OSFI Annual report 2023-2024

I, Peter Routledge, on behalf of the Office of the Superintendent of Financial Institutions (OSFI), present the annual performance statement of OSFI for the Fiscal Year 2023-24 reporting period, as required under the Bank Act, the Trust and Loan Companies Act, the Insurance Companies Act and the Cooperative Credit Associations Act. In my opinion, this annual report accurately presents the performance of OSFI and complies with section 40 of the OSFI Act.

A letter from the Superintendent

I am pleased to present the Office of the Superintendent of Financial Institutions' (OSFI) 2023-24 Annual Report that highlights key accomplishments over the past year. For over 37 years now, OSFI has been regulating and supervising Canada's banks, most insurance companies, and many private pension plans. OSFI also houses the Office of the Chief Actuary (OCA), which provides a range of actuarial valuation and advisory services to the federal government.

Fiscal year 2023-24 was very busy for us. Not only did we successfully navigate an increasingly complex risk environment, but we also continued to build resilience into Canada's financial system through our initiatives and advancement of supervisory and regulatory actions.

This year, we updated our Supervisory Framework to reflect our new risk appetite, better respond to new financial and non-financial risks, and give broader flexibility to our supervisors in their decision-making processes. We also updated several of our guidelines, and we embarked upon a series of culture change initiatives that transformed the way we connect with and support our people in the work they do. To support our supervisory and regulatory activities, we have continued to build our data and analytical capabilities. This work included making notable progress on the Data Collection Modernization initiative that was launched last year alongside the Bank of Canada and the Canada Deposit Insurance Corporation.

Further, our mandate was expanded through Budget 2023 to include integrity, security, and foreign interference in our supervisory and regulatory functions. To implement this new mandate, we published our final Integrity and Security guideline in January 2024 to set expectations for how financial institutions should protect themselves.

Finally, the OCA continued to meet its mandate by providing independent actuarial services and advice to ensure the stability and sustainability of Canada's social programs, public sector pension plans, and insurance arrangements.

I am proud of all the work we have accomplished in fiscal year 2023-24. OSFI will continue to take a balanced approach that protects depositors, policyholders, creditors, and pension plan beneficiaries while respecting financial institutions' ability to compete and take risks. As always, OSFI will continue its work to protect the safety and soundness of Canada's financial institutions and ensure confidence in our financial system.

Thank you,

Peter Routledge

Superintendent

OSFI's background

OSFI was established in 1987 to protect depositors, policyholders, financial institution creditors and pension plan members, while allowing financial institutions to compete and take reasonable risks.

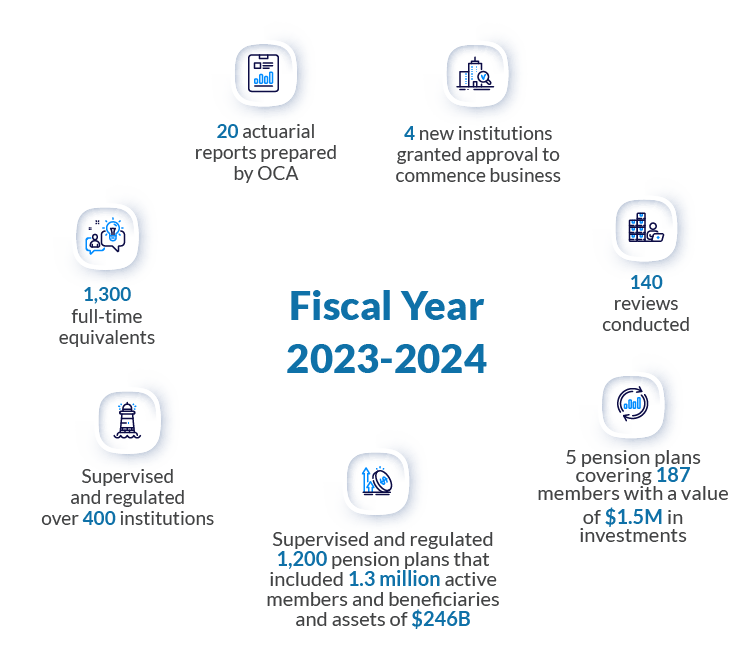

OSFI by the numbers

OSFI by the numbers - text description

- 20 actuarial reports prepared by Office of the Chief Actuary

- 4 new institutions granted approval to commence business

- 140 reviews conducted

- 5 pooled registered pension plans covering 187 members with a value of $1.5 million in investment

- Supervised and regulated almost 1,200 pension plans that included 1.3 million active members and beneficiaries and assets of $246 billion

- Supervised and regulated over 400 institutions

- 1,300 full-time equivalents

About us

The Office of the Superintendent of Financial Institutions (OSFI) is an independent agency of the Government of Canada. We contribute to public confidence in the Canadian financial system by regulating and supervising approximately 400 federally regulated financial institutions (institutions)Footnote 1 and 1,200 federally regulated pension plans (pension plans).

Mandate

Our mandate is to:

- ensure that institutions remain in sound financial condition and determine if pension plans are meeting minimum funding requirements and other requirements under the legislation

- ensure institutions protect themselves against threats to their integrity and security, including foreign interferenceFootnote 2

- act early when issues arise and require institutions and pension plans to take necessary corrective measures without delay

- monitor and evaluate risks and promote sound risk management by institutions and pension plans

Our mandate sets the basis for us to take actions to protect the rights and interests of depositors, policyholders, and institution creditors while having due regard for the need to allow institutions to compete effectively and take reasonable risks. It also directs our work with pension plans to protect the rights and interests of members, former members and beneficiaries.

Did you know?

On June 22, 2023, OSFI’s mandate was expanded by Parliament and now includes ensuring institutions protect themselves against threats to their integrity and security, including foreign interference.

Office of the Chief Actuary

The Office of the Chief Actuary (OCA) is an independent unit within OSFI. The OCA is mandated to provide a range of independent actuarial valuation and advisory services to the federal government. This includes actuarial reports for the following programs:

- Canada Pension Plan (CPP)

- Old Age Security Program

- Canada Student Financial Assistance Program

Although the Chief Actuary reports to the Superintendent, they independently develop the content and actuarial opinions contained in the reports.

Remaining a top employer

We are proud to announce that for the fourth consecutive year, OSFI was named a National Capital Region top employer for 2023-24. We are pleased to have our efforts recognized once again as we strive to be a diverse and dynamic employer of choice.

Leadership and organizational structure

Our organization is comprised of a diverse group of engaged employees who work to ensure confidence in the Canadian financial sector. Led by our Superintendent, our organization consists of five sectors, as well as the OCA and the Internal Audit team.

Leadership and organizational structure - text description

- Peter Routledge, Superintendent

- Ben Gully, Deputy Superintendent, Supervision Sector

- Angie Radiskovic, Assistant Superintendent and Chief Strategy and Risk Officer

- Tolga Yalkin, Assistant Superintendent, Regulatory Response Sector

- Michelle Doucet, Assistant Superintendent, Chief Operating Officer, Corporate Services

- Kathy Thompson, Assistant Superintendent, National Security Sector

- Lissa Lamarche, Chief Audit Executive

- Assia Billig, Chief Actuary

Internal governance

Over the past two years, we redefined our governance structure, which ensures a stronger and more stable governance discipline to support an agile risk response, the delegation of decision-making authority, and our ability to take timely action within our risk appetite.

Our core governance committees

Executive Committee: Our senior governing body that supports the Superintendent and is responsible for defining our overall strategic planning and reporting. It also provides effective oversight of our operations.

Supervision and Policy Oversight Committee: Our governance body that provides strategic oversight of supervision and policy issues, supporting the Superintendent with prudential oversight for institutions and pension plans.

Management Oversight Committee: Our central advisory body that provides oversight on key internal administration and corporate matters.

Enterprise Risk Management Committee: Our risk committee that provides advice to the Superintendent and other committees on fulfilling risk oversight, challenge and monitoring.

Audit Support Office, Internal Audit

Departmental Audit Committee (DAC): Our advisory body that provides the Superintendent with objective and independent advice in the areas of governance, risk management, and internal control. The committee membership includes external experts who are familiar with private and public sector financial reporting. The DAC also offers the Superintendent feedback and suggestions on specific emerging priorities, concerns, risks, opportunities, and accountability reporting.

Organization details

How we work

We regulate and supervise institutions and pension plans. For institutions, we do this by applying our regulatory and supervisory frameworks that balance the goals of safety and soundness and allows institutions to function in a competitive marketplace. We also determine if pension plans are meeting minimum funding requirements and other requirements under the legislation.

Regulate

We develop rules, interpret legislation, and regulations; provide various regulatory approvals; and contribute to new accounting, auditing, and actuarial standards.

Supervise

We analyze financial and economic trends; assess financial conditions, non-financial, and material risks; and we evaluate the quality of governance, risk management, and compliance.

Who we work with

In Canada, the Financial Institutions Supervisory Committee works together to share information and discuss issues about supervising institutions. Chaired by our Superintendent, committee members include the Department of Finance, the Bank of Canada, the Canada Deposit Insurance Corporation, and the Financial Consumer Agency of Canada who meet at least quarterly.

To contribute to a strong global financial system, we actively participate with international organizations and forums in the development of international financial regulatory frameworks. For example, we work with international organizations including the Financial Stability Board, Basel Committee on Banking Supervision, and International Association of Insurance Supervisors.

Organizational context

The risk environment we operate in

In April 2023, we released our second Annual Risk Outlook (ARO), a publication that outlines what we see as the most significant risks facing Canada's financial system. Our ARO also informs Canadians about the supervisory and regulatory actions we plan to take in response to these risks. We published a semi-annual update to the ARO in the fall of 2023, highlighting the changing risk environment and providing an update of our planned actions and future policy expectations.

Our ARO for 2023-24 identified the following key risks:

Housing market downturn risk

Liquidity and funding risk

Commercial real estate risk

Transmission risk from the non-bank financial intermediaries sector

Corporate and commercial credit risk

Digital innovation risk

Climate risk

Cyber risk

Third-party risk

As the risk environment evolved throughout 2023-24, we continued to remain transparent and worked towards an effective risk response through our supervisory and regulatory actions.

OSFI's second Annual Risk Outlook highlights the significant risks facing Canada's financial system and informs Canadians about our regulatory and supervisory responses to these risks. As Canada's federal financial institutions' regulator, we promote sound risk management in the financial sector in a deliberate and proactive way to reinforce Canadians' confidence in our financial system.

Our key accomplishments

In 2023-24, we continued to focus on:

- modernizing our supervisory and regulatory frameworks

- simplifying and enhancing our data collection and analytical capabilities

- implementing our expanded mandate on integrity and security in the financial system

- building our operational resilience and implementing our Blueprint

Through these efforts, we have helped maintain confidence in the Canadian financial system with our agile supervisory and regulatory response to evolving risk landscapes.

Proactive supervisory activities

Director, Risk & Data Analytics

We supervise institutions to determine whether they are in sound financial condition and meeting regulatory and supervisory requirements. We assessed overall risk management practices of regulated institutions to determine if they are aligned to the evolving risk environment that they operate in.

The supervisory letter is our main written communication to institutions. The letters summarize recommendations, requirements, and key findings of our assessments with the purpose of enhancing controls and processes. In total, we issued over 368 supervisory letters in 2023-24, similar to the total number of letters we issued each year in the last several years. We conducted 38 supervisory reviews of credit risk management at institutions, which led to more than 100 recommendations. We also assessed 139 submissions with evidence of meeting outstanding recommendation requirements.

Continuing our practice of holding Colleges of Supervisors to promote dialogue across regulators, facilitate information sharing and strengthen the supervision of Canada's largest banks, in 2023-24, we hosted three supervisory colleges. We host colleges every year, with institutions participating on a rotating basis.

| Measures | 2021-22 | 2022-23 | 2023-24 |

|---|---|---|---|

| Number of reviews completed | Over 130 | Over 130 | 140 |

| Number of letters issued | 367 | 375 | 368 |

| Number of colleges hosted by OSFI | 4 | 7 | 3 |

New Supervisory Framework

In the most profound change to our supervisory approach in 25 years, we launched our new Supervisory Framework in February 2024, which came into force on April 1, 2024, to guide our supervision of institutions and pension plans. Based on an extensive development process that involved benchmarking and peer reviews, the new framework brings improvements that aim to better protect depositors, policyholders, institution creditors, and pension plan beneficiaries. To align effectively with the new framework, we upgraded our supervisory system of record in December 2023 to a new cloud-based application with enhanced functional changes.

Notable changes

Notable changes about the redesign of our new Supervisory Framework include:

- expanded risk rating scale to provide earlier indications of risk

- improved rating information about risk drivers, size, and complexity

- new risk assessment categories that differentiate between financial and non-financial risks

- use of data analytics to generate insights and provide signals of changes in risk levels to support more timely interventions

Supervision Institute

Director, Supervision Data and Analytics Insights, Supervision Institute

Our new Supervision Institute supports our supervisors in enhancing their skills, offering new or improved supervisory tools and practices, and new supervision technologies. In 2023-24, the Supervision Institute delivered a new onboarding program for supervisors and held a series of training sessions to prepare staff for the transition to the new Supervisory Framework. The training program supported the consistency of supervisory assessment and renewed the commitment to providing our supervisors with the supervision-specific knowledge, competencies, and tools they need to assess risk and intervene effectively.

OSFI will never rest easy when it comes to the role of supervision in promoting financial safety and soundness. Our supervisors are on the front line, verifying that Canada's federally regulated financial institutions and private pension plans are meeting mandatory regulatory expectations through effective corporate governance and sound risk management. We're working hard on transforming our approach to supervision that builds capability and is best suited for the changes in the risk environment.

Supervision quality assurance

We implemented supervisory quality assurance approaches, which included group rating committees and quality assurance reviews. This supported overall supervision renewal and sound risk management to improve the quality and consistency of prudential risk assessments and responses and also supported continuous improvements for supervisors.

Monitoring regulatory capital

We continuously monitor institutions' regulatory capital positions and respond in a timely manner to ensure that institutions are effectively managing risks and ensuring financial resiliency.

We launched a public consultation in July 2023 on the capital and liquidity treatment of crypto-asset exposures. The final guidance is expected to be issued in 2024-25 and aims to ensure banks and insurers hold adequate capital and have implemented the appropriate liquidity treatment for their crypto-asset exposures.

We also published the final Parental Stand-Alone (Solo) Total Loss Absorbing Capacity (TLAC) Framework in September 2023 for domestic systematically important banks (D-SIBs), and Parental Solo Capital Framework for life Internationally Active Insurance Groups (IAIGs), including the related reporting templates. The Solo TLAC and capital frameworks focus on the loss-absorbing capacity of the Canadian parent bank or Canadian parent operating life insurer, rather than its entire, consolidated operations. Doing so allows us to assess the stand-alone financial strength of the parent and its ability to act as source of strength for its subsidiaries and branches.

In addition, we published a revised Capital Adequacy Requirements Guideline in October 2023, establishing capital requirements for lenders. Changes require institutions to hold more capital for mortgages where payments do not cover the interest portion of the loan and, therefore, promote prudent allocation of capital against risks that lenders take.

Holly Long

Policy Analyst, Policy Development team

We also performed quarterly Life Insurance Capital Adequacy Test (LICAT) and Minimum Capital Test (MCT) reviews throughout 2023-24, evaluating insurers' understanding and interpretation of the updated insurance capital test post International Financial Reporting Standard 17 (IFRS 17). For life insurers, we also performed a capital sensitivity test to understand LICAT volatility post IFRS 17.

Finally, we published LICAT adjustments and clarifications to ensure consistent and appropriate interpretation of the updated capital guideline and its implementation under IFRS 17, with a focus on the new segregated fund guarantee capital approach. Two LICAT adjustments and clarifications were published by June 2023.

Effective regulation and stakeholder engagement

Our regulatory framework refers to the set of rules, guidelines, standards, and principles to regulate and supervise institutions and private pension plans. To ensure effective regulation, we have also continued to advance our stakeholder engagement activities.

Advancing our regulatory approach on non-financial risks

Effective identification, assessment, and monitoring of technology, governance, operational risk and other non-financial risks are important parts of our regulatory framework. Throughout 2023-24, we developed and updated supervisory expectations and tools to ensure alignment with new or revised non-financial risk guidelines, including technology and cyber, third party, operational resilience, culture and behaviour, and compliance. Notably:

-

We developed supervisory support information products and enabled meeting and forum participation to enhance clarity and develop understanding about digital topics. These include a scan of digital innovation work planned and actioned within institutions, establishing the Digital Innovation Forum and Open-Door Meetings, and refining our Digital Innovation and Impact Roadmap in July and October 2023.

- We supported the rollout of phase two of the third-party data call to identify and monitor third-party exposures and vulnerabilities.

Domestic stability buffer

The domestic stability buffer (DSB) decisions for June 2023 and December 2023 were supported by an assessment of systemic risks and vulnerabilities in the financial services sector. We also developed and published the DSB design framework in December 2023 to enhance transparency of the DSB decision-making process.

The domestic stability buffer is a usable capital buffer that supports the resilience of systematically important banks (SIBs). Semi-annual DSB decisions ensure SIBs build capital during periods of growth and subsequently have the capacity to withstand challenges during periods of stress. In addition, during stress periods, we can release or lower the buffer, offsetting volatility in the financial system and broader economy.

Real estate and housing

We continued to be vigilant in monitoring and addressing heightened risks in the real estate mortgage lending environment. This included monitoring the risk profile of federally regulated lenders' real estate secured lending (RESL) activities and reinforcing expectations on sound residential mortgage underwriting and account and portfolio management practices. To this end, we:

-

Undertook a B-20 consultation, which focused on debt serviceability measures given the increase in mortgage risk associated with the heightened level of indebtedness and the higher interest rate environment.

-

Pivoted from developing a macro to a micro-prudential loan-to-income (LTI) limit based on industry feedback. We established institution-specific LTI limits on the portfolios of federally regulated lenders for new uninsured real estate secured loans to address industry concerns on lender proportionality. The LTI limits will become effective at the commencement of an institution's fiscal year 2025. We held two industry sessions to discuss this LTI tool, and a backgrounder is available on our website. This stress test has proven to be a crucial risk mitigant against the increase in rates, elevated inflation, and the potential loss or reduction of borrower income, and the LTI limit acts a backstop to the stress test in periods of low interest rates.

-

Issued the RESL regulatory notice in March 2024 that underscored the need to proactively identify and address vulnerable accounts, portfolio segments, and concentrations (for example, variable rate, fixed-payment mortgages). We also ensured that forward-looking credit risk measurement, modelling, and stress testing processes were in place to estimate potential losses, and called for lenders to apply timely recognition of expected and unexpected losses due to account vulnerabilities or adverse shifts in the risk environment.

Partner engagement through public opinion research

In 2023-24, we explored opportunities for measuring and addressing gaps in stakeholder and partner engagement, which included key performance indicators. We collected feedback from financial institutions on their engagement experience with OSFI through various means, including the biennial Financial Institutions Survey (FIS).

For the 2023-24 FIS, we received a total of 99 completed surveys. Overall, satisfaction levels were positive with the majority (85%) of respondents providing a rating of ‘very satisfied' (43%) or ‘somewhat satisfied' (42%). Many respondents also cited cyber risk and IT (Information Technology) security as areas that should remain a top priority for us in the coming years.

The results of the survey provided us with valuable guidance on overall performance and opportunities for improvements with respect to recommendations, activities, communications, and processes.

Stakeholder affairs framework

Throughout 2023-24, we streamlined our approach to stakeholder affairs. This included the creation of a Stakeholder Relationship Management system as well as the development of tools, templates, strategies, communications and engagement plans, best practices, and processes. We developed an increasingly strategic lens for stakeholder engagement and leveraging strategic outreach and horizontal discussions on key issues.

Implementing our expanded mandate

Manager, Private Pension Plans

In Budget 2023, the Government of Canada introduced legislative amendments to expand our mandate, requiring OSFI to supervise institutions to determine whether they have adequate policies and procedures to protect themselves against threats to their integrity and security, including foreign interference. This expansion affirms that the financial system is vulnerable and can benefit from interventions. We moved swiftly to implement the mandate, including establishing the Emerging Risk Operations Directorate and the National Security Sector (NSS).

Since its formation in November 2023, the NSS has made substantial strides implementing the necessary foundational vision, authorities, technology, staff, and infrastructure to become fully operational. This also includes establishing relationships with non-traditional OSFI stakeholders and key intelligence organizations including the Communications Security Establishment and Public Safety Canada, and evolving our relationships with the Canadian Security Intelligence Service and the Financial Transactions and Reports Analysis Centre of Canada.

Integrity and Security guideline

To set expectations for integrity and security and highlight related expectations in existing guidelines, we issued a draft Integrity and Security guideline for public consultation. With the feedback provided, we published the final guideline in January 2024. The guideline sets out expectations for integrity and security policies and procedures to all institutions,Footnote 3 including foreign bank branches and foreign insurance company branches.Footnote 4

Modernized data and analytics

Our data platform enables analytical research and insight-generation while at the same time eliminating most ad hoc data requests to regulated institutions. Advancing data and analytics ensures efficiency and efficacy in our work through technological modernization and strategies. Notable accomplishments for 2023-24 follow.

Data Collection Modernization

We continued our work alongside our partners at the Bank of Canada and the Canada Deposit Insurance Corporation on the Data Collection Modernization (DCM) initiative with the goal of replacing our data collection technology and enhancing our regulatory data assets. In particular, we:

-

circulated the DCM launch letter to institutions and pension plans, received feedback from industry, and held conversations with associations

- held the first DCM industry webinar, with 525 attendees from institutions, pension plans, associations, and vendors

- initiated the multi-step procurement process to acquire the optimal vendor software to replace the current Regulatory Reporting System platform

- completed the current state data assessment to modernize regulatory data collection through opportunities in improved data quality and increased data collection

- rolled out data assessment work to all relevant Financial Information Committee business units and data subject matter experts, targeting completion and recommendations by spring 2024

As we approach the technology implementation phase for DCM, we will conduct a data assessment to better understand long-term data enhancements and opportunities for rationalization, enabling us to develop a holistic understanding and facilitate effective planning for both the short and long term.

Vision 2030

In 2023-24, we built towards our “Vision 2030” Data Strategy, a medium-to-long-term foundation for transforming the use of data and analytics. Our data management, data governance, data engineering, and advanced analytical capabilities were improved with new cloud technologies, enhanced governance processes and use cases.

Highlights of this work included:

-

Conducting research and internal consultation to develop the Vision 2030 strategy

- Establishing a three-year work plan and high-level roadmap to 2030 for implementation

- Embedding advanced data and analytics tools such as OpenAI in the new Technology Exploration Space release

Data literacy strategy

We made extensive progress developing our data literacy strategy, which will be launched in 2024-25. Our goals include building a strong foundational and advanced understanding of data literacy, and supporting the wide range of skills and experience of users across our organization. To this end, we provided tools and resources to assist employees in identifying relevant data literacy competencies, and identified four key objectives aimed at leveraging data effectively across our organization. These objectives aim to:

-

introduce the Data Literacy Competency Model

- establish a baseline on data literacy through Foundational Data Literacy Training

- incorporate the Data Literacy Competency Model into our human resource processes

- continue to build data literacy at OSFI

Sound risk management

As part of our transformation journey, we have developed our capabilities to assess and respond to our risk environment. Our effective risk management approach recognizes the interconnectivity of regulatory, supervisory, and operational commitments.

Risk analysis and reporting

We continued to develop our risk analysis and reporting capabilities and offered strategic insights to support decision-makers. Key achievements include the following:

-

We developed PowerApps to share visual data depictions of risk on dashboards, risk prioritization, research, and analytics enterprise-wide, which covered DSB vulnerability and risk indicators, external risks, corporate and commercial credit, structured finance, combined loan plan – home equity line of credit analysis, and credit bureau analytics

- We streamlined the collection of data processes for both external and internal sources of information

- We developed and implemented a geopolitical risk stress test for four internationally active insurance groups and six systematically important banks

- We designed and executed an artificial intelligence and quantum computing questionnaire in partnership with the Financial Consumer Agency of Canada to understand how the use of advanced tools has evolved in the financial services industry

Stress testing

Stress testing is achieved through a comprehensive examination of actions that banks would take under severe but plausible scenarios. These exercises provide important insights about systemic risks and inform policy actions and supervisory focus. In 2023-24, we completed an independent validation of the (internal) Risk Scenario Assessment Tool and implemented key enhancements identified in the validation report. We also conducted the 2023 macro stress test with 11 large and medium size banks using a severe stagflation scenario.

Enterprise risk management

In 2023-24, we articulated our enterprise risk management (ERM) vision, mandate, and risk appetite statement, which are the foundation for our decision making, operations, and infrastructure. We also made progress on an ERM framework and policy and a risk culture framework while working with stakeholders to strengthen our risk awareness and culture. We developed our ERM monitoring and testing approach, which sets out how we monitor risks and test the effectiveness of internal controls, along with raising risk awareness across the organization through training and information sharing. We also established committees and roundtables – both internally and externally – to exchange knowledge around ERM practices.

On March 26 and 27, 2024, we hosted the first International Financial Regulators Chief Risk Officer Roundtable in Toronto. The roundtable provided a forum for financial regulators to exchange insights and best practices related to managing internal risks they face that could impact the achievement of their mandates. This inaugural in-person event marked an important step in fostering collaboration and knowledge exchange within the global financial regulatory community.

International Financial Regulators Chief Risk Officer Roundtable

Superintendent Peter Routledge (centre) alongside financial regulators and OSFI staff

Office of the Chief Actuary

The Office of the Chief Actuary (OCA) works as an independent actuarial centre, preparing actuarial studies and reports and providing actuarial advice that enables sound decision making. The OCA prepared several actuarial reports tabled before Parliament by the President of the Treasury Board.

Jackie Ruan

Actuary, Social Insurance Programs

The OCA released the triennial Actuarial Report on the CPP as at 31 December 2021, which involved the projection of demographic and economic trends based on CPP revenues and expenditures over a 75-year period. The OCA commissioned an independent peer review of the CPP 31 report, the ninth review of this kind, and results were released early in fiscal year 2023-24. The independent panel's findings confirm that the work performed by the OCA on the report meets professional standards of practice and statutory requirements and that the assumptions and methods used are reasonable. The panel also found that the report fairly communicates the results of the work performed by the Chief Actuary and her staff.

The OCA also prepared the Actuarial Report on the Canada Student Financial Assistance Program. This report provides actuarial information to decision makers, parliamentarians, and the public. In addition, the OCA submitted various actuarial reports for the purpose of Public Accounts of Canada, presenting the obligations and costs, as at March 31, 2023, associated with federal public sector pension and benefit plans including future benefits to veterans. Actuarial reports that support Public Accounts of Canada are critical input for formulating the position of Public Accounts, and they provide assurance to the accountability mechanisms of government.

As part of its ongoing research, the OCA conducted an actuarial study in 2023-24 on climate change and how it may affect the plans and programs under the OCA's responsibility. The results will be published in 2024-25. In addition, the OCA staff collaborated in a joint study conducted by the International Actuarial Association and the International Social Security Association on actuarial considerations around climate-related risks on social security. The study will be published later in 2024.

Along with publishing actuarial reports and studies, the OCA assisted federal government departments with actuarial advice including:

-

Department of Finance

- Department of Justice

- Department of National Defence

- Employment and Social Development Canada

- Public Services and Procurement Canada

- Royal Canadian Mounted Police

- Treasury Board Secretariat

- Veterans Affairs Canada

In addition, during 2023-24 the OCA supported ad hoc requests for Immigration, Refugees and Citizenship Canada and Health Canada.

Enabling internal services

Our ability to achieve our core mandate and maintain operational resilience relies on a wide range of enabling functions, activities, and operations. Considerable accomplishments in 2023-24 are summarized below.

Human capital strategy

Manager, Privacy

Throughout 2023-24, we analyzed our environment to inform our 2024-27 Human Capital Strategy (HCS). We undertook several consultations to gather more insight into emerging themes, gaps, and risks, which lead to our five key areas of focus in the HCS, their desired outcomes, and the actions required to achieve them. The strategy reflects what we are doing to support our people and propel our culture journey forward, building on the important work completed through the first HCS and our supporting human resources strategies.

One area of focus in our HCS is to modernize our human capital management system, which is the digital application that underpins the management of our human resources. Doing this will allow us to gain efficiency for human resources business processes, improve the user experience for employees and managers, and deliver modern data and analytics capabilities, enabling better planning and decision-making. The human capital management system is expected to launch in 2025-26.

Official languages strategy

To foster a bilingual culture within OSFI, we launched our Official Languages (OL) strategy in February 2024 with a two-year OL Action Plan. This led to a series of office-wide activities, training, and enhanced resources to offer more support for employees to improve their language skills. Notable examples include OSFI's OL Week, Journée de la Francophonie, Rendez-vous de la Francophonie, the creation of an OL Hub with a repository of OL-related tools and resources to better support employee learning, and the launch of a new language exchange program to help employees improve their OL language skills.

Diversity, equity, and inclusion

To foster a diverse, equitable, and inclusive workplace, we advanced multiple Diversity, Equity and Inclusion (DEI) Action Plan items this year, which meets legislative requirements and, more importantly, reduces equity barriers for employees in meaningful ways. Notable highlights include:

-

advanced on 14 of 16 recommended actions (short- and medium-term initiatives) on our Accessibility Plan and we also published our Annual Progress Report

- reviewed our employment systems, policies, and practices and engaged in consultations with employees to identify barriers and develop recommendations to foster inclusivity

- established a Pay Equity Committee that developed an OSFI-specific job evaluation tool that establishes and evaluates job classes and gender predominance

- launched a sponsorship program for employment equity-designated groups, with the first cohort ending in February 2024

We have an Inclusion Network (IN) that brings together staff interested in promoting workplace inclusion and nurturing diversity of thought. The IN provides our organization with suggestions on issues that impact equity and equity-seeking groups. Various streams hosted regular events that were open to all employees regardless of membership in the network. In addition, the IN hosted activities for important and commemorative dates.

We also ran our first cohort of SponsorMe and MentorMe, two programs aimed at the development of employees, with 18 sponsor/protégé relationships created in the SponsorMe program. While MentorMe was made available to all employees, SponsorMe was created to support a limited number of candidates from employment equity designated groups and equity-seeking groups. As part of this program, which is modelled after the Government of Canada Mentorship Plus initiative, senior leaders actively advocated on behalf of their protégé and were involved in their career development.

Culture change

Building on our past culture change activities, we established a culture change action plan and vision that articulate our critical success factors of grit, urgency, and integrity. Additionally, to strengthen our capacity to prepare for and respond to organizational change in an increasingly dynamic environment, we also developed an Enterprise Change Management Framework.

Closing out our transformation journey

In December 2021, we announced our plans to launch a bold transformation journey, enabling us to respond to the evolving risk environment and position OSFI to thrive in uncertainty. Over the course of the last two years, we have made valuable progress and realized much of our transformation aspirations across six strategic initiatives:

Director, Application Services, IMIT

-

Culture and enablers

- Risk, strategy, and governance

- Policy innovation

- Strategic stakeholder and partner engagement

- Supervision renewal

- Data management and analytics

Given the success achieved in implementing these initiatives, coupled with the continuously evolving external environment, our transformation priorities were closed out as of March 31, 2024, so that we could focus on delivering on new strategic priorities. We will continue to build on the successes of our transformation initiatives as part of our everyday efforts and our goal of relentless improvement.

Key accomplishments of our transformation journey

Through our journey, we launched many projects across six strategic initiatives, transforming our organization and operating model to strengthen our ability to deliver on our mandate. By the end of 2023-24, most projects were nearing completion.

Key successes in our transformation journey

- Undertook a comprehensive update of the Supervisory Framework, which came into force on April 1, 2024, ensuring that it remains relevant, fit for purpose, and responsive to changes in risks within the Canadian financial system

- Refined the policy innovation and regulatory response vision to align with the evolving risk landscape

- Redesigned and launched a new internal governance structure focused on risk management and decision-making, adopting a three lines model in enterprise risk management

- Developed the stakeholder affairs framework, which guides our strategic approach to stakeholder and partner engagement and developed and tested a stakeholder engagement tracking and reporting tool

- Continued to advance our data strategy and laid the foundation to support enterprise functions with improved data and analytics capabilities

OSFI's legislated reporting requirements

Our legislated reporting expectations are set out in the Office of the Superintendent of Financial Institutions Act, the Bank Act, the Insurance Companies Act, the Trust and Loan Companies Act, the Cooperative Credit Associations Act, the Pension Benefits Standards Act, 1985 (PBSA, 1985) and the Pooled Registered Pension Plans Act.

DisclosureFootnote 5

Principal Analyst, Climate Risk Division

As part of our role in building confidence in the Canadian financial system, we promote active disclosure by publishing select financial information and providing institutions with advice guiding their own disclosures. To promote the disclosure of information of institutions, in March 2024 we published updates to the final Guideline B-15 on Climate Risk Management and Final Climate Risk Data return instructions. These instructions will ensure standardized climate-related data on emissions and exposures from institutions. The B-15 Guideline updates ensure that the expectations for institutions align with the International Sustainability Standards Board's final IFRS S2 Climate-related Disclosures standard and allow us to integrate climate-related risks into prudential supervision.

To support sound management practices, we also issued various standard policy instruments and guidelines in the following areas:

-

Culture and Behaviour Risk Guideline: We issued a draft Culture and Behaviour Risk Guideline in February 2023, and undertook a public consultation process in 2023-24. Following the consultation period, we will assess comments and feedback before issuing a final guideline.

-

Intelligence-led Cyber Resilience Testing (I-CRT) Framework: We issued our I-CRT Framework in April 2023 to help identify areas where the financial sector could be vulnerable to sophisticated cyber attacks. The I-CRT framework outlines a methodology and serves as an implementation guide for institutions conducting I-CRT assessments.Footnote 6

-

Guideline B-10 – Third-Party Risk Management and Guideline B-13 – Technology and Cyber Risk Management: We issued the final Guideline B-10 in April 2023, setting out OSFI's expectations for managing risks associated with third-party arrangements. We made consequential amendments to Guideline B-13 and Guideline B-10 in February 2024, providing clarification on foreign branches.

-

Commercial real estateregulatory notice: We issued a commercial real estate lending regulatory notice in September 2023 to reinforce and clarify risk management expectations.

-

Integrity and Security guideline: We issued a draft Integrity and Security guideline in September 2023 that included a public consultation process, and issued the final guideline in January 2024. This guideline augments our regulatory scope beyond traditional prudential risk management, recognizing that integrity and security can be related to financial instability and merit consideration and intervention. The guideline aligns to our new Supervisory Framework, and calls on institutions to proactively identify, address, and respond to these risks to be more resilient.

-

Guideline E-21 - Operational Risk and Resilience: We issued a draft revised Guideline E-21 in October 2023 and led a public consultation process (which closed February 2024). The draft revised Guideline E-21 aims to modernize our guidance on operational risk management and identifies new expectations for business continuity management, crisis management, change management, and data risk management. It also builds on consultations held in 2021 and supports Guideline B-13, Technology and Cyber Risk Management and Guideline B-10, Third-Party Risk Management.

-

Guideline B-20 - Residential Mortgage Underwriting Practices and Procedures: We issued a targeted regulatory notice on RESL in March 2024, reinforcing risk management expectations and complementing our B-20 Guideline.

Approvals

The Bank Act, the Trust and Loan Companies Act, and the Insurance Companies Act require institutions to seek regulatory approval from the Superintendent or the Minister of Finance before engaging in certain transactions. Regulatory approval is also required by persons wishing to incorporate an institution, and by foreign banks or foreign insurers wishing to establish a presence or to make certain investments in Canada.

In 2023-24, we processed 112 applications of this nature: 108 were approved and four were withdrawn.

Within the applications, 231 approvals were granted. The Minister of Finance granted 80 approvals and the Superintendent granted 151 approvals.

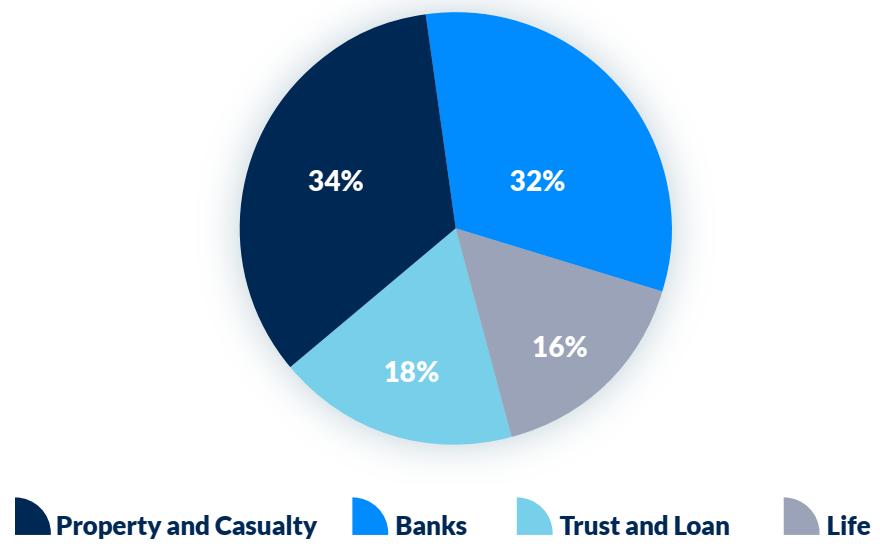

Breakdown of approvals granted by industry - text description

| Industry | % of approvals granted |

|---|---|

| Property and casualty | 34% |

| Banks | 32% |

| Life | 16% |

| Trust and loan | 18% |

Pension Benefits Standards Act, 1985

40 (1) The Superintendent shall, after consultation with the Chief Actuary of the Office of the Superintendent of Financial Institutions and as soon as possible after the end of each fiscal year, submit to the Minister a report on (a) the operation of this Act during that year; and (b) the success of pension plans in meeting the funding requirements, determined in accordance with section 9, and the corrective measures taken or directed to be taken to deal with any pension plans that are not meeting the funding requirements.

Our supervision activities, such as monitoring minimum funding requirements under the PBSA, 1985, increase transparency and confidence in Canada's retirement income system and its sustainability. We intervene to protect pension plan members' benefits first by clearly communicating expectations directly with plan administrators and employers and then, if necessary, exercising our powers to enforce legislative requirements.

| Indicators | Type | As at March 31, 2023 | As at March 31, 2024 |

|---|---|---|---|

| Number of Plans | Defined BenefitTable 2 Footnote 1 | 240 | 239 |

| CombinationTable 2 Footnote 2 | 117 | 115 | |

| Defined ContributionTable 2 Footnote 3 | 823 | 830 | |

| Total | 1,180 | 1,184 | |

| Active Membership | Defined Benefit | 161,800 | 166,200 |

| Combination | 352,500 | 378,400 | |

| Defined Contribution | 168,100 | 180,700 | |

| Total | 682,400 | 725,300 | |

| Other Beneficiaries | Defined Benefit | 226,600 | 230,100 |

| Combination | 310,800 | 314,500 | |

| Defined Contribution | 27,100 | 29,000 | |

| Total | 564,500 | 573,600 | |

| Assets ($ millions) | Defined Benefit | 102,200 | 104,044 |

| Combination | 124,900 | 130,456 | |

| Defined Contribution | 10,700 | 11,227 | |

| Total | 237,800 | 245,727 | |

|

Table 2 Footnotes

|

|||

We develop guidance on risk management and mitigation, assess whether pension plans are meeting their funding requirements and managing risks effectively, and intervene promptly if we identify a need for corrective action. Administrators are ultimately responsible for sound and prudent management of their pension plans.

Interventions

In 2023-24, 252 pension plans failed to meet the minimum funding requirements under the PBSA, 1985, either because negotiated contributions were insufficient or required contributions were outstanding for over 30 days. We issued letters to employers who failed to pay contributions on time, notifying them of their obligation to remit required contributions. For six of these pension plans, despite our efforts, required contributions remained outstanding for an extended period. We intervened in these cases by either issuing a notice of intent to issue a direction of compliance or by issuing a direction of compliance. Following these interventions, one pension plan remitted all outstanding contributions, with interest, and we continue to work with the other five pension plans to ensure minimum funding requirements are met.

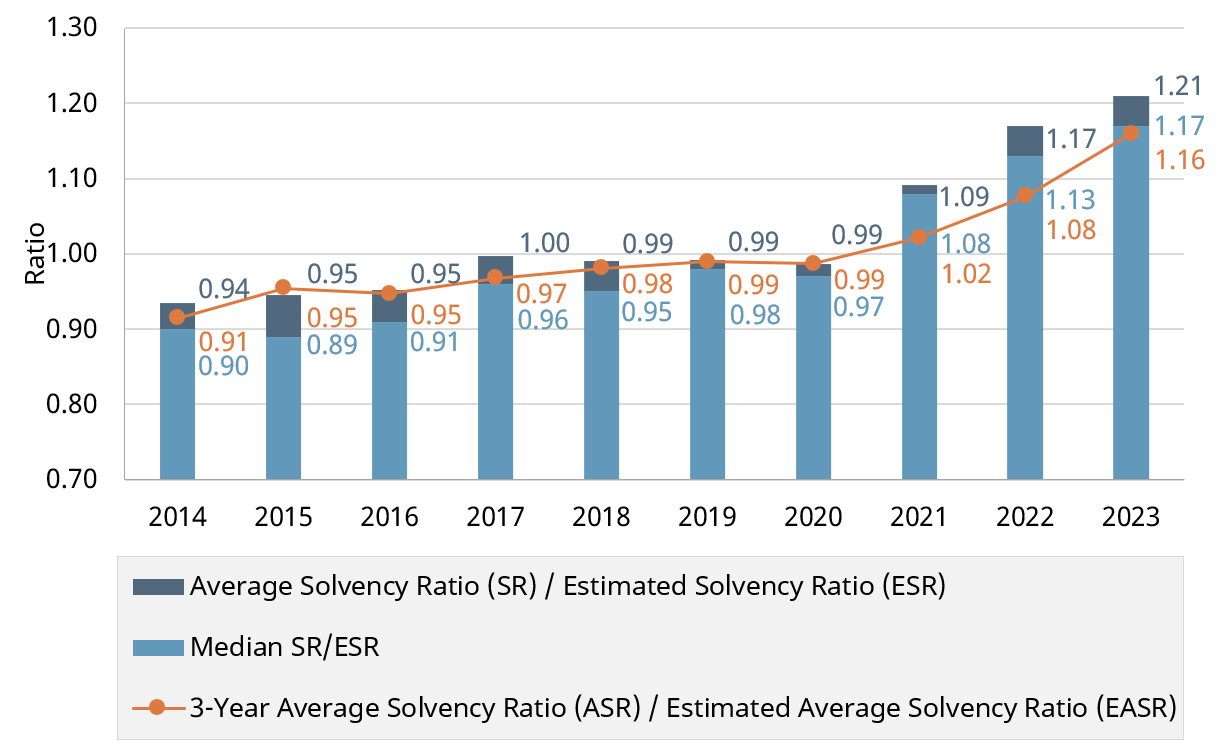

The median solvency ratio of pension plans increased to 1.17 at the end of 2023, up from 1.13 at the end of 2022. Figure 2 below shows the evolution of the solvency position since 2014. As of December 31, 2023, 89% of pension plans with defined benefit provisions were fully funded. The percentage of underfunded plans decreased (11% in 2023 versus 17% in 2022). All underfunded pension plans are designated plans, the funding of which is limited by the Income Tax Regulations.

Solvency position of pension plans as at December 31 - text description

| December 31 (Year) | Average SR/ESR | Median SR/ESR | 3-Year ASR/EASR |

|---|---|---|---|

| 2014 | 0.94 | 0.90 | 0.91 |

| 2015 | 0.95 | 0.89 | 0.95 |

| 2016 | 0.95 | 0.91 | 0.95 |

| 2017 | 1.00 | 0.96 | 0.97 |

| 2018 | 0.99 | 0.95 | 0.98 |

| 2019 | 0.99 | 0.98 | 0.99 |

| 2020 | 0.99 | 0.97 | 0.99 |

| 2021 | 1.09 | 1.08 | 1.02 |

| 2022 | 1.17 | 1.13 | 1.08 |

| 2023 | 1.21 | 1.17 | 1.16 |

Actuarial reports

In 2023-24, 245 actuarial reports were filed with OSFI. In-depth reviews of selected reports raised questions on certain actuarial assumptions and enabled enforcement of compliance with legislation and guidance. We communicate issues revealed during in-depth reviews to pension plan actuaries, particularly when these concerns have an impact on current and future funding requirements. As a result of our interventions, some pension plans amended and re-submitted their actuarial reports.

Examinations

During 2023-24, we conducted five standard desk reviews and a thematic review on investment risk management for seven pension plans. Findings and recommendations relate to governance documents and self-assessment, performance monitoring of service providers, compliance with the statement of investment policies and procedures, and risk management.

Pension plan approvals and guidance

Pension plans are required to obtain the approval of the Superintendent for various types of transactions, including registrations, terminations, asset transfers, surplus refunds, and accrued benefits reductions. In the fiscal year 2023-24, we:

-

registered 11 new pension plans, nine of which were defined contribution plans

- approved 13 plan termination reports

- authorized four defined benefit asset transfer requests

In total, 31 pension plan transactions were submitted for approval in 2023-24, compared to 40 in the previous fiscal year. We processed 33 applications and successfully met our service standard for pension plan approvals.

Pooled Registered Pension Plans Act

78 The Superintendent must, as soon as feasible after the end of each fiscal year, submit to the Minister a report on the operation of this Act during that year, and the Minister must cause the report to be laid before each House of Parliament on any of the first 15 days on which that House is sitting after the day the Minister receives it.

Under the Pooled Registered Pension Plans Act, the Superintendent is responsible for licensing pooled registered pension plans (pooled plans) administrators, registering pooled plans, and conducting ongoing supervision of pooled plans. At the end of 2023, there were five pooled plans, covering 17 employers and 187 members. The total value of investments was $1.5 million.

Guidance and newsletters

During the fiscal year 2023-24 reporting period, we published guidance documents for pension plans, which among other instructions, encompassed the following areas.

-

We released two editions of our newsletter called InfoPensions in May and November 2023. These newsletters served as a valuable communication tool, providing important announcements, reminders, and descriptions of how we apply pension legislation and its guidance.

- We published the revised Instruction Guide for the Preparation of Actuarial Reports for Defined Benefit Pension Plans. This guide reflects our updated expectations regarding the maximum going concern discount rate and updated references to the 2020 Agreement Respecting Multi-Jurisdictional Pension Plans, OSFI instruction guides and Canadian Institute of Actuaries educational notes regarding pension plans.

- We published the Instruction Guide for Asset Transfers related to Defined Contribution Provisions of Pension Plans. This guidance informs the pension industry of our expectations on certain asset transfers and filing requirements.

- We published a draft Advisory for Technology and Cyber Security Incident Reporting for consultation, describing our expectations for reporting technology and cyber security incidents that affect FRPPs.

Looking forward

Senior Analyst, Risk and Data Analytics

As we reflect on fiscal year 2023-24, there are many accomplishments to celebrate. We successfully transformed our organization by developing agile functions and capabilities while strengthening our culture and ability to thrive in uncertainty. These efforts have enabled us to pivot effectively in response to Parliament's changes to our mandate to ensure that institutions establish policies and procedures to safeguard themselves against threats to their integrity and security, including foreign interference.

While our 2022-25 Blueprint and Strategic Plan was fulfilled a year earlier than expected, change is a constant at OSFI. Our organization has evolved over the past few years in so many ways – in capacity, mandate, and strategic priorities, supporting the need for a new forward-looking plan.

Our new 2024-27 Strategic Plan came into effect on April 1, 2024, outlining a new set of six priorities to guide us over the next three years. Some of these priorities build on transformed functions, while others represent new areas of focus. We will continue to supervise and regulate institutions and pension plans by focusing on sound risk management, thereby supporting the stability and safety of the financial system and contributing to public confidence in the Canadian financial system.

Key priorities for 2024-25 and beyond

Our 2024-27 Strategic Plan has six new strategic priorities and targeted outcomes as described below, towards which we will strive over the next three years.

-

Expanded mandate – Integrity and security regime

Outcome: our supervisory and regulatory framework will help ensure institutions address risks to their integrity and security.

-

Supervisory renewal

Outcome: we have the capacity and capability to provide effective supervisory actions and timely intervention that are supported by a mature, risk-based supervisory framework.

-

Culture initiatives

Outcome: our employees thrive in an ever-changing and uncertain environment and embrace our critical success factors of grit, integrity, and urgency in all aspects of their daily work.

-

Data management and analytics

Outcome: we maintain leading-edge data management, collection, and analytical capabilities and systems.

-

Critical functions

Outcome: we respond to uncertainty and emerging risks to ensure institutions are in sound financial condition. We also determine if pension plans are meeting minimum funding and other requirements under the legislation, and help to ensure that social security programs and insurance arrangements remain sustainable for Canadians.

-

Operational resilience

Outcome: we're able to deliver critical functions despite adversity and uncertainties and remain agile in our response to current and emerging threats and opportunities.

2023-24 Financial overview

Financial review and highlights

We are funded mainly through assessments on the institutions and pension plans that we regulate and a user-pay program for legislative approvals and other select services.

The amount charged to individual institutions is set out in regulations for our main activities:

-

risk assessment and intervention (supervision)

- approvals and precedents

- regulation and guidance

In general, our system is designed to allocate costs based on the approximate amount of time spent supervising and regulating each industry. Costs are then assessed to individual institutions within an industry based on the applicable formula for the industry and the size of the institution. Staged institutionsFootnote 7 are assessed a surcharge on their base assessment, approximating the extra supervision resources required.

In addition to our annual financial statements, we publish quarterly financial statements.

We also receive revenues for cost-recovered services. These include revenues from federal Crown corporations such as the Canada Mortgage and Housing Corporation, which OSFI supervises under the National Housing Act, provinces for which we provide supervision of their institutions on contract, and revenues from other federal organizations to which we provide administrative services.

We collect administrative monetary penalties from financial institutions when they contravene a provision of a financial institutions act and are charged in accordance with the Administrative Monetary Penalties (OSFI) Regulations. These penalties are collected and remitted to the Consolidated Revenue Fund. By regulation, we cannot use these funds to reduce the overall assessment costs for the industries we regulate.

The OCA provides a range of actuarial valuation and advisory services, under the Canada Pension Plan Act and the Public Pensions Reporting Act to the CPP and some federal government entities, including the provision of advice in the form of reports tabled in Parliament. These services are funded by fees charged to either the underlying pension plan or the federal government entity to which advisory services are provided, and by a parliamentary appropriation.

Significant activities for 2023-24

During 2023-24, we continued to implement the transformational changes outlined in our Blueprint for OSFI's Transformation 2022-25. The Blueprint articulated the direction for a transformation of OSFI that takes into account a rapidly changing risk environment and is aimed to ensure that we continue to contribute to confidence in Canada's financial system.

We also continued to implement the 2022-25 Strategic Plan that built upon the vision of the Blueprint and established our goals and priorities for the 2022-25 period. It presented six priority initiatives:

-

Culture

- Risk Strategy and Governance

- Strategic Stakeholder and Partner Engagement

- Policy Innovation

- Supervisory Framework

- Data Management and Analytics

The implementation of these plans led to the growth in both personnel and spending seen during 2023-24.

In addition to these initiatives, on June 22, 2023, Parliament passed Bill C-47, the Budget Implementation Act (BIA), which expanded our mandate. These changes complement our existing purpose which is to contribute to public confidence in the Canadian financial system.

The OSFI-related amendments in the BIA add to the suite of compliance and intervention tools available to the Superintendent and the Minister of Finance. These changes will enhance the strong oversight of institutions that underpins a sound and stable Canadian financial system.

Starting January 1, 2024, institutions are required to have and adhere to adequate policies and procedures to protect themselves from threats to their integrity and security, including foreign interference. We will examine each institution's policies and procedures to determine if they are adequate and will annually report on these examinations to the Minister of Finance.

Our financial statements for the 2023-24 fiscal year can be found in Annex A.

Our total costs were $311.7 million, a $68.9 million or 28.4% increase from the previous year. Personnel costs, OSFI's largest expense, rose by $59.3 million, or 31.4%. This variance reflects an increase in the number of full-time equivalent employees in accordance with the new strategic plan, expanded mandate, and normal economic and merit increases. Professional services costs increased by $6.3 million or 26.4% as OSFI implemented the initiatives outlined in the Blueprint and Strategic plan. Rental costs increased by $1.7 million or 10.7% because of increased software licensing fees related to full-time equivalent (FTE) growth. Information costs increased by $1.1 million or 49.5% because of increased data access charges to support OSFI's increased risk monitoring activities. All other costs, in total, remained stable.

OSFI's FTE count in 2023-24 was 1,315, a 28.4% increase from the previous year.

Institutions

Revenues

Total revenues from institutions were $287.3 million, an increase of $64.5 million or 29.0% from the previous year. Base assessments on institutions, which are recorded at an amount necessary to balance revenue and expenses after all other sources of revenue are considered, increased by $63.4 million or 28.7% from the previous year.

Revenue from user fees and charges increased by $0.6 million or 81.6% because of an increase in the number of surcharge assessments for staged institutions.

Revenue from cost-recovered services increased by $0.5 million or 42.0% because of an increase in the amount of work done for federal crown corporations.

Costs

Total costs attributed to institutions were $287.3 million, an increase of $64.5 million or 29.0% from the previous year. The increase is primarily due to higher costs in the following categories: personnel ($56.8 million), professional services ($5.6 million), information ($1.2 million), and rentals ($1.7 million), as explained above.

Pension Plans

Assessments

Our costs to regulate and supervise private pension plans are recovered from an annual assessment charged to plans based on the number of beneficiaries. Plans are assessed upon applying for registration under the PBSA, 1985 and annually thereafter.

The assessment rate is established based on our estimate of current year costs to supervise these private pension plans, adjusted for any accumulated excess or shortfall of assessments in the preceding years. The estimate is then divided by the anticipated number of assessable beneficiaries to arrive at a base fee rate. The rate established for 2023-24 was $11.00 per assessable beneficiary, up from $10.00 the previous year. Total fees assessed during the fiscal year were $8.0 million ($7.2 million in 2022-23) whereas total fees recognized as revenue in 2023-24 were $7.6 million (up from $5.6 million in 2022-23). The difference between revenue recognized and fees assessed gives rise to unearned assessments, as discussed below.

The excess or shortfall of assessments in any particular year is amortized over five years in accordance with the assessment formula set out in regulations whereby the annual shortfall or excess is recovered or returned to the private pension plans over a period of five years commencing one year from the year in which they were established through an adjustment to the annual fee rate. The rate established and published in the Canada Gazette in September 2023 for 2024-2025 is set at $11.00 per assessable beneficiary, unchanged from 2023-2024. OSFI anticipates that the rate for 2024-25 will fully recover the estimated annual costs of this program; however, variations between actual and estimated costs or private pension plan beneficiaries in any particular year will cause an excess or shortfall of assessments.

Costs

The cost of administering the PBSA, 1985 for 2023-24 was $7.6 million, an increase of $1.9 million or 34.6% from the previous year. Costs were lower than normal in 2022-23 due to vacancies in the pension division caused by retirements and employee turnover. As those vacancies have been filled, costs are returning to expected levels.

| Fiscal year | 2018-2019 | 2019-2020 | 2020-2021 | 2021-2022 | 2022-2023 | 2023-2024 |

|---|---|---|---|---|---|---|

| Assessments | 5,612 | 6,295 | 7,131 | 7,093 | 7,223 | 8,015 |

| Costs | 6,664 | 6,646 | 7,175 | 7,351 | 5,613 | 7,556 |

| Basic fee rateTable 3 Footnote * per assessable beneficiary | 8.00 | 9.00 | 10.00 | 10.00 | 10.00 | 11.00 |

|

Table 3 Footnotes

|

||||||

Actuarial Valuation and Advisory Services

The OCA is funded by fees charged for actuarial valuation and advisory services and by an annual parliamentary appropriation. Total expenses in 2023-24 were $16.9 million, an increase of $2.5 million, or 17.1%, from the previous year due primarily to an increase in the number of full-time equivalent employees in accordance with the new strategic plan, normal economic and merit increases, and an increase in associated overhead costs.

Statement of management responsibility including internal control over financial reporting

Responsibility for the integrity and objectivity of the accompanying financial statements for the year ended March 31, 2024 and all information contained in these statements rests with the management of the Office of the Superintendent of Financial Institutions (OSFI). These financial statements have been prepared by management using the Government of Canada’s accounting policies, which are based on Canadian public sector accounting standards.

Management is responsible for the integrity and objectivity of the information in these financial statements. Some of the information in the financial statements is based on management’s best estimates and judgment, and gives due consideration to materiality. To fulfill its accounting and reporting responsibilities, management maintains a set of accounts that provides a centralized record of OSFI’s financial transactions. Financial information submitted in the preparation of the Public Accounts of Canada, and included in OSFI’s Departmental Results Report, is consistent with these financial statements.

Management is also responsible for maintaining an effective system of internal control over financial reporting (ICFR) designed to provide reasonable assurance that financial information is reliable, that assets are safeguarded and that transactions are properly authorized and recorded in accordance with the Financial Administration Act and other applicable legislation, regulations, authorities and policies.

Management seeks to ensure the objectivity and integrity of data in its financial statements through careful selection, training, and development of qualified staff; through an organizational structure that provides appropriate divisions of responsibility; through communication programs aimed at ensuring that regulations, policies, standards, and managerial authorities are understood throughout OSFI; and through conducting an annual assessment of the effectiveness of the system of ICFR.

The system of ICFR is designed to mitigate risks to a reasonable level based on an on-going process to identify key risks, to assess effectiveness of associated key controls, and to make any necessary adjustments.

Under the responsibility of the Chief Financial Officer, a risk based assessment of the system of ICFR for the year ended March 31, 2024 was completed in accordance with the Treasury Board Policy on Financial Management and the results and action plans are summarized in the annex.

The effectiveness and adequacy of OSFI’s system of internal control is reviewed by the internal audit staff, who conduct periodic risk based audits of different areas of OSFI’s operations, and by OSFI’s Audit Committee, which oversees management’s responsibilities for maintaining adequate control systems and the quality of financial reporting, and which reviews and provides advice to the Superintendent on the audited financial statements.

Deloitte LLP has audited the financial statements of OSFI and reports on their audit to the Minister of Finance. This report does not include an audit opinion on the annual assessment of the effectiveness of OSFI’s internal controls over financial reporting.

Michael Hammond CPA, CGA

Chief Financial Officer

Peter Routledge

Superintendent of Financial Institutions

Ottawa, Canada

July 4, 2024

Independent auditor’s report

To the Superintendent of Financial Institutions and the Minister of Finance

Opinion

We have audited the financial statements of the Office of the Superintendent of Financial Institutions (“OSFI”), which comprise the statement of financial position as at March 31, 2024, and the statements of operations, changes in net financial assets and cash flow for the year then ended, and notes to the financial statements, including a summary of significant accounting policies (collectively referred to as the “financial statements”).

In our opinion, the accompanying financial statements present fairly, in all material respects, the financial position of OSFI as at March 31, 2024, and the results of its operations and its cash flows for the year then ended in accordance with Canadian public sector accounting standards (“PSAS”).

Basis for opinion

We conducted our audit in accordance with Canadian generally accepted auditing standards (“Canadian GAAS”). Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are independent of OSFI in accordance with the ethical requirements that are relevant to our audit of the financial statements in Canada, and we have fulfilled our other ethical responsibilities in accordance with these requirements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Responsibilities of management and those charged with governance for the financial statements

Management is responsible for the preparation and fair presentation of the financial statements in accordance with Canadian accounting standards for public sector, and for such internal control as management determines is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the financial statements, management is responsible for assessing OSFI’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless management either intends to liquidate OSFI or to cease operations, or has no realistic alternative but to do so.

Those charged with governance are responsible for overseeing OSFI’s financial reporting process.

Auditor’s responsibilities for the audit of the financial statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with Canadian GAAS will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these financial statements.

As part of an audit in accordance with Canadian GAAS, we exercise professional judgment and maintain professional skepticism throughout the audit. We also:

- Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control.

- Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of OSFI’s internal control.

- Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by management.

- Conclude on the appropriateness of management’s use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on OSFI’s ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditor’s report to the related disclosures in the financial statements or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our auditor’s report. However, future events or conditions may cause OSFI to cease to continue as a going concern.

- Evaluate the overall presentation, structure and content of the financial statements, including the disclosures, and whether the financial statements represent the underlying transactions and events in a manner that achieves fair presentation.

We communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that we identify during our audit.

Deloitte LLP

Chartered Professional Accountants

Licensed Public Accountants

July 4, 2024

Financial statements: March 31, 2024

| Note(s) | 2024 | 2023 | |

|---|---|---|---|

| Financial assets | |||

| Cash entitlement | no data | $72,958 | $73,622 |

| Trade and other receivables, net | 4, 5 | 7,366 | 9,367 |

| Accrued base assessments | 4 | 16,901 | no data- |

| Total financial assets | no data | 97,225 | 82,989 |

| Financial liabilities | |||

| Accrued salaries and benefits | 12 | 59,268 | 42,636 |

| Trade and other payables | 5,12 | 8,337 | 8,946 |

| Unearned base assessments | 12 | no data- | 2,085 |

| Unearned pension plan assessments | 12 | 2,644 | 2,185 |

| Deferred revenue | no data | 415 | 244 |

| Employee benefits - severance | 7 | 4,563 | 4,418 |

| Employee benefits - sick leave | 7 | 13,464 | 12,805 |

| Total financial liabilities | no data | 88,691 | 73,319 |

| Net financial assets | no data | 8,534 | 9,670 |

| Non-financial assets | |||

| Tangible capital assets | 6 | 14,601 | 13,728 |

| Prepaid expenses | no data | 2,545 | 2,282 |

| Total non-financial assets | no data | 17,146 | 16,010 |

| Accumulated surplus | 13 | $25,680 | $25,680 |

| Contingencies | 11 | no data | no data |

The accompanying notes form an integral part of these financial statements.

Michael Hammond CPA, CGA

Chief Financial Officer

Peter Routledge

Superintendent of Financial Institutions

| Note(s) | Budget 2023‑24 | 2024 | 2023 | |

|---|---|---|---|---|

| Regulation and supervision of federally regulated financial institutions | ||||

| Revenue | no data | $269,764 | $287,258 | $222,745 |

| Expenses | no data | 269,764 | 287,258 | 222,745 |

| Net results before administrative monetary penalties revenue | no data | no data- | no data- | no data- |

| Administrative monetary penalties revenue | 9 | 50 | 68 | 5 |

| Administrative monetary penalties revenue earned on behalf of the Government | no data | (50) | (68) | (5) |

| Net results | no data | no data- | no data- | no data- |

| Regulation and supervision of federally regulated private pension plans | ||||

| Revenue | no data | 7,534 | 7,556 | 5,613 |

| Expenses | no data | 7,534 | 7,556 | 5,613 |

| Net results | no data | no data- | no data- | no data- |

| Actuarial valuation and advisory services | ||||

| Revenue | no data | 15,858 | 15,663 | 13,194 |

| Expenses | no data | 17,102 | 16,907 | 14,438 |

| Net results | no data | (1,244) | (1,244) | (1,244) |

| Net results from operations before government funding | no data | (1,244) | (1,244) | (1,244) |

| Government funding | 5 | 1,244 | 1,244 | 1,244 |

| Surplus from operations | no data | $ no data- | $ no data- | $ no data- |

The accompanying notes form an integral part of these financial statements.

| Note | Budget 2023‑24 | 2024 | 2023 | |

|---|---|---|---|---|