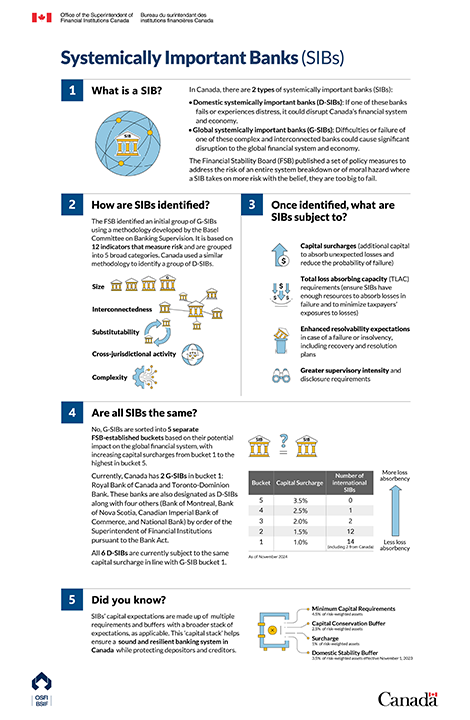

Systemically important banks

A domestic systemically important bank (D-SIB) that fails or experiences distress could disrupt Canada’s financial system and economy.

The failure of a global systemically important bank (G-SIB) could have a significant impact on the global financial system and economy since G-SIBs are large, complex, and interconnected with other global banks.

Identifying systemically important banks

The Basel Committee on Banking Supervision applies a set of risk indicators to assess the requirements for banks.

For D-SIBs, the bank-specific indicators are grouped into four categories:

- Size – how big is its share of domestic banking activity

- Substitutability – how easily can it be replaced as a market participant and financial service provider

- Complexity – how many different services does it offer

- Interconnectedness – how connected is it to other financial institutions

For G-SIBs, a fifth category is added:

- Cross-jurisdictional activity – how much activity does it undertake in other financial jurisdictions

Canada’s systemically important banks

Canada has 6 D-SIBs:

-

Bank of Montreal

- Bank of Nova Scotia

- Canadian Imperial Bank of Commerce

- National Bank of Canada

- Royal Bank of Canada

- Toronto-Dominion Bank

The Royal Bank of Canada and Toronto-Dominion Bank are also considered G-SIBs.

D-SIBs have stricter requirements than other banks in Canada, including:

-

capital absorbency (for example, the domestic stability buffer applies to these banks)

- disclosure

- supervisory expectations

This higher level of supervision helps to ensure that these banks remain prudentially sound to protect the Canadian financial system.

At a global level, G-SIBs have even stricter requirements and higher levels of supervision to ensure they remain prudentially sound to protect the global financial system.