Actuarial Report on the Canada Student Financial Assistance Program as at 31 July 2022

Office of the Chief Actuary

Office of the Superintendent of Financial Institutions Canada

12th Floor, Kent Square Building

255 Albert Street

Ottawa, Ontario

K1A 0H2

E-mail: oca-bac@osfi-bsif.gc.ca

Web site: www.osfi-bsif.gc.ca

© His Majesty the King in Right of Canada, 2023

Cat. No. IN3-16/27E-PDF

ISSN 2564-1026

23 June 2023

Jonathan Wallace

Director General, Canada Student Financial Assistance Program

Employment and Social Development Canada

200 Montcalm Street

Montcalm Building, Tower 2 - 1st Floor

Gatineau, QC

K1A 0J9

Dear Jonathan Wallace:

As per the business plan for 2023-2024 to 2025-2026, I am pleased to submit the Actuarial Report on the Canada Student Financial Assistance Program, prepared as at 31 July 2022. This report is prepared for the CSFA Program to support internal accounting requirements as well as your partners’ needs between statutory reports.

Yours sincerely,

Laurence Frappier, FCIA, FSA

Managing Director

Office of the Chief Actuary

Table of contents

Index of tables

- Table 1 Demographic assumptions

- Table 2 Economic assumptions

- Table 3 Prepayments and net default rate assumptions

- Table 4 Provision rates

- Table 5 New grants issued

- Table 6 New loans issued

- Table 7 Population and post-secondary enrolment of participating provinces

- Table 8 Loan and/or grant recipients

- Table 9 Student need (in dollars)

- Table 10 Average loan size

- Table 11 Direct loan portfolio (in millions of dollars)

- Table 12 Defaulted loans (in millions of dollars)

- Table 13 Interest on defaulted loans (in millions of dollars)

- Table 14 Guaranteed and risk-shared regimes portfolio (in millions of dollars)

- Table 15 Estimated peak of aggregate amount of outstanding loans (in millions of dollars)

- Table 16 Allowance for Repayment Assistance Plan – Principal (in millions of dollars)

- Table 17 Allowance for bad debt – Principal (in millions of dollars)

- Table 18 Allowance for bad debt – Interest (in millions of dollars)

- Table 19 Summary of expenses (in millions of dollars)

- Table 20 Student related expenses (in millions of dollars)

- Table 21 Government liabilities on outstanding loans (in millions of dollars)

- Table 22 Total revenues (in millions of dollars)

- Table 23 Net annual cost of the program (in millions of dollars)

- Table 24 Direct loans issued (in millions of dollars) and number of students

- Table 25 Direct loans consolidated (in millions of dollars)

- Table 26 Direct loans default portfolio - Principal (in millions of dollars)

- Table 27 Repayment Assistance Plan - Principal payments (in millions of dollars)

- Table 28 Repayment Assistance Plan - Interest payments (in millions of dollars)

- Table 29 Demographic assumptions

- Table 30 Labour force assumptions (in percentage)

- Table 31 Full-time post-secondary enrolment rate by labour force status (in percentage)

- Table 32 Inflation assumption (in percentage)

- Table 33 Real wage increase assumption (in percentage)

- Table 34 Borrowing cost (in percentage)

- Table 35 Short-term increase of tuition expenses (in percentage)

- Table 36 Tuition increase assumption (in percentage)

- Table 37 Adjustments to normal payments

- Table 38 Administrative expense (in millions of dollars)

- Table 39 RAP-Stage 1 utilization rates

- Table 40 RAP-Stage 2 utilization rates

- Table 41 RAP-D utilization rates

- Table 42 Other RAP assumptions

- Table 43 Short-term adjustments to the default assumptions

- Table 44 Provision rates for bad debt – Interest

- Table 45 Number of students receiving a grant by institution type (in thousands)

- Table 46 Grants disbursed by institution type (in millions of dollars)

- Table 47 Number of students receiving a loan by institution type (in thousands)

- Table 48 Loans issued by institution type (in millions of dollars)

Index of charts

- Chart 1 Formula for grants issued

- Chart 2 Formula for loans issued

- Chart 3 Evolution of CSFA loans issued through the program

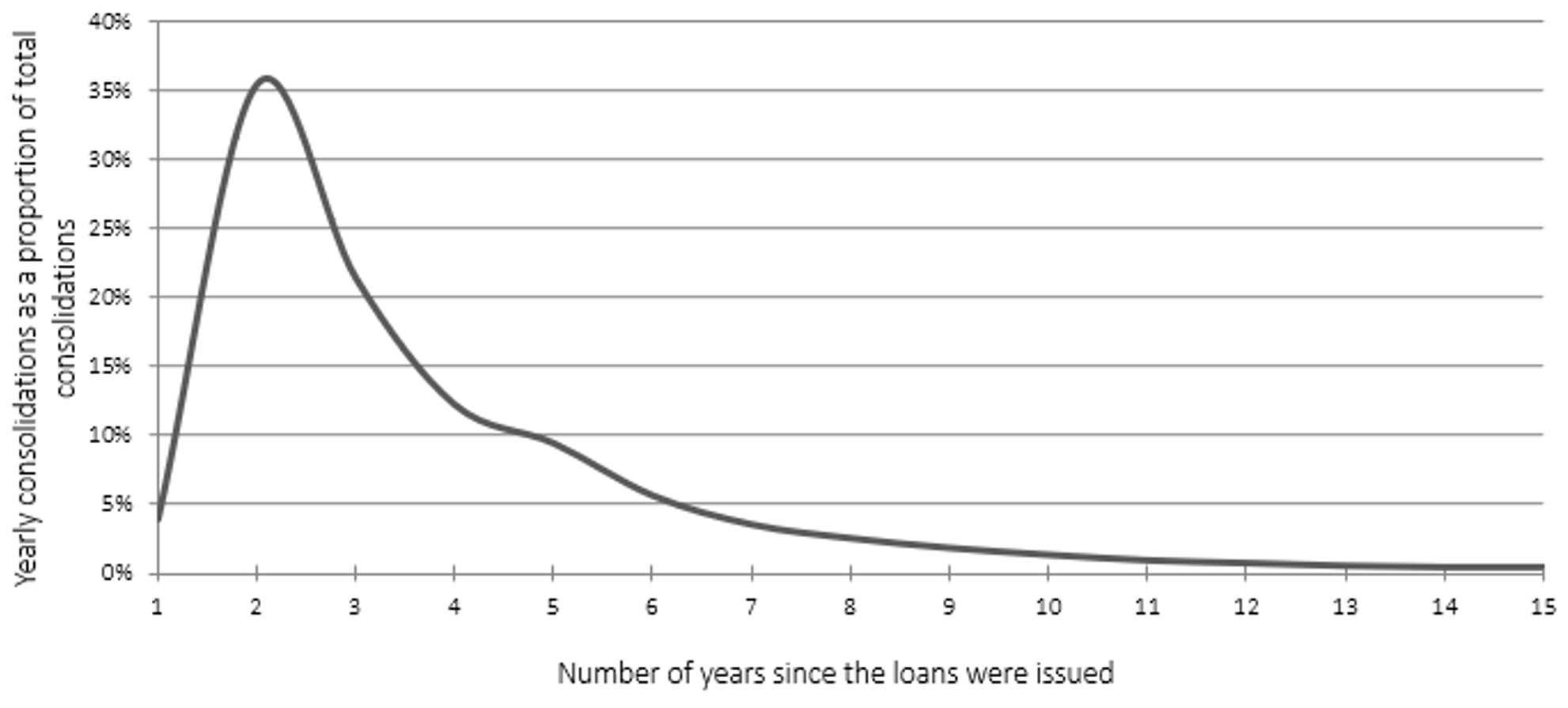

- Chart 4 Distribution of consolidation amounts over 15 years

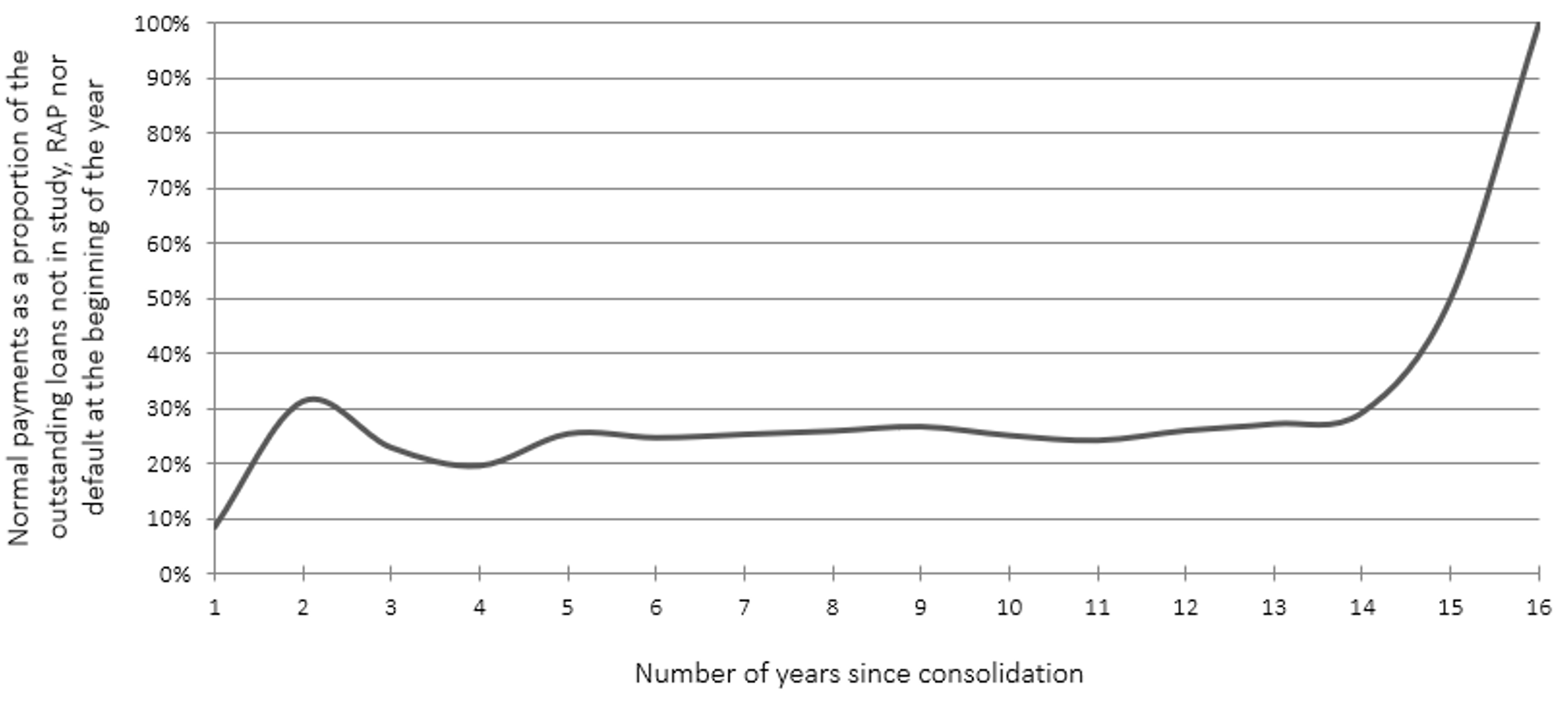

- Chart 5 Normal payments over 16 years

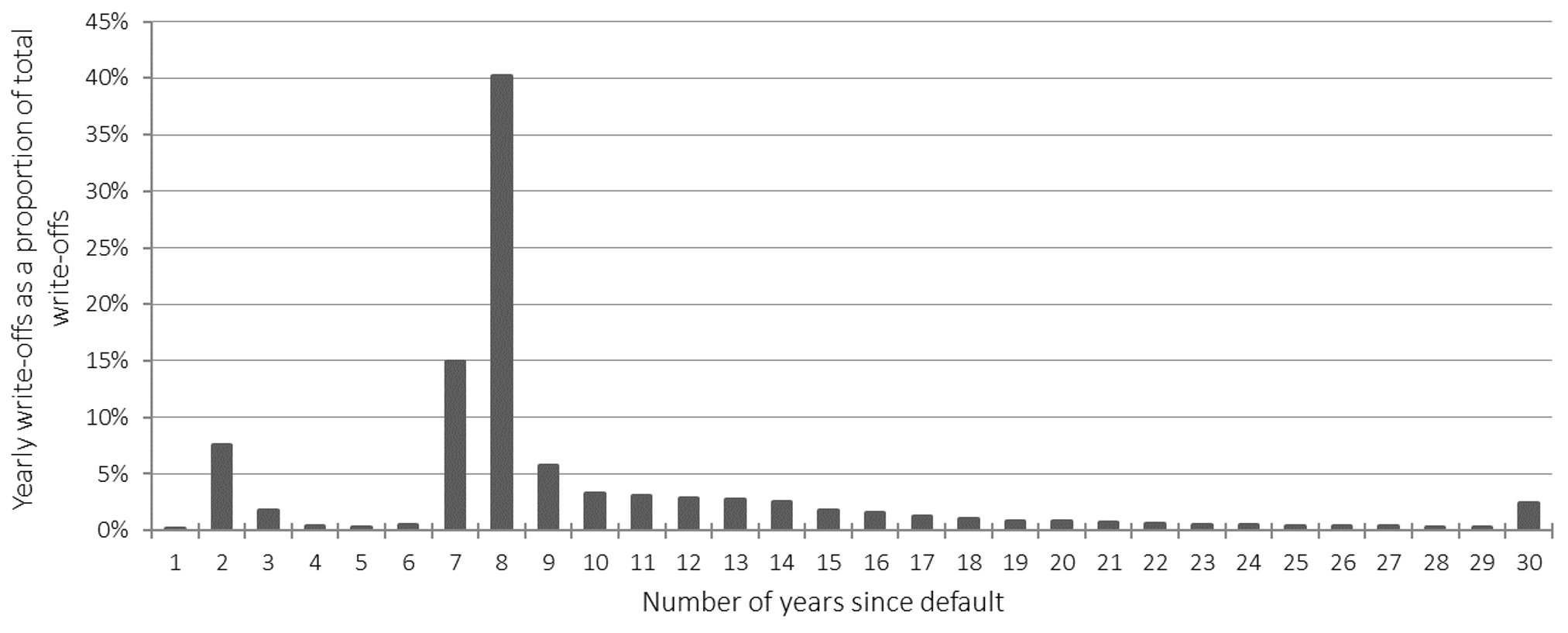

- Chart 6 Write-off distribution over 30 years

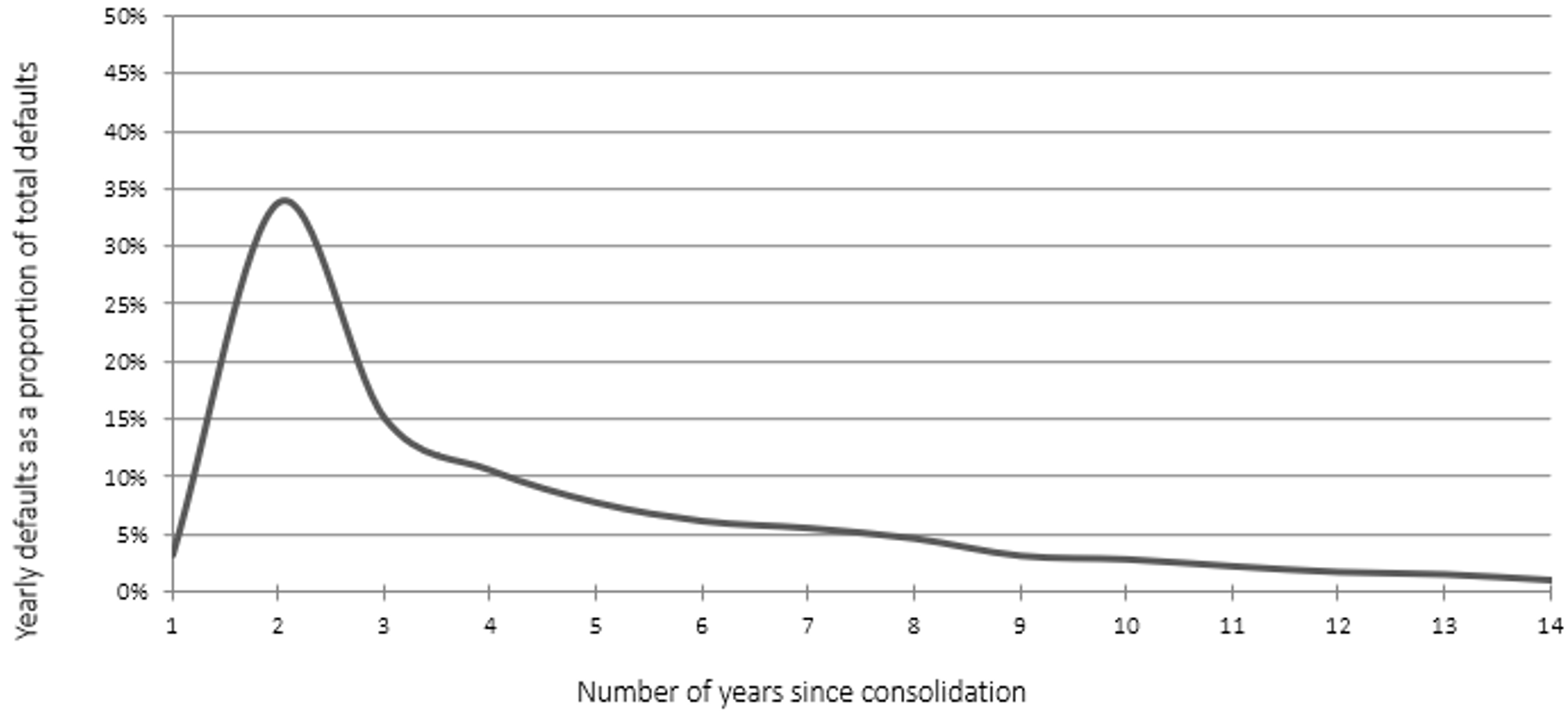

- Chart 7 Default distribution over 14 years

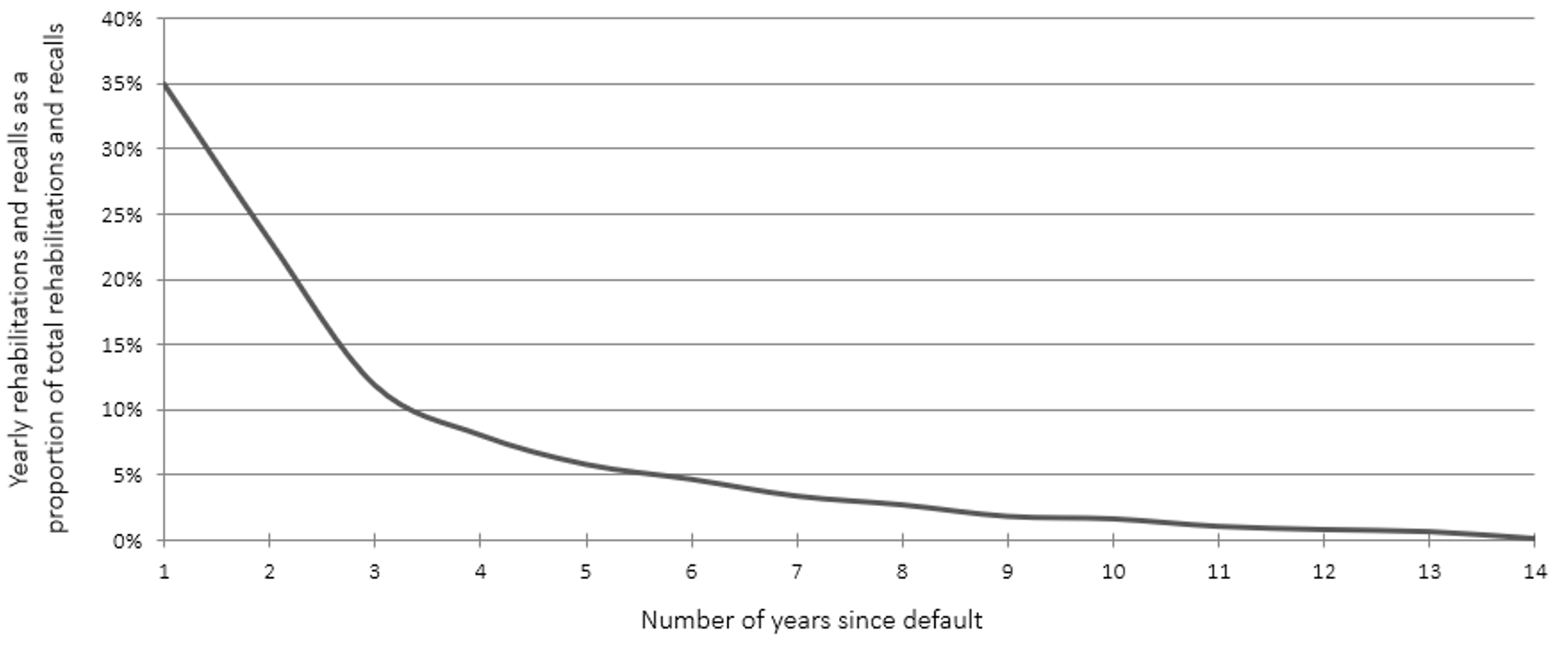

- Chart 8 Recalls and rehabilitations distribution over 14 years

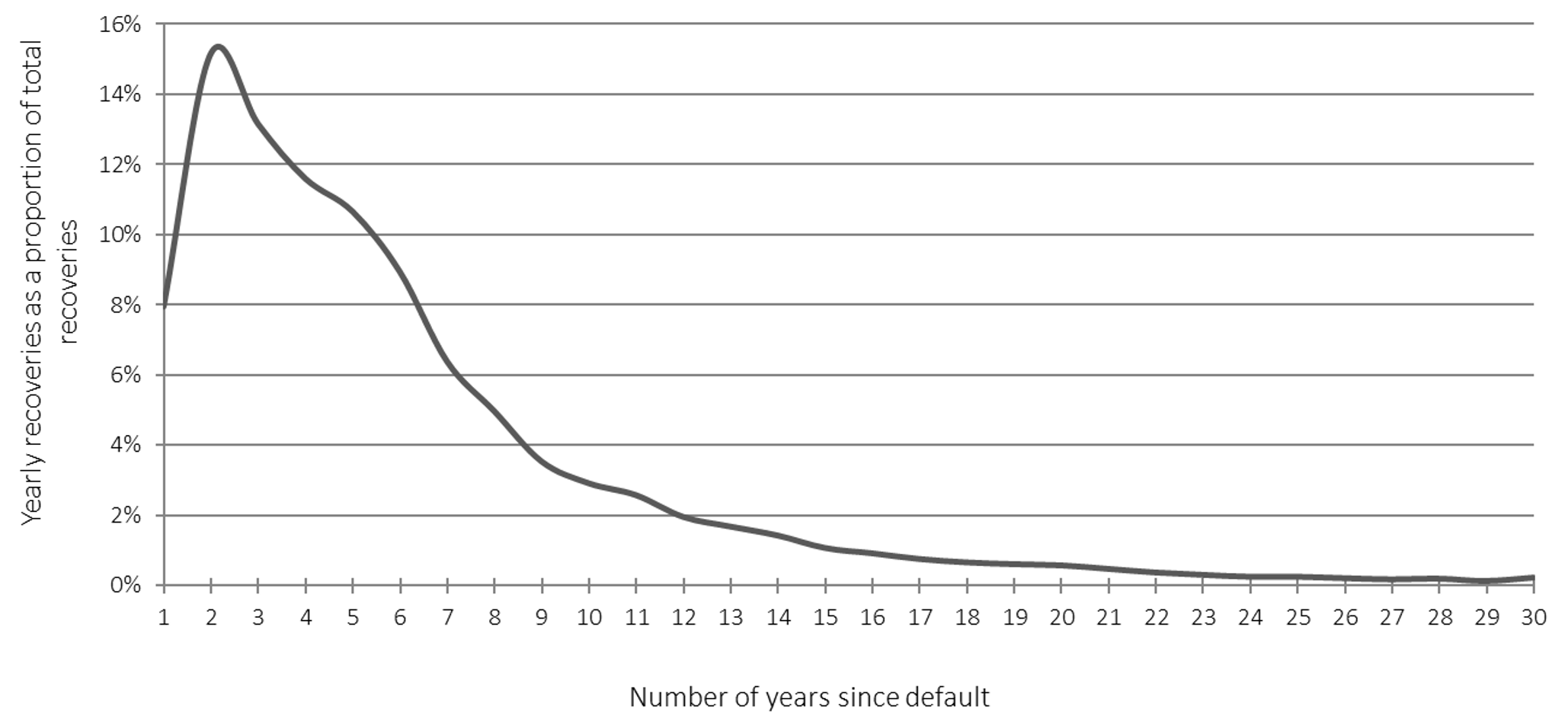

- Chart 9 Recovery distribution over 30 years

1 Highlights of the report

| Highlights | Main findings | Current report | Previous report |

|---|---|---|---|

| Grants issued | Disbursement in 2022‑2023 | $3,408M | $3,386M |

| End of the projection period Table A footnote 1 | $1,793M | $1,972M | |

| Loans issued | Disbursement in 2022‑2023 | $3,015M | $2,872M |

| End of the projection period | $5,478M | $5,600M | |

| Direct loan portfolio | Balance as at 31 July 2023 | $23.2B | $22.5B |

| Balance as at the end of the projection period | $37.1B | $39.0B | |

| Loan year in which the limit of $34B is expected to be reached | 2034-2035 | 2035-2036 | |

| Repayment Assistance Plan | Allowance – Principal as at 31 July 2023 | $2,075M | $2,334M |

| Defaults (Bad debt) |

Long-term net default rate | 6.9% | 8.1% |

| Allowance – Principal as at 31 July 2023 | $2,659M | $3,074M | |

| Allowance – Interest as at 31 July 2023 | $129M | $171M | |

| Net cost | In 2022‑2023 | $4.8B | $5.6B |

| End of the projection period | $5.1B | $4.8B | |

| Proportion of grants in 2022‑2023 | 70% | 60% | |

| Allowances for public accounts | no data | 31 March 2023 | 31 March 2022 |

| RAP – Principal | $2,007M | $1,768M | |

| Default – Principal | $2,652M | $3,037M | |

| Default – Interest | $139M | $209M | |

Table A footnotes

|

|||

Glossary

- Allowance

-

The amount that is set aside in the expectation of a cost that will be incurred at a future date. In this report, there is an allowance to cover the future cost of students benefiting from the RAP, and two allowances (principal and interest) to cover the risk of future default. Each allowance is determined as at 31 July.

- Allowance for Public Accounts

-

Allowance based on the program's conditions as at 31 March.

- Provision rates

-

Allowance divided by the related outstanding portfolio.

2 Introduction

Since 1 August 2000, the Canada Student Financial Assistance Program (CSFA Program) is directly financed by the Government and the Office of the Chief Actuary has the mandate to conduct an actuarial review of the program.

2.1 Purpose

Section 19.1 of the Canada Student Financial Assistance Act defines the mandate given to the Chief Actuary, that is, to prepare a report on the financial assistance provided under this Act no later than three years apart. Such an actuarial report was prepared as at 31 July 2020 and tabled before Parliament on 7 December 2021. The next triennial statutory report will be prepared as at 31 July 2023 and is scheduled to be tabled before Parliament in 2024.

This actuarial report, prepared as at 31 July 2022, is provided to support Employment and Social Development Canada (ESDC) accounting and policy analysis requirements. It also supports ESDC's partners, the Office of the Auditor General, the Treasury Board Secretariat and the Department of Finance.

2.2 Scope

The report includes a forecast of the CSFA Program's costs and revenues for 25 years (through the loan year 2046‑2047), and shows estimates of:

- the number of students receiving grants or loans under the CSFA Program;

- the amount of new grants or loans issued;

- the portfolio of loans in-study, loans in repayment and loans in default;

- the allowances under the direct loan regime in effect since August 2000; and

- the revenues, the expenses and the net resulting cost.

This valuation report is based on the program provisions as described in Appendix A.

Appendices B and C provide information on data, assumptions and methodologies. Appendix D illustrates the new loans and grants issued by institution type and Appendix E offers information on concessionary terms.

2.3 Recent program changes

This section summarizes recent changes that were implemented in the loan year ending 31 July 2022 or will be implemented in future years. Unless stated otherwise, these measures have been reflected in the projections presented in this report.

| Implementation date | Description | Source |

|---|---|---|

| 1 August 2021 | Flexibility to use current year's income instead of previous year's income to determine eligibility for Canada Student Grants (part of a three-year pilot project introduced in 2018-2019 made permanent). | Budget 2021 / Approved |

| 1 August 2022 | Expand access to supports for students and borrowers with persistent or prolonged disabilities that are not necessarily permanent. | Budget 2021 / Approved |

| 1 November 2022 | Increase accessibility to the RAP by increasing RAP income thresholds and reducing the maximum affordable payment. | Budget 2021 / Approved |

| 1 April 2023 | Permanently eliminating interest on Canada Student Loans. | 2022 Fall Economic Statement / Approved |

| 2023-2024 (expected) | Increase by 50% the maximum amount of loans that can be forgiven for doctors and qualifying nurses working in underserved rural or remote communities. | Budget 2022 / Pending Regulatory Approval |

| 2024-2025 (expected) | Expand the reach of the Canada Student Loan forgiveness for doctors and qualifying nurses to more rural communities. | Budget 2023 / Pending Regulatory Approval |

| To be determined | Expand the list of professionals eligible for loan forgiveness while working in under-served rural or remote communities. | Budget 2022 / Not considered in this report as details are not finalized |

| Start/End date | Description | Source |

|---|---|---|

| 1 April 2021 to 31 March 2022 | Waiver of interest accrual on student loans. | Bill C-14 / Approved |

| 1 August 2021 to 31 July 2023 |

Double the amount for the following Canada Student Grants (CSGs):

|

Budget 2021 / Approved |

| Extend the top-up grant of $200 per month for eligible adult learners returning to school full-time after being out of secondary school for at least 10 years (extension of the three-year pilot project introduced in the loan year 2018-2019). | Budget 2021 / Approved | |

| 1 April 2022 to 31 March 2023 | Extend the waiver of interest accrual on student loans. | Budget 2021 / Approved |

| 1 August 2023 to 31 July 2024 (expected) |

40% increase (compared with the loan year 2019-2020) to the amount for the following CSGs:

|

Budget 2023 / Pending Regulatory Approval |

| Increase the weekly student loan limit, from $210 to $300. | Budget 2023 / Pending Regulatory Approval | |

| Waiving the requirement for mature students, aged 22 years or older, to undergo credit screening in order to qualify for federal student grants and loans for the first time. | Budget 2023 / Pending Regulatory Approval |

3 Main assumptions

Several assumptions are needed to determine the future long-term costs of the CSFA Program. All assumptions used in this report are best-estimate assumptions and do not include any margin for adverse deviations. Assumptions used in the previous report were revised to incorporate new experience.

Table 1, Table 2 and Table 3 show a summary of the main assumptions used in this report for the loan year following the report's valuation date and the last loan year of the projection period, compared with those used in the previous report. A complete description of the assumptions is provided in Appendix C.

| Assumptions | Current report | Previous report | ||

|---|---|---|---|---|

| 2022-2023 | 2046-2047 | 2021-2022 | 2045-2046 | |

| Base population | CPP31st | CPP31st | CPP30th | CPP30th |

| Enrolment rate (15 to 64) | 6.6% | 6.9% | 6.8% | 6.9% |

| Loan uptake rate | 43.7% | 50.0% | 42.3% | 52.2% |

| Assumptions | Current report | Previous report | ||

|---|---|---|---|---|

| 2022-2023 | 2046-2047 | 2021-2022 | 2045-2046 | |

| Inflation | 5.6% | 2.0% | 4.6% | 2.0% |

| Real wage increase | -1.1% | 0.9% | 0.7% | 1.0% |

| Cost of borrowing (Government) | 3.0% | 3.7% | 2.1% | 3.7% |

| Cost of borrowing (Students) | 0.0% | 0.0% | 0.0% | 4.3% |

| Tuition increase | 3.5% | 3.8% | 1.9% | 3.8% |

| Assumptions | Current report | Previous report | ||

|---|---|---|---|---|

| 2022-2023 | 2046-2047 | 2021-2022 | 2045-2046 | |

| Prepayments | 12.5% | 15.0% | 15.0% | 17.5% |

| Net default rateTable 3 footnote 1 | 6.7% | 6.9% | 7.9% | 8.1% |

Table 3 footnotes

|

||||

Table 4 shows a summary of the provision rates as at July 31st of the year following the report's valuation date and the ultimate provision rates used in this report compared with those used in the previous report. A complete description of the provision rates is provided in Appendix C. Also, the provision rates as at 31 July 2023 are used to determine the allowance for Public Accounts, as shown in section 4.3.

| Portfolios | Current report | Previous report | ||

|---|---|---|---|---|

| As at 31 July 2023 | Ultimate | As at 31 July 2022 | Ultimate | |

| In-study | 6.9% | 6.7% | 7.2% | 7.2% |

| In repayment (net of RAP) | 1.9% | 2.3% | 1.8% | 2.0% |

| In RAP (all stages combined) | 36.2% | 29.5% | 45.3%Table 4 footnote 1 | 32.5% |

| Portfolios | Current report | Previous report | ||

|---|---|---|---|---|

| As at 31 July 2023 | Ultimate | As at 31 July 2022 | Ultimate | |

| In-study | 5.9% | 5.9% | 6.7% | 6.7% |

| In repayment | 3.5% | 4.2% | 4.8% | 4.7% |

| In default | 69.5% | 68.4% | 77.0% | 78.1% |

| Portfolios | Current report | Previous report | ||

|---|---|---|---|---|

| As at 31 July 2023 | Ultimate | As at 31 July 2022 | Ultimate | |

| In default | 60.3% | N/A | 72.3% | 70.1% |

Table 4 footnotes

- Table 4 footnote 1

-

The higher allowance rate was mostly due to the lower number of RAP users in the loan year and was expected to be temporary.

4 Projections

This section presents projections of the various CSFA Program's components required to determine the forecasts of the total net cost. First, the total amount of new loans and grants issued are projected. Then, the portfolios for the three types of regimes (guaranteed, risk-shared and direct loan regimes) are projected and the sub-portfolios for the direct loan regime are used to determine the projection of allowances under the same regime. Finally, total expenses and total revenues are projected separately to determine the resulting total net costs. All steps involved in these forecasts are shown in this section.

4.1 Total new grants and loans

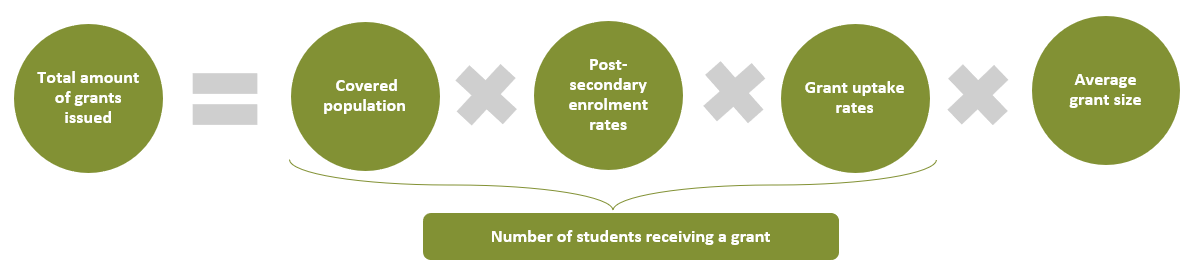

The projection of the total amount of new grants issued under the CSFA Program depends on many factors as illustrated by the following formula:

Chart 1 - Text version

Total Amounts of Grants Issued = Number of Students Receiving a Grant × Average Grant Size

Number of Students Receiving a Grant = Covered Population × Post-Secondary Enrolment Rates × Grant Uptake Rates

Table 5 presents the projection of new grants issued. This projection of the amount of new grants issued, along with the associated projection of students, is broken down by institution type in Appendix D.

| Loan year | Covered population (15 to 64) (thousands) (1) |

Enrolment rates (%) (2) |

Grant uptake rate (%) (3) |

Students in CSFA receiving a grant (thousands) (4) = (1) * (2) * (3) |

Average grant ($) (5) |

New grants issued ($ millions) (4) * (5) |

|---|---|---|---|---|---|---|

| 2021-2022 | 18,621 | 6.8 | 42.7 | 544 | 5,985 | 3,256 |

| 2022-2023 | 18,796 | 6.6 | 44.4 | 549 | 6,202 | 3,408 |

| 2023-2024 | 18,981 | 6.7 | 44.6 | 567 | 4,194 | 2,377 |

| 2024-2025 | 19,141 | 6.8 | 45.0 | 587 | 2,995 | 1,758 |

| 2025-2026 | 19,274 | 6.9 | 45.0 | 601 | 3,002 | 1,805 |

| 2026-2027 | 19,379 | 6.9 | 44.6 | 601 | 3,006 | 1,806 |

| 2027-2028 | 19,480 | 7.0 | 44.2 | 601 | 3,010 | 1,809 |

| 2028-2029 | 19,565 | 7.0 | 43.8 | 600 | 3,019 | 1,810 |

| 2029-2030 | 19,644 | 7.0 | 43.4 | 597 | 3,025 | 1,807 |

| 2030-2031 | 19,731 | 7.0 | 43.0 | 595 | 3,033 | 1,803 |

| 2031-2032 | 19,834 | 7.0 | 42.6 | 591 | 3,044 | 1,798 |

| 2032-2033 | 19,957 | 7.0 | 42.1 | 586 | 3,058 | 1,791 |

| 2033-2034 | 20,079 | 6.9 | 41.6 | 578 | 3,079 | 1,781 |

| 2034-2035 | 20,195 | 6.9 | 41.1 | 571 | 3,101 | 1,769 |

| 2035-2036 | 20,303 | 6.8 | 40.5 | 562 | 3,125 | 1,756 |

| 2036-2037 | 20,405 | 6.8 | 39.9 | 554 | 3,153 | 1,747 |

| 2037-2038 | 20,545 | 6.8 | 39.4 | 550 | 3,174 | 1,744 |

| 2038-2039 | 20,700 | 6.8 | 39.0 | 547 | 3,186 | 1,743 |

| 2039-2040 | 20,863 | 6.8 | 38.6 | 545 | 3,197 | 1,742 |

| 2040-2041 | 21,027 | 6.8 | 38.2 | 543 | 3,210 | 1,741 |

| 2041-2042 | 21,195 | 6.7 | 37.8 | 540 | 3,223 | 1,741 |

| 2042-2043 | 21,369 | 6.7 | 37.4 | 539 | 3,239 | 1,746 |

| 2043-2044 | 21,545 | 6.8 | 37.0 | 540 | 3,251 | 1,755 |

| 2044-2045 | 21,715 | 6.8 | 36.6 | 541 | 3,262 | 1,766 |

| 2045-2046 | 21,876 | 6.8 | 36.3 | 543 | 3,272 | 1,778 |

| 2046-2047 | 22,026 | 6.9 | 35.9 | 546 | 3,282 | 1,793 |

The average grant amount is higher over the first three loan years due to the temporary increase in the maximum amount of grants. The number of borrowers receiving a grant is expected to decrease slightly over the projection period as less students become eligible, as described in Appendix C.

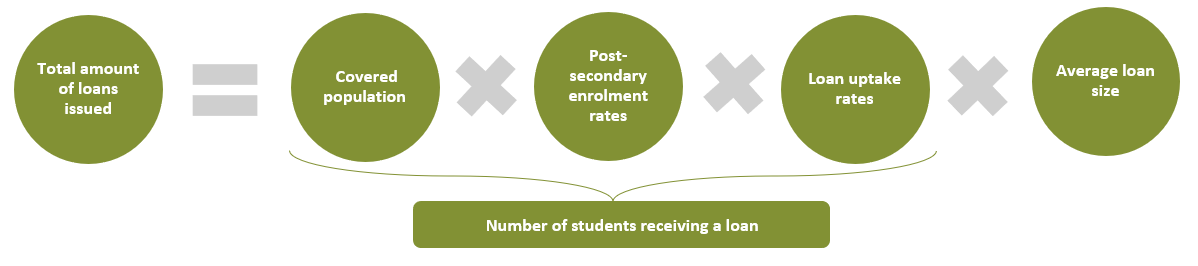

The following formula is used for the projection of the total amount of new loans issued under the CSFA Program:

Chart 2 - Text version

Total Amount of Loans Issued = Number of Students Receiving a Loan × Average Loan Size

Number of Students Receiving a Loan = Covered Population × Post-Secondary Enrolment Rates × Loan Uptake Rates

Table 6 presents the projection of new loans issued. This projection of the amount of new loans issued, along with the associated projection of students, is broken down by institution type in Appendix D.

| Loan year | Covered population (15 to 64) (thousands) (1) |

Enrolment rates (%) (2) |

Loan uptake rate (%) (3) |

Students in CSFA receiving a loan (thousands) (4) = (1) * (2) * (3) |

Average loan ($) (5) |

New loans issued ($ millions) (4) * (5) |

|---|---|---|---|---|---|---|

| 2021-2022 | 18,621 | 6.8 | 43.8 | 558 | 5,266 | 2,940 |

| 2022-2023 | 18,796 | 6.6 | 43.7 | 541 | 5,576 | 3,015 |

| 2023-2024 | 18,981 | 6.7 | 46.8 | 595 | 7,289 | 4,334 |

| 2024-2025 | 19,141 | 6.8 | 50.0 | 652 | 6,312 | 4,119 |

| 2025-2026 | 19,274 | 6.9 | 50.3 | 671 | 6,419 | 4,308 |

| 2026-2027 | 19,379 | 6.9 | 50.2 | 675 | 6,517 | 4,403 |

| 2027-2028 | 19,480 | 7.0 | 50.1 | 681 | 6,610 | 4,501 |

| 2028-2029 | 19,565 | 7.0 | 50.0 | 686 | 6,679 | 4,579 |

| 2029-2030 | 19,644 | 7.0 | 50.0 | 689 | 6,741 | 4,643 |

| 2030-2031 | 19,731 | 7.0 | 50.0 | 691 | 6,798 | 4,700 |

| 2031-2032 | 19,834 | 7.0 | 50.0 | 694 | 6,850 | 4,751 |

| 2032-2033 | 19,957 | 7.0 | 50.0 | 695 | 6,894 | 4,794 |

| 2033-2034 | 20,079 | 6.9 | 50.0 | 696 | 6,933 | 4,824 |

| 2034-2035 | 20,195 | 6.9 | 50.1 | 695 | 6,969 | 4,847 |

| 2035-2036 | 20,303 | 6.8 | 50.1 | 695 | 7,002 | 4,864 |

| 2036-2037 | 20,405 | 6.8 | 50.1 | 696 | 7,032 | 4,891 |

| 2037-2038 | 20,545 | 6.8 | 50.1 | 699 | 7,059 | 4,932 |

| 2038-2039 | 20,700 | 6.8 | 50.1 | 702 | 7,083 | 4,976 |

| 2039-2040 | 20,863 | 6.8 | 50.1 | 707 | 7,105 | 5,020 |

| 2040-2041 | 21,027 | 6.8 | 50.1 | 711 | 7,124 | 5,065 |

| 2041-2042 | 21,195 | 6.7 | 50.1 | 715 | 7,142 | 5,110 |

| 2042-2043 | 21,369 | 6.7 | 50.1 | 722 | 7,157 | 5,169 |

| 2043-2044 | 21,545 | 6.8 | 50.1 | 730 | 7,170 | 5,236 |

| 2044-2045 | 21,715 | 6.8 | 50.1 | 740 | 7,181 | 5,311 |

| 2045-2046 | 21,876 | 6.8 | 50.1 | 750 | 7,191 | 5,391 |

| 2046-2047 | 22,026 | 6.9 | 50.0 | 761 | 7,200 | 5,478 |

Overall, the total new loans issued is expected to increase from $2,940 million in 2021‑2022 to $3,015 million in 2022‑2023. In 2046‑2047, projected new loans issued total $5,478 million, which corresponds to an average annual increase of 2.5%Footnote 1. This average annual increase can be attributed to two factors: an average annual increase in the number of students in the program of 1.2% and an average annual increase in the average loan size of 1.3% over the projection period.

4.1.1 Population

Any eligible student enrolled in a designated post-secondary institution (excluding students from Quebec, Nunavut and the Northwest Territories) can apply for a loan under the CSFA program. Students aged 15‑29 represent the largest segment of the student population and are used for illustrative purposes thereafter. As shown in Table 7, the population aged 15‑29 is expected to increase from 5,012,000 in 2021‑2022 to 5,934,000 in 2046‑2047, or 0.7% per year.

4.1.2 Post-secondary enrolment

Table 7 shows the evolution of the number of eligible students (age group 15-29, age group 30-64 and total) enrolled full time in a post-secondary institution for the covered population.

| Loan year | Covered population (15-29) (thousands) |

Covered population (30-64) (thousands) |

Students enrolled full-time (15-29) (thousands) |

Students enrolled full-time (30-64) (thousands) |

Students enrolled full-time (Total) (thousands) |

Increase (%) |

|---|---|---|---|---|---|---|

| 2021-2022 | 5,012 | 13,608 | 1,129 | 146 | 1,275 | N/A |

| 2022-2023 | 5,030 | 13,766 | 1,077 | 159 | 1,237 | -3.0 |

| 2023-2024 | 5,102 | 13,879 | 1,116 | 154 | 1,270 | 2.7 |

| 2024-2025 | 5,160 | 13,981 | 1,152 | 153 | 1,305 | 2.7 |

| 2025-2026 | 5,202 | 14,072 | 1,184 | 152 | 1,336 | 2.4 |

| 2026-2027 | 5,228 | 14,151 | 1,195 | 151 | 1,347 | 0.8 |

| 2027-2028 | 5,262 | 14,218 | 1,210 | 151 | 1,360 | 1.0 |

| 2028-2029 | 5,296 | 14,268 | 1,220 | 150 | 1,370 | 0.7 |

| 2029-2030 | 5,327 | 14,317 | 1,227 | 150 | 1,377 | 0.5 |

| 2030-2031 | 5,354 | 14,376 | 1,232 | 150 | 1,382 | 0.4 |

| 2031-2032 | 5,387 | 14,448 | 1,236 | 150 | 1,387 | 0.3 |

| 2032-2033 | 5,422 | 14,535 | 1,239 | 151 | 1,390 | 0.2 |

| 2033-2034 | 5,455 | 14,624 | 1,239 | 151 | 1,390 | 0.0 |

| 2034-2035 | 5,477 | 14,718 | 1,238 | 152 | 1,389 | -0.1 |

| 2035-2036 | 5,492 | 14,811 | 1,236 | 152 | 1,388 | -0.1 |

| 2036-2037 | 5,498 | 14,907 | 1,236 | 153 | 1,389 | 0.1 |

| 2037-2038 | 5,523 | 15,022 | 1,241 | 154 | 1,396 | 0.4 |

| 2038-2039 | 5,550 | 15,150 | 1,247 | 156 | 1,403 | 0.5 |

| 2039-2040 | 5,583 | 15,280 | 1,254 | 157 | 1,411 | 0.6 |

| 2040-2041 | 5,621 | 15,406 | 1,261 | 158 | 1,419 | 0.6 |

| 2041-2042 | 5,669 | 15,526 | 1,268 | 160 | 1,428 | 0.6 |

| 2042-2043 | 5,719 | 15,650 | 1,280 | 161 | 1,442 | 0.9 |

| 2043-2044 | 5,772 | 15,773 | 1,295 | 163 | 1,458 | 1.1 |

| 2044-2045 | 5,828 | 15,888 | 1,313 | 164 | 1,477 | 1.3 |

| 2045-2046 | 5,882 | 15,994 | 1,332 | 166 | 1,498 | 1.4 |

| 2046-2047 | 5,934 | 16,092 | 1,354 | 167 | 1,521 | 1.5 |

The total number of enrolled students is expected to increase from its current level of 1,275,000 to 1,521,000 at the end of the projection period. Students aged 15-29 represent more than 85% of the total post-secondary enrolment. Overall, the aggregate enrolment rate for students aged 15-29 is expected to remain between 21% and 23% over the next 25 years.

4.1.3 Students receiving a loan or a grant

Enrolled students must apply to receive a loan or a grant. The ratio of loan or grant recipients to enrolled students is called the uptake rate. Table 8 shows the increasing uptake rate, from 52.5% in 2021‑2022 to 54.0% in 2046‑2047. This, combined with the increase in students enrolled in post-secondary education, results in 151,000 more students in the program over the projection (from 670,000 students in 2021‑2022 to 821,000 in 2046‑2047).

The number of students in the CSFA receiving a loan is 558,000 for the loan year 2021-2022.

| Loan year | Students enrolled full-time (thousands) |

Uptake rate (%) |

Students in CSFA receiving a loan and/or a grant (thousands) |

Increase (%) |

Students in CSFA receiving a loan (thousands) |

Students in CSFA receiving a grant (thousands) |

|---|---|---|---|---|---|---|

| 2021-2022 | 1,275 | 52.5 | 670 | N/A | 558 | 544 |

| 2022-2023 | 1,237 | 54.2 | 670 | 0.0 | 541 | 549 |

| 2023-2024 | 1,270 | 54.0 | 685 | 2.3 | 595 | 567 Table 8 footnote 1 |

| 2024-2025 | 1,305 | 53.9 | 703 | 2.6 | 652 | 587 Table 8 footnote 1 |

| 2025-2026 | 1,336 | 54.1 | 723 | 2.9 | 671 | 601 |

| 2026-2027 | 1,347 | 54.0 | 728 | 0.7 | 675 | 601 |

| 2027-2028 | 1,360 | 53.9 | 734 | 0.8 | 681 | 601 |

| 2028-2029 | 1,370 | 53.9 | 739 | 0.7 | 686 | 600 |

| 2029-2030 | 1,377 | 53.9 | 742 | 0.5 | 689 | 597 |

| 2030-2031 | 1,382 | 53.9 | 745 | 0.4 | 691 | 595 |

| 2031-2032 | 1,387 | 53.9 | 748 | 0.3 | 694 | 591 |

| 2032-2033 | 1,390 | 53.9 | 749 | 0.2 | 695 | 586 |

| 2033-2034 | 1,390 | 53.9 | 750 | 0.1 | 696 | 578 |

| 2034-2035 | 1,389 | 53.9 | 750 | 0.0 | 695 | 571 |

| 2035-2036 | 1,388 | 54.0 | 749 | −0.1 | 695 | 562 |

| 2036-2037 | 1,389 | 54.0 | 750 | 0.1 | 696 | 554 |

| 2037-2038 | 1,396 | 54.0 | 753 | 0.5 | 699 | 550 |

| 2038-2039 | 1,403 | 54.0 | 757 | 0.5 | 702 | 547 |

| 2039-2040 | 1,411 | 54.0 | 762 | 0.6 | 707 | 545 |

| 2040-2041 | 1,419 | 54.0 | 766 | 0.6 | 711 | 543 |

| 2041-2042 | 1,428 | 54.0 | 771 | 0.6 | 715 | 540 |

| 2042-2043 | 1,442 | 54.0 | 779 | 0.9 | 722 | 539 |

| 2043-2044 | 1,458 | 54.0 | 787 | 1.1 | 730 | 540 |

| 2044-2045 | 1,477 | 54.0 | 797 | 1.3 | 740 | 541 |

| 2045-2046 | 1,498 | 54.0 | 808 | 1.4 | 750 | 543 |

| 2046-2047 | 1,521 | 54.0 | 821 | 1.5 | 761 | 546 |

Table 8 footnotes

|

||||||

4.1.4 Average loan size

The amount of student loan depends on the expected need of the student. Table 9 summarizes the main elements of the student need calculation. All students who receive a loan or a grant are included. The student net need in Table 9 is then determined as a percentage of the student need less admissible grants.

| Loan year | Resources (1) |

Tuition (2) |

Other expenses (3) |

Total expenses (4) = (2) + (3) |

Average student need (5) = (4) − (1) |

Average grant for net need calculation (6) |

CSFA average student net need (7) = (5) * 60% − (6) |

|---|---|---|---|---|---|---|---|

| 2021-2022 | 3,000 | 8,900 | 13,600 | 22,600 | 19,500 | 4,900 | 6,800 |

| 2022-2023 | 3,100 | 9,300 | 14,400 | 23,700 | 20,600 | 4,800 | 7,500 |

| 2023-2024 | 3,200 | 9,500 | 14,700 | 24,200 | 21,100 | 3,300 | 9,400 |

| 2024-2025 | 3,300 | 10,000 | 15,100 | 25,100 | 21,800 | 2,300 | 10,800 |

| 2025-2026 | 3,300 | 10,500 | 15,400 | 25,900 | 22,600 | 2,300 | 11,200 |

| 2026-2027 | 3,400 | 11,000 | 15,700 | 26,700 | 23,400 | 2,300 | 11,700 |

| 2027-2028 | 3,500 | 11,600 | 16,000 | 27,600 | 24,200 | 2,300 | 12,200 |

| 2028-2029 | 3,600 | 12,000 | 16,300 | 28,400 | 24,800 | 2,200 | 12,600 |

| 2029-2030 | 3,600 | 12,500 | 16,700 | 29,100 | 25,500 | 2,200 | 13,100 |

| 2030-2031 | 3,700 | 13,000 | 17,000 | 30,100 | 26,300 | 2,200 | 13,500 |

| 2031-2032 | 3,800 | 13,500 | 17,300 | 30,900 | 26,900 | 2,200 | 14,000 |

| 2032-2033 | 3,900 | 14,000 | 17,700 | 31,700 | 27,800 | 2,200 | 14,500 |

| 2033-2034 | 4,000 | 14,500 | 18,000 | 32,600 | 28,600 | 2,200 | 15,000 |

| 2034-2035 | 4,100 | 15,100 | 18,400 | 33,600 | 29,500 | 2,100 | 15,500 |

| 2035-2036 | 4,200 | 15,700 | 18,900 | 34,400 | 30,300 | 2,100 | 16,000 |

| 2036-2037 | 4,300 | 16,200 | 19,300 | 35,500 | 31,200 | 2,100 | 16,500 |

| 2037-2038 | 4,400 | 16,900 | 19,600 | 36,500 | 32,100 | 2,100 | 17,200 |

| 2038-2039 | 4,600 | 17,600 | 20,000 | 37,700 | 33,000 | 2,100 | 17,700 |

| 2039-2040 | 4,700 | 18,200 | 20,500 | 38,700 | 34,000 | 2,100 | 18,400 |

| 2040-2041 | 4,800 | 19,000 | 20,800 | 39,800 | 35,000 | 2,000 | 18,900 |

| 2041-2042 | 5,000 | 19,700 | 21,300 | 41,000 | 36,000 | 2,000 | 19,500 |

| 2042-2043 | 5,100 | 20,500 | 21,700 | 42,200 | 37,100 | 2,000 | 20,200 |

| 2043-2044 | 5,200 | 21,200 | 22,200 | 43,400 | 38,200 | 2,000 | 20,900 |

| 2044-2045 | 5,400 | 22,000 | 22,500 | 44,700 | 39,200 | 2,000 | 21,500 |

| 2045-2046 | 5,600 | 23,000 | 23,000 | 46,000 | 40,400 | 2,000 | 22,200 |

| 2046-2047 | 5,700 | 23,800 | 23,500 | 47,400 | 41,600 | 2,000 | 23,000 |

The average grant for the need calculation is strictly used for the purpose of calculating the net need. It is derived from the need assessment data and includes some students with a grant of zero. The real average grant (paid to grant recipients only) in the loan year 2021-2022 is $5,985. The average grant for the first three loan years is higher due to the temporary increase in grants.

As shown in Table 10, the average loan size is calculated as the ratio of new loans issued over the number of students receiving a loan under the CSFA Program. The growth rate of the average loan size is moderated due to the fixed weekly student loan limit of $210, with the only exception being the loan year 2023-2024 where the limit is $300.

Over time, more students reach the loan limit without their needs being completely fulfilled. This is shown in Table 10, where the percentage of students at the loan limit is projected to increase from 57.6% in 2024-2025 to 92.4% in 2046-2047.

| Loan year | New loans issued ($ million) (1) |

Increase (%) |

Students in CSFA receiving a loan (thousands) (2) |

Average loan size ($) (1) / (2) |

Increase (%) |

% of students at limit (%) |

|---|---|---|---|---|---|---|

| 2021-2022 | 2,940 | N/A | 558 | 5,266 | N/A | 37.3 |

| 2022-2023 | 3,015 | 2.5 | 541 | 5,576 | 5.9 | 40.8 |

| 2023-2024 | 4,334 | 43.8 | 595 | 7,289 | 30.7 | 29.8 |

| 2024-2025 | 4,119 | -5.0 | 652 | 6,312 | -13.4 | 57.6 |

| 2025-2026 | 4,308 | 4.6 | 671 | 6,419 | 1.7 | 60.2 |

| 2026-2027 | 4,403 | 2.2 | 675 | 6,517 | 1.5 | 63.1 |

| 2027-2028 | 4,501 | 2.2 | 681 | 6,610 | 1.4 | 65.8 |

| 2028-2029 | 4,579 | 1.7 | 686 | 6,679 | 1.0 | 68.3 |

| 2029-2030 | 4,643 | 1.4 | 689 | 6,741 | 0.9 | 70.7 |

| 2030-2031 | 4,700 | 1.2 | 691 | 6,798 | 0.8 | 73.0 |

| 2031-2032 | 4,751 | 1.1 | 694 | 6,850 | 0.8 | 75.6 |

| 2032-2033 | 4,794 | 0.9 | 695 | 6,894 | 0.6 | 77.9 |

| 2033-2034 | 4,824 | 0.6 | 696 | 6,933 | 0.6 | 79.7 |

| 2034-2035 | 4,847 | 0.5 | 695 | 6,969 | 0.5 | 81.2 |

| 2035-2036 | 4,864 | 0.4 | 695 | 7,002 | 0.5 | 82.5 |

| 2036-2037 | 4,891 | 0.6 | 696 | 7,032 | 0.4 | 83.8 |

| 2037-2038 | 4,932 | 0.8 | 699 | 7,059 | 0.4 | 85.0 |

| 2038-2039 | 4,976 | 0.9 | 702 | 7,083 | 0.3 | 86.1 |

| 2039-2040 | 5,020 | 0.9 | 707 | 7,105 | 0.3 | 87.2 |

| 2040-2041 | 5,065 | 0.9 | 711 | 7,124 | 0.3 | 88.2 |

| 2041-2042 | 5,110 | 0.9 | 715 | 7,142 | 0.2 | 89.2 |

| 2042-2043 | 5,169 | 1.2 | 722 | 7,157 | 0.2 | 90.1 |

| 2043-2044 | 5,236 | 1.3 | 730 | 7,170 | 0.2 | 90.9 |

| 2044-2045 | 5,311 | 1.4 | 740 | 7,181 | 0.2 | 91.5 |

| 2045-2046 | 5,391 | 1.5 | 750 | 7,191 | 0.1 | 92.0 |

| 2046-2047 | 5,478 | 1.6 | 761 | 7,200 | 0.1 | 92.4 |

The average loan amount is lower over the first two loan years due to the temporary doubling of the grants. The average loan for the loan year 2023-2024 is higher than the previous and following loan years, despite the temporary increase of grants. This is due to the temporary increase to the weekly student loan limit ($210 to $300). The percentage of students at the limit of 29.8% for the loan year 2023-2024 is also based on a maximum weekly student loan of $300 instead of the standard $210.

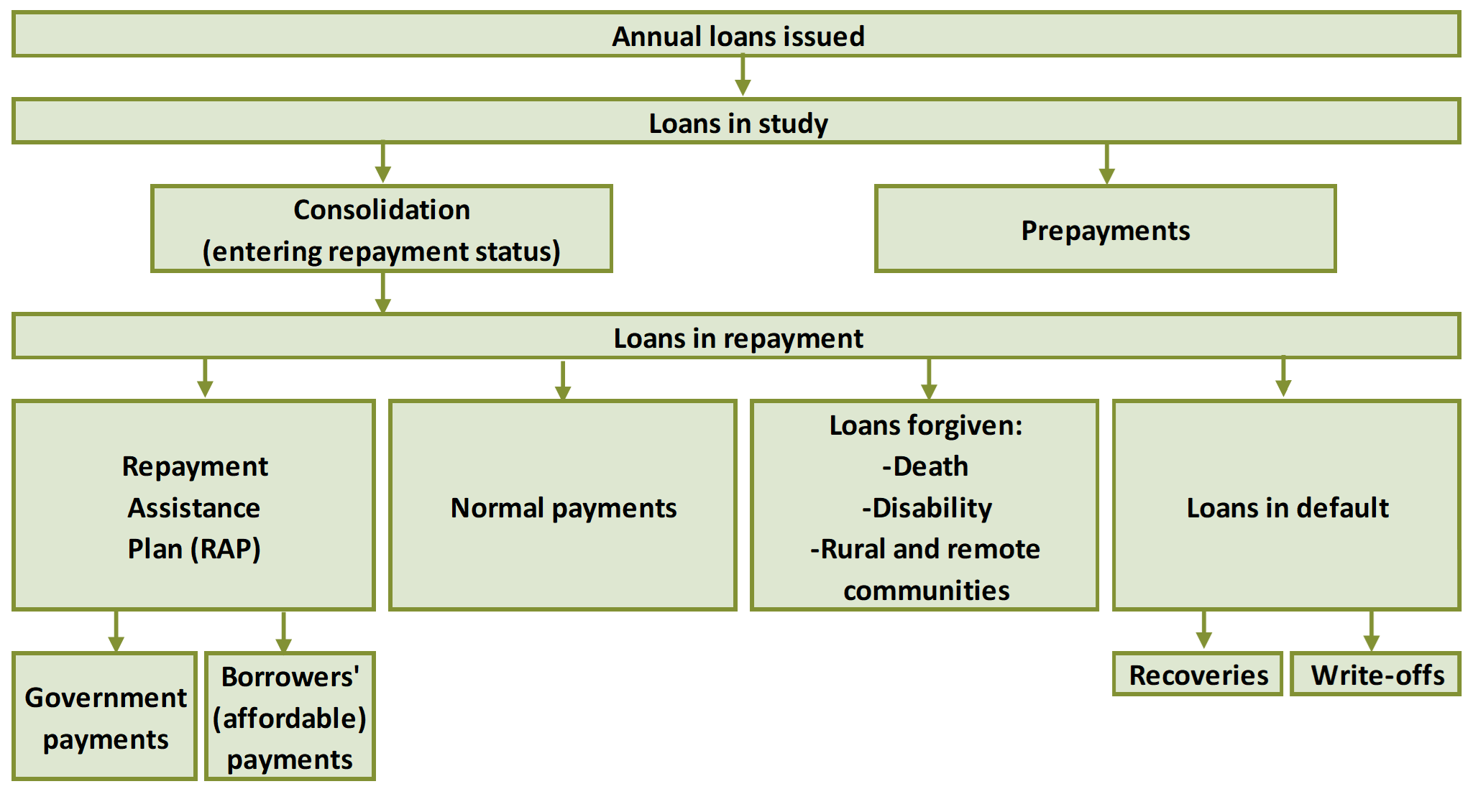

4.2 Portfolios

This section presents projections of the portfolio for all three regimes described in Appendix A (guaranteed, risk-shared and direct loan regimes). The amounts for loans in‑study represent loans issued to students who are still in the post‑secondary educational system. Loans in repayment consist of outstanding loans that have already consolidated and were not returned to the Government (defaulted loans).

4.2.1 Direct loan regime

The projection of the direct loan portfolio includes the balance of outstanding loans (in-study and in repayment separately) and the balance of loans in default. The projection of the direct loan portfolio (principal only) is shown in Table 11.

| As at July 31 | Loans in-study | Loans in repayment | Defaulted loans | Total |

|---|---|---|---|---|

| 2022 | 8,121 | 12,718 | 2,434 | 23,273 |

| 2023 | 7,621 | 13,080 | 2,522 | 23,223 |

| 2024 | 9,200 | 12,545 | 2,588 | 24,333 |

| 2025 | 9,972 | 12,644 | 2,609 | 25,225 |

| 2026 | 10,658 | 12,855 | 2,638 | 26,151 |

| 2027 | 11,215 | 13,092 | 2,678 | 26,985 |

| 2028 | 11,662 | 13,457 | 2,734 | 27,853 |

| 2029 | 12,036 | 13,857 | 2,798 | 28,691 |

| 2030 | 12,349 | 14,269 | 2,862 | 29,480 |

| 2031 | 12,615 | 14,673 | 2,940 | 30,228 |

| 2032 | 12,841 | 15,063 | 3,030 | 30,934 |

| 2033 | 13,032 | 15,424 | 3,121 | 31,577 |

| 2034 | 13,189 | 15,751 | 3,210 | 32,150 |

| 2035 | 13,315 | 16,044 | 3,297 | 32,656 |

| 2036 | 13,417 | 16,299 | 3,378 | 33,094 |

| 2037 | 13,509 | 16,518 | 3,451 | 33,478 |

| 2038 | 13,605 | 16,721 | 3,518 | 33,844 |

| 2039 | 13,710 | 16,905 | 3,582 | 34,197 |

| 2040 | 13,821 | 17,073 | 3,641 | 34,535 |

| 2041 | 13,936 | 17,233 | 3,695 | 34,864 |

| 2042 | 14,055 | 17,387 | 3,748 | 35,190 |

| 2043 | 14,188 | 17,539 | 3,799 | 35,526 |

| 2044 | 14,340 | 17,695 | 3,848 | 35,883 |

| 2045 | 14,511 | 17,861 | 3,897 | 36,269 |

| 2046 | 14,700 | 18,041 | 3,943 | 36,684 |

| 2047 | 14,907 | 18,236 | 3,990 | 37,133 |

The outstanding direct loans in the in-study portfolio is projected to decrease to $7.6 billion as at 31 July 2023 due to lower loans issued (which is the result of the temporary increased grants). The outstanding direct loans portfolio is projected to increase from $23.3 billion as at 31 July 2022 to $27.0 billion five years later. By the end of the 2046‑2047 loan year, the portfolio is projected to reach $37.1 billion.

| New loans issued | $53.3 billion |

|---|---|

| Plus the interest accrued during the non-repayment periodOutstanding direct loan portfolio - Footnote 3 | $ 1.4 billion |

| Minus repaymentsOutstanding direct loan portfolio - Footnote 4 | $28.6 billion |

| Minus loans forgiven and debt reductions in repaymentOutstanding direct loan portfolio - Footnote 5 | $ 1.2 billion |

| Minus defaulted loans written off | $ 1.6 billion |

| Total | $23.3 billion |

Outstanding direct loan portfolio - Footnotes

|

|

4.2.2 Defaulted loans portfolio – Principal

Table 12 provides the calculation details for the projection of the defaulted loans portfolio (principal only) under the direct loan regime.

| Loan year | Balance 1 August (1) |

New defaulted loans (2) |

Collected loans (3) |

Write-offs (4) |

Balance 31 July (1+2) − (3+4) |

|---|---|---|---|---|---|

| 2021-2022 | 2,283 Table 12 footnote 1 | 390 | 105 | 134 | 2,434 |

| 2022-2023 | 2,434 | 379 | 111 | 180 | 2,522 |

| 2023-2024 | 2,522 | 381 | 134 | 181 | 2,588 |

| 2024-2025 | 2,588 | 343 | 146 | 177 | 2,609 |

| 2025-2026 | 2,609 | 353 | 152 | 171 | 2,638 |

| 2026-2027 | 2,638 | 364 | 158 | 166 | 2,678 |

| 2027-2028 | 2,678 | 376 | 161 | 159 | 2,734 |

| 2028-2029 | 2,734 | 398 | 166 | 168 | 2,798 |

| 2029-2030 | 2,798 | 418 | 170 | 184 | 2,862 |

| 2030-2031 | 2,862 | 437 | 173 | 186 | 2,940 |

| 2031-2032 | 2,940 | 451 | 178 | 183 | 3,030 |

| 2032-2033 | 3,030 | 464 | 184 | 189 | 3,121 |

| 2033-2034 | 3,121 | 475 | 188 | 197 | 3,210 |

| 2034-2035 | 3,210 | 484 | 194 | 204 | 3,297 |

| 2035-2036 | 3,297 | 492 | 198 | 214 | 3,378 |

| 2036-2037 | 3,378 | 500 | 203 | 224 | 3,451 |

| 2037-2038 | 3,451 | 507 | 208 | 233 | 3,518 |

| 2038-2039 | 3,518 | 513 | 212 | 237 | 3,582 |

| 2039-2040 | 3,582 | 518 | 215 | 244 | 3,641 |

| 2040-2041 | 3,641 | 523 | 219 | 250 | 3,695 |

| 2041-2042 | 3,695 | 527 | 222 | 253 | 3,748 |

| 2042-2043 | 3,748 | 532 | 225 | 257 | 3,799 |

| 2043-2044 | 3,799 | 537 | 228 | 259 | 3,848 |

| 2044-2045 | 3,848 | 541 | 231 | 262 | 3,897 |

| 2045-2046 | 3,897 | 547 | 233 | 268 | 3,943 |

| 2046-2047 | 3,943 | 553 | 236 | 269 | 3,990 |

Table 12 footnotes

|

|||||

Collected loans (principal recoveries) are expected to increase starting in 2023-2024 following the removal of interest accrual since a higher share of total recoveries will be applied to outstanding principal instead of outstanding interest.

The balance of loans in default (principal only) was $2,434 million as at 31 July 2022. The defaulted loans portfolio is projected to reach $3,990 million by the end of the projection period.

As shown in Table 12, an amount of $134 million was written off in 2021‑2022. The corresponding amount in 2022‑2023 is $180 million and includes all the non‑recoverable loans that were identified and approved for write-off by ESDC and CRA between July 2021 and June 2022. These write-offs were approved on 30 March 2023, via Royal Assent of Bill C‑43 (Appropriation Act No. 5, 2022-2023). The decision to write off particular loans is part of a multi-step process inevitably resulting in some volatility in the actual amount written off from year to year.

4.2.3 Defaulted loans portfolio – Interest

The projection of the balance of interest on defaulted loans is presented in Table 13.

| Loan year | Balance August 1 (1) |

Interest transferred in default (2) |

Interest accrued (3) |

Interest collected (4) |

Write-offs (5) |

Balance July 31 (1+2+3) − (4+5) |

|---|---|---|---|---|---|---|

| 2021-2022 | 338Table 13 footnote 1 | 0 | 8 | 31 | 35 | 280 |

| 2022-2023 | 280 | -2 | 0 | 24 | 41 | 213 |

| 2023-2024 | 213 | -1 | 0 | 23 | 29 | 159 |

| 2024-2025 | 159 | -1 | 0 | 14 | 24 | 120 |

| 2025-2026 | 120 | 0 | 0 | 10 | 18 | 92 |

| 2026-2027 | 92 | 0 | 0 | 7 | 13 | 71 |

| 2027-2028 | 71 | 0 | 0 | 5 | 8 | 57 |

| 2028-2029 | 57 | 0 | 0 | 4 | 6 | 47 |

| 2029-2030 | 47 | 0 | 0 | 4 | 5 | 39 |

| 2030-2031 | 39 | 0 | 0 | 3 | 4 | 32 |

| 2031-2032 | 32 | 0 | 0 | 2 | 3 | 27 |

| 2032-2033 | 27 | 0 | 0 | 2 | 3 | 23 |

| 2033-2034 | 23 | 0 | 0 | 1 | 2 | 19 |

| 2034-2035 | 19 | 0 | 0 | 1 | 2 | 16 |

| 2035-2036 | 16 | 0 | 0 | 1 | 2 | 13 |

| 2036-2037 | 13 | 0 | 0 | 1 | 2 | 10 |

| 2037-2038 | 10 | 0 | 0 | 1 | 2 | 7 |

| 2038-2039 | 7 | 0 | 0 | 0 | 2 | 5 |

| 2039-2040 | 5 | 0 | 0 | 0 | 1 | 4 |

| 2040-2041 | 4 | 0 | 0 | 0 | 1 | 2 |

| 2041-2042 | 2 | 0 | 0 | 0 | 1 | 1 |

| 2042-2043 | 1 | 0 | 0 | 0 | 0 | 1 |

| 2043-2044 | 1 | 0 | 0 | 0 | 0 | 1 |

| 2044-2045 | 1 | 0 | 0 | 0 | 0 | 0 |

| 2045-2046 | 0 | 0 | 0 | 0 | 0 | 0 |

| 2046-2047 | 0 | 0 | 0 | 0 | 0 | 0 |

Table 13 footnotes

|

||||||

Interest accrual on student loans was temporarily waved in loan years 2021-2022 and 2022-2023 (up to March 31, 2023). Moreover, the 2022 Fall Economic Statement permanently eliminated interest on Canada Student Loans. However, interest is still accruing in some special cases for certain borrowers in defaults that have a court judgement. The interest transferred in defaults can be negative due to expected rehabilitations, recalls and other adjustments that occur during the year.

Table 13 shows that the net interest returned to the Government in the loan year 2021-2022 was nil (i.e., the value transferred with newly defaulted principal was offset by rehabilitations). An additional amount of $8 million in interest was accrued during the loan year 2021-2022 on the principal balance of the recoverable defaulted loans portfolio at the beginning of the loan year.

In the loan year 2021-2022, $35 million in interest was written off. As shown in Table 13, the balance of interest in default was $338 million at the beginning of the loan year 2021-2022 and it decreased to $280 million as at 31 July 2022. The balance of interest in default is projected to be fully eliminated by the end of the projection period as interest no longer accrues on loans.

4.2.4 Guaranteed and risk‑shared regimes

Table 14 presents the projections of the guaranteed and risk-shared loans owned by financial institutions and by the Government, as well as the loans returned to the Government because of default (principal only). The guaranteed and risk‑shared regimes are gradually being phased out.

| As at July 31 | Loans in study or repayment | Loans in default (returned to the Government) |

Total | ||

|---|---|---|---|---|---|

| (with financial institutions) Guaranteed and risk-shared |

(bought back by the Government) Guaranteed and risk-sharedTable 14 footnote 1 |

Guaranteed | Risk-shared | ||

| 2022 | 14Table 14 footnote 2 | 14 | 45 | 31 | 104 |

| 2023 | 10 | 10 | 39 | 27 | 86 |

| 2024 | 7 | 6 | 34 | 24 | 71 |

| 2025 | 3 | 3 | 29 | 21 | 56 |

| 2026 | 0 | 0 | 24 | 18 | 42 |

| 2027 | 0 | 0 | 20 | 14 | 34 |

| 2028 | 0 | 0 | 15 | 11 | 26 |

| 2029 | 0 | 0 | 11 | 8 | 19 |

| 2030 | 0 | - no data | 8 | 5 | 13 |

| 2031 | 0 | - no data | 4 | 3 | 7 |

| 2032 | 0 | - no data | - no data | 0 | 0 |

| 2033 | 0 | - no data | - no data | 0 | 0 |

| 2034 | 0 | - no data | - no data | - no data | 0 |

| 2035 | - no data | - no data | - no data | - no data | - no data |

| 2036 | - no data | - no data | - no data | - no data | - no data |

Table 14 footnotes

|

|||||

At the end of the 2021‑2022 loan year, the sum of all loans coming from the guaranteed and risk-shared regimes that are owned by the Government amounts to approximately $147Footnote 2 million.

4.2.5 Limit on the aggregate amount of outstanding loans

The Canada Student Financial Assistance Regulations (CSFAR) imposes a limit on the aggregate amount of outstanding loans in the program. The current limit of $34 billion was last increased in June 2019.

Table 15 presents the projection of the aggregate amount of outstanding loans. It is the sum of:

- Total principal amount of direct loans in study, in repayment and in default;

- Total principal amount of defaulted risk-shared loans returnedFootnote 3 to the Government from financial institutions.

In comparison with Table 11, which show the projection of the loan portfolio at the end of loan years, Table 15 presents the estimated peak of the portfolio during the loan year. Monthly fluctuations throughout the year cause the aggregate amount of loans to be lower both at the beginning and at the end of the loan year. The peak usually occurs in the middle of the loan year (January) and is 1% to 4% higher than the aggregate amount at the end of the loan year.

Table 11 shows an aggregate amount of outstanding direct loans of $23.3 billion as at 31 July 2022. Table 15 shows that the aggregate amount of outstanding direct loans reached $24.0 billion in October 2021 (loan year 2021-2022) and $24.4 billion in December 2022 (loan year 2022-2023).

The projection shows that the $34 billion limit is expected to be reached during the loan year 2034-2035 if the program's provisions do not change and assumptions materialize. The limit is reached one year earlier than estimated in the previous report.

| Loan year | Direct loans | Risk-shared loans | Total |

|---|---|---|---|

| 2021-2022 | 24,041 | 32 | 24,073 |

| 2022-2023 | 24,379 | 29 | 24,408 |

| 2023-2024 | 25,496 | 25 | 25,521 |

| 2024-2025 | 26,335 | 22 | 26,357 |

| 2025-2026 | 27,294 | 19 | 27,313 |

| 2026-2027 | 28,201 | 16 | 28,217 |

| 2027-2028 | 29,087 | 13 | 29,100 |

| 2028-2029 | 29,977 | 10 | 29,987 |

| 2029-2030 | 30,826 | 7 | 30,833 |

| 2030-2031 | 31,620 | 4 | 31,624 |

| 2031-2032 | 32,365 | 1 | 32,366 |

| 2032-2033 | 33,059 | 0 | 33,059 |

| 2033-2034 | 33,684 | 0 | 33,684 |

| 2034-2035 | 34,236 | - no data | 34,236 |

| 2035-2036 | 34,721 | - no data | 34,721 |

| 2036-2037 | 35,147 | - no data | 35,147 |

| 2037-2038 | 35,542 | - no data | 35,542 |

| 2038-2039 | 35,919 | - no data | 35,919 |

| 2039-2040 | 36,284 | - no data | 36,284 |

| 2040-2041 | 36,637 | - no data | 36,637 |

| 2041-2042 | 36,981 | - no data | 36,981 |

| 2042-2043 | 37,335 | - no data | 37,335 |

| 2043-2044 | 37,707 | - no data | 37,707 |

| 2044-2045 | 38,106 | - no data | 38,106 |

| 2045-2046 | 38,537 | - no data | 38,537 |

| 2046-2047 | 39,000 | - no data | 39,000 |

4.3 Allowances

This section presents projections of the three allowances under the direct loan regime described in Appendix A. There is an allowance for the RAP (principal) to cover the future cost of students benefiting from this program, and two allowances for bad debt (principal and interest) to cover the risk of future default.

The provision rates used to determine the 2022‑2023 allowance and the ultimate provision rates are presented in Appendix C. The portfolios to which those provision rates apply are presented in Table 11.

The Government sets up a separate allowance in the Public Accounts for Guaranteed and Risk-Shared Loans. This allowance calculation is not included in this report. Expenses related to those loans are presented in Table 20 and Table 21.

4.3.1 Allowance for the Repayment Assistance Plan

Table 16 provides the calculation details for the projection of the allowance for the Repayment Assistance Plan (RAP) – principal under the direct loan regimeFootnote 4.

| Loan year | Allowance 1 August (1) |

RAP expenses (2) |

Allowance 31 July (3) |

Yearly expense (3) − (1−2) |

|---|---|---|---|---|

| 2021-2022 | 2,125 | 156 | 2,448Table 16 footnote 1 | 479 |

| 2022-2023 | 2,448 | 172 | 2,075 | -201 |

| 2023-2024 | 2,075 | 194 | 2,178 | 297 |

| 2024-2025 | 2,178 | 201 | 2,258 | 281 |

| 2025-2026 | 2,258 | 208 | 2,341 | 291 |

| 2026-2027 | 2,341 | 212 | 2,427 | 298 |

| 2027-2028 | 2,427 | 220 | 2,510 | 303 |

| 2028-2029 | 2,510 | 227 | 2,591 | 308 |

| 2029-2030 | 2,591 | 231 | 2,672 | 312 |

| 2030-2031 | 2,672 | 237 | 2,750 | 315 |

| 2031-2032 | 2,750 | 245 | 2,825 | 320 |

| 2032-2033 | 2,825 | 252 | 2,894 | 321 |

| 2033-2034 | 2,894 | 260 | 2,957 | 323 |

| 2034-2035 | 2,957 | 267 | 3,012 | 322 |

| 2035-2036 | 3,012 | 273 | 3,058 | 319 |

| 2036-2037 | 3,058 | 278 | 3,099 | 319 |

| 2037-2038 | 3,099 | 286 | 3,142 | 329 |

| 2038-2039 | 3,142 | 294 | 3,181 | 333 |

| 2039-2040 | 3,181 | 301 | 3,216 | 336 |

| 2040-2041 | 3,216 | 307 | 3,249 | 340 |

| 2041-2042 | 3,249 | 311 | 3,280 | 342 |

| 2042-2043 | 3,280 | 316 | 3,311 | 347 |

| 2043-2044 | 3,311 | 319 | 3,342 | 350 |

| 2044-2045 | 3,342 | 323 | 3,375 | 356 |

| 2045-2046 | 3,375 | 326 | 3,411 | 362 |

| 2046-2047 | 3,411 | 329 | 3,449 | 367 |

Table 16 footnotes

|

||||

The allowance for the RAP – principal is estimated at $2,448 million as at 31 July 2022, which is higher than the $2,323 million projected in the previous report. For the loan year 2021‑2022, the yearly expense for the allowance for RAP – principal allowance is $479 million, which reflects the revision, that was done in the previous report, to the estimated cost of the RAP threshold changes and the new expanded disability definition. The allowance is lower as at 31 July 2023 mainly due to the partial recognition of the recent lower RAP utilization experience.

Allowance for Public Accounts (RAP – Principal)

Provision rates used to determine the allowance for Public Accounts were based on the program's conditions as of 31 March 2023.

- 6.9% of the outstanding balance of loans in-study, which is $8,198 million as at 31 March 2023;

- 1.9% of the outstanding balance of loans in repayment (reduced by loans in the RAP – all stages), which is $9,850 million as at 31 March 2023;

- 36.2% of the outstanding balance of loans in the RAP (all stages), which is $3,465 million as at 31 March 2023.

- Total allowance RAP – principal as at 31 March 2023: $2,007 million.

4.3.2 Allowance for bad debt – Principal

Table 17 provides the calculation details for the projection of the allowance for bad debt – principal under the direct loan regime.

| Loan year | Allowance 1 August (1) |

Write-offs (2) |

Allowance 31 July (3) |

Yearly expense (3) − (1 − 2) |

|---|---|---|---|---|

| 2021-2022 | 3,001 | 134 | 3,035Table 17 footnote 1 | 168 |

| 2022-2023 | 3,035 | 180 | 2,659 | -196 |

| 2023-2024 | 2,659 | 181 | 2,734 | 256 |

| 2024-2025 | 2,734 | 177 | 2,799 | 242 |

| 2025-2026 | 2,799 | 171 | 2,880 | 252 |

| 2026-2027 | 2,880 | 166 | 2,971 | 257 |

| 2027-2028 | 2,971 | 159 | 3,076 | 264 |

| 2028-2029 | 3,076 | 168 | 3,178 | 270 |

| 2029-2030 | 3,178 | 184 | 3,267 | 273 |

| 2030-2031 | 3,267 | 186 | 3,358 | 277 |

| 2031-2032 | 3,358 | 183 | 3,455 | 280 |

| 2032-2033 | 3,455 | 189 | 3,548 | 282 |

| 2033-2034 | 3,548 | 197 | 3,636 | 285 |

| 2034-2035 | 3,636 | 204 | 3,717 | 285 |

| 2035-2036 | 3,717 | 214 | 3,790 | 287 |

| 2036-2037 | 3,790 | 224 | 3,855 | 289 |

| 2037-2038 | 3,855 | 233 | 3,913 | 291 |

| 2038-2039 | 3,913 | 237 | 3,969 | 293 |

| 2039-2040 | 3,969 | 244 | 4,021 | 296 |

| 2040-2041 | 4,021 | 250 | 4,069 | 298 |

| 2041-2042 | 4,069 | 253 | 4,118 | 302 |

| 2042-2043 | 4,118 | 257 | 4,166 | 305 |

| 2043-2044 | 4,166 | 259 | 4,215 | 308 |

| 2044-2045 | 4,215 | 262 | 4,266 | 313 |

| 2045-2046 | 4,266 | 268 | 4,316 | 318 |

| 2046-2047 | 4,316 | 269 | 4,369 | 322 |

Table 17 footnotes

|

||||

The allowance for bad debt – principal is estimated at $3,035 million as at 31 July 2022, which is higher than the $3,018 million projected in the previous report. For the loan year 2021‑2022, the yearly expense for the allowance for bad debt – principal is $168 million. The allowance is lower starting 31 July 2023 mainly due to the revision of some assumptions. Expected rehabilitations and recalls are increased to reflect recent experience. Expected recoveries are increased due to the elimination of the interest accrual (i.e., recoveries will be fully attributable to the outstanding principal balance instead of having a share applied to the outstanding interest balance).

Allowance for Public Accounts (Bad debt – Principal)

Provision rates used to determine the allowance for Public Accounts were based on the program's conditions as of 31 March 2023.

- 5.9% of the outstanding balance of loans in-study, which is $8,198 million as at 31 March 2023;

- 3.5% of the outstanding balance of loans in repayment, which is $13,315 million as at 31 March 2023; and

- 69.5% of the outstanding balance of loans in default, which is $2,449 million as at 31 March 2023.

- Total allowance bad debt – principal as at 31 March 2023: $2,652 million.

4.3.3 Allowance for bad debt – Interest

The projection of the allowance for bad debt – interest under the direct loan regime is presented in Table 18.

| Loan year | Allowance August 1 (1) |

Write-offs (2) |

Allowance July 31 (3) |

Yearly expense (3) − (1−2) |

|---|---|---|---|---|

| 2021-2022 | 224 | 35 | 201Table 18 footnote 1 | 12 |

| 2022-2023 | 201 | 41 | 129 | -32 |

| 2023-2024 | 129 | 29 | 99 | 0 |

| 2024-2025 | 99 | 24 | 75 | 0 |

| 2025-2026 | 75 | 18 | 57 | 0 |

| 2026-2027 | 57 | 13 | 44 | 0 |

| 2027-2028 | 44 | 8 | 36 | 0 |

| 2028-2029 | 36 | 6 | 30 | 0 |

| 2029-2030 | 30 | 5 | 25 | 0 |

| 2030-2031 | 25 | 4 | 21 | 0 |

| 2031-2032 | 21 | 3 | 19 | 0 |

| 2032-2033 | 19 | 3 | 16 | 0 |

| 2033-2034 | 16 | 2 | 13 | 0 |

| 2034-2035 | 13 | 2 | 11 | 0 |

| 2035-2036 | 11 | 2 | 10 | 0 |

| 2036-2037 | 10 | 2 | 8 | 0 |

| 2037-2038 | 8 | 2 | 6 | 0 |

| 2038-2039 | 6 | 2 | 4 | 0 |

| 2039-2040 | 4 | 1 | 3 | 0 |

| 2040-2041 | 3 | 1 | 2 | 0 |

| 2041-2042 | 2 | 1 | 1 | 0 |

| 2042-2043 | 1 | 0 | 1 | 0 |

| 2043-2044 | 1 | 0 | 0 | 0 |

| 2044-2045 | 0 | 0 | 0 | 0 |

| 2045-2046 | 0 | 0 | 0 | 0 |

| 2046-2047 | 0 | 0 | 0 | 0 |

Table 18 footnotes

|

||||

The allowance for bad debt – interest is estimated at $201 million as at 31 July 2022, which is higher than the $195 million projected in the previous report. For the loan year 2021‑2022, the yearly expense for the allowance for bad debt – interest is $12 million. There are no more yearly expenses after the permanent removal of the interest accrual. However, there is an allowance for the current outstanding interest balance, which is projected to be gradually written-off over the next years.

The provision rates used to determine the allowances for Public Accounts were based on the conditions of the program as of 31 March 2023. The resulting allowance for Public Accounts as at 31 March 2023 corresponds to $139 million.

4.4 Total expenses

As shown in Table 19, and notwithstanding impacts from temporary measures, total expenses associated with the program increase from $4.0 billion in 2025-2026Footnote 5 to $5.1 billion in 2046‑2047. On average, total expenses are projected to increase at an annual rate of 1.1%.

| Loan year | Student related expenses | Government liabilities on outstanding loans | Alternative payments | Administrative expenses | Total | |

|---|---|---|---|---|---|---|

| Fees paid to provinces | General | |||||

| 2021-2022 | 4,211.0 | 220.8 | 927.4 | 34.8 | 107.4 | 5,501.4 |

| 2022-2023 | 3,875.0 | -191.2 | 999.2 | 36.2 | 119.1 | 4,838.3 |

| 2023-2024 | 3,326.1 | 300.8 | 1,147.9 | 37.0 | 118.1 | 4,929.9 |

| 2024-2025 | 2,736.8 | 300.1 | 886.1 | 38.0 | 118.9 | 4,079.9 |

| 2025-2026 | 2,820.3 | 311.8 | 742.0 | 39.1 | 120.1 | 4,033.4 |

| 2026-2027 | 2,876.5 | 318.2 | 772.9 | 40.3 | 121.9 | 4,129.9 |

| 2027-2028 | 2,936.9 | 328.1 | 799.8 | 41.5 | 125.6 | 4,231.9 |

| 2028-2029 | 2,995.7 | 335.7 | 830.1 | 42.8 | 129.4 | 4,333.6 |

| 2029-2030 | 3,049.6 | 342.2 | 862.4 | 44.1 | 133.3 | 4,431.5 |

| 2030-2031 | 3,101.8 | 347.6 | 895.0 | 45.4 | 137.3 | 4,527.1 |

| 2031-2032 | 3,152.1 | 352.5 | 926.4 | 46.8 | 141.4 | 4,619.2 |

| 2032-2033 | 3,199.6 | 356.4 | 952.3 | 48.2 | 145.7 | 4,702.3 |

| 2033-2034 | 3,240.4 | 359.5 | 974.3 | 49.7 | 150.1 | 4,773.9 |

| 2034-2035 | 3,246.5 | 361.9 | 991.9 | 51.2 | 154.6 | 4,806.1 |

| 2035-2036 | 3,245.5 | 363.8 | 994.7 | 52.7 | 159.3 | 4,816.0 |

| 2036-2037 | 3,250.1 | 366.3 | 992.7 | 54.3 | 164.1 | 4,827.5 |

| 2037-2038 | 3,270.0 | 369.5 | 989.2 | 55.9 | 169.1 | 4,853.7 |

| 2038-2039 | 3,284.0 | 372.9 | 989.3 | 57.6 | 174.2 | 4,877.9 |

| 2039-2040 | 3,298.3 | 376.3 | 991.3 | 59.4 | 179.4 | 4,904.7 |

| 2040-2041 | 3,312.6 | 379.7 | 993.3 | 61.1 | 184.8 | 4,931.6 |

| 2041-2042 | 3,327.1 | 383.1 | 990.5 | 63.0 | 190.4 | 4,954.1 |

| 2042-2043 | 3,347.8 | 387.4 | 986.3 | 64.9 | 196.2 | 4,982.5 |

| 2043-2044 | 3,372.9 | 392.1 | 983.9 | 66.9 | 202.1 | 5,017.8 |

| 2044-2045 | 3,402.1 | 397.3 | 980.6 | 68.9 | 208.2 | 5,057.1 |

| 2045-2046 | 3,434.4 | 403.0 | 974.7 | 71.0 | 214.5 | 5,097.6 |

| 2046-2047 | 3,470.6 | 408.1 | 965.6 | 73.1 | 221.0 | 5,138.3 |

The larger student related expenses over the first three loan years and the larger alternative payments over the first four loan years are mainly due to the temporary increase of the grants. The reduction in Government liabilities in the loan year 2022-2023 is mostly due to the immediate recognition of the impact of removing interest accrual on all future years for all outstanding student loans.

4.4.1 Student related expenses

The primary expense of the CSFA Program is the cost of supporting students during their study and repayment periods. The student related expenses are presented in Table 20.

| Loan year | Direct loan | Risk-shared and guaranteed loans RAP – Interest and principal |

Canada Student Grants | Total | |||

|---|---|---|---|---|---|---|---|

| Interest subsidy - Before consolidation | Interest subsidy - After consolidation | RAP – Interest | Provision RAP – Principal | ||||

| 2021-2022 | 193.8 | 280.8 | 0.1 | 478.6 | 1.5 | 3,256.2 | 4,211.0 |

| 2022-2023 | 252.1 | 415.1 | 0.0 | -200.9 | 0.8 | 3,407.8 | 3,875.0 |

| 2023-2024 | 265.2 | 386.7 | 0.0 | 296.4 | 0.8 | 2,376.9 | 3,326.1 |

| 2024-2025 | 303.7 | 394.1 | 0.0 | 280.1 | 0.8 | 1,758.1 | 2,736.8 |

| 2025-2026 | 325.4 | 398.2 | 0.0 | 291.4 | 0.7 | 1,804.7 | 2,820.3 |

| 2026-2027 | 355.3 | 418.0 | 0.0 | 297.2 | 0.0 | 1,806.1 | 2,876.5 |

| 2027-2028 | 382.8 | 442.2 | 0.0 | 303.2 | 0.0 | 1,808.7 | 2,936.9 |

| 2028-2029 | 408.4 | 469.3 | 0.0 | 308.1 | 0.0 | 1,810.0 | 2,995.7 |

| 2029-2030 | 432.5 | 497.9 | 0.0 | 312.0 | 0.0 | 1,807.2 | 3,049.6 |

| 2030-2031 | 455.6 | 527.6 | 0.0 | 315.6 | 0.0 | 1,803.0 | 3,101.8 |

| 2031-2032 | 477.8 | 558.0 | 0.0 | 318.8 | 0.0 | 1,797.5 | 3,152.1 |

| 2032-2033 | 499.0 | 588.3 | 0.0 | 321.5 | 0.0 | 1,790.8 | 3,199.6 |

| 2033-2034 | 519.3 | 618.1 | 0.0 | 322.1 | 0.0 | 1,780.8 | 3,240.4 |

| 2034-2035 | 524.6 | 630.5 | 0.0 | 322.3 | 0.0 | 1,769.1 | 3,246.5 |

| 2035-2036 | 528.8 | 641.5 | 0.0 | 319.1 | 0.0 | 1,756.1 | 3,245.5 |

| 2036-2037 | 532.5 | 651.2 | 0.0 | 319.0 | 0.0 | 1,747.4 | 3,250.1 |

| 2037-2038 | 536.3 | 660.1 | 0.0 | 329.3 | 0.0 | 1,744.3 | 3,270.0 |

| 2038-2039 | 540.3 | 668.3 | 0.0 | 332.8 | 0.0 | 1,742.6 | 3,284.0 |

| 2039-2040 | 544.7 | 675.7 | 0.0 | 336.1 | 0.0 | 1,741.8 | 3,298.3 |

| 2040-2041 | 549.2 | 682.7 | 0.0 | 339.4 | 0.0 | 1,741.4 | 3,312.6 |

| 2041-2042 | 553.9 | 689.3 | 0.0 | 342.5 | 0.0 | 1,741.4 | 3,327.1 |

| 2042-2043 | 559.0 | 695.9 | 0.0 | 346.4 | 0.0 | 1,746.5 | 3,347.8 |

| 2043-2044 | 564.9 | 702.4 | 0.0 | 350.9 | 0.0 | 1,754.7 | 3,372.9 |

| 2044-2045 | 571.5 | 709.1 | 0.0 | 356.0 | 0.0 | 1,765.5 | 3,402.1 |

| 2045-2046 | 578.8 | 716.2 | 0.0 | 361.5 | 0.0 | 1,778.0 | 3,434.4 |

| 2046-2047 | 586.8 | 723.8 | 0.0 | 367.4 | 0.0 | 1,792.6 | 3,470.6 |

Starting on 1 April 2023, there is permanently no interest accrual on student loans. This results in higher interest subsidies after the loans consolidate. The negative value of $200.9 million for the RAP provision mainly stems from the immediate recognition of the expected reduction in the RAP utilization for all future years on all outstanding loans. Assumptions for the RAP are provided in Appendix C.

Interest subsidies are still projected for the Risk-Shared and Guaranteed loans for the first 4 years of the projection. However, those results were removed from Table 20 since they are negligible (they round to $0.0M).

In the loan year 2021‑2022, a total of $3,256 million of Canada Student Grants were disbursed. Those grants are projected to increase slightly in 2022‑2023 (due to the change in the definition of disability), to decrease in 2023-2024 (due to the change in the temporary grant increase from an additional 100% to 40%, compared with the loan year 2019-2020) and to decrease again in 2024-2025 (due to the removal of the temporary grant increase).

4.4.2 Government liabilities on outstanding loans

Another expense for the Government corresponds to the risk that loans will never be repaid. This includes the risk of loan default and the risk of loans being forgiven upon a student's death or severe and permanent disability. Loans forgiven for family physicians and qualifying nurses practicing in under-served rural or remote communities are also included in Table 21 below.

| Loan year | Direct loan Provision for bad debt |

Risk-shared Risk premium, put-backs & refunds to FIs |

Guaranteed Claims for defaulted loans |

Loans forgiven | Total | |

|---|---|---|---|---|---|---|

| Principal | Interest | |||||

| 2021-2022 | 167.5 | 12.4 | 0.2 | -0.2 | 40.9 | 220.8 |

| 2022-2023 | -196.3 | -31.7 | 0.0 | 0.0 | 36.7 | -191.2 |

| 2023-2024 | 255.3 | 0.0 | 0.0 | 0.0 | 45.5 | 300.8 |

| 2024-2025 | 241.8 | 0.0 | 0.0 | 0.0 | 58.3 | 300.1 |

| 2025-2026 | 252.5 | 0.0 | 0.0 | 0.0 | 59.3 | 311.8 |

| 2026-2027 | 257.0 | 0.0 | 0.0 | 0.0 | 61.3 | 318.2 |

| 2027-2028 | 263.8 | 0.0 | 0.0 | - no data | 64.2 | 328.1 |

| 2028-2029 | 269.3 | 0.0 | 0.0 | - no data | 66.4 | 335.7 |

| 2029-2030 | 273.5 | 0.0 | 0.0 | - no data | 68.7 | 342.2 |

| 2030-2031 | 276.9 | 0.0 | 0.0 | - no data | 70.7 | 347.6 |

| 2031-2032 | 279.9 | 0.0 | 0.0 | - no data | 72.5 | 352.5 |

| 2032-2033 | 282.4 | 0.0 | - no data | - no data | 74.0 | 356.4 |

| 2033-2034 | 284.2 | 0.0 | - no data | - no data | 75.3 | 359.5 |

| 2034-2035 | 285.6 | 0.0 | - no data | - no data | 76.3 | 361.9 |

| 2035-2036 | 286.6 | 0.0 | - no data | - no data | 77.2 | 363.8 |

| 2036-2037 | 288.2 | 0.0 | - no data | - no data | 78.1 | 366.3 |

| 2037-2038 | 290.6 | 0.0 | - no data | - no data | 78.9 | 369.5 |

| 2038-2039 | 293.2 | 0.0 | - no data | - no data | 79.7 | 372.9 |

| 2039-2040 | 295.8 | 0.0 | - no data | - no data | 80.5 | 376.3 |

| 2040-2041 | 298.4 | 0.0 | - no data | - no data | 81.3 | 379.7 |

| 2041-2042 | 301.1 | 0.0 | - no data | - no data | 82.0 | 383.1 |

| 2042-2043 | 304.5 | 0.0 | - no data | - no data | 82.8 | 387.4 |

| 2043-2044 | 308.5 | 0.0 | - no data | - no data | 83.6 | 392.1 |

| 2044-2045 | 312.9 | 0.0 | - no data | - no data | 84.4 | 397.3 |

| 2045-2046 | 317.7 | 0.0 | - no data | - no data | 85.3 | 403.0 |

| 2046-2047 | 322.0 | 0.0 | - no data | - no data | 86.1 | 408.1 |

The increase in loans forgiven is due to the upcoming increase in the maximum amount of forgivable loans by 50% in the loans forgiveness program for doctors and qualifying nurses a well as the expected expansion of the program to more rural communities.

The reductions in the provision for bad debt in the loan year 2022-2023 are mostly due to the full recognition of the impact of removing interest accrual on student loans going forward.

4.4.3 Other expenses

Other expenses are composed of alternative payments and administrative expenses (fees paid to participating province and general expenses) and are presented in Table 19. Alternative payments are made directly to Quebec, the Northwest Territories and Nunavut, as they do not participate in the CSFA Program. The calculation of alternative payments is based on expenses and revenues for a given loan year and the payment is accounted for in the following loan year.

The short-term projection of the administrative fees was provided by ESDC. All collection activities on defaulted loans are fulfilled by CRA and a cost is included in the projected general administrative fees for this purpose.

4.5 Total revenues

With the permanent elimination of interest accrual, revenues for the direct loan regime have nearly been reduced to zero. Only a small share of loans in default still accrues interest. It is expected that these loans will also be reduced to zero in the short-term future.

Under the guaranteed and risk-shared regimes, revenues come from recoveries of principal and interest from defaulted loans owned by the Government.

As shown in Table 22, total revenues are projected to decrease to $0.

| Loan year | Direct loan Interest revenues |

Risk-shared Principal and interest from recovery |

Guaranteed Principal and interest from recovery |

Total revenues |

|---|---|---|---|---|

| 2021-2022 | 9.9 | 1.8 | 2.5 | 14.1 |

| 2022-2023 | 0.0 | 1.8 | 2.9 | 4.7 |

| 2023-2024 | 0.0 | 1.6 | 2.5 | 4.1 |

| 2024-2025 | 0.0 | 1.5 | 2.2 | 3.7 |

| 2025-2026 | 0.0 | 1.4 | 1.9 | 3.2 |

| 2026-2027 | 0.0 | 1.2 | 1.6 | 2.8 |

| 2027-2028 | 0.0 | 1.0 | 1.3 | 2.3 |

| 2028-2029 | 0.0 | 0.7 | 1.0 | 1.8 |

| 2029-2030 | 0.0 | 0.5 | 0.8 | 1.3 |

| 2030-2031 | 0.0 | 0.4 | 0.5 | 0.9 |

| 2031-2032 | 0.0 | 0.2 | 0.5 | 0.8 |

| 2032-2033 | 0.0 | 0.0 | - no data | 0.0 |

| 2033-2034 | 0.0 | 0.0 | - no data | 0.0 |

| 2034-2035 | 0.0 | - no data | - no data | 0.0 |

| 2035-2036 | 0.0 | - no data | - no data | 0.0 |

| 2036-2037 | 0.0 | - no data | - no data | 0.0 |

| 2037-2038 | 0.0 | - no data | - no data | 0.0 |

| 2038-2039 | 0.0 | - no data | - no data | 0.0 |

| 2039-2040 | 0.0 | - no data | - no data | 0.0 |

| 2040-2041 | 0.0 | - no data | - no data | 0.0 |

| 2041-2042 | 0.0 | - no data | - no data | 0.0 |

| 2042-2043 | 0.0 | - no data | - no data | 0.0 |

| 2043-2044 | 0.0 | - no data | - no data | 0.0 |

| 2044-2045 | 0.0 | - no data | - no data | 0.0 |

| 2045-2046 | 0.0 | - no data | - no data | 0.0 |

| 2046-2047 | 0.0 | - no data | - no data | 0.0 |

4.6 Total net cost

Table 23 shows projected total expenses, total revenues and the total net cost of the program for all three regimes for the projection period. The expenses and revenues shown correspond to values presented earlier in this report.

| Loan year | Total expenses | Total revenues | Total net cost | Changes | Direct loan | Risk-shared & guaranteed |

|---|---|---|---|---|---|---|

| 2021-2022 | 5,501.4 | 14.1 | 5,487.3 | N/A | 5,489.4 | -2.1 |

| 2022-2023 | 4,838.3 | 4.7 | 4,833.6 | -11.9% | 4,837.3 | -3.8 |

| 2023-2024 | 4,929.9 | 4.1 | 4,925.8 | 1.9% | 4,929.0 | -3.2 |

| 2024-2025 | 4,079.9 | 3.7 | 4,076.2 | -17.2% | 4,079.0 | -2.8 |

| 2025-2026 | 4,033.4 | 3.2 | 4,030.2 | -1.1% | 4,032.7 | -2.5 |

| 2026-2027 | 4,129.9 | 2.8 | 4,127.2 | 2.4% | 4,129.9 | -2.7 |

| 2027-2028 | 4,231.9 | 2.3 | 4,229.6 | 2.5% | 4,231.9 | -2.3 |

| 2028-2029 | 4,333.6 | 1.8 | 4,331.9 | 2.4% | 4,333.6 | -1.8 |

| 2029-2030 | 4,431.5 | 1.3 | 4,430.1 | 2.3% | 4,431.4 | -1.3 |

| 2030-2031 | 4,527.1 | 0.9 | 4,526.3 | 2.2% | 4,527.1 | -0.9 |

| 2031-2032 | 4,619.2 | 0.8 | 4,618.4 | 2.0% | 4,619.2 | -0.8 |

| 2032-2033 | 4,702.3 | 0.0 | 4,702.3 | 1.8% | 4,702.3 | 0.0 |

| 2033-2034 | 4,773.9 | 0.0 | 4,773.9 | 1.5% | 4,773.9 | 0.0 |

| 2034-2035 | 4,806.1 | 0.0 | 4,806.1 | 0.7% | 4,806.1 | 0.0 |

| 2035-2036 | 4,816.0 | 0.0 | 4,816.0 | 0.2% | 4,816.0 | 0.0 |

| 2036-2037 | 4,827.5 | 0.0 | 4,827.5 | 0.2% | 4,827.5 | 0.0 |

| 2037-2038 | 4,853.7 | 0.0 | 4,853.7 | 0.5% | 4,853.7 | - no data |

| 2038-2039 | 4,877.9 | 0.0 | 4,877.9 | 0.5% | 4,877.9 | - no data |

| 2039-2040 | 4,904.7 | 0.0 | 4,904.7 | 0.5% | 4,904.7 | - no data |

| 2040-2041 | 4,931.6 | 0.0 | 4,931.6 | 0.5% | 4,931.6 | - no data |

| 2041-2042 | 4,954.1 | 0.0 | 4,954.1 | 0.5% | 4,954.1 | - no data |

| 2042-2043 | 4,982.5 | 0.0 | 4,982.5 | 0.6% | 4,982.5 | - no data |

| 2043-2044 | 5,017.8 | 0.0 | 5,017.8 | 0.7% | 5,017.8 | - no data |

| 2044-2045 | 5,057.1 | 0.0 | 5,057.1 | 0.8% | 5,057.1 | - no data |

| 2045-2046 | 5,097.6 | 0.0 | 5,097.6 | 0.8% | 5,097.6 | - no data |

| 2046-2047 | 5,138.3 | 0.0 | 5,138.3 | 0.8% | 5,138.3 | - no data |

As shown in Table 23, the initial net annual cost for the direct loan regime is $5.5 billion for the loan year 2021‑2022. The net cost is projected to increase between the loan year 2025-2026Footnote 5 and the loan year 2046-2047 from $4.0 billion to $5.1 billion, representing an annual average increase of 1.1%.

The net costs shown in Table 23 include the amount of grants disbursed, representing 59% of the net cost for the loan year 2021-2022. Moreover, the net costs also include yearly expenses to account for provisions that recognize in advance the risk of future losses associated with student loans.

5 Actuarial opinion

In our opinion, considering that this Actuarial Report on the Canada Student Financial Assistance Program was prepared pursuant to the Canada Student Financial Assistance Act:

- the data on which this report is based are sufficient and reliable for the purposes of this report;

- the assumptions used are, individually and in aggregate, reasonable and appropriate for the purposes of this report; and

- the methods employed are appropriate for the purposes of this report.

This report has been prepared, and our opinion given, in accordance with accepted actuarial practice in Canada, in particular, the General Standards of the Standards of Practice of the Canadian Institute of Actuaries.

Subsequent events occurred after the valuation date. They consist of upcoming temporary and permanent changes to the program proposed in the Fall Economic Statement and in Budget 2023, as described in Section 2.3. In order to provide projections based on up-to-date information, these changes were considered in our report.

Laurence Frappier, FCIA, FSA

Managing Director

Mathieu Désy, FCIA, FSA

Thierry Truong, FCIA, FSA

Ottawa, Canada

23 June 2023

Appendix A – Summary of program provisions

The Canada Student Financial Assistance Program (CSFA Program) came into force on 28 July 1964 to provide Canadians equal opportunity to study beyond the secondary level and to encourage successful and timely completion of post-secondary education. The CSFA Program is meant to supplement resources available to students from their own earnings, their families', and other student awards.

Historically, two successive acts were established to assist qualifying students. The Canada Student Loans Act applied to loan years preceding August 1995 while the subsequent Canada Student Financial Assistance Act applies to loan years starting after July 1995.

The population covered by the CSFA Program is the Canadian population excluding non-permanent residents as well as the non-participating province and territories of Québec, Northwest Territories and Nunavut.

A.1 Eligibility criteria

In order to be eligible for financial assistance, a student must be a Canadian citizen, permanent resident, protected person within the meaning of the Immigration and Refugee Protection Act or a person registered as an Indian under the Indian Act, and must demonstrate the need for financial assistance, which is determined by the Need Assessment Process under the program. The assessed need is the difference between the student's costs and the student's resources. A student must also fulfill a series of criteria (scholastic standard and financial) to be considered for financial assistance. Each year, upon application with their province of residence, financial assistance is available to full‑time students regardless of age, and since 1983, financial assistance is also available to part-time students.

A multi-year student financial assistance agreement was implemented in all jurisdictions starting in the loan year 2013‑2014. It is referred to as the Master Student Financial Assistance Agreement (MSFAA) and replaces the former single‑year student loan agreement. By signing an MSFAA, a borrower agrees to repayment terms that will apply to their loans when they leave their studies.

Starting in the loan year 2017-2018, the student's resources definition was modified to consider only the student contribution as well as the parental or spousal contribution, if applicable. The student contribution is comprised of the fixed student contribution, merit-based scholarships, need-based bursaries, and targeted resources.

The fixed student contribution depends on the borrower's previous year's gross annual family income, family size and the number of weeks of study. Students with gross family income from the previous year equal to or below a low-income threshold will contribute up to $1,500 per academic year. Students with gross family income from the previous year above a low-income threshold will contribute $1,500 plus an additional 15% of income above the threshold up to a maximum total contribution of $3,000 per academic year. The low-income thresholds vary depending on the student's family size. The previous year's gross family income is defined by the applicable student category. For independent students and single parent, family income is comprised of the student's income only. For dependent students, family income is comprised of the student's parental income only. In the case of a married or common-law student, family income is comprised of the student's and the spouse's or partner's income. Indigenous learners, students with a disability recognized by the CSFA Program, students with dependants and current or former Crown wards are exempted from the fixed student contribution.

The expected contribution from merit-based scholarships and need-based bursaries is equivalent to the combined assessed actual amount less an exemption of $1,800 per loan year.

Targeted resources are those provided to help with specific educational costs and may include funds received from municipal, provincial, or federal governments (e.g., training allowances from the skills portion of Employment Insurance benefits), or from the private sector (e.g., room and board provided by an employer while a full-time student). They are assessed at 100%.

Parents of single dependent students are expected to contribute to their children's education. The amount of parental contribution depends on family income and size, but do not depend on the living situation of the student.

The spouses and partners of married or common-law students are expected to make a spousal contribution equal to 10% of their gross family income exceeding the low-income thresholds. Spouses and partners at or below the low-income threshold, as well as those who are themselves full-time students, are not expected to make any spousal contribution.

Partnerships

Since the program's inception in 1964, the Minister entered into an agreement with the participating provinces/territory regarding their powers, duties and functions related to the administration of the program. The participating provinces have their own student financial assistance programs that complement the CSFA Program. On behalf of the Government of Canada, the provinces and territory determine whether students require financial assistance as well as their eligibility for the CSFA Program. Provincial/territorial authorities determine the students' required financial needs based on the difference between their expected expenses and available resources.

In general, for each school year, the CSFA Program covers around 60% of the assessed need up to the sum of the maximum grant (for eligible students) and a maximum of $210 per week in student loans. Budget 2023 proposed a temporary increase to the maximum for the loan year 2023-2024, increasing it to $300 per week. The participating provinces and territory complement the CSFA Program by providing additional financial assistance up to established maximum amounts. The amount of money students may borrow depends on their individual circumstances.

The National Student Loans Service Centre (NSLSC) was established on 1 March 2001 and is responsible for the administration of student loans and grants. The NSLSC processes all applicable documentation from loans' disbursement to their consolidation and repayment for the federal portion of the loans, as well as for the provincial portion of integrated loans. It keeps students informed of all available options to assist in repaying their loans. The NSLSC is run by a private entity contracted by the government.

The type of financial arrangement has changed through time and legislation. The following describes the different arrangements and explains who bears the risk associated with default.

-

Guaranteed Loan Regime: Student loans provided by lenders (financial institutions) under the Canada Student Loans Act prior to August 1995 were fully guaranteed by the Government to the lenders. The Government reimbursed lenders for the outstanding principal, accrued interest and costs in the event of default or death of the borrower. Therefore, the Government bore all the risk involved with guaranteed loans.

-

Risk-Shared Loan Regime: Between August 1995 and July 2000, student loans continued to be disbursed, serviced and collected by financial institutions. However, the loans were no longer fully guaranteed by the Government. Instead, the Canada Student Financial Assistance Act permitted the Government to pay financial institutions a risk premium of five per cent of the value of loans that consolidated in each loan year. Under this financial arrangement, the Government was not at risk except for the payment of the risk premium. Financial institutions could also decide to sell a certain amount of defaulted loans and the Government had to pay a put-back fee of five cents on the dollar for these loans. Finally, the agreement provided that part of the recoveries be shared with financial institutions.

-