Domestic stability buffer

The domestic stability buffer allows Canada’s largest banks to easily adjust to key vulnerabilities and system-wide risks. It helps foster stability and public confidence in the Canadian financial system.

Domestic stability buffer is set at 3.50% of total risk-weighted assets

Why the domestic stability buffer is important

The buffer is like a rainy-day fund. Canada’s largest banks, known as domestic systemically important banks, need to set aside these funds to cover losses during financial uncertainties. If these banks fail, it can have a negative impact on our domestic economy or the global financial system.

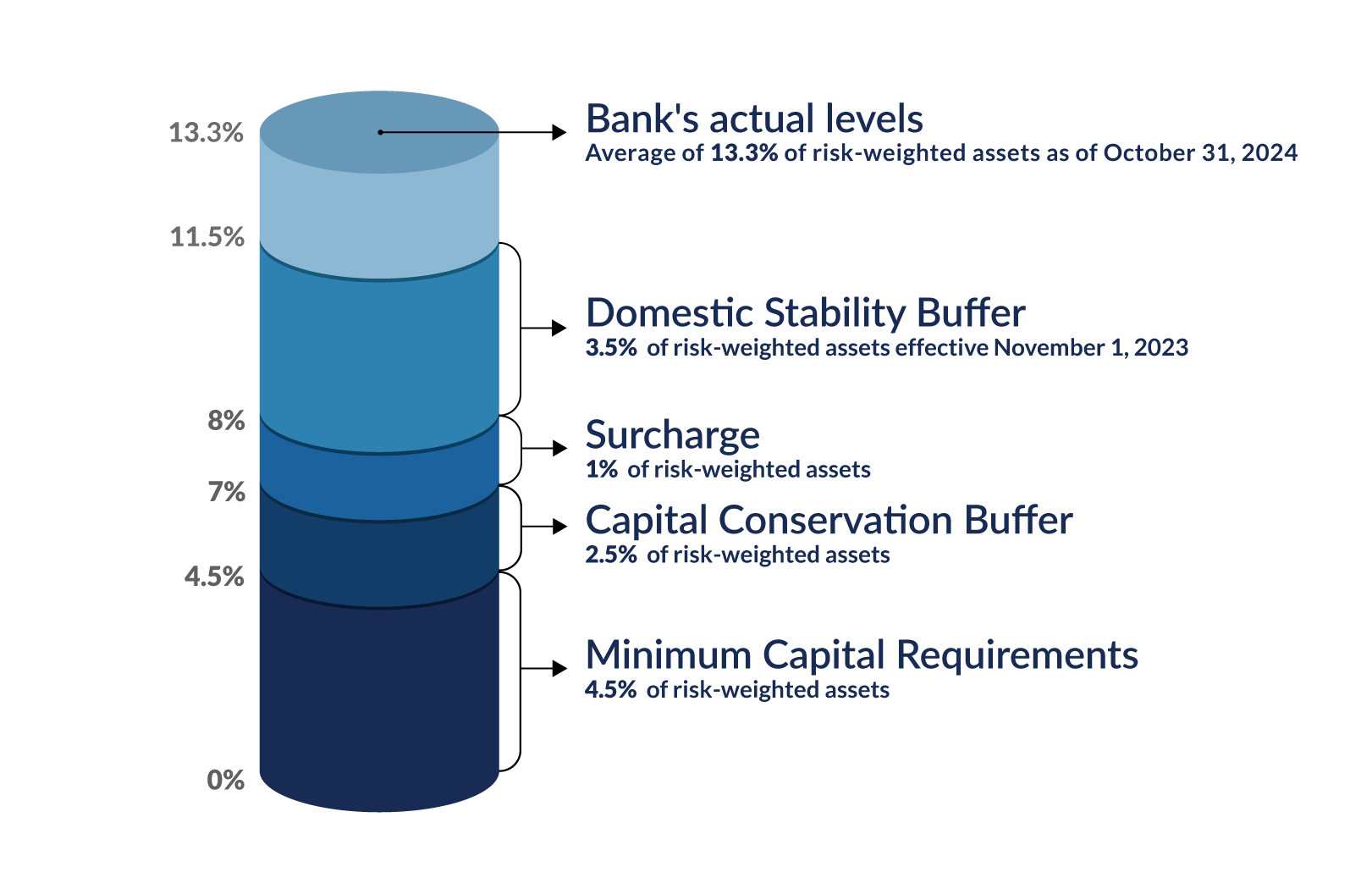

Text description - Big Banks Capital CET1 Requirements

- 0% to 4.5% - Minimum Capital Requirement

- 4.5% of risk-weighted assets

- 4.5% to 7% - Capital Conservation Buffer

- 2.5% of risk-weighted assets

- 7% to 8% - Surcharge

- 1% of risk-weighted assets

- 8% to 11.5% - Domestic Stability Buffer

- 3.5% of risk-weighted assets effective November 1, 2023

- 13.3% - Banks' actual levels

- Average of 13.3% of risk-weighted assets as of October 31, 2024

How we set the domestic stability buffer

We set the buffer level in consultation with our federal financial regulatory partners. The buffer level is set twice a year, in June and December, but it can change any time when needed. For example, on March 13, 2020, we lowered the buffer from 2.25% to 1% in response to the COVID-19 pandemic.

We determine the buffer level based on financial trends, risks and key vulnerabilities. The types of vulnerabilities include:

- Canadian household indebtedness

- High levels of consumer debt can make it hard for households to manage financial stress. This can lead to consumers reducing spending and cause a recession. A recession, in turn, can expose banks to loan defaults and losses.

- Canadian asset imbalances

- Sharp increases in the value or price of assets such as houses can make the economy vulnerable should those values or prices drop. This can trigger reduced spending and investment and reduce the value of banks’ loan collateral.

- Canadian institutional indebtedness

- High levels of institutional, or corporate, debt can reduce the ability of businesses and governments to withstand periods of economic stress. If those businesses and governments reduce spending and investment as a result, it can bring prices down and cause a recession. A recession, in turn, can expose banks to loan defaults and losses.

- External systemic vulnerabilities

- External systematic vulnerabilities are global developments such as pandemics, conflict or political unrest that make the Canadian economy and the domestic systemically important banks more vulnerable to an economic downturn. This includes measurable vulnerabilities as well as vulnerabilities that are more difficult to measure but could contribute to global macro-economic risk.

Domestic stability buffer reviews

We review the buffer periodically to ensure it:

- promotes stability of the financial system

- is flexible in responding to changes

The latest review of the Domestic Stability Buffer Design and Range

We reviewed the buffer’s design on December 8, 2022, and increased its upper limit from 2.5% to 4%. The new range will ensure that:

- the buffer stays effective over the longer-term and in an uncertain environment

- we have more capacity to respond to severe but probable scenarios

- domestic systemically important banks have more room to absorb losses while maintaining lending