 2040-2041 13.9 17.2 3.7 34.9 2041-2042 14.1 17.4 3.7 35.2 2042-2043 14.2 17.5 3.8 35.5 2043-2044 14.3 17.7 3.8 35.9 2044-2045 14.5 17.9 3.9 36.3 2045-2046 14.7 18.0 3.9 36.7 2046-2047 14.9 18.2 4.0 37.1