InfoPensions – Issue 30 – May 2024

InfoPensions includes announcements and reminders on matters relevant to federally regulated pension plans including pooled registered pension plans. To receive email notifications of new items posted to our website, including this newsletter and other pension-related documents, please subscribe using Email Notifications.

If you have any questions about the articles you read in InfoPensions or if you have suggestions for future articles, please contact us at Pension-Retraite@osfi-bsif.gc.ca. We expect to publish the next issue of InfoPensions in November 2024.

For general enquiries, including pension-related questions, please contact us at information@osfi-bsif.gc.ca. If you prefer to contact us by telephone, by fax, or by mail, please refer to the contact information on our website.

Table of contents

Supervision

Supervisory framework renewal

On April 1, 2024, our new Supervisory Framework for federally regulated pension plans (FRPPs) and federally regulated financial institutions (FRFIs) came into effect. We held an information session for plan administrators and pension industry stakeholders on February 5, 2024.

As mentioned in InfoPensions 29, the new framework represents a comprehensive update to how we supervise FRPPs and FRFIs and recognizes the specific nature of the different industries we regulate. Supervisory judgement will continue to be a core part of our approach to risk-based and principles-based supervision.

The changes in our Supervisory Framework require no action by FRPP administrators. You can read more about our new approach to supervision on our website.

Pension plan liquidity survey

We surveyed the plan administrators of select large (by plan assets) federally regulated pension plans (FRPPs) in October 2022, and then again in April 2023 with an expanded survey. The aim of these surveys was to better understand their FRPP's exposures to leverage and associated liquidity risks. We received 43 survey responses, and here are the key findings of our analysis:

- Most respondents reported some exposure to leverage: embedded leverage (84%), synthetic leverage (60%), and financial leverage (32%)

- Use of direct leverage is correlated with plan size

- Use of indirect leverage is uniformly observed across pension plans

- 68% of respondents reported using securities financing transactions (SFTs)

- Use of SFTs is primarily for hedging pension liabilities, achieving a desired asset mix and enhancing investment returns

- Strategies related to securities lending (52%) and repurchase agreements (44%) are the most frequently used

- 60% of respondents reported direct exposure to synthetic leverage through derivatives

- Use of derivatives is primarily for managing currency/foreign exchange exposures

- Derivatives strategies related to forwards (37%) and swaps (35%) are the most frequently used

- Risk measurement through monitoring is performed by adopting several techniques

- Measurement and monitoring of asset sensitivities to changes in market risk factors and other variables (92%)

- Liquidity monitoring (80%)

- Stress testing of assets (76%)

Our analysis revealed that there are no material concerns of liquidity risk exposures for most FRPPs surveyed. However, we will be conducting further analysis on a small subset. Additionally, we observed a gap between measures of leverage reported compared to value of imputed leverage (for example, gross economic exposure). This gap could be explained by a lack of data and the absence of a standard industry definition on leverage.

Guidance and legislative matters

The Government of Canada's 2023 Fall Economic Statement

On November 21, 2023, the federal government announced several initiatives involving federally regulated pension plans (FRPPs) in the 2023 Fall Economic Statement (FES).

The FES announced that:

- The federal government will work collaboratively with Canadian pension funds to create an environment that encourages and identifies more opportunities for investments in Canada by pension funds and by other responsible investment pools, while helping to deliver secure pensions for Canadians.

- To improve transparency, the federal government proposes to require large FRPPs to disclose how they distribute their investments, both by jurisdiction and asset-type per jurisdiction, to the OSFI. In addition, this information will be made publicly available, and the federal government will engage with provinces and territories to discuss similar disclosures by Canada's largest pension plans in a simple and uniform format.

- The federal government will explore removing the "30% rule" from investments in Canada. The 30% rule restricts Canadian pension funds from holding more than 30% of the voting shares of most corporations.

The FES also communicated that the federal government has been advancing measures to require disclosures of crypto-asset exposures from FRPPs (as announced in Budget 2023: A Made-in-Canada Plan: Strong Middle Class, Affordable Economy, Healthy Future). As most of Canada's largest pension plans are provincially regulated, the federal government is also engaging provinces in this work and encouraging them to require these plans to disclose their crypto-asset exposures.

Please direct any questions regarding the FES to the Department of Finance Canada.

Government of Canada's Budget 2024

On April 16, 2024, the federal government released Budget 2024: Fairness for every generation (Budget 2024), which includes proposed initiatives involving federally regulated pension plans (FRPPs).

Budget 2024 announced that the federal government:

- Working with pension plans, will create a working group, to explore how to catalyze greater domestic investment opportunities for Canadian pension funds. The working group will be led by Stephen Poloz (former Governor of the Bank of Canada) and supported by the Deputy Prime Minister and Minister of Finance. Efforts of this group will focus on areas such as:

- digital infrastructure and AI investment;

- physical infrastructure;

- airport facilities;

- venture capital investments;

- building more homes, including on public lands; and,

- the removal of the 30 per cent rule for domestic investments.

- Proposes to amend the Pension Benefits Standards Act, 1985 to enable and require OSFI to publish information related to the investments of large FRPPs. The information to be disclosed would be set out in regulations and would include the distribution of plan investments by jurisdiction and, within each jurisdiction, by asset class.

- Will engage with provinces and territories to discuss similar disclosures by Canada’s largest pension plans in a simple and uniform format. This was previously communicated in the 2023 Fall Economic Statement.

- Proposes to amend the Pooled Registered Pension Plans Act (PRPP Act) to ensure that all members of a pooled registered pension plan are provided with similar information about the plan.

On May 2, 2024, the federal government tabled Bill C-69, An Act to implement certain provisions of the budget tabled in Parliament on April 16, 2024 (The Budget Implementation Act, 2024, No. 1 or the BIA 1). The BIA 1 includes the proposed amendments to the PBSA and the PRPP Act announced in Budget 2024, as described above.

Department of Finance Canada Forward Regulatory Plan

Finance Canada recently updated their Forward Regulatory Plan (FRP), which describes proposed regulatory initiatives. You may wish to consult the FRP for information on proposed amendments to the Pension Benefits Standards Regulations, 1985 and the Pooled Registered Pension Plans Regulations. Questions regarding proposed amendments to regulations should be directed to Finance Canada.

Guideline E-23 on Model Risk Management

In November 2023, we released our draft Guideline E-23 - Model Risk Management for federally regulated financial institutions (FRFIs) and federally regulated pension plans (FRPPs), for consultation.

The consultation period on draft Guideline E-23 ended on March 22, 2024, and we would like to thank the stakeholders who submitted feedback. OSFI has reviewed its policy agenda to ensure priorities are aligned with the current risk environment and further details are communicated in our 2024-2025 Annual Risk Outlook (ARO).

Guidance posted on our website

The following documents were posted to our website since the last edition of InfoPensions:

- February 2024 – final Instruction Guide for Completing the OSFI 49 Annual Information Return, OSFI 49A Schedule A - Canada Revenue Agency Information Requirements and the Pension Plan Annual Corporate Certification and forms: OSFI 49, OSFI 49A, and PPACC

- February 2024 – final Instruction Guide for Completing the Auditor's Report Filing Confirmation (ARFC) and its accompanying ARFC form

- February 2024 – final Instruction Guide for Completing the Certified Financial Statements (OSFI 60) and its accompanying OSFI60 form

- February 2024 – final Instruction Guide for Completing the Actuarial Information Summary (AIS) and its accompanying AIS form

- February 2024 – final Instruction Guide for Completing the Replicating Portfolio Information Summary (RPIS) and its accompanying RPIS form

- January 2024 – final Instruction Guide for Completing the Solvency Information Return (SIR) and its accompanying SIR form

- January 2024 – 2024 YMPE Updates - Unlocking funds from a pension plan or from a locked-in retirement savings plan FAQ#2

- January 2024 – 2024 YMPE Updates - Form 1 and Instructions – Attestation regarding withdrawal based on financial hardship

- December 2023 – 2024 Maximum Annual Amount of Income from a LIF, RLIF and Variable Benefit Account

Actuarial

Estimated solvency ratio results

We regularly estimate the solvency ratio for federally regulated pension plans (FRPPs) with defined benefit provisions. The estimated solvency ratio (ESR) exercise assists us in identifying solvency issues that could affect the security of pension benefits promised to members and beneficiaries before a FRPP files their actuarial report. The ESR results also help identify broader trends.

We calculate the ESR using the most recent actuarial, financial, and membership information filed with us for each plan before the analysis date. Assets are projected based on either the rate of return provided on the solvency information return (SIR) or an assumed rate of return for the plan when no SIR has been filed. Solvency liabilities are projected using relevant commuted value and annuity proxy rates prescribed by the Canadian Institute of Actuaries. Expected contributions, benefit payments, and expenses are considered and an ESR based on the estimated adjusted market value of the fund and estimated liabilities is then calculated for each plan.

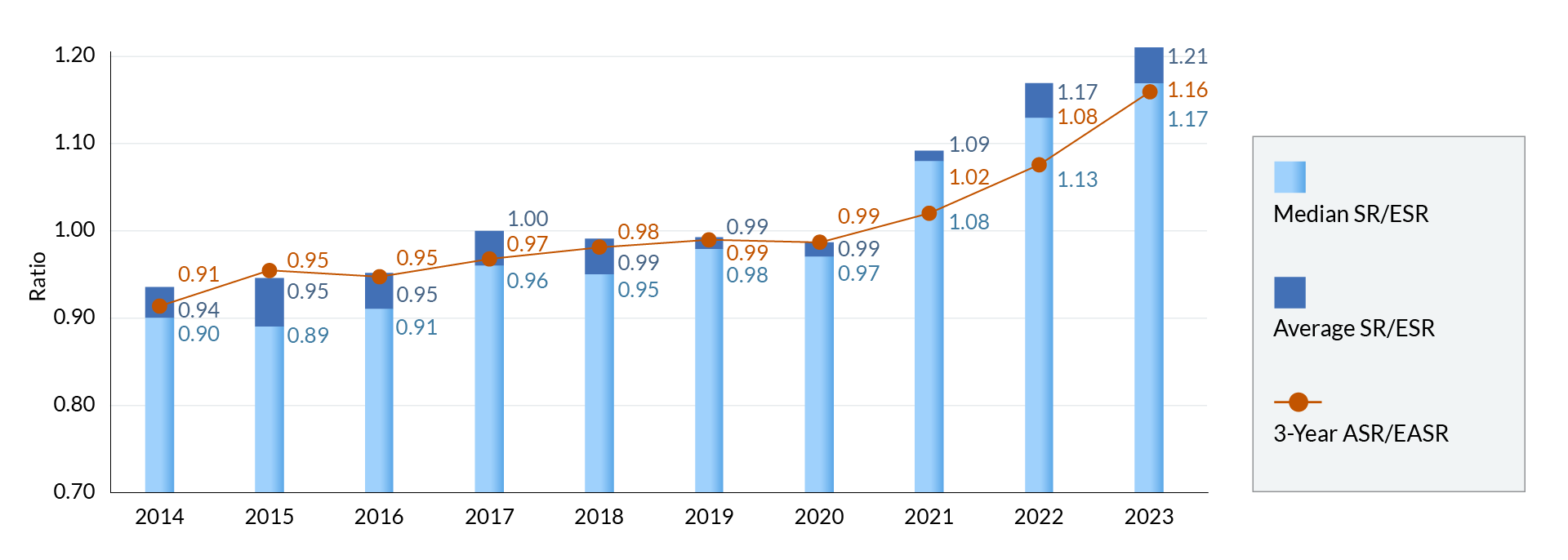

The solvency position of FRPPs with defined benefit provisions improved in 2023. The median ESR for the 308 plans included in the exercise (down from 324 last year) increased to 1.17 as at December 31, 2023, up from 1.13 at the end of 2022. The liability weighted average ESR for all plans is 1.21 as at December 31, 2023, up from 1.17 at the end of 2022. The main drivers of the variation from the SR at the end of 2022 to the ESR at the end of 2023 are the positive investment returns that largely offset any fluctuations in liabilities associated with minimal changes in solvency discount rates. The three-year estimated average solvency ratio (EASR), on which funding requirements are based, has increased to 1.16 as at December 31, 2023, up from a three-year average solvency ratio (ASR) of 1.08 at the end of 2022.

Graph 1 below shows the reported SRs, median SRs, and ASRs from December 2014 to December 2022. It also shows the ESR, median ESR, and the three-year EASR for December 2023.

Graph 1: Solvency position of pension plans as at December 31

Solvency position of pension plans as at December 31 - text description

| Year | Median SR/ESR | Average SR/ESR | 3-Year ASR/EASR |

|---|---|---|---|

| 2014 | 0.90 | 0.94 | 0.91 |

| 2015 | 0.89 | 0.95 | 0.95 |

| 2016 | 0.91 | 0.95 | 0.95 |

| 2017 | 0.96 | 1.00 | 0.97 |

| 2018 | 0.95 | 0.99 | 0.98 |

| 2019 | 0.98 | 0.99 | 0.99 |

| 2020 | 0.97 | 0.99 | 0.99 |

| 2021 | 1.08 | 1.09 | 1.02 |

| 2022 | 1.13 | 1.17 | 1.08 |

| 2023 | 1.17 | 1.21 | 1.16 |

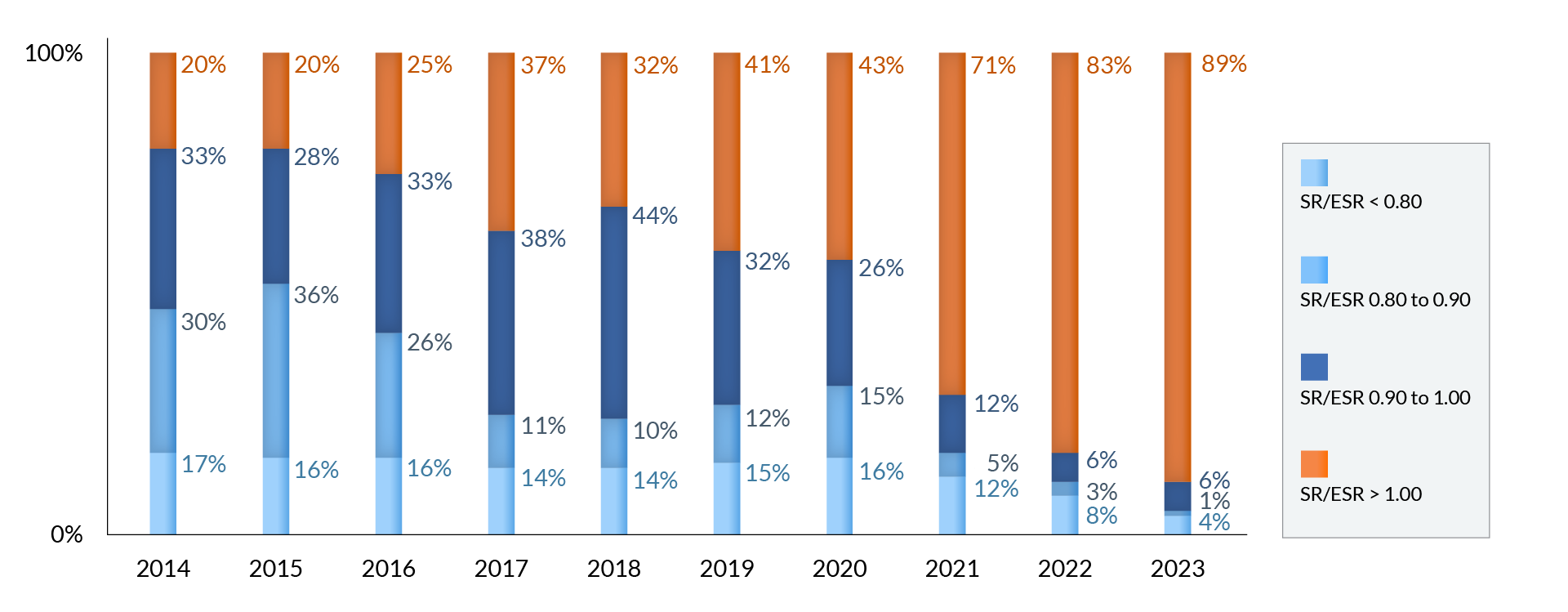

The most recent ESR results show that nearly 90% of FRPPs with defined benefit provisions are fully funded. There was a reduction in the percentage of plans that were underfunded (11% in 2023 versus 17% in 2022). The number of plans that were significantly underfunded (SRs or ESRs below 0.80) also decreased (4% in 2023 down from 8% in 2022). It should be noted that all significantly underfunded plans are designated plans and therefore their funding is limited by the Income Tax Regulations. Graph 2 below illustrates the distribution of the SR/ESR results as at December 31 of each year since 2014.

Graph 2: Percentage distribution of the estimated solvency ratio of pension plans as at December 31

Percentage distribution of the estimated solvency ratio of pension plans as at December 31 - text description

| Year | SR/ESR < 0.80 | SR/ESR 0.80 to 0.90 | SR/ESR 0.90 to 1.00 | SR/ESR > 1.00 |

|---|---|---|---|---|

| 2014 | 17 % | 30 % | 33 % | 20 % |

| 2015 | 16 % | 36 % | 28 % | 20 % |

| 2016 | 16 % | 26 % | 33 % | 25 % |

| 2017 | 14 % | 11 % | 38 % | 37 % |

| 2018 | 14 % | 10 % | 44 % | 32 % |

| 2019 | 15 % | 12 % | 32 % | 41 % |

| 2020 | 16 % | 15 % | 26 % | 43 % |

| 2021 | 12 % | 5 % | 12 % | 71 % |

| 2022 | 8 % | 3 % | 6 % | 83 % |

| 2023 | 4 % | 1 % | 6 % | 89 % |

Frequently occurring regulatory findings

Actuarial reports

The instruction guide for the Preparation of Actuarial Reports for Defined Benefit Pension Plans (Guide) sets out the reporting requirements for actuarial reports filed with us. Based on the Standards of Practice of the Canadian Institute of Actuaries, it is expected that plan actuaries provide sufficient details in their actuarial report to enable another actuary to assess the reasonableness of the data, assumptions, and methods used.

We would like to remind plan actuaries of our expectations relating to the following items that warranted a more detailed review in some actuarial reports:

- Average solvency ratio

The average solvency ratio used for funding purposes is the arithmetic average of the adjusted solvency ratios at the valuation date, prior valuation date, and prior second valuation date. Adjustments made to the current and prior solvency ratios should be determined in accordance with subsections 9(8) through 9(11) inclusively of the Pension Benefits Standards Regulations, 1985.

Although actuaries generally adjust solvency ratios appropriately, we have noted that occasionally solvency ratios have not been adjusted for contribution holidays. Since many federally regulated pension plans (FRPPs) are currently in a surplus position on both going concern and solvency bases, we remind you that for the purpose of the average solvency ratio, the solvency ratios must be adjusted to reduce the solvency assets by the present value of any contribution holidays.

- Overlay strategy

Certain FRPPs have adopted an overlay strategy as part of their target asset mix provided in their Statement of Investment Policies and Procedures. As mentioned in the Guide, if the overlay strategy is expected to impact the long-term expected return on assets, an additional adjustment to OSFI's maximum going concern discount rate may be made. In such a case, the actuarial report should include the following elements with respect to the overlay:

- description of the strategy;

- target asset mix of the plan fund excluding and including the overlay;

- expected cost of overlay financing; and

- adjustment to the maximum rate due to the overlay strategy.

- Actuarial Information Summary

The Actuarial Information Summary (AIS) should be completed and submitted to us with any actuarial report required to be filed. We would like to remind you that the data collected on the AIS is important and useful to us, as it is used in many of our analysis projects. As a result, it is essential that the return filed contains accurate and adequate information about the pension plan.

Examinations

OSFI conducts examinations of a select number of pension plans each year. Desk reviews in 2023 revealed some recurring areas of concern that resulted in similar recommendations for the plans examined. These included the following:

- Governance documents and self-assessments

Some plans do not have comprehensive written documentation regarding the roles, responsibilities, and accountabilities of those involved in the administration of the plan. In addition, not all plan administrators are performing periodic self-assessments to determine the effectiveness of the administration of their plans. We understand that, depending on the size of the plan, governance documents and self-assessments may vary.

Although OSFI does not require plan administrators to use a specific type of governance model or self-assessment technique, the Canadian Association of Pension Supervisory Authorities' Guideline No. 4 – Pension Plan Governance (PDF) and the Self-Assessment Questionnaire (PDF) are recommended resources to help plan administrators meet their governance responsibilities.

- Statement of Investment Policies and Procedures

Some plan administrators have not been reviewing their Statement of Investment Policies and Procedures annually as required by section 7.2 of the Pension Benefits Standards Regulations, 1985. The results of this annual review should be documented.

- Risk management

For most plans, the risk management framework appears to be limited in scope to asset management activities and may not provide an appropriate level of information required for effective risk mitigation. In addition, some plan administrators were not able to provide evidence of review, discussions, or decisions regarding risks that could affect their plans. An effective framework to identify and manage risks, proportionate to the size and complexity of the plan, supports plan administrators in meeting their stated objectives.

Reminder regarding funding requirements for defined benefit pension plans

Normal cost contributions and special payments

As mentioned in OSFI's instruction guide for the Preparation of Actuarial Reports for Defined Benefit Pension Plans, under the section Funding Requirements, and in accordance with subsection 9(14) of the Pension Benefits Standards Regulations, 1985 (PBSR), normal cost contributions and special payments are required to be remitted to the pension fund on a monthly basis. Any payment that is not paid at the times set out in subsection 9(14) of the PBSR is subject to the interest adjustment described in subsection 10(2) of the PBSR. The actuarial report should state that normal cost contributions and special payments are required to be remitted to the pension fund on a monthly basis and that outstanding contributions will accrue with interest.

Given that the actuarial report is generally prepared after the beginning of the plan year to which the funding recommendation applies, we expect that, until a subsequent actuarial report is filed, normal cost contributions and special payments continue to be paid based on the most recent actuarial report. A subsequent actuarial report may reveal required normal cost contributions or special payment amounts that are greater than those paid to the plan since the beginning of the plan year. In this case, the amounts that were due 30 days after the end of the period in respect to which the installments would have been paid, accumulated with interest from the required payment date, are outstanding when the report is filed. The receivable amounts are due and continue to accrue with interest until the date of the remittance. The actuarial report should state that any adjustments to normal cost contributions and special payments applicable to the year should be made when the report is filed.

In cases where a subsequent actuarial report indicates a reduction in the amount of required contributions, the Pension Benefits Standards Act, 1985 (PBSA) does not allow the employer to withdraw the contributions already paid into the pension fund. Additionally, no interest adjustment should be made in the case where special payments were made in excess of those required.

If the employer wishes to withdraw the amounts in question from the pension fund, the only option would be to apply to us for a refund of the surplus to the employer in accordance with section 9.2 of the PBSA. For more information on OSFI's policies and procedures in this regard, please refer to OSFI's Instruction Guide on Refund of Surplus to the Employer. Although the employer is not permitted to withdraw these amounts, outside of the process referred to above, the employer may adjust the remaining required contributions for the plan year. For example, if an employer overpaid, they could use the extra funds towards normal cost or special payments for that year.

Contribution holiday

An employer's normal cost contributions may be reduced under subsection 9(5) of the PBSR if certain conditions are met and if a contribution holiday is permitted under the terms of the plan and other plan documents, including trust agreements, other agreements, and historical plan documents where relevant.

Regulatory filings and important dates

Important reminders and dates

Annual filings and plan amendments must be filed using the Regulatory Reporting System (RRS).

Under the Pension Benefits Standards Act, 1985:

| Action or required filing | Deadline |

|---|---|

| Annual Information Return (OSFI 49) and Schedule A – Canada Revenue Agency Information Requirements (OSFI 49A) | 6 months after plan year end |

| Pension Plan Annual Corporate Certification (PPACC) | 6 months after plan year end |

| Certified Financial Statements (OSFI 60), Auditor's Report Filing Confirmation (ARFC) and, if required, an Auditor's Report | 6 months after plan year end |

| Payment of Plan Assessments | Upon receipt of the OSFI-issued invoice |

| Annual statements to members and former members and their spouses or common-law partners | 6 months after plan year end |

| Amendments to documents that create or support the plan or pension fund | Within 60 days after the amendment is made |

| Action or required filing | Deadline |

|---|---|

| Actuarial Report and Actuarial Information Summary and, if required, Replicating Portfolio Information Summary | 6 months after plan year end |

| Solvency Information Return (OSFI 575) | The later of 45 days after the plan year end or February 15 |

Documents in support of an application for plan registration can be submitted by email to Approvals-Approbations@osfi-bsif.gc.ca. All other documents in support of an application that requires the Superintendent's authorization must be filed using RRS. For additional information including instruction guides for filing an application using RRS, please visit the Amendments, Applications and Approvals section of our website.

Under the Pooled Registered Pension Plans Act:

| Action or required filing | Deadline |

|---|---|

| Pooled Registered Pension Plan Annual Information Return (includes financial statements) | April 30 (4 months after the end of the year to which the document relates) |

| Auditor's Report | April 30 (4 months after the end of the year to which the document relates) |

| Pension Plan Annual Corporate Certification (PPACC) | April 30 (4 months after the end of the year) |

| Payment of Plan Assessments | Upon receipt of the OSFI-issued invoice |

| Annual statements to members and their spouses or common-law partners | February 14 (45 days after the end of the year) |

Other topics

Change to our pensions inbox email

In March 2024, we changed our pensions inbox email to Pension-Retraite@osfi-bsif.gc.ca. This new pensions inbox replaced our previous one which is no longer in use.

Plan administrators and pension stakeholders can use this new email to:

- provide plan information

- contact us to confirm the name and email of the lead supervisor for a plan at OSFI

- contact us for general enquiries related to returns, late remittances or issues related to the Regulatory Reporting System

Note that we may also use this email to contact plan administrators with general reminders or information.

Any emails sent to our previous pensions inbox will be automatically redirected to our new one; however, please update your address lists as soon as possible.

For general enquiries, please continue to contact us at information@osfi-bsif.gc.ca. If you prefer to contact us by telephone, by fax or by mail, please refer to the contact information on our website.

OSFI launches new website

In January 2024, we launched our new website. We have:

- improved usability and re-organized navigation by topic

- provided content written in plain language

- improved site search

- ensured compatibility with mobile and assistive technologies

- applied accessible upgrades to our Who we regulate information

Please update your bookmarks to the new content as soon as you can and resubscribe to OSFI's email notifications. You can choose to subscribe to pensions-related content only.

We've also refreshed our stance on providing information using portable document formats (PDF). Rather than providing static files, our site now includes a "Generate PDF" option for most of our guidance documents. We are working towards having this option available for more of our guidance documents soon.

Should you wish to provide feedback on the new site, please contact our webmaster.

Organizational changes

Since January 2024, the following staffing changes affected staff responsible for federally regulated pension plans:

- Annie St-Jacques was appointed Managing Director, Pensions in the Office of the Chief Actuary (OCA), a role which includes responsibilities related to federally regulated pension plans. This position was previously held by John Kmetic, who retired from the OCA in March 2024. Benoit Brière, who is the Director, Private Pensions in the OCA, responsible for pension plan actuarial function, is now reporting to Annie.

- Henri Boudreau moved from his role of Managing Director, Insurance and Pensions to a new role focused on insurance supervision and is no longer involved in pension plan supervision.

- Patrick Clermont joined the Risk Assessment and Intervention Hub (RAIH) as Senior Director. Kim Page, who is the Director, Private Pensions in RAIH, responsible for pension plan supervision, is now reporting to Patrick.

- Chris Machado was appointed Director, Insurance and Pensions, in the Approvals Division. Chris was previously a Manager in the Intergovernmental Affairs and Policy Division at OSFI.