Analysis of Climate Change Impact on the Office of the Chief Actuary’s Assumption-Setting Process: Actuarial Study No. 24

Accessibility statement

The Web Content Accessibility Guidelines (WCAG) defines requirements for designers and developers to improve accessibility for people with disabilities. It defines three levels of conformance: Level A, Level AA, and Level AAA. This report is partially conformant with WCAG 2.0 level AA. If you require a compliant version, please contact webmaster@osfi-bsif.gc.ca.

Office of the Chief Actuary

Office of the Superintendent of Financial Institutions Canada

255 Albert Street

Ottawa, Ontario

K1A 0H2

E-mail address: oca-bac@osfi-bsif.gc.ca

Table of contents

List of tables

List of charts

1 Executive summary

1.1 Purpose

This is the twenty-fourth actuarial study to be published by the Office of the Chief Actuary (OCA). The OCA is responsible for conducting statutory actuarial valuations for federal public sector employee pension and insurance plans, and a range of Canadian social security programs, including the Canada Pension Plan (CPP), the Old Age Security (OAS) Program, the Canada Student Financial Assistance Program, and the Employment Insurance Program.

The purpose of this study is to assess how climate change can affect the OCA’s overall assumption-setting process for its actuarial valuations. Climate change is increasingly recognized as one of the most pressing global risks impacting ecosystems, economies, and communities worldwide. Climate change can therefore affect the programs under OCA’s responsibility through various channels as the demographic, economic and investment environments can all be affected by climate change in the future.

1.2 Scope

The OCA conducted literature research to better understand the potential impact from climate change on the assumptions underlying the actuarial valuations. The results of this research are presented in this study. Section 2 provides high-level background information on climate change and the programs under OCA’s responsibility. Sections 3 to 5 discuss the potential impacts from climate change on demographic assumptions, economic assumptions, and investment assumptions, respectively. The last section presents the conclusions.

1.3 Main findings

There is presently a lot of uncertainty on the direction and magnitude of climate change potential impacts, and the risk is evolving. In addition, research and data to quantify the full impact of climate change remain incomplete and, in certain cases, somewhat conflicting. The OCA is thus not ready to incorporate the impacts from climate change explicitly in the best-estimate assumptions and continues to believe that scenario analysis is a sound approach to understanding and illustrating risk.

This study aims to refine the existing climate scenario analysis framework presented in the 31st Actuarial Report on the Canada Pension Plan (CPP31 AR). One area of consideration lies within the demographic assumptions. The OCA decided to exclude demographics from climate change scenario analysis, due to the high level of uncertainty and the lack of Canadian-specific research. The absence of reliable projections makes it challenging to assess the potential impacts of climate change on population dynamics and migration patterns, though it remains an important consideration.

For economic assumptions, the study recommends maintaining a similar framework to that used in the CPP31 AR. The existing framework builds on a foundation for relating economic assumptions to potential shocks in Gross Domestic Product (GDP) from climate change.

Finally, for investment assumptions, the focus is on enhancing the existing framework used in CPP31 AR by incorporating additional dynamics. This involves integrating factors such as climate change impact on fixed income returns, as well as varying GDP impacts by different markets under each climate scenario.

2 Background information

This section offers background information on climate-related risks as well as information on key organizations and climate scenarios that are commonly used as a reference when assessing climate change impacts. It also outlines the various programs under OCA’s responsibility.

2.1 Climate-related risks

Climate change risks have been ranked among the top emerging risks globally, and they are generally classified into two categories: physical risks, which are linked to the increase in the frequency and severity of climate events, and transition risks, which are linked to efforts undertaken for a transition towards a lower carbon economy. It is also important to note that regardless of the transition path, full elimination of physical risksFootnote 1 is not realistic at this point given that a certain level of physical risk is already embedded from past global warming. However, physical risks may be reduced or mitigated if new technologies that reduce and/or capture carbon emissions are developed, or through adaptation to the increasing frequency and severity of hazard events.

2.1.1 Examples and types of physical risks

There are two types of physical risks: acute (short-term) physical risks arising from extreme weather events such as storms, flooding, wildfires, heatwaves; and chronic (long-term) physical risks represented by temperature rise, sea-level rise, changing precipitation patterns, etc. Physical risks can also be categorized into direct and indirect risks. Direct physical risks are the immediate, observable effects of climate change, generally resulting from extreme weather events and long-term environmental changes that directly impact assets, infrastructure, or systems. Indirect physical risks are linked to the secondary effects arising from the direct impacts of climate change, and through complex interactions within ecosystems, economies, and social systems. Examples include disruption of supply chains, increased insurance costs, loss of biodiversity, etc.

2.1.2 Examples of transition risks

Transition risks may include climate mitigation policies and legislation, adaptation measures, innovation technologies, shifting market preferences and investment sentiment, etc.

2.2 Climate change organizations and scenarios

This section provides a brief introduction on some climate change scenarios and climate organizations, which will be referred to in the rest of the study.

2.2.1 Key climate change organizations

Numerous climate modeling institutions around the world each produce their own climate model, and every five to seven years, come together to use the latest version of these models in a coordinated site of simulations. Such global collaboration, known as the Coupled Model Intercomparison Project (CMIP), strengthens climate projections by combining insights from various institutions.

In addition to these modeling efforts, several international organizations focus on collaborative climate change initiatives. Among them the most prominent ones are the Intergovernmental Panel on Climate Change (IPCC) and the Network for Greening the Financial System (NGFS).

The IPCC is the United Nations body for assessing the state of science related to climate change. While IPCC does not conduct its own research, it performs comprehensive assessments of scientific literature related to climate change and releases these findings in Assessment Reports (ARs) periodically.

The NGFS is a group of more than 100 central banks and supervisors and a score of observers committed to sharing best practices, contributing to the development of climate and environment-related risk management in the financial sector and mobilizing mainstream finance to support the transition toward a sustainable economy. NGFS also publishes its climate scenarios and updates regularly.

2.2.2 Key climate change scenarios

In the IPCC sixth assessment report (IPCC AR6), various scenarios based on the Shared Socio-economic Pathways (SSPs) from the sixth phase of the Coupled Model Intercomparison Project (CMIP6) are discussed. These scenarios are based on information on social-economic development and climate projections. They are labelled as “SSPx-y”, where “SSPx” refers to a specific Shared Socio-economic Pathway and “y” indicates the radiative forcing level (measured in W/m2, the higher the value, the stronger the climate warming effects) at the end of the 21st century. There are five SSPs, SPP1 to SPP5, each with different assumptions of human developments (population, education, urbanization, etc.), economic growth, technology developments, gas emissions, energy supply and demand, and so on. Each SSP can lead to multiple scenarios depending on the associated radiative forcing levels. AR6 mentions 5 top priority scenarios of SSPs, as follows.

- SSP1-1.9 and SSP1-2.6: the low end of future CO2 and other greenhouse gas (GHG) emissions pathways, warming by 2100 possibly limited to be below 2°C.

- SPP2-4.5: intermediate future CO2 and GHG emissions, warming by 2100 possibly limited to be below 3°C.

- SPP3-7.0: high future CO2 and GHG emissions, warming by 2100 around 3.6°C.

- SPP5-8.5: very high future CO2 and GHG emissions, warming by 2100 around 4.4°C.

The SSPs were designed to complement and function in combination with the Representative Concentration pathways (RCPs), which are introduced in the Coupled Model Intercomparison Project Phase 5 (CMIP5) and the IPCC fifth assessment report (IPCC AR5). The RCP scenarios are named by the radiative forcing level projected for 2100. There are four RCPs in AR5, as follows.

- RCP2.6: the radiative forcing level decreased to 2.6 W/m2 by 2100.

- RCP4.5: the radiative forcing level stabilized at 4.5 W/m2 by 2100.

- RCP6.0: the radiative forcing level stabilized at 6.0 W/m2 by 2100.

- RCP8.5: the radiative forcing level increased to 8.5 W/m2 by 2100.

Note that both SSPs and RCPs specify the radiative forcing level projected for 2100, thus providing a way of comparison between their scenarios. However, for a given radiative forcing level, the composition of greenhouse gases and emission trajectories between the SSPs and RCPs may differ.

2.3 Programs under OCA’s responsibility

The OCA, as an independent unit within the Office of the Superintendent of Financial Institutions (OSFI), provides advisory services to the Government of Canada. As part of its mandate, the OCA conducts statutory actuarial valuations for federal public sector employee pension and insurance plans, and a range of Canadian social security programs (Canada Pension Plan (CPP), Old Age Security (OAS) Program, Canada Student Financial Assistance Program and Employment Insurance Program).

2.3.1 Old Age Security Program

The OAS program comprises a universal basic pension and targeted supplements aimed at poverty reduction. The OAS program is financed through the general tax revenues on a pay-as-you-go basis. One of the measures of the program’s cost is the ratio of expenditures to Gross Domestic Product (GDP). The OCA conducts triennial valuations of the OAS program, which present the projected and historical expenditures and cost ratios. Such projections involve assumptions of both demographic and economic variables. Key demographic assumptions include fertility rates, mortality rates, and net migration; key economic assumptions include inflation, real wage increase, and assumptions related to labour force.

2.3.2 Canada Pension Plan

The CPP is a mandatory earnings-related defined benefit social insurance program, with the primary purpose of providing basic retirement income. The CPP consists of two parts: the base CPP (benefits in existence prior to the enhancement) and the additional CPP (the enhancement), which commenced in 2019. The base CPP is partially funded while the additional CPP is fully funded, both through employee and employer contributions. Contributions that are not immediately needed to pay expenditures are invested in financial markets.

2.3.2.1 Base CPP

Triennial valuations determine the minimum contribution rate (MCR) on an open-group-projection basis. Such MCR represents the lowest contribution rate that results in the ratio of projected assets over the projected expenditures being generally constant. Important demographic assumptions to determine the MCR include fertility, mortality, migration, retirement patterns and disability rates; key economic assumptions are real wage increase, labour force, inflation, and investment returns.

2.3.2.2 Additional CPP

Since the additional CPP is fully funded, the investment income is an important source of revenue. The projected revenues (contributions and investment income) should be sufficient to fully pay the projected expenditures of the additional CPP over the long term. With this as one of the objectives, triennial valuations determine the additional minimum contribution rates (AMCRs) on an open group basis. Unlike MCR for base CPP, AMCRs for additional CPP are not very sensitive to fertility, labour force, or migration assumptions, because of the stronger link between individuals’ contributions and their future benefits. Meanwhile, AMCRs are sensitive to mortality, real wage, and investment assumptions (real rate of return assumptions), which is similar to public sector pension plans.

2.3.3 Public sector pension plans

Public sector pension plans provide defined pension benefits to various groups of federal employees. Generally, such benefits are proportional to the accrued service and salary. For major public sector pension plans (Public Service, Canadian Forces, Royal Canadian Mounted Police), benefit accruals for service since 1 April 2000 are fully funded. Contributions by employees and the government are put into specific funds, which are expected to grow with investment returns. Triennial valuations determine the financial position (in terms of actuarial surplus/deficit and funding ratio)Footnote 2, and the contributions (which include employee contributions, government contributions and if applicable, government special payments) for these plans. The financial position and the required contributions are sensitive to demographic assumptions and economic assumptions used in the valuations. One of the key demographic assumptions is mortality, and key economic assumptions include investment return, pension indexation, salary increase and inflation.

For each of the above plans, the contributions made, and benefits earned up to 31 March 2000 are tracked through a special account, which is credited with interest earnings as if the net cash flows were invested quarterly in certain government bonds. The triennial valuations determine the financial position of these accounts and the special credit to be made to the accounts in case of a deficit. The financial position of the accounts is sensitive to demographic assumptions such as mortality rates and to economic assumptions such as bond yield, pension indexation, salary increase and inflation.

Additionally, there are a couple of relatively small public sector plans which are unfunded. Either there is a special account established for the plan to hold the contributions and the account is credited with a prescribed interest rate; or the plan is financed through the Consolidated Revenue Fund (CRF) on a pay-as-you-go basis.

2.3.4 Other programs

This study focuses on the impact of climate change on the above programs/plans, and CPP in particular. The following sections will discuss key considerations and potential impact of climate change on the main demographic, economic and investment assumptions made by the OCA to evaluate these programs/plans.

There are some other programs for which OCA prepares the actuarial reports, for example, the Canada Student Financial Assistance programs, the Employment Insurance Program, and several public sector benefit programs. These programs are not addressed in this study.

3 Demographic assumptions

This section of the study discusses key considerations when evaluating the potential impacts of climate-related risks on the demographic assumptions that are developed by the OCA when preparing actuarial reports for the CPP, the OAS program and public sector pension plans.

Population size and age structure could undergo changes in the future due to climate variability or natural disasters. For example, rising sea levels, extreme weather events, changes in temperature and precipitation patterns may exacerbate health issues, affecting birth rates and mortality rates, and could disrupt agriculture leading to global food scarcity and forced migration. On the other hand, warmer winters could reduce cold-related and flu-related mortality. These impacts are interconnected and can have complex and varying effects on a country’s demographics.

The following part explores, with a focus on the Canadian perspective when feasible, the potential implications of climate-related risks on three main demographic assumptions: fertility, mortality, and migration.

3.1 Fertility

The impact of climate-related risks on fertility can vary widely depending on geographical location and socio-economic factors, as well as access to healthcare and family planning services.

The first two subsections investigate potential directional impacts on fertility from direct physical risks and from indirect transition and physical risks. These subsections are meant to identify potential drivers in general, and they do not necessarily translate into material impacts on fertility in Canada. The third subsection provides a summary from a Canadian-centric perspective. Finally, the last subsection presents a case study exploring a framework to quantify the potential impacts of climate-related risks on fertility rates by linking historical fertility data to environmental stressors.

3.1.1 Direct impacts

Climate-related risks can affect fertility through direct physical impact channels, such as temperature rise, air pollution, sea-level rise, as well as food and water scarcity. Studies generally show that direct physical impacts from climate-related risks have a negative effect on fertility (i.e., downward pressure). This section discusses some examples of such downward pressure.

First, fertility can be impacted by the environment, which in turn can be aggravated by the changing climate. For example:

- Air pollutionFootnote 3 could reduce fertility (Gaskin, et al., 2019), and greater air pollution exposure could increase time to pregnancy. Multiple studies found that an increase in fine particle matter decreases fecundability (Mahalingaiah, et al., 2016) (Slama, et al., 2013) (Wesselink, et al., 2022). High levels of pollutants are also shown to be linked to increased risk of miscarriages and adverse pregnancy outcomes (Ha, et al., 2018).

- Extreme heatwaves can lead to heat stress, which can affect fertility. Studies show that exposure to extreme heat in the preconception period can decrease the probability of conception. It also increases pregnancy losses, reduces gestational length, and lowers birth weight (Hajdu & Hajdu, 2021).

- Research suggests that changes in precipitation levels can have differential effects on fertility. Extreme precipitation events may lead to decreased fertility in the short term, due to reduced plant productivity and potential food insecurity (Segal & Giudice, 2022) (Zeppel, Wilks, & Lewis, 2014). In the long term, climate change may exacerbate inequalities by increasing fertility in poorer tropical regions while decreasing it in the richer northern areas (Casey, et al., 2019). These effects are largely influenced by socio-economic factors (discussed below). Additionally, rising sea levels, are predicted to increase the salinity levels in drinking water, which is associated with the development of preeclampsia (Khan, et al., 2014).

Second, climate change can disrupt food production through droughts, floods, and other extreme weather events. Similarly, water scarcity, exacerbated by climate change, can affect hygiene and sanitation. Lack of food and access to clear water and sanitation facilities may create downward pressure on fertility through malnutrition impacting reproductive health and increased risk of waterborne diseases, respectively (O’Kelly & Lambert, 2020). The geographic distribution of vector-borne diseases like malaria and Zika virus could also be altered by the changing climate (Cella, et al., 2019) (Mills, Gage, & Khan, 2010), which can have serious implications on pregnancy, including birth defects and miscarriages (Oberlin & Wylie, 2023).

3.1.2 Indirect impacts

Climate-related risks can also affect fertility through indirect impact channels caused by the transition to a low carbon emission economy or through the aftereffects of physical impacts. Based on the research, the indirect impacts could create both downward and upward pressure on fertility.

In the shorter term, transitioning to a low carbon economy could cause disruption in employment and income stability, which may lead some part of the population to delay having children or having fewer children. The cost of living might also increase due to the transition, causing short-term financial challenges for families, potentially influencing family planning and fertility. Finally, the psychological stress associated with climate-related events, loss of livelihoods and uncertainty about the future can impact mental health, potentially affecting decisions related to family planning and fertility (Smith, Sales, Williams, & Munro, 2023).

In the longer term, a successful climate transition can improve the environmental conditions which could increase fertility. An unsuccessful climate transition could lead to decreased fertility in the longer term as a result of increased economic uncertainty and psychological stress, as well as higher impacts stemming from the direct impacts mentioned in the previous subsection.

Depending on the socio-political stability of a country, climate change can also cause societal disruption and increase both intragenerational and intergenerational conflicts (Hsiang, Meng, & Cane, 2011) (Islam & Winkel, 2017). In turn, this can reduce fertility due to increased stress and uncertainty in the lives of the affected population.

Extreme weather events associated with climate change can displace communities and force people to migrate. Research has shown that migration can impact fertility, and that differences in fertility can arise based on the mothers’ birth places (Beine, Docquier, & Schiff, 2009). The demographic composition of displaced populations can therefore influence fertility patterns. For example, if a significant portion of the displaced population consists of workers of childbearing age, it could lead to a temporary increase in fertility for the receiving country provided there are no challenges in accessing healthcare, family planning services and other infrastructure.

Finally for certain developing countries, another argument for increased fertility due to climate change is for the agriculture sector. Studies show that family size might increase to compensate for the reduced crop production due to climate change (Casey, et al., The Impact of Climate Change on Fertility, 2019).

3.1.3 Summary and Canadian perspective

Based on the research performed, this subsection provides a summary of conclusions thus far, and how they could affect the OCA’s assumption-setting process for fertility in Canada. This subsection is meant to represent the OCA’s current observations which will evolve as more research and data become available. For context, lower fertility leads to higher cost ratios for pay-as-you-go and partially funded programs, and vice versa.

Overall, on a global scale, direct physical risks stemming from climate change are expected to exert downward pressure on fertility. In terms of timeframe, the impact would be expected to occur more in the medium to long term. For Canada more specifically:

- Due to a colder climate and generally better air quality relative to other countries, the potential downward pressure on fertility stemming from higher temperatures and air pollution are not expected to be significant. This conclusion is supported by a quantitative analysis presented in the next subsection.

- Climate change is a global problem and the potential impacts on global food production and water quality would also affect developed countries such as Canada, albeit to a lesser extent. Although there is some downside risk to fertility from this factor, at this point, it is not expected to be significant.

As mentioned, indirect risks stemming from climate change could create both downward and upward pressure on fertility. For Canada more specifically:

- The financial uncertainty related to transitioning to a low carbon economy as well as the psychological stress associated with climate risk have the potential to decrease fertility in the shorter term. These are factors that may be considered when setting OCA’s fertility assumption for the next actuarial valuation cycle (31 December 2024). At this point, these factors would be considered on a qualitative basis and not explicitly quantified.

- Longer-term impacts depend heavily on the success of the design and implementation of global and Canadian climate policies for transition. At this point, given the high level of uncertainty related to the transition path in Canada and globally, the OCA is not ready to adjust its fertility assumption to reflect longer-term indirect risks stemming from climate change.

3.1.4 Quantitative analysis

The OCA conducted a quantitative analysis to estimate the potential impact of climate change on fertility in Canada. This section briefly describes the framework used for the analysis and its results along with comparisons to similar analysis performed by peers for other countries.

3.1.4.1 Framework

The methodology is based on a framework that takes a statistical analysis approach to assessing the relationship between environmental stressors and health impacts. It is a well-established and widely accepted framework in environmental epidemiology (Bhaskaran, Gasparrini, Hajat, Smeeth, & Armstrong, 2013).

The following list of environmental stressors were tested:

- Number of days per month above 30°C measured between eight and 15 months before birth,

- Number of days per month above 15°C, 20°C and 25°C measured nine months before birth,

- PM2.5 (air quality) measured nine months before birth, and

- Ozone levels (air quality) measured nine months before birth.

Additionally, combinations of environmental stressors were analyzed in relationship to number of live births or total fertility rates. The selected best fitted model based on various statistical metrics as well as the balance between complexity and goodness-of-fit, is shown below:

- Health impact: Live births, by month

- Environmental stressor: Number of days above 30°C per month measured nine months before birth

- Geography level: By individual province (and excluding territories)

- Generalized linear model: Poisson distribution with log-link function

- Control for seasonality and the long-term trend (to separate the short-term association between the environmental stressor and the outcome): Cubic spline with degree of freedom of six.

While air quality (PM2.5 and ozone levels) is a potential future driver for fertility, the available Canadian data may be insufficient to establish a relationship in Canada and as such it was excluded from the model. More specifically, it lacks consecutive days of significant exposure, as research suggests that studies of pollution effects need thousands of observation days with an average of tens of events per day to have credible precision and power (Bhaskaran, Gasparrini, Hajat, Smeeth, & Armstrong, 2013).

3.1.4.2 Data

The analysis relies on provincial fertility data from 1991 to 2022 from Statistics CanadaFootnote 4 and on provincial environmental stressors data from ClimateData.caFootnote 5 and Environment and Climate Change CanadaFootnote 6. Monthly data were used for the live births while monthly total fertility rates were estimated from annual total fertility rates.

3.1.4.3 Results

Based on the model, each additional day above 30°C in a month would result in a relative decline in the number of births after nine months of 0.54%. Under the SSP5-8.5 scenario (IPCC scenario with the most severe physical impact), the number of days above 30°C is expected to increase on average by about 1.30 days per month by 2050, and 5.30 days per month by 2100. This would result in a relative reduction in the number of births of around 0.70% by 2050 and 2.85% by 2100.

Based on this analysis, the direct impact on births from increasing temperature alone is expected to be minimal in Canada. However, the impact of climate change is not limited to direct environmental impacts such as rising temperature. As discussed earlier, it could also negatively impact the general population’s health and have important socio-economic implications which were not reflected in the model and may have a more significant impact on future births.

Finally, the relative decline of 0.54% for Canada is in line with the findings of comparable studies conducted in other countries, as summarized in Table 1 below (Keivabu, Cozzani, & Wilde, 2023). The last column illustrates the impact of climate change on fertility in terms of relative decline in birth rate for each additional day above a certain temperature threshold (column 3). Table 1 highlights consistent impacts across various regions, with declines in birth rates ranging from −0.18% to −0.90%, for each additional day above the temperature threshold selected in the study. While the magnitude of the impact varies slightly between countries, the potential effect of climate change on fertility is generally expected to be modest across diverse climates.

| Study | Region | Temperature threshold (°C) | Impact on birth rateTable 1 footnote * |

|---|---|---|---|

| This study (OCA) | Canada | >30 (mean) | −0.54% |

| Keivabu et al. (2023) | Spain | >30 (mean) | −0.90% |

| Cho (2020) | South Korea | 30-32 (max) | −0.24% |

| Barreca et al. (2018) | USA | >26.6 (mean) | −0.40% |

| Hajdu & Hajdu (2022) | Hungary | >25 (mean) | −0.18 to −0.85% |

|

Table 1 footnotes

|

|||

3.1.4.4 Model assumptions/limitations

The framework represents a simplified version of quantifying the impact from environmental stressors based on historical data. Some underlying assumptions were made:

- The population (and fertility rates) are assumed to be constant going forward. While it does not account for some groups, such as older individuals, being more susceptible to climate change, it does allow for the isolation of the climate effects from other demographic trends.

- Geographical location and temperature at conception are assumed to be in the two cities with the highest population in the province (one city for Prince Edward Island and one for Newfoundland).

- The period of gestation is assumed to be nine months prior to birth for all individuals.

- The model assumes no adaptation (e.g., behaviour) or changes/access to technology (e.g., increase in the number of individuals having an air conditioner).

3.2 Mortality

This section discusses the potential impacts of climate change on human mortality. Unlike the research on fertility, there is more information available on mortality that is specific to Canada; therefore, the various subsections have a more direct Canadian focus than for fertility.

It is important to note that this section focuses solely on the potential impacts on mortality from climate change in isolation. For example, stating that mortality could increase because of climate change does not mean that mortality would be expected to increase overall given that many other factors influence mortality.

The first subsection looks at the potential direct impacts on mortality arising from environmental channels associated with the physical risks of climate change. The second subsection explores potential indirect consequences of climate change on socio-economic and demographic factors that could influence mortality. Conclusions are provided in the third subsection, and the last subsection concentrates on examples of research papers that provide quantitative impacts.

3.2.1 Direct impacts

Climate change can impact future human mortality directly through various environmental channels. These channels include changes in temperature, changes in precipitation and pathogen patterns, increased air pollution and more frequent wildfires. This subsection discusses the impacts of climate change on mortality through these distinct channels. The interplays among different channels and their potential synergies can compound the possible overall impacts.

It is important to note that the impact on mortality from these direct channels can vary significantly depending on future emission levels. Although the directional impacts indicate potential increases in mortality, the extent of these increases depends heavily on the design and implementation of current and future climate policies.

3.2.1.1 Temperature change

One of the most apparent changes from climate change involves noticeable shifts in temperature across the globe. While global temperatures are generally rising due to climate change, the pace of warming and level of temperatures reached will vary from one region to the next, with Canada projected to warm at a faster pace than the global averageFootnote 7. In addition, some regions may experience colder winters due to complex interactions in the climate system. According to the Canadian Centre for Occupational Health and Safety, although it is expected that Canadian winters, on average, will have milder temperatures in the future, extreme cold events are still predicted to occur in CanadaFootnote 8.

Increases in future mortality from climate change can arise from both hotter summers and extreme cold events (Masselot, et al., 2023) (Raimi, 2021). Many studies found evidence of excess mortality from increased heatwaves (Gasparrini, et al., 2015) (Luthi, et al., 2023) (Hajat & Kosatky, 2010) (Ryti, Guo, & Jaakkola, 2016). More extreme winter weather can also exacerbate health conditions such as respiratory and cardiovascular diseases (Seltenrich, 2015), and cause disruptions in infrastructure of healthcare services, transportation, and emergency response systems, ultimately leading to increased mortality. On the other hand, some studies suggest that decreases in mortality could arise as a result of warmer winters (Davis, Knappenberger, Michaels, & Novicoff, 2004) (Kinney, et al., 2015). An important question is whether these potential decreases in cold-related mortality would be sufficient to offset the potential increases from hotter summers and more extreme weather patterns.

The Canadian-specific research suggests that the increases in mortality may not be balanced by a decrease in cold-related deaths, especially under the higher-emission scenarios. This research supports predominantly increased mortality from temperature changes in Canada (Club Vita, 2018) (Gasparrini, et al., 2017) (Gosselin, Campagna, Demers-Bouffard, Qutob, & Flannigan, 2022) (Hebbern, et al., 2023) (Lavigne, 2020).

From a more regional perspective, a 2012 study of 15 Canadian cities estimates that four cities would see a net increase in mortality: London, Hamilton, Regina, and Montréal (Martin et al., 2012). Later studies also show that the net impacts of temperature on excess mortality appear to vary across geographic regions (Gasparrini, et al., 2017) (Gosselin, Campagna, Demers-Bouffard, Qutob, & Flannigan, 2022) (Hebbern, et al., 2023) (Lavigne, 2020).

3.2.1.2 Changing patterns of precipitation and pathogens

Climate change may alter the patterns of precipitation in Canada, which could contribute to an increased frequency and intensity of extreme weather events such as floods, storms, and droughts (Bonsal, Peters, Seglenieks, Rivera, & Berg, 219). These events can lead to direct physical injuries, long-term impacts on mental health, forced displacement and disruptions in healthcare services (Ebi, et al., 2022). These multifaceted consequences could lead to increased mortality, especially under high emissions scenarios.

Furthermore, gradual shifts in temperature and precipitation can impact urban ecosystems, causing shifts that enable insects to expand poleward. This increases the risks of vector-borne diseases such as West Nile virus and Lyme disease in North America (Portner, et al., 2022). Approximately 17% of all infectious diseases are caused by vector-borne diseases, resulting in over 700,000 deaths worldwide annually, according to the World Health Organization (WHO)Footnote 9.

3.2.1.3 Air pollution

Climate change is generally expected to degrade air quality in Canada (Egyed, et al., 2022) (Fiore, Naik, & Leibensperger, 2015). The degraded air quality can also exacerbate the impacts of climate change, as many air pollutant sources are also carbon dioxide emitters (Fiore, Naik, & Leibensperger, 2015). These interactions ultimately have both direct and indirect repercussions on human mortality and morbidity (Orru, Ebi, & Forsberg, 2017).

Air pollutants, especially from combustion, can adversely affect the respiratory system, leading to conditions such as asthma, chronic obstructive pulmonary disease, and other respiratory illnesses. Long-term exposure to these pollutants can also contribute to cardiovascular diseases. Most of the literature has shown positive correlations of air pollution (and/or exposure to weather variables) with mortality and/or hospital admissions, especially related to respiratory and cardiovascular diseases (Abed Al Ahad, Sullivan, Demsar, Melham, & Kulu, 2020) (World Health Organization, 2013). In Canada, chronic exposure to fine particulate air pollution resulting from the burning of fossil fuels is responsible for 7,100 premature deaths and $53.5 billion in health-related costs per year (Howard, Rose, & Rivers, 2018).

Air pollutants can also affect mortality and morbidity indirectly, by boosting climate change. For instance, certain greenhouse gases like black carbon (soot) and methane can intensify extreme temperatures (Bunker, et al., 2016), and pollutants such as ozone can impact crop yields affecting food security and public health (McGrath, 2020) (Patz, Frumkin, Holloway, Vimont, & Haines, 2014). There is also the combined synergistic effect of high temperatures and air pollution on mortality, as elevated temperature and air pollution have been associated with increased mortality (Willers, et al., 2016).

3.2.1.4 Wildfires

Climate change may result in an increased frequency of heatwaves and greater variability in precipitation patterns, resulting in prolonged dry periods and intensified rainfall events. The amalgamation of extreme heat and drought escalates the occurrences of wildfires. Projections indicate heightened fire activity in numerous North American regions (Halofsky, Peterson, & Harvey, 2020) (Ranasinghe, et al., 2021), attributed to extended fire seasons (USGCRP, 2017), persistent warming (Villarreal, Haire, Iniguez, Cortes Montano, & Poitras, 2019) (Wahl, Zorita, Trouet, & Taylor, 2019) and increased lightning frequency (Chen, et al., 2021).

Wildfires, particularly wildland-urban interface fires, can exert detrimental effects on mortality, morbidity, and mental health, as delineated in the IPCC AR6. The release of substantial particulate matter, toxic gases, and volatile organic compounds during wildfires contribute directly to ground-level ozone formation. These wildfire smoke particulates can travel considerable distances, impacting air quality and health. They are found to elevate risk of cardiovascular disease, morbidity and mortality by increasing specific cardiovascular outcomes, such as cardiac arrests (Dennekamp, et al., 2015). Vulnerable populations, including children, the elderly, pregnant women, individuals with low socio-economic status, and first responders often experience these effects more acutely (Abbott & Chapman, 2018) (Agyapong, et al., 2018) (Ford, 2012) (Maguet, 2019). Notably, in northern Canada, reports highlight high levels of respiratory stress and disease among Inuit and First Nation communities in relation to wildfires (Howard, et al., 2021).

3.2.2 Indirect impacts

This subsection discusses the potential indirect impacts from climate change on mortality. Once again, the extent of the potential impacts depends heavily on the design and implementation of current and future climate policies.

3.2.2.1 Agricultural productivity impacts

Climate change may lead to increases in mortality through declining agricultural productivity, leading to lower caloric availability. Studies suggest this may increase underweight individuals and climate-related deaths in North America by 2050 (Springmann, Godfray, Rayner, & Scarborough, 2016) (Springmann, et al., 2016) (Springmann, et al., 2018). While reduced caloric availability could decrease obesity-related deaths, research shows that the increases in mortality from decline in fruits and vegetable consumption are projected to more than offset the mortality reductions due to lower obesity-related deaths by 2050, especially in Canada and the USA (Springmann, Godfray, Rayner, & Scarborough, 2016) (Springmann, et al., 2016).

Nutrition impacts also vary within countries (Shannon, Kim, McKenzie, & Lawrence, 2015) (Zeuli, Nijhuis, Macfarlane, & Ridsdale, 2018). Alaska and Canada have already experienced challenges to nutrition security from climate-induced changes that have impacted locally harvested foods (Bunce, Ford, Harper, Edge, & IHACC Research Team, 2016) (Harper, et al., 2015) (Hupp, Brubaker, Wilkinson, & Williamson, 2015) (Lynn, et al., 2013) (Petrasek MacDonald, Harper, Cunsolo Willox, Edge, & Rigolet Inuit Community Government, 2012). First Nations coastal communities in western Canada are projected to face reduced access to traditionally harvested seafood by 2050 under scenarios RCP2.6 and RCP8.5, adversely affecting nutrition, particularly for many older adults (Marushka, et al., 2019).

3.2.2.2 Mental health

Climate change exerts a profound impact on mental health, manifesting through various direct and indirect pathways associated with extreme weather events, cumulative environmental changes, and anticipatory stressors (Cunsolo & Ellis, 2018) (Hayes, Blashki, Wiseman, Burke, & Reifels, 2018).

Specific climate hazards, including storms, floods, heatwaves, wildfires, and drought, have demonstrated significant adverse effects on mental health, with extensive research highlighting their correlation with conditions such as PTSD, anxiety, and depression (Charlson, et al., 2021) (Hayes, Blashki, Wiseman, Burke, & Reifels, 2018) (Obradovich, Migliorini, Paulus, & Rahwan, 2018). Within the context of North America, climate change is intricately linked to a spectrum of emotional responses, including depression, generalized anxiety, ecological grief, increased substance use, family stress, domestic violence, heightened suicide rates, and loss of cultural knowledge and place-based identities (Clayton, 2020) (Cunsolo & Ellis, 2018) (Dumont, Haase, Dolber, Lewis, & Coverdale, 2020).

Studies show that deteriorated mental health can exacerbate physical conditions, and subsequently increase mortality. Mental disorders are significant contributors to morbidity and mortality around the globe, and people with mental disorders have higher mortality rates than the population without mental disorders (Charlson, et al., 2021) (Hayes, Blashki, Wiseman, Burke, & Reifels, 2018) (Reisinger Walker, McGee, & Druss, 2015).

3.2.2.3 Socio-economic impact

Climate change could pose a multifaceted threat to public health in Canada. The increasing frequency of severe weather events could strain the existing healthcare systems and infrastructure (Felio, 2017) (Health Care Without Harm, 2018), potentially leading to increased healthcare costs, reduced access to healthcare, and worsened health conditions, ultimately increasing mortality.

Disadvantaged groups, who may already face greater challenges in mitigating and preventing climate-related risks (Islam & Winkel, 2017), are particularly vulnerable to the health impact of climate change. Vulnerability to health impacts of climate change is determined by the exposure to climate change hazards, the sensitivity to possible impacts, and the capacity to respond or adapt (Gosselin, Campagna, Demers-Bouffard, Qutob, & Flannigan, 2022). Populations that are disproportionately affected include Indigenous peoples, women, children, older adults, low-income individuals, people living with pre-existing physical and mental health conditions, and certain occupational groups.

3.2.2.4 Transition to a low-carbon emission economy

The transition to a low-carbon emission economy may have profound implications on mortality as societies adopt cleaner energy sources and sustainable practices. The transition towards a low-carbon emission economy, while potentially increasing mortality rates in the shorter term due to redirected research (from health to transition) and increased mental pressure, may bring promising benefits for minimizing the potential increases in mortality from all the factors mentioned in previous subsections, and in some cases lead to other indirect and independent decreases in mortality.

Studies published in The Lancet have shown that appropriate climate change mitigation strategies can have additional, independent, and largely beneficial effects on public health (Haines, 2017) (Watts, et al., 2018). A successful transition can improve the environment with better air quality and promote better lifestyles, which all reduce the prevalence of illnesses (Erickson, Griswold, Maghirang, & Urbaszewski, 2017) (Watts, et al., 2018). Increased emphasis on sustainable practices can also lead to enhanced water quality and availability, reducing waterborne diseases. Furthermore, investments in climate-resilient infrastructure have the potential to enhance healthcare systems and emergency response capabilities, ensuring better access to healthcare and timely responses to health emergencies. Additionally, the transition may contribute to stabilizing extreme weather events. Sustainable agriculture and improvements in food systems could also enhance food security and nutrition, thereby potentially improving overall mortality over time (Friel, et al., 2009) (McMichael, Powles, Butler, & Uauy, 2007).

3.2.3 Summary of conclusions

Based on the research performed, this subsection provides a summary of conclusions thus far, and how they could affect the OCA’s assumption-setting process for mortality in Canada. This subsection is meant to represent the OCA’s current views which will evolve as more research and data become available. For context, lower mortality leads to higher cost ratios for pay-as-you-go, fully funded and partially funded programs, and vice versa.

It is worth reiterating that that the section focuses solely on the potential impacts on mortality of climate change in isolation. While climate change is a factor potentially impacting future mortality, numerous other factors (e.g., advances in medical technology, increased access to healthcare, etc.) exert considerable influence on future mortality and mortality improvement rates.

The following is a summary of the OCA’s current views on how climate change could impact mortality:

- Direct impacts, stemming from temperature change, changing patterns of precipitation and pathogens, air pollution and wildfires, collectively contribute to a predominantly negative outlook on mortality (upward pressure).

- Indirect impacts stemming from potential ramifications on agriculture productivity, mental health, and socio-economic factors could further compound this negative outlook.

- Amidst these various challenges posed by climate change, the transition to a low-carbon emission economy could help minimize or even reverse the potential climate-related mortality increases. Thus, the net future effect from climate change on mortality depends heavily on the success of climate transition both globally and in Canada.

- Despite the potential avenue for positive changes stemming from the transition, the overall impact of climate seems to be more skewed towards potential increases in mortality. The OCA may take this into account when setting the mortality assumption for the next actuarial valuation cycle (31 December 2024). At this point, it would be considered on a qualitative basis and not explicitly quantified.

3.2.4 Quantitative impact of climate change on mortality

Although the OCA did not conduct a quantitative analysis linking climate change and mortality, there are a number of studies available on the subject. This subsection provides a few examples of publicly available papers quantifying the potential impact of climate change on mortality.

3.2.4.1 Club Vita: hot and bothered?

The Club Vita paper (Club Vita, 2018) outlines three climate change longevity scenarios that pension plans in the United Kingdom (UK) can use to stress test their funding. While much of the existing work on climate change has been centered on financial markets and investment choices, this paper highlights the importance for trustees to ensure that pension plans are resilient to potential future outcomes, specifically with regards to life expectancy.

The scenarios presented in the paper are therefore meant to inform risk assessments as part of regular governance, or to feed into assumption-setting. Although probabilities are not assigned to each scenario, it is possible to look at the stress tests and assess the level of preparedness to each scenario.

The first scenario is referred to as the “Head in the Sand” scenario. This is an extreme case where there is a complete lack of response to resource and environmental risk. Under this scenario, the UK experiences food shortages and a surge in diseases that make their way from warmer climates. A decline in proper nourishment results in larger rates of cancer and cardiovascular diseases. Harsh flu epidemics are experienced every three years because of fluctuating temperatures. It is assumed that life expectancy will fall and that it will happen quickly.

The second scenario is referred to as the “Challenging Times” scenario. This is a more moderate case where some climate adaptation is achieved, but availability of oil becomes a constraint to economies in the future. This leads to severe funding issues with the national health system and increased cost of imported food stocks. This scenario assumes that a significant portion of lower income groups are unable to afford their basic needs, while higher income groups are less affected. It is assumed that life expectancy will stop improving for the lower income groups.

The final scenario is referred to as the “Green Revolution” scenario. This entails positive and successful adaptation to climate change, leading to improved longevity. Improvements in environmental conscience, legislation, and health education are all contributing factors under this scenario.

Table 2 below shows the impact on cohort life expectancy from age 65 for the three scenarios.

| Scenario | Typical member | Current deferred, age 50 | Current pensioner, age 65 |

|---|---|---|---|

| Head in the sand | Men | −3.6 | −1.1 |

| Women | −4.0 | −1.4 | |

| Challenging times | Men | −1.2 | −0.4 |

| Women | −1.7 | −0.7 | |

| Green revolution | Men | +1.9 | +0.9 |

| Women | +1.6 | +0.8 |

3.2.4.2 Canadian Journal of Public Health: Future temperature-related excess mortality under climate change and population aging scenarios in Canada

The Canadian Journal of Public Health paper (Hebbern, et al., 2023) provides an evaluation of temperature-related mortality across Canada until 2099, accounting for changes in the age-structure of the population and scenarios of population growth relative to a baseline scenario, which uses 2010-2019 as the reference period. The authors used daily counts of non-accidental deaths from 2000 to 2015 for all 111 health regions across Canada (obtained from Statistics Canada) and conducted a two-part time series analysis of mean daily temperatures and mortality.

Three different SSP climate change scenarios are considered: SSP1-2.6, SSP2-4.5, and SSP5-8.5. The results show a positive correlation between temperature rising and heat-related mortality across SSP scenarios, with the largest increases occurring under SSP5-8.5, and the smallest increases occurring under SSP1-2.6. Cold-related mortality impacts are expected to decrease under the SSP1-2.6 scenario and increase under the other two scenarios.

The net increase in excess mortality in 2090-2099 is expected to range between 3.29% and 17.31% depending on the SSP scenario. Interestingly, results by broad age group show that younger age groups are expected to experience negative net excess mortality across all SSP scenarios, while those aged 65 and over are expected to experience positive net excess mortality across all SSP scenarios.

3.2.4.3 Canadian Institute for Climate Choices - The Health Costs of Climate Change: How Canada can adapt, prepare, and save lives

This paper (Clark, D. G., Coffman, & Beugin, 2021) analyzes potential health cost impacts of climate change for Canada under low (RCP 4.5) and high (RCP 8.5) global greenhouse gas emissions scenarios. It covers impacts on a wide range of variables such as morbidity and mortality outcomes, healthcare costs, the value of lost lives and lost quality of life as well as productivity losses and associated costs. This section focuses on the part of the analysis that covers heat-related deaths in Canada.

To estimate the potential mortality impact associated with higher temperatures under climate change scenarios, exposure-response functions (ERF) were coupled with socio-economic data and climate data, and results were compared to those under a baseline scenario. Canadian studies analyzing regional relationships between high-temperature days and health outcomes helped to produce these ERF. The baseline is a combination of 2016 socio-economic data and climate data for the period 1971-2000.

The ERF coefficients are obtained from Gasparrini et al. (Gasparrini, et al., 2015), a study that included 21 Canadian cities and analyzed all deaths between 1986 and 2009. Excess deaths are defined as deaths caused by temperatures above or below the “optimum” temperature (between the 2.5th and 97.5th percentiles of mean temperature).

Resulting modeling estimates from the paper show that by mid-century, an additional 400 heat-related deaths may occur annually in Canada under the high-emission scenario (RCP 8.5) compared with the baseline. That figure nearly doubles by the end of the century at 790 deaths per year. This represents about 1.1 additional deaths per 100,000 people annually by mid-century and 1.7 additional deaths per 100,000 annually by the end of the century.

3.3 Migration

This section discusses the potential impacts of climate change on migration patterns. When faced with climate change, including the potential economic uncertainty and political instability resulting from the changing climate, migration is one of the strategies that individuals and households may willingly or be forced to undertake to improve their well-being and livelihoods.

The first two subsections discuss various climate-related drivers of migration, which can be viewed in two groups: direct and indirect drivers of migration and displacement. It is important to underscore the broad and general scope of these drivers. Regional impacts can vary significantly, shaping migration patterns in diverse ways depending on the local conditions. The subsequent subsection investigates how these drivers may influence future migration patterns in Canada.

It is important to note that there remain a lot of uncertainties and more research is needed, as highlighted by the special IPCC report: “our understandings of the links of global warming to human migration are limited and represent an important knowledge gap” (Hoegh-Guldberg, et al., 2018).

3.3.1 Direct drivers of migration

The various direct climate drivers of migration and displacement can be broadly grouped into two categories.

First, there are the slow-onset changes, encompassing chronic physical risks such as shifts in temperature and precipitation patterns, sea-level rise, agricultural land salinization, desertification, etc. Changes in temperature and precipitation patterns can instigate migration through environmental displacement and agricultural challenges (Bohra-Mishraa, Oppenheimera, & Hsiang, 2014). Temperature rise can also contribute to the melting of glaciers and polar ice, causing sea-level rise. This has impacts on coastal areas and small islands, poses threats to habitation, food security, and economic growth. Tipping points related to sea-level rise, especially under high levels of warming, may increase the global population at risk of displacement (Ranasinghe, et al., 2021).

The second direct drivers of migration and displacement are related to the rapid-onset climate events, referred to as acute physical risks. Extreme storms, floods and wildfires are strongly associated with high levels of short- and long-term displacement, while droughts, extreme heat and precipitation anomalies are more likely to stimulate longer-term changes in migration patterns (Hoffman, Dimitrova, Muttarak, Crespo Cuaresma, & Peisker, 2020) (Kaczan & Orgill-Meyer, 2019). According to the Internal Displacement Monitoring CentreFootnote 10, based on data collected since 2008, the extreme storms and floods consistently top the list of weather-related drivers causing population displacements globally, emphasizing the significance of these events.

There are many empirical studies on the relationship between migration and climate and/or other environmental drivers. However, the direction and the extent to which the environmental factors influence migration are not clear. Environmental change has been found to contribute to increased human migration in some studies, whereas no effect or a decline in migration has been reported in others. The empirical results differ depending on the environmental factors considered, the data and scale of the analysis, the methodology employed, and the geographical contexts covered (Berlemann & Steinhardt, 2017) (Cattaneo, et al., 2019) (Hunter, Luna, & Norton, 2015).

Finally, environmental hazards and events are just one of many factors influencing the decision to migrate. The recent literature has emphasized the role of different macro-level conditions including economic, cultural and socio-political factors which can reinforce or suppress migratory responses to environmental shocks (Barnett & McMichael, 2018) (Cattaneo, et al., 2019) (Hoffman, Dimitrova, Muttarak, Crespo Cuaresma, & Peisker, 2020) (Kaczan & Orgill-Meyer, 2019) (McLeman, 2017).

3.3.2 Indirect drivers of migration

Migration decisions are often multi-causal, and the environmental stress is merely one of many underlying drivers of migration. Climate change may influence migration indirectly through political and socio-economic factors (Black, Bennett, Thomas, & Beddington, 2011). Different regions, countries and communities have different adaptive capacities. National and individual wealth plays an important role in determining the vulnerability to climate events, as they can reduce the risk of impacts from climate disasters as well as improve disaster education and responses (Brown, 2008).

3.3.2.1 Political factors

When faced with climate change challenges, governments may respond through the implementation of various policies. These could include measures to adapt to changing conditions, promote sustainable practices, or allocate resources more efficiently. However, if policies are inadequate or not effectively implemented, it can contribute to social and economic disparities, potentially fueling migration as people seek better opportunities in regions with more favourable policies (McLeman, 2017).

As the environmental shifts intensify, nations may increasingly face heightened competition for vital resources such as water and arable land. This competition can escalate into political tensions and conflicts, potentially displacing populations and setting the stage for cross-border migration (Raleigh, Linke, & O’Loughlin, 2014) (Stern N. , 2006). These factors could contribute to forced migration, including asylum seekers and refugees. Although climate refugees do not currently qualify as a “Convention refugee”Footnote 11, a country may decide to extend protection to individuals displaced due to climate changeFootnote 12.

At the international level, several pertinent policy initiatives and agreements have been established to address potential challenges on migration governanceFootnote 13. These initiatives could influence the international migration outlook.

3.3.2.2 Socio-economic factors

Climate change is anticipated to drive global human migration and displacement through changes in various socio-economic factors (Portner, et al., 2022), including availability of job opportunities, access to social services and socio-economic inequality in the place of origin, which are all pertinent migration drivers (Massey, 1999) (Migali & Scipioni, 2019).

Climate change can impact an individual’s access to healthcare, education, job opportunities, other social services, and infrastructure. This reduced access can in turn influence migration decisions. As climate change intensifies in the region of origin, residents may decide to migrate both internally, from rural to urban areas (Lustgarten, 2020) (Rigaud, et al., 2018), or internationally (Goodman, et al., 2021) (McLeman, 2017) (Reuveny & Moore, 2009). In general, individuals or families with greater financial resources and higher levels of education have greater capacity to adapt to the changing climate (Butz, Lutz, Sendzimir, & Andruchowitz, 2014) (Ocello, Petrucci, Testa, & Vignoli, 2014). They are also the ones who are better able to migrate internally or internationally (Adams & Kay, 2019) (Koubi, Schaffer, Spilker, & Böhmelt, 2022) (Kubik & Maurel, 2016) (Riosmena, Kuhn, & Jochem, 2017).

Furthermore, climate change could exacerbate social and economic inequality within a country, leading to increased migration (Burzynski, Deuster, Docquier, & Melo, 2019) (Islam & Winkel, 2017) (Mardhiori & Ingmar, 2009). This is due to the disproportionate impact of climate change on disadvantaged groups, including increased exposure to adverse effects, greater susceptibility to damage, and decreased ability to cope and recover (Islam & Winkel, 2017). Moreover, research shows that climate change can also increase global economic inequality, which could increase international migration (Diffenbaugh & Burke, 2019).

In summary, climate change may increase the number of international migrants to developed countries, but the potential scale and effect are still very uncertain. There are still knowledge gaps regarding the long-term effects of climate change on human migration and considerably more research is required (Portner, et al., 2022) (Stern N. , 2006).

3.3.2.3 Climate transition

The transition to a low-carbon economy introduces its own set of economic risks and opportunities that can influence migration dynamics. Job displacement in carbon-intensive industries may prompt individuals and families to migrate in search of alternative employment in emerging green sectors or regions with more resilient economies. Shifts in investment patterns and capital flows towards renewable energy and sustainable infrastructure can also impact migration as people move to areas with greater economic prospects (Bluedorn, et al., 2022).

On the contrary, effective climate policies and investments in sustainable development can contribute to reducing migratory pressure by addressing underlying vulnerabilities and enhancing resilience in communities facing climate-related challenges (World Bank, 2023).

3.3.3 Research and considerations specific to Canada and summary of conclusions

As mentioned above, the impact of climate change goes beyond environmental concerns, influencing both internal and international migration patterns, and can vary significantly by region. The research available for Canada is scarce, there is not always consensus on results, and in many cases, there is no clear conclusion on how climate change could affect migration patterns in Canada.

This subsection provides an overview of considerations and research that are relevant to Canada, as well as a summary of conclusions in the context of the OCA’s assumption-setting process for migration in Canada.

3.3.3.1 Internal migration

There is very little research on potential climate-driven internal migration in Canada. OCA’s assumption-setting process for both demographic and economic assumptions is performed at the macro-level and is focused mainly on a Canada-wide perspectiveFootnote 14. At this point, the OCA is not ready to adjust demographic and economic assumptions to reflect the potential impact of climate-driven internal migration in Canada.

3.3.3.2 International migration

In Canada, international immigration consists of the following categories:

- Economic immigrants are individuals who have been selected for their ability to contribute to the Canadian economy.

- Immigrants sponsored by family are individuals who are granted permanent resident status through sponsorship by a family member who is a Canadian citizen or a permanent resident.

- Refugees are individuals who are granted permanent resident status based on a well-founded fear of returning to their home country. In Canada, the definition of "refugee"Footnote 15 is limited in its application to specific legal categories. The individuals displaced by climate change can only qualify as refugees in Canada if other displacement drivers interact with climate change, for example, political violence resulting from conflicts over water access. Although Canada has mechanisms for addressing emergencies such as sudden-onset climate disasters, it lacks a designated immigration pathway for those forced to leave their countries due to long-term environmental degradation.

- Other immigrants include all other individuals who are granted permanent resident status.

- Non-permanent residents are individuals who have a work study or permit, or who are asylum claimants seeking refugee status.

Canada’s future population growth will depend on immigration levels. Beyond the actual immigration levels, the composition of immigrants (age, gender, level of education, job skill, etc.) and the immigration category can also affect Canada’s future economic growth. Climate change could have an impact on both the future levels of immigration in Canada and the composition of immigrants. Unfortunately, there is very little research on the subject. A summary of a few Canadian-specific references is provided below.

Studies show that international climate-related immigration is mainly observed between countries sharing borders (Hoffman, Dimitrova, Muttarak, Crespo Cuaresma, & Peisker, 2020) (Kaczan & Orgill-Meyer, 2019). This observation suggests that historical immigrants to Canada have been motivated by factors that are not directly related to climate issues, given Canada's sole border is with the United States. However, some studies underscore that environmental considerations can still play primary or secondary roles in motivating migration to Canada (McLeman, 2017) (Veronis & McLeman, 2014).

Like the refugee category, asylum claimants may also be affected by climate hazards, yet research on their international movements in Canada is limited. While some studies (Abel, Brottrager, Cuaresma, & Muttarak, 2019) (Missirian & Schlenker, 2017) suggest links between climate fluctuations and asylum-seeking migration in Europe and Middle East, contradictory findings also exist (Schutte, Vestby, & Jørgen Carling, 2021). The absence of Canadian-specific research and the lack of consensus among studies from other regions underscore the uncertainty regarding the correlation and directional impact between climate change and asylum claimants in the Canadian context.

3.3.3.3 Summary of conclusions

Despite the little research available, the OCA developed its own views and considerations on how the drivers of migration discussed in the first section could relate to Canada. These views and considerations are summarized below. They are not meant to be exhaustive, and future data and research will help further inform the OCA’s thinking. For context, lower immigration levels lead to higher cost ratios for pay-as-you-go and partially funded programs, and vice versa.

In terms of the direct and indirect drivers of migration, Canada may experience relatively milder impacts due to its unique geographical landscape and stable socio-political environment. This could make Canada a desirable destination for climate-related migrants worldwide and make it easier to attract and retain high-skilled immigrants who can contribute to the economy. At the same time, there may be some pressure for Canada to accept climate-related migrants from other immigration categories that may not contribute as quickly to the economy.

Canada's response to climate change, such as its commitment to sustainability and green initiatives, can also influence decisions to migrate to Canada. A successful climate transition could help attract and retain skilled workers, but the reverse is also true.

While climate change may influence the trend of international migration to Canada, the total number of immigrants primarily depend on the government’s annual immigration targets. These targetsFootnote 16 guide immigration policies, determine visa allocation, and shape the composition of the immigrant population, reflecting national priorities and societal needs.

The diversity in drivers, contexts and outcomes makes establishing a general relationship between climate change and migration challenging. The frequency, severity of damage, duration, and spatial reach of climatic drivers differ greatly, while the responses to migration are shaped by a complex interplay of cultural, demographic, economic, political, and social factors spanning different scales.

As it currently stands, there is too much uncertainty to even assess the potential directional impact of climate change on migration patterns in Canada. Although it is an important topic to monitor for the future, the OCA does not plan on making any adjustments to incorporate climate change in its assumption-setting process for migration for the next actuarial valuation cycle (31 December 2024).

4 Economic assumptions

Climate change has significant implications that may extend far beyond environmental concerns to impact key economic indices and result in both direct and indirect costs to the Canadian economy.

In the context of preparing actuarial reports for the CPP, the OAS program and public sector pension plans, the OCA develops assumptions for a wide range of Canadian macro-economic variables such as inflation, unemployment/employment rates, real wage increases, productivity growth, GDP growth, etc. This part of the study discusses key considerations when evaluating the potential impacts of climate-related risks on these economic assumptions. As the research available specifically focused on the Canadian economy is limited, some of the following analysis draws references from peer countries.

The first two subsections focus on two broad variables: inflation and economic growth. The last subsection discusses various considerations for developing a framework that translates potential climate change impacts on economic growth into variables that are relevant to OCA’s models. The framework can be useful to illustrate potential impacts on the cost of the CPP, the OAS program and public sector pension plans.

4.1 Inflation

The Bank of Canada uses the consumer price index (CPI) to measure inflationFootnote 17. The CPI tracks how much the average Canadian household spends, and how those spendings change over time. The average Canadian household spends on items such as food, shelter, transportation, household expenses, clothing, healthcare, etc. Among these items, food, shelter, and transportation receive relatively larger weights compared to the other itemsFootnote 18 when determining the CPI, totaling around 60%.

Potential climate change related impacts on inflation have received much attention lately, and they are being analyzed through different angles. For example, in a 2022 speech, European Central Bank’s Executive Member Isabel Schnabel declared a "new age of energy inflation"Footnote 19 and brought up three types of inflation: “climateflation”, which reflects price changes due to physical risks, “fossilflation”, which reflects price changes due to cost fluctuations in fossil fuels and “greenflation”, which reflects price changes due to the transition to a green economy. Although understanding these three types of inflation and their dynamics can be useful, most research examines potential future increases and decreases in inflationary pressure stemming from climate change on an aggregate level. This section applies a similar approach and explores the divergent pressures and their consequences through the lens of physical risks and transition risks.

4.1.1 Climate physical risks

Climate change can influence future inflation in Canada through climate-related physical risks. Many studies found empirical evidence of a positive relationship between temperature rise and the level of inflation in a country. As climate change brings more frequent and more severe weather shocks, the volatility and heterogeneity of inflation may increase, and hotter summers may result in more frequent and persistent upward pressures on inflation (Faccia, Parker, & Livio, 2021) (Kotz, Kuik, Lis, & Nickel, 2024) (Li, Zhang, & He, 2023) (Mukherjee & Ouattara, 2021). In Canada, the average annual temperature is projected to increase between 1.8°C (RCP 2.6) and 6.3°C (RCP 8.5) by the end of the century, with variations by region and seasonsFootnote 20. Therefore, as hot summers become more frequent and more severe, stronger inflationary impacts may be expected in the future.

Climate-related events, such as heatwaves, droughts or storms, can impact agricultural productivityFootnote 21 (Cœuré, 2018) (Lesk, Rowhani, & Ramankutty, 2016), increase production costs for businesses (Rodrigues, Salish, & Salish, 2024) (Yu, Cai, Zhang, & You, 2022), and cause negative supply-side shocks worldwide (Batten, Sowerbutts, & Tanaka, 2020). Furthermore, climate-related events can damage infrastructure thereby increasing transportation costs or increase the need to import goods from abroad. This may cause upward pressures on prices and create spillover across countries (Klomp & Sseruyange, 2021) (Peersman, 2018). These spillover effects may pass the increased costs to Canadian consumers through higher prices for food and other goods, driving up inflation in the future.

On the other hand, climate physical risks can result in positive supply shocks in some locations and have deflationary effects in Canada. For example, according to Agriculture CanadaFootnote 22, warmer winters and rising temperature may prolong and enhance the growing seasons in Canada, potentially improving agricultural output. Reconstructions after climate-related events may also increase investment and create positive effects on the supply-side (Batten, Sowerbutts, & Tanaka, 2020).

On the demand side, extreme climate-related events such as floods and wildfires can reduce wealth for households and businesses and lead to reduced consumption and investments. Climate-related events could also undermine business confidence and trigger a sharp sell-off in the financial markets, which in turn could increase the cost of funding new investments and thus reduce investment demand. These impacts on the demand-side are mostly deflationary, especially if the losses from these weather events are uninsured or underinsured (Batten, Sowerbutts, & Tanaka, Let’s talk about the weather: the impact of climate change on central banks, 2016).

4.1.2 Climate transition risks

Climate transition risks have important implications on future inflation in Canada, and the magnitude of impact is heavily dependent on the transition pathways and climate policies.

There are typically three types of climate policies for reducing carbon emissions (Batten, Climate change and the macro-economy: a critical review, 2018). The first type achieves reductions by decreasing the energy intensity, as well as production and consumption of high carbon products. The second type of climate policies focuses on improving the energy efficiency of existing products and processes, and the third type focuses on transitioning to renewable energy sources.

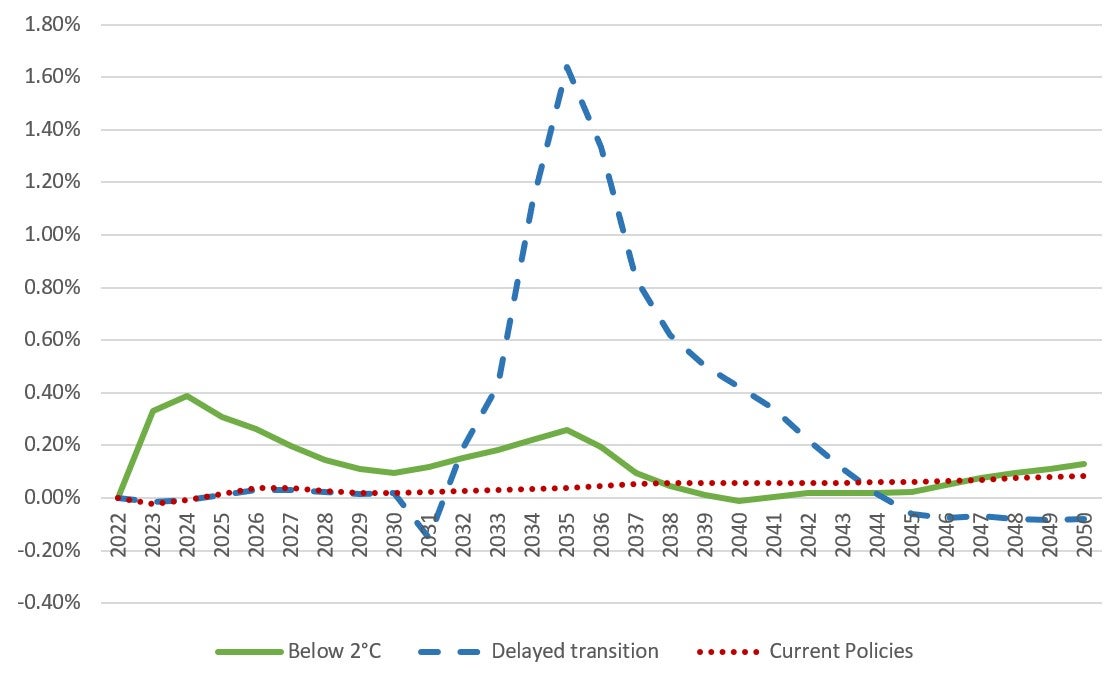

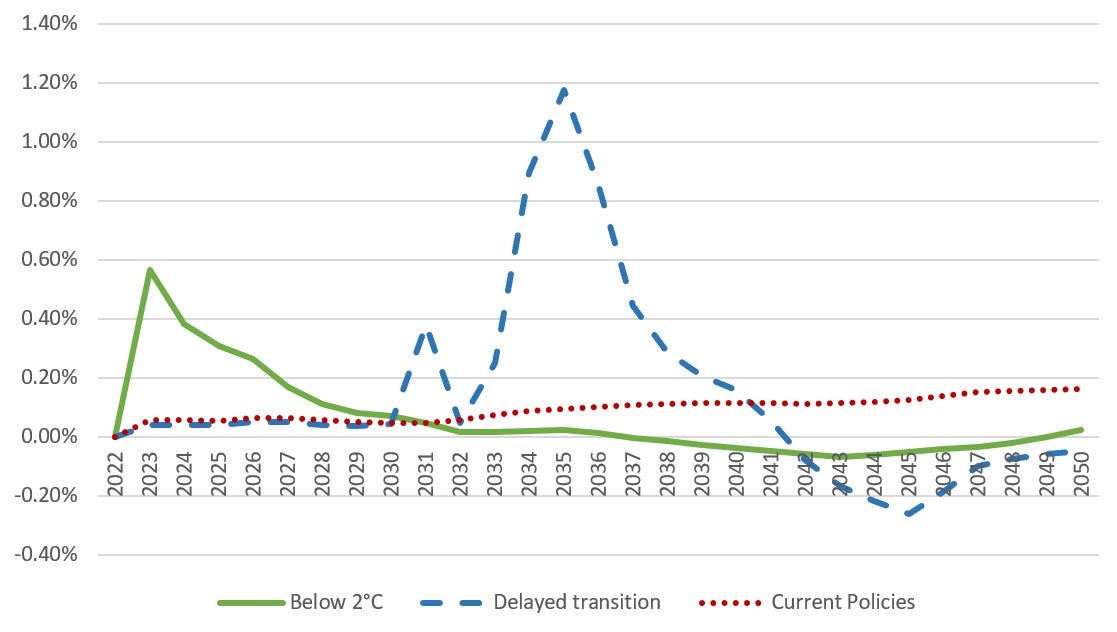

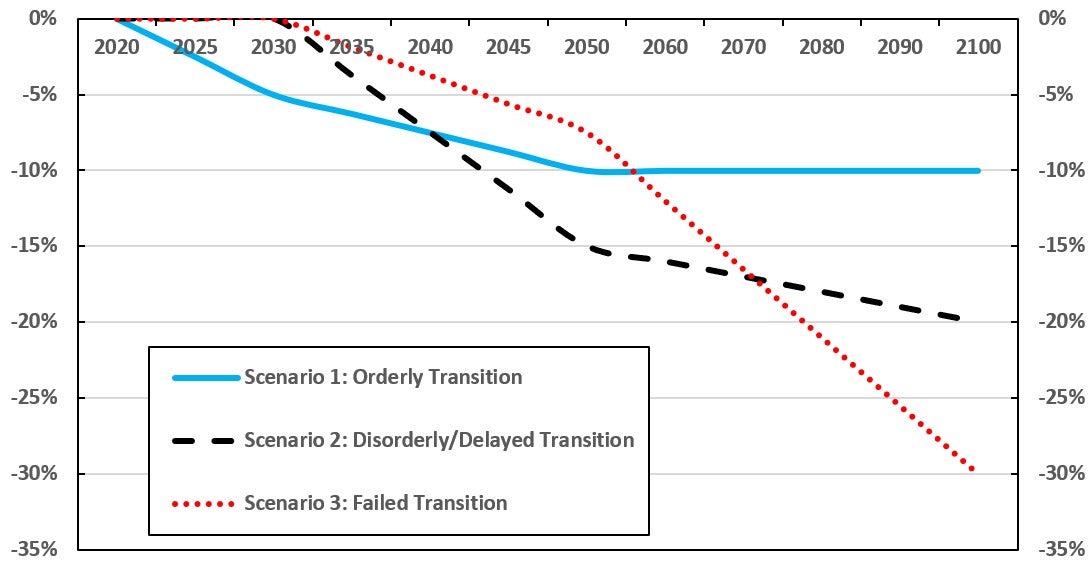

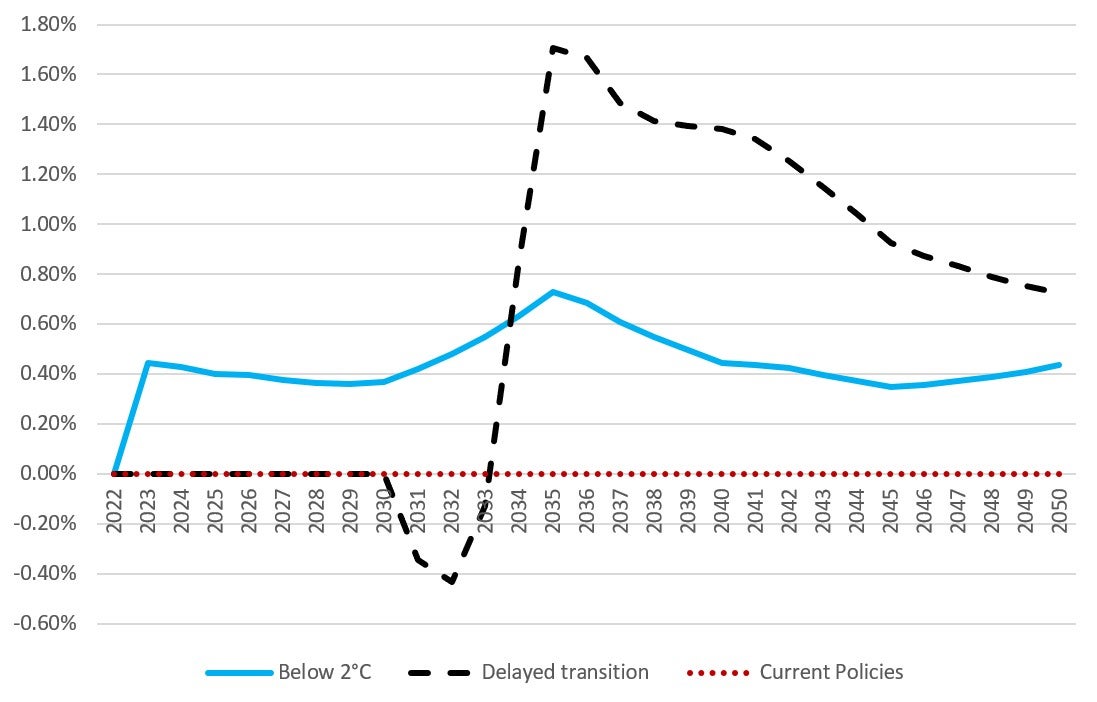

The first type of climate policies can reduce economic growth, with everything else being equal (Batten, Climate change and the macro-economy: a critical review, 2018), which may result in upward pressure on inflation when analyzing from the supply side. The reduced supply of fossil fuel is expected to drive up its price, which usually has an immediate direct impact on the inflation, since energy goods feature substantially in inflation indices. Higher fossil fuel prices may also contribute to inflation indirectly over time as most goods and services require energy throughout the production and transportation process. On the demand side, lower foreign demand of fossil fuels may offset the cost-push effect of the carbon price increase under the first type of climate policies, resulting in downward pressure on inflation (Bank of Canada; Office of the Superintendent of Financial Institutions, 2022).